Bulk Buys: New Hope pays monster dividend, could double production

Pic: Tim Wright/Corbis Documentary

- New Hope pays monster dividend on last year’s coal boom

- Targeting doubling of production in three years, with expectations demand will outstrip supply despite ESG pressures

- Magnetite completes optimisation study ahead of high grade iron ore DFS

Thermal coal is down this year, but not at all out if $4.5 billion capped major New Hope Group (ASX:NHC) is to be believed.

Since the start of 2023 Newcastle high caloric value coal prices have tripped over their own feet.

With prices in the low US$400s as 2022 came to a close, miners were promising to see continued high prices throughout 2023 and the years to come.

Rather a collapse in demand from the northern hemisphere on higher gas stores and milder weather has curbed spot prices, dropping more than 50% with spot front month futures crashing to US$174.05/t yesterday.

Long term the drive to replace coal power with renewables should dull demand for the carbon-emitting fossil fuel.

Rather, New Hope thinks demand will grow.

Rather than conserve cash for leaner times it has paid out a monster interim dividend, return 40c per share in the form of a 30c per share payout and 10c per share special divvie after a massive 103% lift in NPAT to $669 million.

That payout represents a total return of $350.7m.

That came on an 87% rise in EBITDA to $1.039b, 54% lift in revenue to over $1.5 billion and record average realised price of $467.4/t, more than compensating for a 59% rise in free on-board costs to $83.8/t at the Bengalla mine and 34% fall in output to 3.4Mt.

Doubled in three years

New Hope has an ambitious growth plan, aiming to double production in three years through organic growth according to an investor presentation released yesterday.

The delivery of the New Acland Stage 3 expansion in Queensland, a ramp up of the scale of Bengalla in New South Wales to 13.4Mtpa and its 15% stake in Maxwell mine owner Malabar Resources should do it.

The process will require around $200 million of investment, though acquisitions such as the Daunia and Blackwater mines on the market through BHP (ASX:BHP) could be on the cards as well.

That would give New Hope access to the booming met coal market, where prices remain strong. Steelmaking coal futures were paying over US$350/t yesterday.

Semi-soft and PCI prices are not too far behind thanks to Russia’s large role in the pre-invasion supply chain for those coal grades.

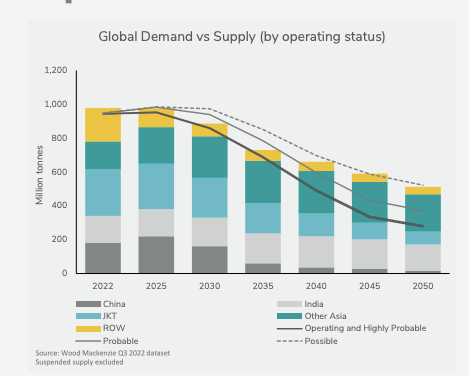

Meanwhile, NHC says demand will outstrip supply, with challenges facing companies looking to expand. The roughly 13-year process to have the Stage 3 expansion of its New Acland mine approved amid environmental opposition is a case in point.

| CODE | COMPANY | PRICE | 1 WEEK RETURN % | 1 MONTH RETURN % | 6 MONTH RETURN % | 1 YEAR RETURN % | MARKET CAP |

|---|---|---|---|---|---|---|---|

| NAE | New Age Exploration | 0.006 | 0% | 0% | -33% | -54% | $ 8,615,393.46 |

| CKA | Cokal Ltd | 0.165 | 3% | -11% | -27% | -3% | $ 178,026,581.70 |

| NCZ | New Century Resource | 1.185 | 8% | 54% | -15% | -38% | $ 148,482,094.20 |

| BCB | Bowen Coal Limited | 0.26 | -9% | -4% | -32% | -2% | $ 506,186,407.65 |

| SVG | Savannah Goldfields | 0.18 | 6% | -3% | -25% | -25% | $ 31,159,992.27 |

| GRX | Greenx Metals Ltd | 0.57 | -15% | -21% | 133% | 178% | $ 152,574,430.23 |

| AKM | Aspire Mining Ltd | 0.055 | -10% | -5% | -50% | -39% | $ 27,920,034.18 |

| AVM | Advance Metals Ltd | 0.008 | -11% | -20% | -33% | -47% | $ 4,656,352.55 |

| AHQ | Allegiance Coal Ltd | 0.013 | 0% | 0% | -85% | -96% | $ 13,063,647.08 |

| YAL | Yancoal Aust Ltd | 5.6 | -18% | 1% | -9% | 32% | $ 7,130,372,959.80 |

| NHC | New Hope Corporation | 5.32 | -4% | 4% | -10% | 82% | $ 4,323,120,437.30 |

| TIG | Tigers Realm Coal | 0.013 | 8% | 0% | -28% | 0% | $ 156,800,428.42 |

| SMR | Stanmore Resources | 3.21 | -9% | -15% | 44% | 101% | $ 2,785,300,149.06 |

