How Low Can You Go?: Where will the newest ASX gold mines land on the global cost curve?

Picture: Getty Images

The global banking crisis has sent gold prices past $3000/oz in Australian dollar terms for the first time in the past week.

And while they have struggled to push through those levels, facing resistance at the critical US$2000/oz mark ($2970/oz), commentary from the US Fed this week will provide hope the rate hike cycle which dampened the gold sector’s spirits last year is nearing an end.

At US$1966/oz yesterday, gold prices responded well to the fact Fed Chair Jerome Powell and his governors stuck with the expected 25bps rate rise to 4.75-5%, less severe than previous 50 and 75bps hikes.

Fitch this week became the latest analyst to predict a strong 2023 for gold stocks, with predictions of stronger safe haven gold investing this year prompting it to lift its year forecast from US$1850/oz to US$1950/oz.

A run in the next few weeks to records last seen in August 2020 of US$2075/oz are not out of the question.

The ASX All Ords Gold Sub-index has performed well in 2023 so far, up 8.71% year to date and 10.57% over the past month.

While that sounds positive, the sub-index maintained by S&P Global is up just 6.03% over the past five years.

In March 2018, the price of gold was a tick over US$1300/oz. Go figure.

One reason why gold stocks have not been more frothy amid what has been a dramatic rise in the value of bullion is the impact rising inflation, labour shortages and costs have had on gold equities.

