Up, Up, Down, Down: Gold hits record high as lithium and rare earths tumble in a manic March for commodities

Picture: Getty Images

- Finally, gold hits a record high, but silver wins the month

- Lithium hydroxide falls 18% in March

- Federal Government’s Department of Industry, Science and Resources back iron ore, uranium to rise

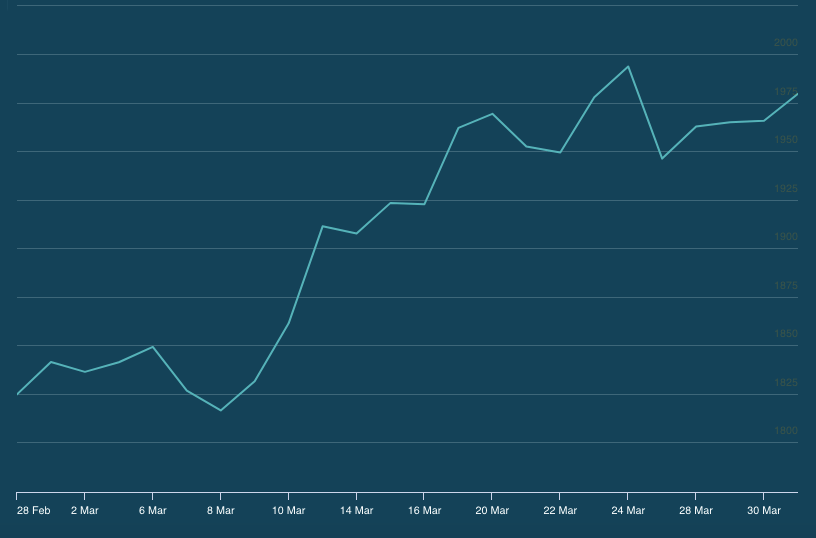

Gold

Price: US$1979.70/oz

% Change: +8.19%

It feels like a very long time since we’ve said this but last month gold was the standout commodity.

At one point the price of bullion surged to an Australian dollar record in excess of $3000/oz.

It has had so many goes at clearing the US$2000/oz mark over the past month — a key resistance level — the commodity would have been sent home for an early shower if this were a pole vaulting competition.

But it will live another day, with gold bulls hopeful a dovish change could come over the US Fed as they look to balance their priorities between fighting inflation and preventing the collapse of the financial system of the whole goddamn free world.

“It’s been a very good start to the year for gold and the banking turmoil in March was another very bullish catalyst for it,” OANDA’s Craig Erlam said.

“So much so that it’s barely given back any of those gains as interest rate expectations have barely shifted back and yields have remained lower.

“Gold bulls may be encouraged by this but $2,000 could be a big barrier to overcome, considering it’s already failed here twice over the last few weeks. A hold above that level could be the catalyst for a run at all-time highs around $2,070.”

How are equities doing in all this? Finally, not too bad. The All Ords Gold Sub-index has gold miners among Australia’s top 500 high liquidity listed companies, up 9.79% as a collective over the past month and 14.57% over the year to date.

READ: How Low Can You Go?: Where will the newest ASX gold mines land on the global cost curve?

Gold miners share prices today:

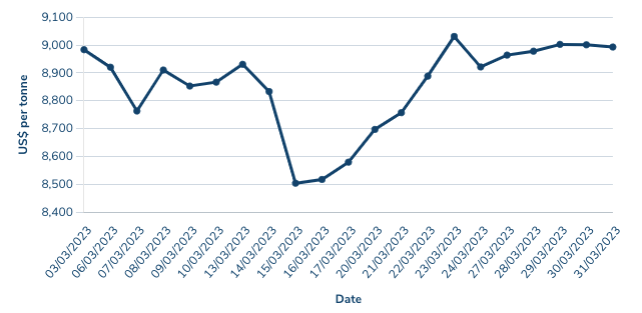

Copper

Price: US$8993/t

% Change: +0.36%

Copper prices remain in pre-breakout purgatory, buttressed between supply issues out of South America on one side and demand concerns on the other amid general economic wobbles.

Another duck lining up for long #copper ? Feb copper production in Chile weakest in 6 years, down 3.7%yy and down 11% versus the 5yr seasonal average for Feb. Codelco guiding production could fall another 7% this year. pic.twitter.com/4NBdemJg3o

— Robert Rennie (@Robert__Rennie) April 3, 2023

It is not all doom and gloom. And many in the market see prices exiting this middle of the road period to surge higher, given waning global copper inventories, a strong demand outlook and poor visibility on major new sources of supply.

“I would highlight copper as the most critical metal globally given the shortage in the market. We only had 3.5 days of copper stock equivalent at the end of last year,” said Trafigura’s co-head of metals and minerals Kostas Bintas at a conference in Europe last month.