| WHC | Whitehaven Coal | 6.6 | -7% | -12% | -24% | 65% | $ 5,664,536,265.57 |

| BRL | Bathurst Res Ltd. | 0.925 | -8% | -14% | 1% | -5% | $ 172,223,802.00 |

| CRN | Coronado Global Res | 1.66 | -8% | -21% | 3% | 1% | $ 2,833,206,803.70 |

| JAL | Jameson Resources | 0.072 | 0% | 0% | 3% | -15% | $ 28,188,799.20 |

| TER | Terracom Ltd | 0.55 | -9% | -24% | -46% | 20% | $ 432,521,766.90 |

| ATU | Atrum Coal Ltd | 0.005 | 0% | -17% | -29% | -54% | $ 6,958,495.86 |

| MCM | Mc Mining Ltd | 0.155 | -18% | -37% | -78% | 77% | $ 59,652,238.35 |

| DBI | Dalrymple Bay | 2.63 | 6% | 7% | 22% | 31% | $ 1,303,853,184.21 |

Magnetite Mines inches closer to DFS on green steel supply

There is little doubt iron ore is heading into a new marketplace, with expectations that the need for green steel will increase substantially by 2050.

Wood Mac last year placed the investment required at US$1.4 trillion.

If that isn’t enough the raw material and energy requirements are mind-boggling. 2000GW of renewables will be required – around 2/3rds of current capacity – alongside 52Mt of green hydrogen.

Then there is the 750Mt of DR grade iron ore required, an extraordinary five times current supply.

As with lithium, graphite, copper and other metals tied into the energy transition, that could be extremely difficult.

It is worth noting that even high-grade hematite iron ore – like the Brazilian 65% product turned out by Vale and the Simandou mine in Guinea where Rio Tinto, the Guinean Government and Chinese partners look to have resumed early works recently – is not necessarily suited to direct reduced iron (DRI) plants. The latter is technology most likely to leverage investment in renewable hydrogen to make low-emissions steel in the future.

Australian iron ore developer Magnetite Mines (ASX:MGT) signalled its intention to move into that market this week, outlining a 5Mtpa initial capacity for its Razorback mine in South Australia, where the small cap plans to produce a 68.5% DR grade pellet product with low 3% silica and alumina impurities.

It came after the company halted study plans last year on a more modest 2.5Mtpa development. A larger, 10Mtpa project would follow the initial 5Mt production profile, with the highest grade ore to be accessed in the early years to de-risk the Stage 1 development.

Also in this week’s announcement, MGT revealed it was in “discussions and due diligence with multiple parties for potential Project partnering and offtake.”

CEO Tim Dobson says MGT is now ready to progress to a final study phase.

“The Project has been optimised on all fronts, headlined by a substantial, but manageable, Stage 1 production scenario capable of producing of 5 million tonnes per year, with potential staged expansion up to 10 million tonnes a year,” he said.

“We are now prioritising the assessment of Iron Peak for Ore Reserves, enabling the completion of financial modelling for the new Project configuration, and taking advantage of Iron Peak’s superior mass recovery and metallurgy.

“Magnetite Mines is creating an extraordinary opportunity to capitalise on the fast-growing momentum towards Green Steel, with the focus of regional steelmakers now increasingly on supply from tier 1 jurisdictions with renewable energy grids and emerging green hydrogen production such as South Australia.

“We are well positioned to now enter a final study phase and deliver a DFS based on a superior project design, which will generate significant, sustainable value for all shareholders.”

| CODE | COMPANY | PRICE | 1 WEEK RETURN % | 1 MONTH RETURN % | 6 MONTH RETURN % | 1 YEAR RETURN % | MARKET CAP |

|---|---|---|---|---|---|---|---|

| ACS | Accent Resources NL | 0.025 | 0% | 0% | -17% | -55% | $ 11,828,182.08 |

| ADY | Admiralty Resources. | 0.008 | 33% | -27% | -11% | -56% | $ 10,428,633.22 |

| AKO | Akora Resources | 0.145 | 4% | -17% | -31% | -61% | $ 10,828,531.50 |

| BCK | Brockman Mining Ltd | 0.026 | 0% | -4% | -4% | -45% | $ 241,286,035.41 |

| BHP | BHP Group Limited | 43.53 | -5% | -10% | 11% | 6% | $ 217,627,651,085.76 |

| CIA | Champion Iron Ltd | 7.22 | -4% | -6% | 34% | 4% | $ 3,708,274,713.42 |

| CZR | CZR Resources Ltd | 0.185 | 9% | -10% | -36% | 49% | $ 42,432,236.28 |

| DRE | Dreadnought Resources Ltd | 0.06 | -12% | -33% | -50% | 50% | $ 207,504,877.86 |

