Sleeping on North America’s brine lithium? It’s time to wake the DLE up

On North American salt flats lies a sleeping giant of global lithium production. Pic via Getty Images.

Across US states such as Arkansas, Nevada, California, Utah and the Saskatchewan province in Canada, North American lithium brine operations are developing quickly and could possibly become some of the most economical producers of the battery material in the world.

Direct lithium extraction (DLE) technology is advancing at pace, with multiple innovative techniques emerging to extract lithium from salty brines yielding promising results – making projects extremely attractive for explorers and investors.

As an alternative to hard rock mining of lithium, extraction of the raw material from brine found in salt flats has largely been produced from South America’s “lithium triangle” – a region across Bolivia, Argentina and Chile where lithium is produced from evaporation ponds known as ‘salars’.

Bolivia’s large lithium endowment is yet to really take off. And while Chile and Argentina have burgeoning lithium industries, political tensions about the nationalisation of lithium production are steering investment into the sector towards more robust jurisdictions.

Yet it’s the adoption of DLE tech that the resources sector is really getting excited about – some calling it “Shale 2.0”.

Goldman Sachs is bullish on the potential of DLE compared to traditional pond extraction, stating in a report that it “may significantly increase the supply of lithium” (much like shale did for oil), nearly doubling lithium production on higher recoveries and improving project returns.

It’s North America’s time to brine

The United States and Canada are well known for their air-tight mining regulatory processes, as geopolitical tensions and government changes do not affect private investment in their resources sectors – and both are blessed with emerging lithium brine precincts.

The cherry on top is the US Inflation Act’s mandate that EV manufacturers looking to take advantage of up to US$7,500 in tax credits to source domestic or free-trade agreement partners is giving a leg up to North American lithium.

The money flow goes upstream to Canada too, where global automakers and battery manufacturers are setting up shop near critical minerals production in Quebec and Ontario.

Enter: the Smackover Formation

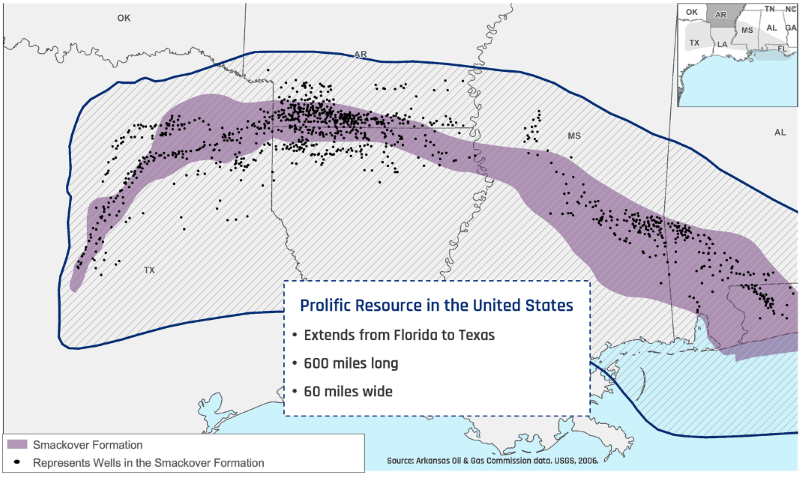

Smackover is a well-documented oil and gas-producing geological region centred around Arkansas that contains a high water cut (brine) that has been drilled for about 100 years; and for more than 60 years, the area has been a global centre of commercial brine operations for the production of bromine.

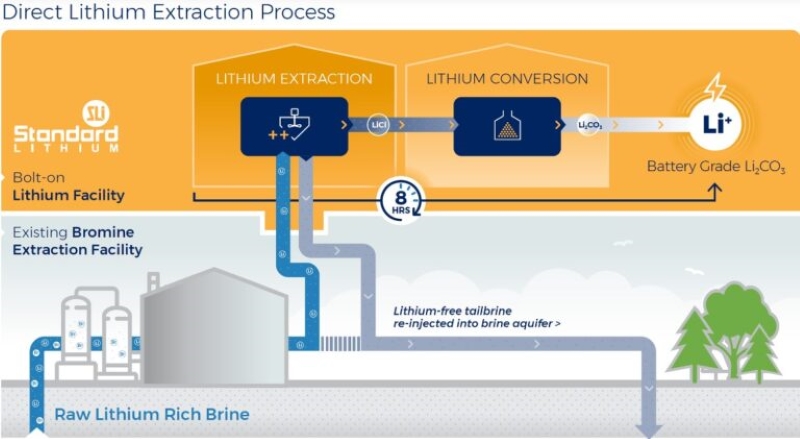

A major advantage of extracting and processing lithium from the Smackover region is the quality and usefulness of existing infrastructure.

In Southern Arkansas, DLE tech is being applied to the existing bromine extraction facilities for lithium production, lowering initial capex.

There are a plethora of incoming DLE technologies that promise to produce cheaper, higher quality, and more environmentally friendly lithium than incumbent processes.

Rubber-stamping Smackover as a Tier 1 lithium brine district was ExxonMobil’s recent entrance into the region, marked by a +US$100m acquisition of 120,000 acres of private leases from lease-holder Galvanic Energy.

This, coupled with an agreement with Tetra Technologies to develop more than 6,100 lithium-rich acres in Arkansas, marks one of the first forays by an oil and gas major into the sector.

Exxon’s landholding is estimated to have 4Mt of LCE at an average of 325 parts per million (ppm) lithium – enough to power ~50 million EVs.

It also plans to build a 75,000-100,000mt production plant nearby, which at current levels equates to ~15% of the world’s lithium production.

“The oil and gas industry are eyeing up lithium with the implementation of DLE tech,” AZL MD Paul Lloyd said.

“There are so many similarities to the O&G business that it is no surprise that large household names such as Exxon are getting involved in Li and DLE.”