Bintas thinks prices could hit record highs in the next 12 months, potentially above US$12,000/t.

Miners in Australia are bullish too, with M & A in the red metal from the likes of BHP (ASX:BHP) and Rio Tinto (ASX:RIO) suggesting they hold a constructive view of the years ahead.

“There would have to be a discovery equivalent to 5-10 Escondidas to fill in the deficit,” Coda Minerals (ASX:COD) CEO and executive director Chris Stevens, a mineral economist by training, told Stockhead last month after the release of a scoping study on its Elizabeth Creek copper and cobalt project.

“The chance of that discovery, in my opinion, is as close to zero as anything could possibly be because the dollars are not being spent on exploration. You can’t find something you’re not looking for.

“The other thing is that deposits the size of Escondida tend to be reasonably simple or reasonably easy to find. So in terms of supply, it’s just not coming online. We know what the predictable and likely copper supply coming online is and it’s just simply not enough.”

READ: Q+A: Coda Minerals boss Chris Stevens on why copper prices have to go higher

Copper miners share prices today:

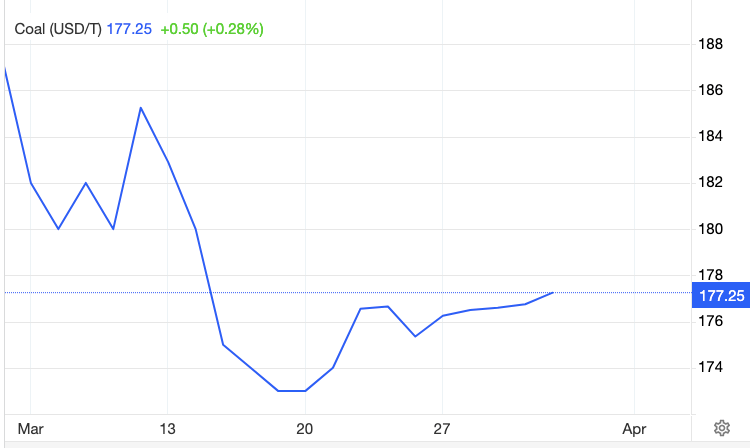

Coal (Newcastle 6000 kcal)

Price: US$193.00/t

% Change: +0.07%

Coal prices fell precipitously to start 2023 after a milder than expected northern winter sent shivers down the backs of thermal coal producers in New South Wales also facing government intervention in the form of a new domestic sale quota.

But a 9% rise on Friday ended the month to take prices just about higher for the energy fuel, which is still delivering solid margins to Australian high CV producers.

More impressive has been metallurgical coal, which remains above US$300/t thanks to strong steel demand in China, where coal imports from Australia have recently resumed after a diplomatic spat that saw the Middle Kingdom knock back Australian product in October 2020.

Bowen Coking Coal (ASX:BCB) CEO Matt Ruston, whose company is investing in a doubling of wash plant capacity to 5.5Mtpa, says coking coal demand will remain strong with China’s return to the Australian market.

“At a time when Bowen is significantly ramping up production, we believe that strong coking coal prices will be here for some time to come,” Ruston said as premium hard coking coal remained above US$321/t on March 27.

“The expected re-entry of China, the world’s largest steel producer, is likely to make up lost ground this year after ending its strict zero-COVID policy, which has previously dampened growth and its associated steel and metallurgical coal demand.”

READ: Bulk Buys: New Hope pays monster dividend, could double production

Coal miners share prices today:

LOSERS

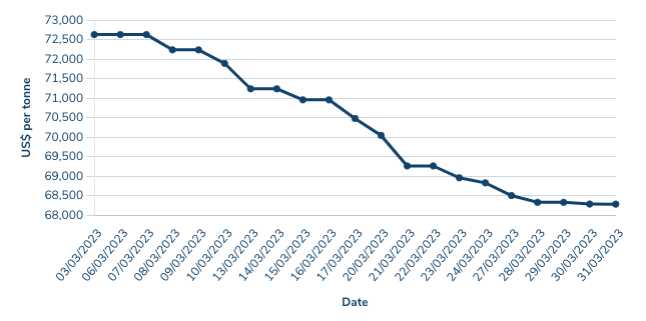

Lithium (Fastmarkets Hydroxide CIF China, Japan and Korea)

Price: US$61,500/t

% Change: -18.00%

That’s it for the winners and this month’s first loser is a very high profile one.

Lithium prices have gone off the boil after surging to record highs last year. While lithium hydroxide prices according to Fastmarkets remain attractive at US$61,500/t, that is supported by the fact Japanese and South Korean prices have remained strong.

