‘A geological rarity’: mine developer Myanmar Metals establishes a foothold in one of the world’s most exciting mineral provinces

Pic: Schroptschop / E+ via Getty Images

Special Report: International investors are now involved in nearly every major industry within Myanmar’s budding economy. Yet its mineral bounty remains relatively untouched, giving near-term mine developer Myanmar Metals that all-important ‘first-mover advantage’.

The southeast Asian nation of Myanmar is not well known, or understood, by many global investors because of its +60 years as a ‘closed state’.

It is now considered open for business, with over five years of stable, democratically elected government under its belt.

Hundreds of companies from all over the world are actively investing and operating in-country.

They include multi-billion-dollar companies like Shell and Woodside (oil and gas), Wilmar (agribusiness), Unilever (home and personal care products) and Ford, which makes vehicles from start to finish in Myanmar.

Companies like this have been staking their claims ahead of “a decade or two of high growth and stable government” now that the first term of democracy is successfully completed, Myanmar Metals (ASX:MYL) chief executive John Lamb says.

“All foreign investors in Myanmar need to take a long-term view as they see Myanmar’s growth and development story playing out positively over the next decade or so. Like Myanmar Metals, they want to be part of the action,” he says.

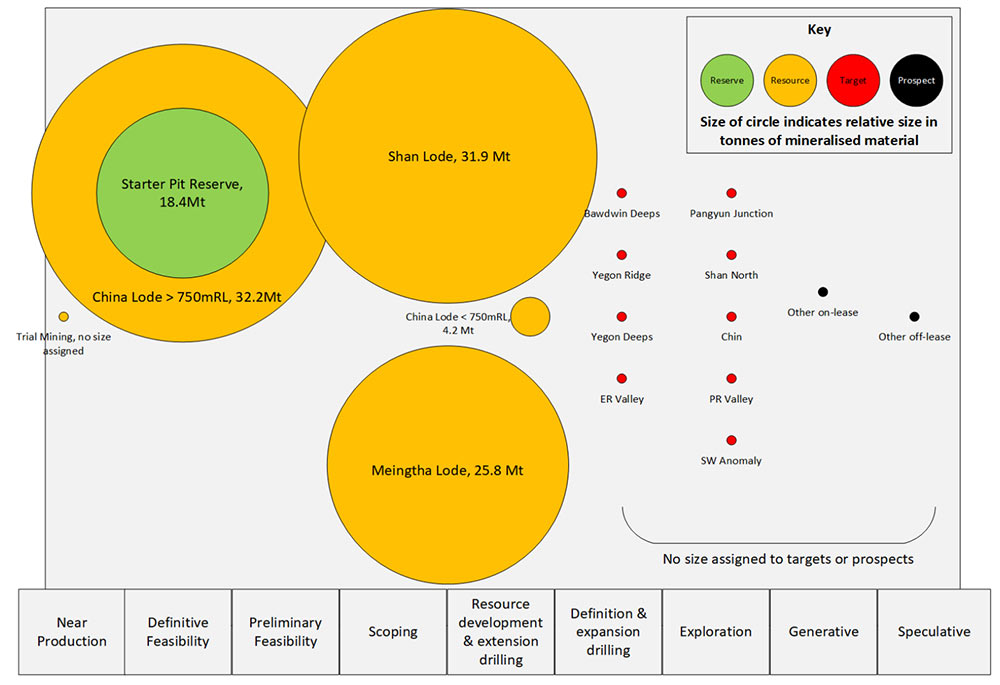

When production begins in 2022/2023, Bawdwin will be the world’s #3 lead producer and a top-10 silver producer.

It’s a monster. The first 13 years of production at Bawdwin is called the ‘starter pit’, but the company has since defined two further phases of open cut mining – that’s decades and decades of mining and processing.

Hitting development milestones

Myanmar Metals’ main focus is to get Bawdwin into production.

The COVID-19 pandemic may slightly delay project development, but Myanmar Metals has one of the most important things a company can have during times of prolonged global financial market uncertainty – lots of cash.

At March 31, the company had $15.3m in the bank with no debt.

“Cash is king in any crisis. Thanks to our cost-saving measures and healthy balance sheet, the company is well-placed to progress the Bawdwin project, despite any delays which may arise from the pandemic,” Lamb says.

“We’re actually fortunate to not be in production or construction during this time – disruption to activities with a large workforce and a lot of capital deployed could drain cash reserves quickly.

“Instead, we are able to control our cash burn to a level that gives the board confidence that we can indeed ride out the storm.”

All site-based tasks related to the upcoming feasibility study are complete and no further fieldwork by foreign consultants at Bawdwin is needed, Lamb says. This study will be completed in Australia by Myanmar Metals and its consultants and will then be independently reviewed.

Engagement with the Myanmar government regarding the MIC Permit Application — crucial for any foreign company looking to build, own and operate an asset in-country — continues to be positively advanced by Myanmar Metals’ partners.

The company expects to receive the MIC permit this year.