All in Sustaining Costs at record highs in 2022

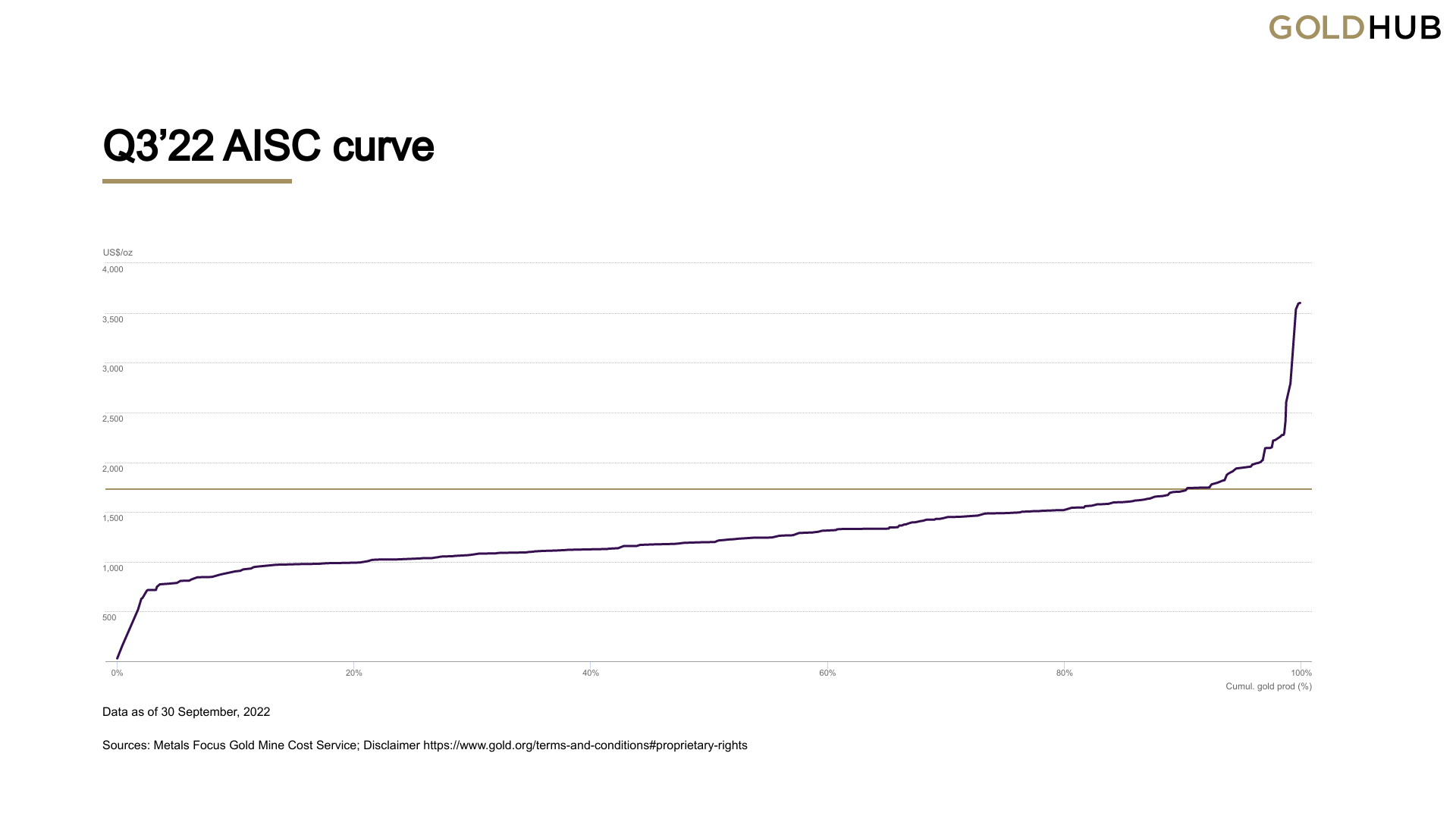

Data from the World Gold Council, which introduced the all in sustaining cost measure to standardise cost reporting across gold miners in 2013, shows even as prices have risen costs have eaten into margins.

At US$1289/oz, average AISC globally in the September quarter was at record levels according to the Metals Focus Gold Mine Cost Service.

“This significant rise in costs has largely been driven by inflation of almost all input costs for miners,” director of mine supply at Metals Focus Adam Webb said at the time.

“In particular, a tight labour market in many major gold producing countries has led to increasing wage rates and therefore rising staff costs.

“Meanwhile, rising oil and gas prices, especially following Russia’s invasion of Ukraine, have pushed up the price of diesel and electricity. Higher prices for these commodities, alongside increased ammonium nitrate prices, has also had the knock-on effect of increasing the price of key consumables for miners, such as cyanide and explosives.”

Up 1% quarter on quarter, that represented a rise of 14% year on year and 32% on the September quarter of 2020.

At just over 9%, the percentage of producers operating at below the gold price was also at the highest level since the WGC began compiling the data, though prices have risen considerably since the end of September and inflationary pressures, especially related to energy costs, have been more subdued.

According to the WGC, utilising data from the Metals Focus Gold Mine Cost Service, only around 20% of miners were operating with AISCs below US$1000/oz in September 2022.

Among the best performers when it comes to meeting cost guidance in recent years on the ASX have been new mid-tier gold miners.

How do gold hopefuls stack up?

Take West African Resources (ASX:WAF) and Capricorn Metals (ASX:CMM) for example.

Up 150% over the past five years, in its first full year of operations at the Sanbrado mine in Burkina Faso in 2021, West African exceeded the upper end of its 280,000oz production target, delivering almost 289,000oz at just US$796/oz.

It followed up last year by producing 229,224oz at AISC of US$1,086/oz, within its planned guidance.

At Capricorn, up a whopping 1250% over the past five years, its first full year of mining at the Karlawinda project in northern WA in FY22 yielded 118,432oz at $1112/oz, well within guidance of $1100-1200/oz.

For last year’s September quarter, 31,005oz at $1166/oz (followed in December by 29,310oz at $1105/oz, below its $1160-1260/oz guidance range), it would have comfortably been within the top 20% of operators on cost alone with a US dollar equivalent of US$786/oz.

There are a string of new developers lining up to join West African and Capricorn among the ASX’s gold success stories, who could capture the attention of the market if like their peers – and similar high achievers such as Emerald Resources (ASX:EMR), Perseus Mining (ASX:PRU) and Alkane Resources (ASX:ALK) -they can deliver on costs.

Here are a few to watch out for, and where they may measure up on the current global cost curve.

Tietto Minerals (ASX:TIE)

Up 24% over the past six months, $615m capped Tietto is hoping to follow in the footsteps of West African and Perseus to become the next boom West African gold stock.

It owns the 3.45Moz Abujar mine in Cote d’Ivoire, where the first blast of fresh rock took place on March 14 and production guidance is due in April this year.

We’ll be on the lookout for that one, given costs in the DFS are very attractive indeed. If it can deliver to plan, Tietto anticipates producing an average of 200,000ozpa for its first six years in production at US$800/oz, placing it in and around the top 10% of producers globally on costs if that can be achieved.

Tietto Minerals (ASX:TIE) share price today:

Bellevue Gold (ASX:BGL)

ASX 200 listed Bellevue Gold has designs on not only being one of the cheapest gold producers on the ASX when its eponymous mine near Leinster in WA opens later this year, but also one of the cleanest.

With a high degree of renewables penetration onsite at the mine’s opening, the company has tied executive incentives in to meeting greenhouse gas emissions targets and wants to be carbon neutral by 2026.

Part of the reason that may be achievable is the extraordinarily high grades at Bellevue and predictable nature of the orebody, which means it can be accessed from underground, generating less waste to process and store. That should be positive for costs as well.

The 200,000ozpa mine is slated to open in the second half of 2023, with life of mine all in sustaining costs of $1014/oz according to a 2021 feasibility study, as low as $922/oz over its first five years of production.

