Uh, we don’t even have enough resources to replace the batteries we’re running now…

Picture: Getty Images

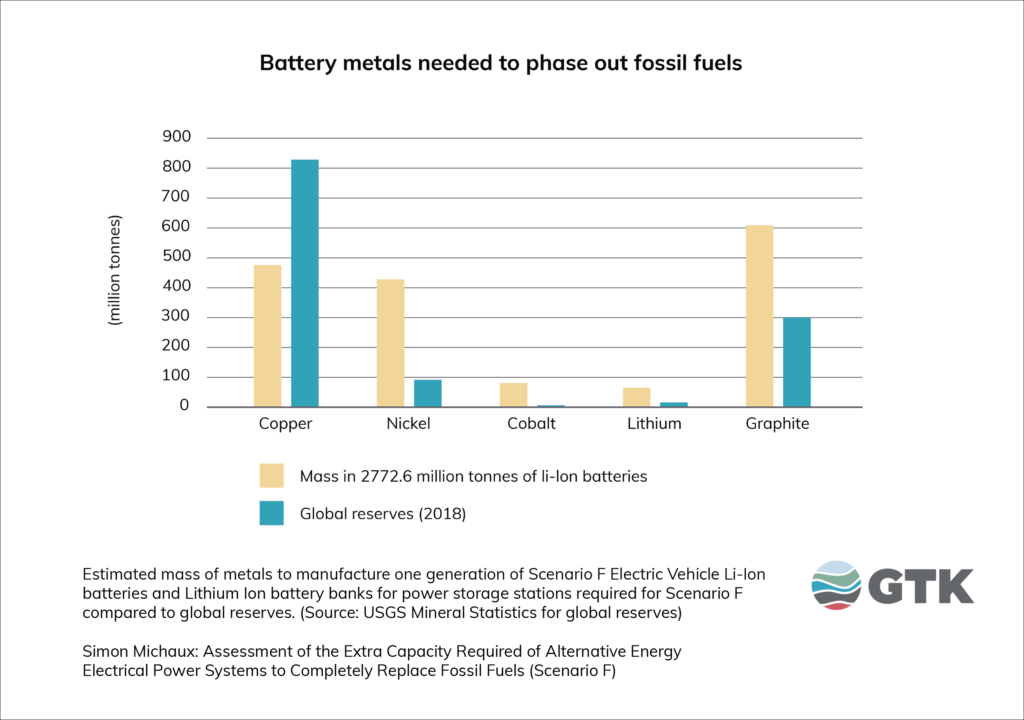

- We don’t have enough lithium, cobalt and nickel to build even one generation of batteries for all EVs and stationary power storage

- To phase out ICE and fossil fuels we need a better plan; that includes recycling and alternate battery tech (vanadium, zinc)

- ASX stocks looking to build battery recycling businesses include Neometals, Hannans, Lithium Australia

There are not enough minerals, like lithium, cobalt and nickel, in the currently reported global reserves to build even one generation of batteries for all EVs and stationary power storage, according to a recent report.

Associate Research Professor Simon Michaux from Geological Survey of Finland GTK says those batteries have an estimated life cycle of ~10 years.

“This means even if technology improves by doubling efficiency, then the same quantity of metal has to be sourced from somewhere only 10 to 20 years later,” he says.

To phase out ICE and fossil fuels we need a better plan

Overall, there is not enough time, or resources, to phase out fossil fuels by the current target dates set by the world’s most influential nations.

The current plan is not large enough in scope and is missing vital elements, Michaux says.

“The world needs a new strategy to build a genuinely sustainable non-fossil fuel industrial ecosystem,” he says.

“If we want to transition away from fossil fuels, mining of minerals and using recycled minerals and metals from industrial waste streams in new ways will have to increase greatly.

“This must be done with parallel technology systems that require different material chemistries.”

Mineral exploration and development needed on ‘unprecedented scale’

Exploration for new mineral deposits, feasibility studies, and pilot scale tests of existing known deposits will be needed on an unprecedented scale, all over the world, Michaux says.

To hit official 2050 decarbonisation targets we need a shedload of mining/downstream battery materials projects to come online sooner rather than later.

That seems far-fetched, as it can take up to 10 years to bring a mine online.

S&P Global says that even if every lithium project around the world was to come online by 2030 there is still going to be a 220,000t gap minimum in demand in 2030.

In fact, they said it could be as a high as a 2 million tonne gap.

For the cobalt market, a long-term deficit will emerge from 2024.

This deficit will keep getting bigger into the medium term as supply growth fails to keep pace with demand, the Institute says.

“From 2024-26, supply growth will average 8% per year, compared to more than 12% for demand,” it says.

“Prices will remain elevated to incentivise further investment and prevent wide deficits developing.

“Supply side investment remains critical to ensure sufficient supply into the longer term as cobalt demand continues to rise even higher.”

