Bulk Buys: New Aussie coal mines are getting off the ground, but supply remains fragile

Pic: Monty Rakusen/Image Source via Getty Images

- AQC faces roadblocks in its bid to revive Dartbrook coal mine, while New Hope gets approval for New Acland coal extension after 13 years

- New coal supply is slowly emerging, but the market is expected to remain tight with wet weather expected on Australia’s east coast this summer

- Iron ore drops below US$90 in Singapore

Fresh off a bruising takeover battle and years of disputes with local horse breeders, the Dartbrook coal mine looks like it could get off the ground within a year.

It is not a development without its challenges.

Over the weekend the mine’s owner Australian Pacific Coal (ASX:AQC) saw its right to resume open cut mining restricted by the New South Wales Government, in a compromise with the Hunter Throughbred Breeders’ Asssociation, a body which had long contested a decision to extend the mine’s approvals to 2027.

AQC will be able to conduct, as it had planned, underground mining at Dartbrook once it can be reopened, but has requested a moratorium from the NSW Government on the decision – flagged back in April – to allow for “further consideration by the Company and its Joint Venture Partners”.

After years in development hell, the heavily indebted AQC was bailed out after a three-cornered corporate stoush between coal trader M Resources, a company linked to pearler Nick Paspaley and fallen bogan coal tsar Nathan Tinkler.

The underground operation under the MOD7 proposal is licensed to extract up to 6Mtpa from longwall and or board and pillar mining methods, though exactly what the scale of the mine would be is unclear.

The former Anglo Coal mine delivered around 5.5Mtpa ROM when in its final year before entering care and maintenance in 2006 amid weak coal market conditions and safety issues including three workplace fatalities.

Record prices but production stalls

The conversation around Dartbrook’s development has emerged this year amid a historic boom for the kind of thermal coal produced at the site.

Newcastle 6000kcal coal has traded over US$450/t at times this year, averaging US$421/t in the September quarter.

It is currently fetching around US$390/t.

That came not just amid a crimp on supplies due to sanctions on Russian production after its invasion of Ukraine but also heavy rains and labour shortages in Australia, which saw the major coal miners fall around 30% short on their sales in the three months to September 30.

Whitehaven Coal’s (ASX:WHC) sales slid 32% against the June quarter and 14% on the previous September.

BHP’s (ASX:BHP) Mount Arthur mine, the largest energy coal operation in the Hunter Valley with 2022-23 guidance of 13-15Mt, saw its sales fall 38% YoY to 2.62Mt, while Yancoal (ASX:YAL) saw coal sales drop 36% year on year.

According to Whitehaven, total coal exports through the Port of Newcastle for September 2022 year to date are down 11.9% on 2021 to 14.2Mt and 15.5% on the record 18.9Mt to September in 2019.

With La Nina weather conditions coming in the summer, it raises the prospect of more tightness in coal markets ahead of the northern hemisphere winter.

“Given the lack of available supply side response, we continue to view thermal coal prices as well supported throughout FY23 and beyond. La Niña and labour shortages may continue to impact production with strong demand for high-CV coal and extremely tight supply in the absence of Russian coal,” the company said in its recent quarterly report.

“In metallurgical markets, while pricing is relatively strong compared to historical levels, we expect further volatility with ongoing global economic pressures.”

More new coal mines on the horizon

To some extent it has been difficult to bring supply on because chasing the funds to open new coal mines is a hard task.

Investing capital in new fossil fuel operations has become a major political football on both sides of the equation.

BHP has notably spat the dummy at its world-leading Queensland met coal mines, saying it will not put capital expenditure towards its 50-50 owned BMA mine network because of a major royalty increase from the Sunshine State’s government this year.

The increased weighting of ESG policies in investment priorities has also seen many banks and funds turn their backs on debt or equity offerings for coal developments.

While record high prices in most commodities would stir a supply response, in this climate miners are more likely to return their earnings to shareholders in the form of dividends and buybacks.

It is unlikely to move the dial when it comes to global seaborne supply, but there are some new tonnes coming online around the margins in both the met coal and thermal coal markets.

On Thursday, New Hope Corporation (ASX:NHC) received a final water licence for its New Acland Coal Mine, 13 years since the submission of the project’s initial EIS.

It would enable NHC to produce up to 7.5Mtpa until 2034 at the currently mothballed operation.

Meanwhile junior Bowen Coal (ASX:BCB) has begun its journey to its 2024 aspiration of producing 5Mt of run of mine coal a year.

The first load of coal has been railed from the Broadmeadow East Mine to the Dalrymple Bay Coal Terminal near Mackay, the second of its mines to enter operations after the first sales from the Bluff mine in June.

Broadmeadow East is expected to hit a steady state production rate of 0.8-1.1Mtpa over the next quarter.

A train containing 10,426t of coal has been sold under a spot deal with marketing partner M Resources, with another three trains to be railed to DBCT over the next week.

A cape size vessel is planning to carry 140,000t of Broadmeadow East coal overseas in late December.

“Having two mines producing in different parts of the Bowen Basin and using alternative infrastructure, spreads risk brought on by the unseasonal wet weather,” Bowen MD and CEO Gerhard Redelinghuys said yesterday, describing the Broadmeadow East mine as “essentially a paddock” as recently as May this year.