That would place BGL far into the lowest 10% of the cost curve. It may well be more difficult to achieve than planned given inflationary pressures since that study was released, but it will be a while still before we find out.

Bellevue Gold (ASX:BGL) share price today:

Red 5 (ASX:RED)

Red 5 hit commercial production last year at its King of the Hills gold mine near Leonora, where a recent $80 million capital raise, its second in less than six months, gave an indication of its ramp up issues.

It will report all in sustaining costs for the first time in the March quarter, but expects to deliver 95,000-105,000oz at $1750-1950/oz over the latter half of FY23.

On a US dollar and at the current current exchange rate that would place Red 5 around the 50th percentile depending on where those costs land.

It also gives some sense of how inflation has impacted gold miners and developers since the early days of the pandemic. The project originally carried a final feasibility study cost forecast of $1339/oz for years 1-6 and $1415/oz for the life of mine.

Red 5 (ASX:RED) share price today:

De Grey Mining (ASX:DEG)

By any measure De Grey’s Mallina gold project and the Hemi discovery it made in 2020 is a monster.

At over 10.5Moz of gold resources and with a reserve of 5.1Moz, it is one of the three largest gold finds in Australia this century.

The other two have proven consistent performers when it comes to cost management, AngloGold and Regis’ Tropicana and the Gold Fields-Gold Road JV at Gruyere.

A DFS with updated numbers is due in the middle of 2023, but last September’s PFS makes for positive reading for the ASX 200 listed explorer.

Producing 540,000ozpa for a decade, De Grey would produce those ounces at $1220/oz for the first five years and $1280/oz for the next five.

Sure to pique the interest of global Tier 1 gold miners once its final study is realised, similar numbers in the world class discovery’s DFS would make De Grey another top 10% cost performer in US dollar terms if achievable.

De Grey Mining (ASX:DEG) share price today:

Kingsgate Consolidated (ASX:KCN)

Kingsgate Consolidated declared its Chatree mine in Thailand open this month.

For much of its life the prolific ~130,000ozpa Chatree mine made Kingsgate an ASX success story, enjoying a share-price ride from $2.37 in late 2008 to $12.15 just two years later.

Since that peak it’s been a long downhill slide, partially thanks to a crappy gold price but especially thanks to the Thai government ordering the closure of Chatree in December 2016.

KCN challenged the closure of operations, and finally won.

Gold will initially be sourced from low grade stockpiles before mining restarts in September.

The 3.4Moz mine will now produce ~110,000ozpa once fully ramped up over an initial 8-10 year life, at an all in sustaining cost of ~US$1,193/oz.

That would give the operation a healthy margin, somewhere around the upper end of the second quartile for costs on the most recent cost curve.

Theta Gold Mines (ASX:TGM)

Sprott-backed Theta Gold Mines says it will be one of the lowest cost producers on the ASX and in South Africa once it is in production in the Eastern Transvaal Goldfields.

With a projected cost of under US$900/oz, Theta controls around 6.1Moz of resources across a string of historic mines and is aiming to revive what was one of South Africa’s first gold fields 130 years ago.

It plans to produce 1.08Moz over a near 13-year mine life, and signed a US$70m term sheet with the Sprott Streaming and Royalty Corporation last year to support its near US$100m capital requirements.

Due diligence is still ongoing, with the company hoping for a mid-2024 start date if it could achieve a FiD in the first quarter of this year.

Theta Gold Mines (ASX:TGM) share price today:

Anyone else on the cards?

There are a number of companies in the study phase now who could well use higher gold prices to leap into production, but are yet to publish recent all in sustaining cost forecasts.

Black Cat Syndicate (ASX:BC8) posted a new high-grade underground resource of 258,000oz at 10.8g/t for its Paulsens mine, acquired in a $44.5m deal from Northern Star Resources (ASX:NST) last year, and could make a decision to restart the operation by mid-2023.

Besra Gold (ASX:BEZ) meanwhile is up 90% for the month after putting the development of its 3Moz Bau project in Malaysia’s Sarawak region on the agenda with a US$300 million non-binding offtake and funding deal with major shareholder Quantum Metal Recovery Inc.

The hopeful gold miner is currently planning to update a feasibility study completed all the way back in late 2013.

Calidus Resources (ASX:CAI) meanwhile declared commercial production at its Warrawoona mine in WA in January.

It anticipates delivering 31,000 to 36,000 ounces at relatively high AISC of $2,000-$2,250/oz in the first half of the calendar year before declining to life of mine averages of $1,700-$1,850/oz as strip ratios fall and milling rates pick up.

Black Cat Syndicate (ASX:BC8), Besra Gold (ASX:BEZ) and Calidus Resources (ASX:CAI) share prices today:

At Stockhead, we tell it like it is. While De Grey Mining, Besra Gold and Black Cat Syndicate are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.