Then there’s Standard Lithium, expanding its stake in the region by signing a JV with a Koch Industries subsidiary to expand on its industrial-scale lithium extraction demonstration plant and 3.1Mt Lanxess project.

Meanwhile, US industrial behemoth Albemarle is building a facility in Smackover territory to test its own DLE technology for what it hopes will eventually filter lithium from existing bromine operations.

DLE technology

Technological innovation has led lithium hunters to understand that DLE tech has the ability to recover lithium from these regions.

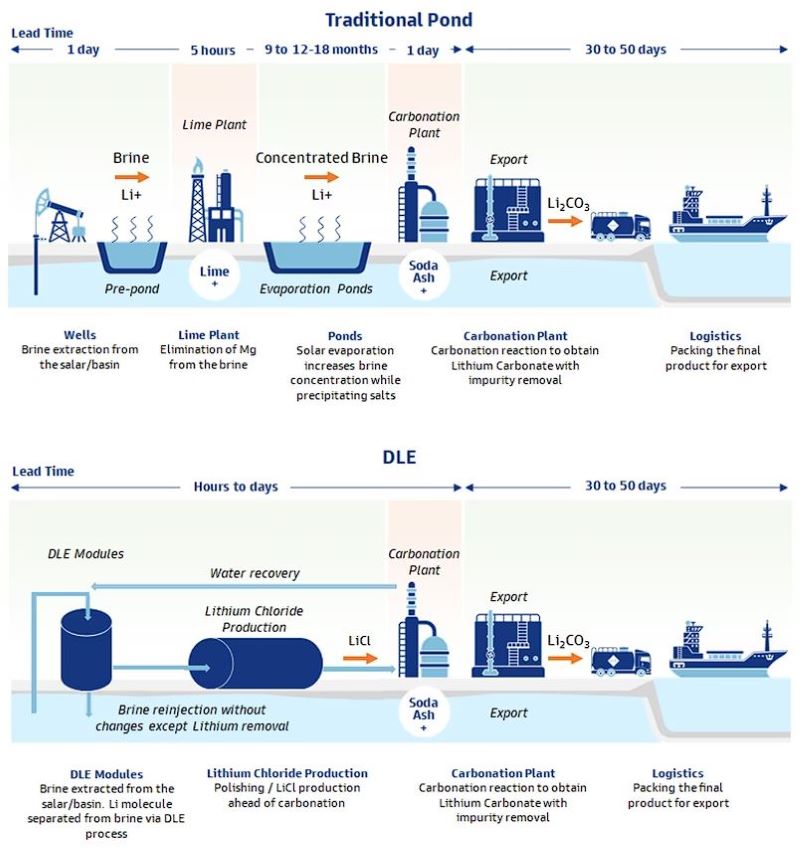

Instead of concentrating lithium by evaporating brine in large pools, DLE pulls the brine directly into a processing unit, puts it through a series of chemical processes to separate the lithium and then injects it back underground.

DLE is nothing new – it’s been used in water treatment for decades and to extract bromine – but its use to extract lithium from brines is just now coming into its own.

Primary forms of the tech include adsorption – where solvents are used to physically adhere to the lithium for selective removal.

Then there’s ion exchange systems which separate ionic contaminants from a solution through a physicochemical process where undesirable ions are replaced by other ions of the same electrical charge in order to recover pure lithium.

Solvent extraction is where lithium is captured either chemically or physically to transform it into lithium chloride or pure lithium.

There are DLE technologies that either use one, or a hybrid of these techniques coupled with other innovative low-carbon solutions.

Which ASX players are in the brine mix?

First stop, Canada. Arizona Lithium’s (ASX:AZL) Prairie project in the Saskatchewan region has just had a 40% resource upgrade to 5.7Mt LCE, with grades in its Middle Mywmark unit averaging 127mg/L Li.

The explorer is constructing a DLE pilot plant and will have a pre-feasibility study (PFS) out before the end of this year.

AZL says it’s got a rare lithium brine resource on its hands that does not require the depleted brine to be injected back into the producing lithium aquifer like other DLE projects.

“The geology of the Prairie lithium project enables it to be one of the only DLE brine projects that does not require the depleted lithium brine to be re-injected into the producing aquifer after the lithium has been extracted from the brine.

“This is due to Prairie currently having enough natural pressure, permeability, and lateral continuity to sustain the production rates required for commercial production of brine.”

Progressing its Paradox and Green River lithium projects in Utah is Anson Resources (ASX:ASN), which is in the market for offtake partners after producing first battery-grade lithium carbonate.

The lithium developer is utilising Chinese extraction innovator Sunresin New Materials’ (SHE:300487) DLE tech that combines adsorption and membrane separation techniques to enable the extraction of high-purity lithium carbonate from lean ore brine.

Anson says this method has significant economic advantages and a low-carbon footprint.

Staying in Utah, Mandrake Resources (ASX:MAN) has picked up the 93,755 acres of leases in the Paradox Basin which hosts oversaturated brines (40% minerals, 60% water), discovered during oil exploration 80 years ago.

Anson’s Paradox project is just 60km up the road.

Reedy Lagoon (ASX:RLC) holds two lithium brine projects located in Nevada, Alkali Lake North and Clayton Valley, both of which are located in large and separate groundwater catchment areas.

The projects are within 30km of the Silver Peak Lithium brine operation owned by Albemarle and a DLE pilot plant operated by Schlumberger under a JV with Pure Energy ~360km from the Tesla Gigafactory in Reno.

Another Nevada play, Morella Mining (ASX:1MC), has the Fish Lake Valley and North Big Smoky lithium brines projects (a 60% earn-in with Lithium Corporation (OTCBB:LTUM)), where exploration work is currently underway.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.