“It also demonstrates the Company’s technical ability by bringing two mines into production in one year, whilst simultaneously refurbishing the Burton Complex.”

ASX coal stocks

Scroll or swipe to reveal table. Click headings to sort.

| CODE | COMPANY | PRICE | % WEEK | % MONTH | $ 6 MONTHS | % YEAR | MARKET CAP |

|---|---|---|---|---|---|---|---|

| NAE | New Age Exploration | 0.008 | 0% | 0% | -43% | -27% | $ 11,487,191.28 |

| CKA | Cokal Ltd | 0.2 | -15% | -11% | 21% | 14% | $ 197,704,285.80 |

| NCZ | New Century Resource | 1.07 | -5% | -17% | -50% | -54% | $ 145,399,691.43 |

| BCB | Bowen Coal Limited | 0.315 | -16% | -15% | 3% | 66% | $ 510,682,758.96 |

| SVG | Savannah Goldfields | 0.195 | -7% | -19% | -3% | 2% | $ 34,019,687.60 |

| GRX | Greenx Metals Ltd | 0.26 | -10% | -10% | 30% | 5% | $ 65,941,320.64 |

| AKM | Aspire Mining Ltd | 0.092 | -6% | -12% | 3% | -1% | $ 47,717,876.59 |

| AVM | Advance Metals Ltd | 0.015 | 7% | 15% | -12% | -12% | $ 6,690,283.63 |

| AHQ | Allegiance Coal Ltd | 0.051 | -4% | -38% | -88% | -86% | $ 36,710,827.14 |

| YAL | Yancoal Aust Ltd | 5.72 | -2% | -7% | 19% | 90% | $ 7,790,592,678.30 |

| NHC | New Hope Corporation | 6.66 | -4% | 5% | 101% | 197% | $ 6,217,063,375.90 |

| TIG | Tigers Realm Coal | 0.014 | 0% | -30% | -7% | -42% | $ 222,133,940.26 |

| SMR | Stanmore Resources | 2.97 | 10% | 36% | 41% | 204% | $ 2,595,979,290.24 |

| WHC | Whitehaven Coal | 10.36 | 0% | 13% | 121% | 265% | $ 10,087,229,365.15 |

| BRL | Bathurst Res Ltd. | 0.93 | -7% | 1% | -17% | 12% | $ 179,878,193.20 |

| CRN | Coronado Global Res | 2.02 | 3% | 19% | -2% | 57% | $ 3,487,023,758.40 |

| JAL | Jameson Resources | 0.065 | -7% | -7% | -23% | -24% | $ 22,633,215.28 |

| TER | Terracom Ltd | 1.04 | -1% | -1% | 73% | 362% | $ 843,491,772.74 |

| ATU | Atrum Coal Ltd | 0.007 | -22% | -13% | -30% | -81% | $ 6,277,251.58 |

| MCM | Mc Mining Ltd | 0.225 | -13% | -47% | 85% | 136% | $ 44,472,345.75 |

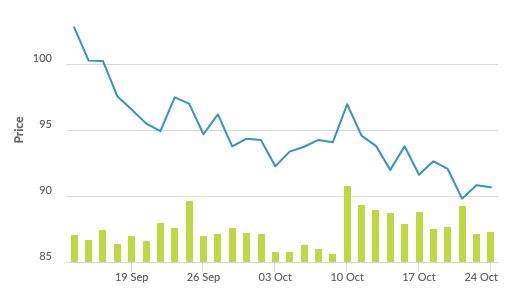

Iron ore drops under US$90/t

And over to iron ore, normally the star of this column but playing second fiddle today as we shine a light on its Bulk Buys cousin.

That isn’t to say the news hasn’t been particularly notable in the sector, though company-wise we were in a lull ahead of the quarterly reports for Mineral Resources (ASX:MIN) and Fortescue Metals Group (ASX:FMG) in a one-two punch Wednesday and Thursday this week.

Rio Tinto (ASX:RIO) also received approval from shareholders at concurrent general meetings in London and Perth yesterday for its JV agreement with Baowu Steel to develop the 25Mtpa Western Range iron ore mine at the Paraburdoo iron ore hub.

But the headlines are really out of China, where Xi Jinping’s return for a rare third term (and possibly life) was the catalyst for an epic dive in Chinese markets.

It entrenches the country’s hardline approach to dealing with Covid-19, characterised by large-scale lockdowns no longer seen elsewhere in the world.

Iron ore markets responded terribly, with 62% Fe Singapore futures down 2.05% at 7.30pm AEDT yesterday to US$88.80/t, their worst level in 2022.