That means the falls seen in key Chinese domestic markets have been ameliorated somewhat.

But the overall trend is not doubt downwards ATM. In China lithium hydroxide is fetching US$51,500/t, but carbonate pricing has fallen to around US$32,000/t.

Spodumene, trading above US$8000/t on the spot market late last year, is now at US$4850/t.

But not everyone thinks lithium can keep tumbling. Albemarle is certainly positive about the outlook for the market, offering $2.50 per share for near term producer Liontown Resources (ASX:LTR).

Valued at $5.5 billion, the rejected bid showed where miners think the market is headed in the coming years, with majors focused on building scale more than cost control or cash preservation.

Pilbara Minerals (ASX:PLS) followed suit, announcing a $560 million investment to add almost 50% to the capacity of its Pilgangoora mine in WA which from September 2025 will become just the second hard rock mine in the world to produce at a rate of more than 1Mtpa.

Lithium stocks prices today:

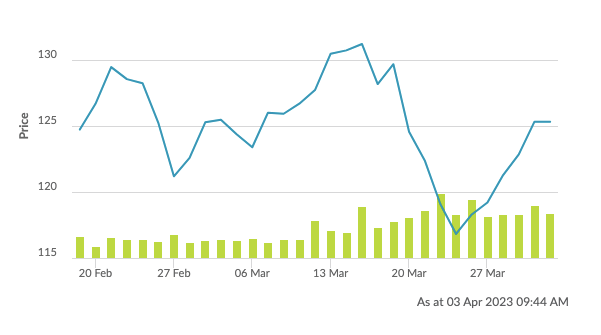

Iron ore (SGX Futures)

Price: US$125.32/t

% Change: -0.38%

Iron ore threatened a nose dive as Chinese authorities began a familiar crackdown on speculation driving higher prices (normally just strong demand influence by Communist Party policy but whatever.)

But it reverted back to what has been a very high mean in 2023 so far, with weak supplies out of Australia and Brazil so far this year aiding the overall picture.

There continue to be hopes of a demand led recovery in China as the year progresses and memories of last year’s Covid lockdowns fade further into the background.

China’s relatively small rebound out of last year’s economic struggles at just 5% planned economic growth could well keep iron ore prices in check, as could its flagging property industry and plans to limit iron ore production to below 2022 levels.

The run in prices, a second straight quarterly lift, has inspired the boffins at Canberra’s Department of Industry, Science and Resources to lift its forecast for the value of Australian exports in 2023 by $8b to $121b.

READ: Bulk Buys: FMG puts back first production for US$3.9b Iron Bridge mine again

Iron ore miners share prices today:

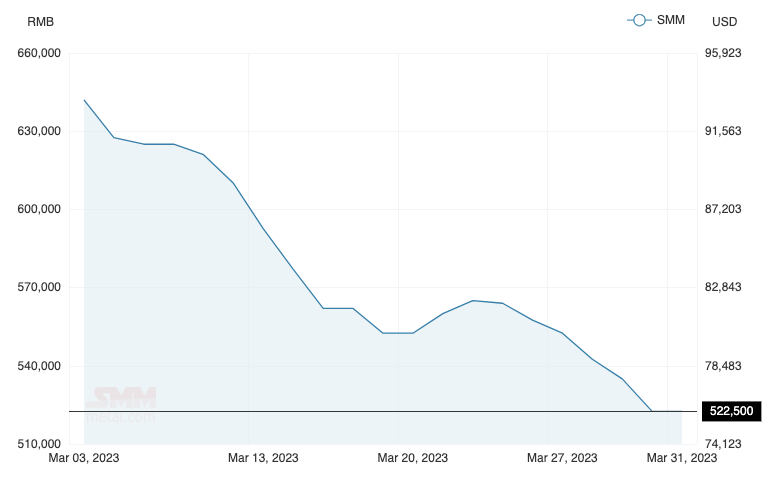

Rare Earths (NdPr Oxide)

Price: US$75.89/kg

% Change: -22.50%

China has begun to roll out rare earth quotas for 2023, with production expected to rise in the Middle Kingdom. At the same time imports and exports have been strong, but prices have fallen at a similar rate to another critical mineral in lithium.

The picture is of a market where demand is strong but sentiment is weak.

“The domestic rare earth mining quota has continued to increase steadily in 2023. At the same time, the imports of overseas rare earth also increased significantly,” Shanghai Metals Market analysts said last week.

“At the beginning of last week, under the influence of increasing inquiries, the transaction prices of rare earth picked up slightly. However, due to the weak downstream demand, most industry players were still pessimistic about the future market.

“Cargo holders lowered their prices to promote transactions and thus the rare earth prices rose slightly compared with the previous week. The supply of oxides remains stable, but the serious losses and the weak demand for alloy forced some metal factories to reduce production. Some metal factories in Baotou have stopped production.”

