Resources Top 5: The Search for Spod – NIS makes bold progress on its WA lithium hunt

"To boldly go, where Allkem has nearby gone before…" Pic via Getty Images

- NickelSearch pumps on the back of positive spodumene confirmation

- Pantera Minerals expands land holdings by 58% across lithium-brine-rich Smackover Formation in Arkansas, USA

- Aurora continues its uranium glow and ChemX is up on its recent 13.1 Mt manganese resource news

Here are the biggest small cap resources winners in early trade, Tuesday September 26.

NickelSearch (ASX:NIS)

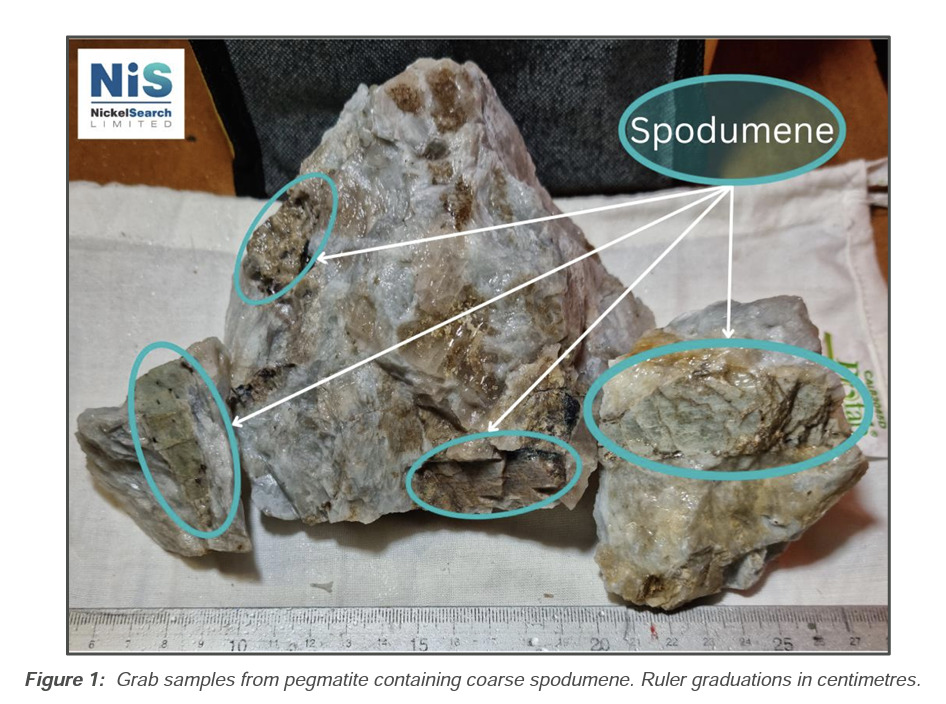

This growing nickel-now-lithium aspirant has moved out of the trading halt it was in yesterday – which was pending lithium-related exploration results at its Carlingup nickel sulphide project near Ravensthorpe in Western Australia.

Those results are now in the wild, and they’ve surged the stock to the top of the resources gainers pack so far today with a near 80% daily gain at the time of writing. The stock is up more than 82% over the past week.

The price excitement comes after the company announced that spodumene has been identified in pegmatites on the project, with NickelSearch accompanied by geologists from Allkem (ASX:AKE) during an inspection.

This collab with Allkem, by the way, is a big deal for NickelSearch, because AKE is a $7.44bn lithium exploring star on the bourse, and clearly has some idea of what it’s doing.

Not that NIS doesn’t, having set up its Carlingup operations with a nearology narrative just 10km from Allkem’s Mt Cattlin lithium mine – which hosts an estimated 12.8Mt high-grade resource.

Regarding the spod identification, NickelSearch managing director Nicole Duncan said:

“This is a great start to the technical collaboration between the companies. Given the similar geology with Mt Cattlin, we have agreed to work together to assess the lithium potential of Carlingup.

“There is a lot of work ahead, and the Mt Cattlin geologists continue to share their vast technical expertise on greenfield lithium exploration.”

NIS share price

ChemX Materials (ASX:CMX)

(Up on no news)

CMX has nothing fresh to report to the market today. But last week the advanced materials company noted it had established a Maiden Mineral Resource of 13.1Mt at 5.7% manganese at its Jamieson Tank deposit, 150km from the Port of Whyalla, South Australia.

ChemX has developed a process to produce High Purity Alumina (HPA) – a critical input for battery technology.

ChemX is developing materials to enable the energy transition and decarbonisation processes through the development of its HiPurA HPA and the Jamieson Tank high purity manganese project.

Manganese demand, as a raw material, is reportedly set to double in the next three years*.

The company’s CEO, Peter Lee, spoke in depth about the project with Christina Morrissy in a recent Stock Insiders podcast, which you can listen to here.

But essentially the project and its resource shows significant growth potential with ~70% of the identified Jamieson Tank strike awaiting further extensional drilling of high grade, near surface targets.

Also, the company notes, testwork shows the shallow resource has “excellent upgrade characteristics”.

*According to Benchmark Mineral Intelligence – June 2023 Gigafactory Assessment.