ASX iron ore stocks

Scroll or swipe to reveal table. Click headings to sort.

| CODE | COMPANY | PRICE | % WEEK | % MONTH | $ 6 MONTHS | % YEAR | MARKET CAP |

|---|---|---|---|---|---|---|---|

| ACS | Accent Resources NL | 0.025 | 0% | -7% | -58% | -55% | $ 11,650,682.08 |

| ADY | Admiralty Resources. | 0.008 | 14% | -11% | -56% | -47% | $ 10,428,633.22 |

| AKO | Akora Resources | 0.195 | 3% | -3% | -35% | -15% | $ 13,969,327.68 |

| BCK | Brockman Mining Ltd | 0.023 | -15% | -15% | -51% | -50% | $ 232,005,803.28 |

| BHP | BHP Group Limited | 38.5 | -3% | 1% | -11% | 14% | $ 197,870,950,917.36 |

| CIA | Champion Iron Ltd | 5.02 | 1% | 0% | -33% | 5% | $ 2,684,232,323.94 |

| CZR | CZR Resources Ltd | 0.012 | -11% | -28% | -23% | 54% | $ 45,322,202.60 |

| DRE | Dreadnought Resources Ltd | 0.12 | 24% | 0% | 173% | 193% | $ 334,678,690.61 |

| EFE | Eastern Resources | 0.038 | -10% | 31% | -24% | -22% | $ 42,552,056.90 |

| CUF | Cufe Ltd | 0.015 | 0% | -17% | -53% | -56% | $ 14,491,685.48 |

| FEX | Fenix Resources Ltd | 0.245 | 0% | -6% | -28% | 4% | $ 143,009,910.40 |

| FMG | Fortescue Metals Grp | 16.26 | -5% | -3% | -23% | 12% | $ 51,634,241,674.86 |

| FMS | Flinders Mines Ltd | 0.53 | -7% | -12% | 0% | -39% | $ 89,489,745.81 |

| GEN | Genmin | 0.24 | 4% | -2% | 20% | 37% | $ 70,821,962.50 |

| GRR | Grange Resources. | 0.745 | -3% | -1% | -44% | 41% | $ 873,790,716.99 |

| GWR | GWR Group Ltd | 0.063 | 2% | -23% | -62% | -59% | $ 20,236,649.27 |

| HAV | Havilah Resources | 0.3 | 0% | -6% | 62% | 54% | $ 93,408,566.95 |

| HAW | Hawthorn Resources | 0.085 | -6% | -6% | -45% | 70% | $ 28,348,827.11 |

| HIO | Hawsons Iron Ltd | 0.12 | 24% | -71% | -80% | 58% | $ 92,631,618.75 |

| IRD | Iron Road Ltd | 0.145 | 12% | 4% | -19% | -28% | $ 103,981,969.52 |

| JNO | Juno | 0.105 | 5% | 5% | -19% | -25% | $ 14,583,235.11 |

| LCY | Legacy Iron Ore | 0.019 | -5% | 0% | -32% | 46% | $ 128,136,523.98 |

| MAG | Magmatic Resrce Ltd | 0.105 | 5% | -16% | 24% | 13% | $ 29,203,547.78 |

| MDX | Mindax Limited | 0.059 | 0% | 0% | 0% | 18% | $ 115,533,663.12 |

| MGT | Magnetite Mines | 0.016 | -24% | -41% | -48% | -33% | $ 60,668,392.99 |

| MGU | Magnum Mining & Exp | 0.034 | -17% | -6% | -58% | -50% | $ 20,253,652.91 |

| MGX | Mount Gibson Iron | 0.385 | -5% | -6% | -41% | -14% | $ 479,695,636.54 |

| MIN | Mineral Resources. | 74.75 | 8% | 11% | 23% | 74% | $ 14,438,485,224.00 |

| MIO | Macarthur Minerals | 0.155 | 11% | 3% | -66% | -63% | $ 25,676,290.64 |

| PFE | Panteraminerals | 0.1 | -20% | -5% | -43% | -71% | $ 5,407,617.60 |

| PLG | Pearlgullironlimited | 0.023 | -8% | -23% | -71% | -82% | $ 1,317,655.39 |

| RHI | Red Hill Iron | 3.59 | 4% | -2% | 6% | -7% | $ 229,143,054.91 |

| RIO | Rio Tinto Limited | 91.32 | -3% | -2% | -20% | -5% | $ 34,370,909,254.26 |

| RLC | Reedy Lagoon Corp. | 0.012 | -14% | -20% | -66% | -63% | $ 7,246,549.86 |

| SHH | Shree Minerals Ltd | 0.008 | 0% | -11% | -47% | -27% | $ 11,146,382.03 |

| SRK | Strike Resources | 0.11 | -21% | 17% | -21% | -4% | $ 28,350,000.00 |

| SRN | Surefire Rescs NL | 0.013 | 0% | -7% | -57% | -13% | $ 19,767,043.46 |

| TI1 | Tombador Iron | 0.026 | 13% | 18% | -40% | -35% | $ 55,561,541.70 |

| TLM | Talisman Mining | 0.135 | -4% | -7% | -23% | -7% | $ 26,283,529.58 |

| VMS | Venture Minerals | 0.024 | 4% | -17% | -59% | -50% | $ 40,258,982.21 |

| EQN | Equinoxresources | 0.125 | -4% | -22% | -36% | -46% | $ 5,625,000.13 |

| AMD | Arrow Minerals | 0.0055 | 22% | -8% | 10% | -8% | $ 10,168,825.47 |

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.