Meanwhile, smaller ‘pilot-scale’ mining of near-surface oxide and transitional ores will commence in coming months, to be funded by Myanmar Metals’ partners. This ore will be processed at a local processing plant to produce lead and zinc concentrates.

Although very small in scale (~5 per cent of the planned production capacity of Bawdwin operations), this pilot-scale mining project provides a number of benefits to the wider project, Lamb says.

“It will engage local participation, provide valuable information on productivity, labour relations, costs for minor works and local contractors, processing and transport efficiency, border processes and costs and the mechanics of calculating and remitting government production share,” he says.

“The oxide ore is expected to result in poorer metallurgical recoveries than sulphide ore if it were to be processed through the full-scale Bawdwin processing plant, therefore its removal is of some benefit to future operations.”

‘A geological rarity’: Opportunities abound in Myanmar

Bawdwin is the flagship for a renewed mining industry in Myanmar, which Lamb calls “one of the world’s greatest under-developed and largely unexplored mineral regions”.

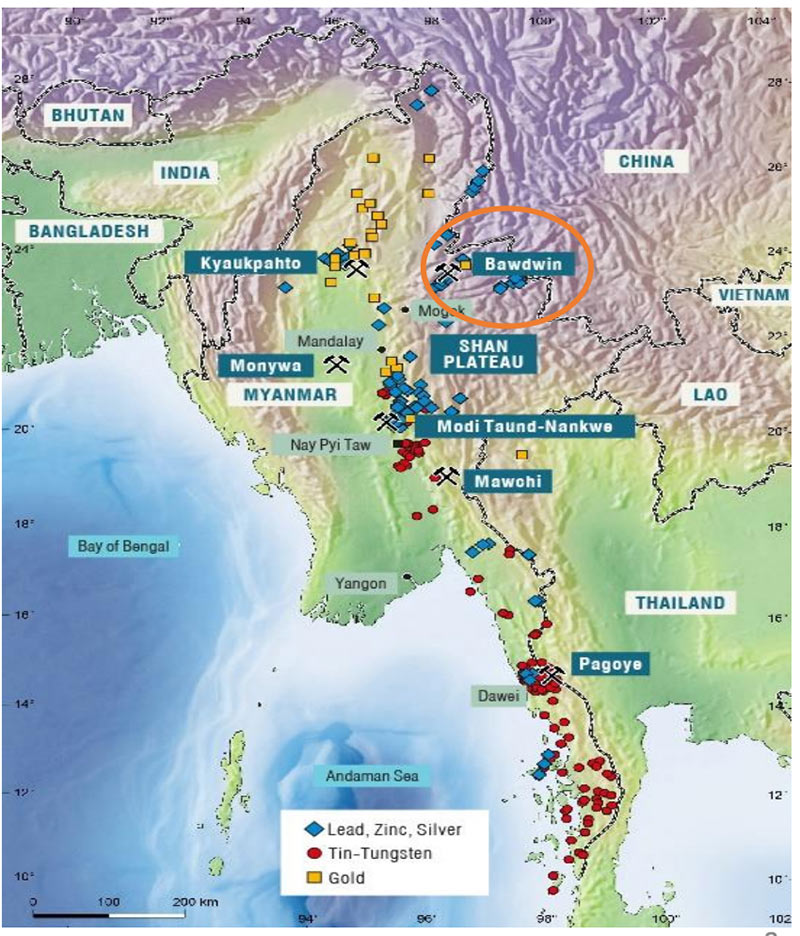

Myanmar is a geological rarity, says Lamb. It is one of the few places on the planet where regional-scale systems meet to produce an abundance of world-class mineral deposits.

“For its size and population, Myanmar has a disproportionately large number of world-class metallic mineral deposits,” he says.

“Myanmar’s mineral wealth is thanks to a confluence of region-scale structures, where the northern end of the Sunda-Andaman arc — host to world-class gold and base metal mines throughout Sumatra and Java — has collided with the Indian continent and is juxtaposed with the eastern end of the India-Asia collision zone and Himalayas to the east, itself an extension of the mineral rich Tethyan Belt that begins in Bulgaria.”

Yet Myanmar has been shut off from the world for almost all of the period since World War II, when scientific exploration began to replace old-style prospecting.

This means opportunities abound for first movers like Myanmar Metals.

“We have the unique situation in which some of the most prospective mineral belts in the world have not been subjected to modern geophysical surveying, on-ground generative exploration work such as mapping and stream-sediment sampling, or drilling,” Lamb says.

“Many discoveries in Myanmar are still being made the old way – where a land-owner stumbles upon an outcrop or finds a nugget.

“This is a place where some of the best exploration is done by word of mouth – leveraging our contacts and reputation for ‘getting things done’ to contact those with a potential discovery but no way to progress it.

“We will have the first-mover advantage of course – others will be a few years behind – but I have the feeling that there are plenty of mineral opportunities to go around.”

This story was developed in collaboration with Myanmar Metals, a Stockhead advertiser at the time of publishing.

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.