CMX share price

Aurora Energy Metals (ASX:1AE)

(Up on no news)

Rising uranium exploration star Aurora is surging ahead again today (+33%) after a strong burst on the ASX yesterday. It’s currently up 71% over the past week.

With a market cap of just $28.6m, Aurora is one of several lately upwardly mobile ASX uranium players, also including Elevate Uranium (ASX:EL8), Alligator Energy (ASX:AGE) and Icon Energy (ASX:ICN), among others, as chatter about a nuclear-powered future builds in intensity.

Aurora is focused on the exploration and development of its namesake project in Oregon, USA, which hosts a defined uranium resource of 107.3Mt at 214ppm U3O8 for 50.6Mlbs U3O8 – and is also prospective for lithium.

A scoping level metallurgical testwork program is currently underway using samples from the latest drill campaign.

As Stockhead’s Jess Cummins wrote in her ’15 uranium explorers under the $50m market cap’ article last week, there are a few promising factors lining up for the nuclear-related fuel:

Nuclear industry forecasters are more bullish than they’ve been in years with spot uranium prices hitting a decade high of US$67/lb this week.

On the demand side, there’s a forecasted supply shortfall of approximately 1.5 billion pounds by 2040.

When you take that into consideration, the bullish reports from the World Nuclear Association (WNA) and price reporter Ux Consulting make sense when they say new operations needed to fill uranium demand from nuclear power plants will almost double by 2040.

Not to mention that countries which had been less than enthusiastic on nuclear are looking to sanction new developments amid the energy transition because they provide baseload electricity with lower emissions than fossil fuel plants.

Tim Boreham also gives 1AE a ‘glowing recommendation’ over here.

1AE share price

Pantera Minerals (ASX:PFE)

Pantera continues to grow its land position, by 58%, across the lithium-brine rich Smackover Formation in Arkansas via its 35% investment in Daytona Lithium.

In exciting news this morning, $PFE's Superbird project leased acerage has increased by 58%.$PFE.ax continues to grow its land position across America’s new #lithium super-highway via its 35% investment in Daytona Lithium.#ASX release ➡️ https://t.co/EnyqtlE9cP#ASXNews pic.twitter.com/cGuCOJNsUH

— Pantera Minerals (@PanteraMinerals) September 26, 2023

Stockhead published an in-depth special report on Pantera’s latest update this morning. Here’s a snippet:

Daytona’s Superbird project covers part of the Smackover Formation, which has a long history of bromine brine processing and oil and gas operations.

Pantera secured exposure to the project in August after acquiring a 35% interest in Daytona by providing a $2m convertible note facility.

More interestingly for Pantera Minerals (ASX:PFE) and Daytona, the Smackover region is increasingly gaining prominence as a prolific source of lithium-rich brines.

Enough so that major energy players have snapped up acreage with supermajor Exxon Mobil (NYSE: XOM) – better known for leading position in the oil and gas sector – reportedly spending >US$100m to acquire 120,000 acres of private leases from Galvanic Energy.

Along with an agreement to develop more than 5,100 lithium-rich acres in Arkansas, Exxon is estimated to have some 4Mt of lithium carbonate equivalent on its ground, enough to power 50 million electric vehicles.

PFE share price

Odessa Minerals (ASX:ODE)

Lithium-focused ODE was pumping earlier today on the back of news that 56,000m (which we guess sounds more impressive than 56km) strike-length of pegmatites have now been mapped by its geology teams on the Yinnetharra project at Lockier Range in WA’s emerging Gascoyne mining district.

The upshot there is that the company has stronger than ever expectations of nailing a big lithium find amongst its outcropping pegmatites in the area.

The Lockier Range is west-adjacent to Delta Lithium’s (ASX:DLI) Yinnetharra and Jamesons discoveries of which mining beast Mineral Resources (ASX:MIN) owns a stake.

Odessa also reports that more than 10,400m strike-length of previously undiscovered pegmatites are being mapped at its new “Central Pegmatite Field” and Mt Yaragner, with 30m-wide pegmatites mapped.

Odessa has now mapped over 56,000 meters of #Pegmatites at the Lockier Range project. These new discoveries have increased previous mapping by over 10,400 meters!

View: https://t.co/uK6y6MFNgf #Lithium #Gascoyne @DavidLenigas pic.twitter.com/n5ZdDWaPo9

— Odessa Minerals (@OdessaMinerals) September 25, 2023

In addition to all the aforementioned mapping work, a total of 187 rock and 1,900 soil samples have been collected by Odessa for analysis and are pending results, while further mapping and rock-chip sampling continues.

David Lenigas, executive director of Odessa, said: “Our on-going exploration program has certainly raised our expectations of a potential lithium discovery at our Yinnetharra Lockier Range Project.

“With over 56km of outcropping pegmatites now mapped, many of which are close to previously identified high-order lithium soil anomalies, our main priority is to receive the assay results and commence interpretation to define LCT drill targets. Drilling these targets as soon as possible is Odessa’s objective.”

ODE share price

At Stockhead we tell it like it is. While NickelSearch and Pantera Minerals are Stockhead advertisers at the time of writing, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.