But there could be supply issues down the line, especially with Lynas (ASX:LYC) facing a potential shutdown of its Malaysian refinery, the largest source of separated rare earths outside China, in the December half.

Rare Earths share prices today:

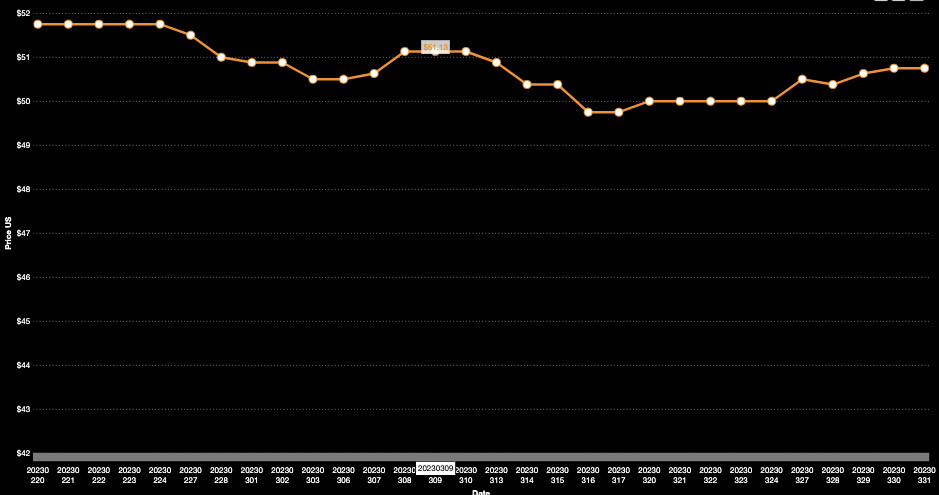

Uranium (Numerco)

Price: US$50.75/lb

% Change: -0.5%

The radioactive rock did little singing in March, as prices remained within a tight range.

There was some positivity this week from forecasters at the Federal Government’s Department of Industry, Science and Resources, who think prices are due to rise in the coming years.

The typically conservative analysts at the Office of the Chief Economist expect yellowcake pricing to lift from US$45/lb in FY22 to US$51/lb this fiscal year and up to US$67/lb by 2028.

Export values from Australia could double in that time from just $600m last year to $1.2b.

Food for thought, or indeed a nuclear power plant.

Uranium share prices today:

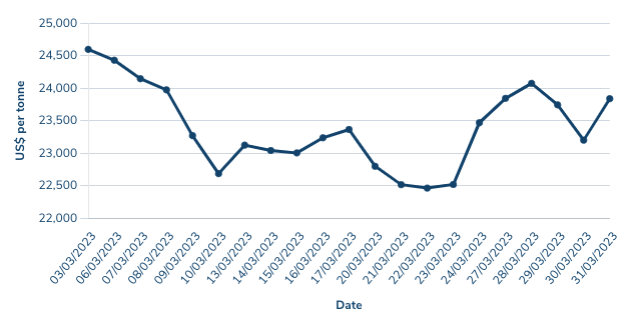

Nickel

Price: US$23,838/t

% Change: -3.85%

Nickel continues to feel the effect of last year’s short squeeze, with volatility affecting the market due to low liquidity on the LME, the primary pricing market for grade 1 nickel.

Prices have largely tracked copper, which has been dictated by sentiment in the world economy.

On a year to date basis, they have fallen more than 20%.

While demand is expected to soar in the years and decades to come thanks to nickel’s role in NCM lithium ion batteries, one potential factor keeping a lid on nickel prices this year is a big rise in production of both class 1 and 2 nickel in Indonesia.

“Class II nickel dominates current nickel supply, but Indonesia has led the recent charge to convert Class II nickel to Class I nickel,” Commbank’s Vivek Dhar said last month.

“Indonesia’s investment in both Class II and Class I nickel supply is likely going to result in a heavy surplus in Class II markets and a narrowing deficit in Class I markets.

“The Class I nickel market deficit forecast for this year mostly reflects the 15‑20% growth in Class I nickel demand.”

READ: Monsters of Rock: Can we count on another nickel rally in 2023?

Nickel miners share price today:

OTHER METALS

Prices correct as of February 28, 2022.

Silver

Price: US$23.89/oz

%: +16.37%

Tin

Price: US$25,835/t

%: +3.49%

Zinc

Price: US$2922.50/t

%: -2.6%

Cobalt

Price: US$34,930/t

%: +2.19%

Aluminium

Price: US$2413/t

%: +1.69%

Lead

Price: US$2107/t

%: +0.14%

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.