READ: Lithium-ion battery supply needs to increase by 400pc (at least) by 2030, WoodMac says

Battery recycling needs to get bigger and better

To supplement primary supply, we need to develop new ways to utilise minerals, metals and materials of our industrial waste and to promote manufacture of easily recyclable products, Michaux says.

In an interview with Argus, France’s Veolia head of EV battery recycling, Emeric Malefant, says recycling will be crucial to the EV revolution for three main reasons.

Firstly, batteries are one of the major contributors to the environmental footprint of EVs.

“Recycling is a key benefit to drastically reducing this footprint and reaping the full benefits of decarbonising electric mobility,” Malefant says.

Long-term, resource supply may become an issue in some territories, depending on geopolitical fluctuations.

“Developing recycling programmes can reduce our dependence by increasing self-sufficiency in strategic metals such as lithium, nickel and cobalt,” Malefant says.

And finally, batteries can be a threat to the environment and the people who handle them, as they contain chemicals and are highly flammable.

“Proper management of their recycling is therefore mandatory to avoid accidents and mitigate any form of risk,” Malefant says.

It’s not just Veolia either. All the big boys are into it, and the recycling plants being proposed are only getting bigger and bigger.

There are already ASX stocks looking to build battery recycling businesses.

The frontrunner here is Neometals (ASX:NMT) which reinvented itself as a battery recycling stock after selling out of its minority stake in the Mt Marion mine a few years ago.

In March, the company’s battery recycling JV, Primobius, officially opened its 10tpd commercial lithium-ion battery (LIB) recycling plant in Germany.

3-2-1-START. During a great event @Primobius_GmbH MD’s Horst Krenn (@SMS_group_GmbH ) and Michael Tamlin (@neometalsltd) officially opened the 10tpd commercial LiB Recycling plant in Hilchenbach, Germany! #batteryrecycling #batterymetals pic.twitter.com/3IFJftEfkn

— Primobius (@Primobius_GmbH) March 30, 2022

In May, it executed a cooperation agreement with iconic German carmaker Mercedes-Benz’s recycling subsidiary LICULAR.

Meanwhile, an investment decision for its first 50tpd operation with Stelco in Canada is expected in the September Quarter of 2022.

Other ASX stocks coming at the recycling thematic from different angles include Hannans (ASX:HNR) (part owned by NMT) and Lithium Australia (ASX:LIT).

What about other battery types?

Some of the world’s leading battery cell producers are targeting mass production of larger cells to increase energy density and cut down on raw material needs.

Still, is it sustainable to focus exclusively on the lithium-ion battery chemistry?

No. We need alternative chemistries, especially for stationary storage, Michaux says.

Stationary storage systems are big batteries often designed to store excess power from the power grid — including from renewable sources — for use during expensive peak demand periods.

“There are not enough minerals in current global reserves, and there is not enough time or capacity to explore and discover the required additional volume,” Michaux says.

“This is a problem as lithium-ion battery power stations were the favoured solution to mitigate intermittency of renewable power generation.”

So, what are some of the alternatives?

There are a couple of battery technologies vying for top spot, but the spotlight is largely on vanadium redox flow batteries (VRFBs) and zinc-bromine.

Benchmark predicts that by 2028, 50 per cent of the burgeoning stationary storage market will be lithium-ion, and 25 per cent will be VRFBs.

Major ASX players in the vanadium space include Australian Vanadium (ASX: AVL), TNG (ASX:TNG), and Technology Metals (ASX:TMT).

“Is it sustainable to focus exclusively on lithium-ion battery chemistry”

Indeed, no.

Which is why it is so important that alternatives for grid scale #EnergyStorage such as the #Vanadium based #VRFB #flowbattery are now gaining traction.#CitySafeBattery #BushveldEnergy https://t.co/aphIrkeC45

— BushveldPerspective (@BMNperspective) August 14, 2022

READ: Vanadium stocks guide: Here’s everything you need to know

Then there are zinc-bromine flow batteries, as popularised by Redflow (ASX:RFX).

RFX says these batteries are designed for tough Aussie conditions and are scalable from small systems through to grid-scale deployments.

In August, RFX was selected to supply 18 zinc bromine flow batteries for the Australian Government Bureau of Meteorology (BoM) Renewable Hybrid Power Supply (RHPS) project.

The 180kWh of Redflow energy storage is part of the Bureau of Meteorology’s (BOM) hybrid solar, battery, diesel solution, which aims to provide improved solar utilisation as well as backup power for extended operation in the event of a power failure.

“The batteries are ideally suited for extreme conditions,” RFX CEO and MD Tim Harris says.

“With no degradation and coupled with our unique hibernation mode which allows the battery to be left at 100% state of charge for months and then have the ability to rapidly restart, (this) makes our batteries the perfect solution.”

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.