| EFE | Eastern Resources | 0.01 | -17% | -41% | -68% | -80% | $ 13,661,411.07 |

| CUF | Cufe Ltd | 0.017 | -6% | -6% | -11% | -48% | $ 16,423,910.21 |

| FEX | Fenix Resources Ltd | 0.235 | 0% | -13% | -11% | -4% | $ 137,278,051.20 |

| FMG | Fortescue Metals Grp | 20.77 | -5% | -8% | 20% | 12% | $ 64,042,470,294.40 |

| FMS | Flinders Mines Ltd | 0.43 | -5% | -11% | -28% | -16% | $ 75,981,859.65 |

| GEN | Genmin | 0.18 | -5% | 0% | -20% | 0% | $ 81,140,982.12 |

| GRR | Grange Resources. | 0.72 | -19% | -27% | -3% | -29% | $ 827,497,169.07 |

| GWR | GWR Group Ltd | 0.11 | 22% | 90% | 33% | -24% | $ 33,727,748.78 |

| HAV | Havilah Resources | 0.325 | -2% | -4% | -4% | 81% | $ 104,490,939.30 |

| HAW | Hawthorn Resources | 0.087 | -5% | -15% | -9% | 9% | $ 29,146,358.33 |

| HIO | Hawsons Iron Ltd | 0.049 | -22% | -34% | -88% | -76% | $ 45,953,552.95 |

| IRD | Iron Road Ltd | 0.12 | 0% | 20% | -14% | -31% | $ 96,412,363.32 |

| JNO | Juno | 0.086 | -4% | -7% | -25% | -11% | $ 11,666,588.09 |

| LCY | Legacy Iron Ore | 0.017 | -6% | 13% | -15% | -11% | $ 108,916,045.38 |

| MAG | Magmatic Resrce Ltd | 0.083 | -7% | -11% | -34% | -13% | $ 25,678,195.03 |

| MDX | Mindax Limited | 0.099 | 1% | 68% | 68% | 68% | $ 197,312,809.32 |

| MGT | Magnetite Mines | 0.6 | -5% | -18% | -56% | -60% | $ 48,157,262.72 |

| MGU | Magnum Mining & Exp | 0.017 | -15% | -15% | -53% | -78% | $ 11,982,933.97 |

| MGX | Mount Gibson Iron | 0.5 | -2% | -11% | 18% | 0% | $ 619,353,859.83 |

| MIN | Mineral Resources. | 77.49 | -7% | -5% | 8% | 67% | $ 14,859,533,986.74 |

| MIO | Macarthur Minerals | 0.14 | 4% | -10% | -10% | -66% | $ 23,191,488.32 |

| PFE | Panteraminerals | 0.094 | 4% | -15% | -15% | -41% | $ 4,841,105.28 |

| PLG | Pearlgullironlimited | 0.033 | -21% | -25% | 35% | -46% | $ 5,474,568.33 |

| RHI | Red Hill Minerals | 4.43 | -2% | -10% | 21% | 27% | $ 292,971,203.91 |

| RIO | Rio Tinto Limited | 115.1 | -3% | -8% | 22% | 4% | $ 42,314,936,233.86 |

| RLC | Reedy Lagoon Corp. | 0.006 | 0% | -25% | -60% | -78% | $ 3,400,317.61 |

| CTN | Catalina Resources | 0.005 | 0% | -38% | -44% | -75% | $ 6,192,434.46 |

| SRK | Strike Resources | 0.058 | -13% | -28% | -42% | -52% | $ 16,741,250.00 |

| SRN | Surefire Rescs NL | 0.018 | 0% | 29% | 20% | 38% | $ 25,301,815.63 |

| TI1 | Tombador Iron | 0.023 | 5% | -8% | 0% | -41% | $ 51,287,576.95 |

| TLM | Talisman Mining | 0.135 | -10% | -10% | -4% | -23% | $ 25,344,832.10 |

| VMS | Venture Minerals | 0.02 | -9% | -17% | -29% | -49% | $ 37,100,859.43 |

| EQN | Equinoxresources | 0.17 | -11% | -11% | 3% | -8% | $ 7,762,500.17 |

| AMD | Arrow Minerals | 0.004 | -33% | -33% | -33% | 0% | $ 11,633,242.20 |

Iron ore under US$130

Iron ore prices suffered their first big drop in weeks on Monday, dropping over 4% to around US$125/t.

It came after a strong start to 2023 for the bulk commodity, up around 60% since hitting lows of just under US$80/t on Halloween last year. (Insert haunted ghost sounds here.)

Reuters reported from Beijing last Friday that the Chinese State planner, the NDRC, was conducting inspections in recent weeks at the major Qingdao and Tangshan ports to assess port inventories, storage fees and prices.

It appears the country is trying to talk down prices, taking aim at “hoarding” and speculation.

Prices are likely to be determined by the strength of China’s property and infrastructure investment this year post-Covid, with market watchers widely tipping steel production to fall on 2022 levels but remain above 1Bt for the fourth straight year.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.