Top Aussie brokers share their hidden value gold tips

Pic: John W Banagan / Stone via Getty Images

Being able to say ‘I told you so’. It’s every small cap investor’s dream.

Identifying potential in an undervalued stock ahead of the curve, going in and watching it grow as others catch on is what market-made fortunes are built on.

Of course, identifying value in a bustling market isn’t easy – especially in a space like gold exploration and development, where with prices strong there are so many companies vying for attention and dollars for their projects.

To help guide reader research, Stockhead recently caught up with some brokers to talk through their value picks in the gold space and offer some advice on what to look for when it comes to gold juniors.

Here’s what they had to say and share.

Potential upside enormous

Harvey Kaplan – managing director at Plutus Capital

For Plutus Capital managing director Harvey Kaplan, it’s hard to go past the value he sees in Golden State Mining (ASX:GSM).

Golden State is currently exploring for gold on a large landholding in the Pilbara’s Mallina Basin, an expansive 700km2 package just 15km south-east of De Grey Mining’s (ASX:DEG) Hemi discovery.

This, combined with a tight capital structure and quality management, means Kaplan sees enormous upside in GSM.

“In the current environment there are literal shells valued at more than GSM,” he said.

“These guys have an enormous landholding adjacent to one of the biggest discoveries of recent times – if they get even the slightest sniff in their upcoming drilling then the upside is absolutely enormous.

“Success will ultimately be determined by the drill-bit, but Golden State is certainly one of those companies that will give you bang for your buck.

“The downside is incredibly low, and the upside is tens of multiples if they have success.”

Kaplan is a beneficial owner of GSM shares via a family trust.

Harvey’s other golden picks: Challenger Exploration (ASX:CEL), Los Cerros (ASX:LCL), Antipa Minerals (ASX:AZY).

Coup situation overblown

Dr Chris Baker – analyst at Bridge Street Capital Partners

Jurisdiction should play a significant part in any investment decision – but sometimes things are not what they seem.

For Dr Chris Baker of Bridge Street Capital Partners, the recent government coup situation in Mali is an example of a political situation which may not be as bad as it looks from the outside.

“We have a lot of contacts in-country and stay very close to the ground in West Africa,” he said.

“As far as we’re concerned, what’s happening in Mali is nothing like what was going on in Tanzania back two or three years ago – what’s happening now is really a shuffling of the deck chairs in preparation for the elections in Mali next year.”

Mali is known for its significant gold endowment. What the combination of factors means in investment terms, according to Dr Baker, is there’s value to be found.

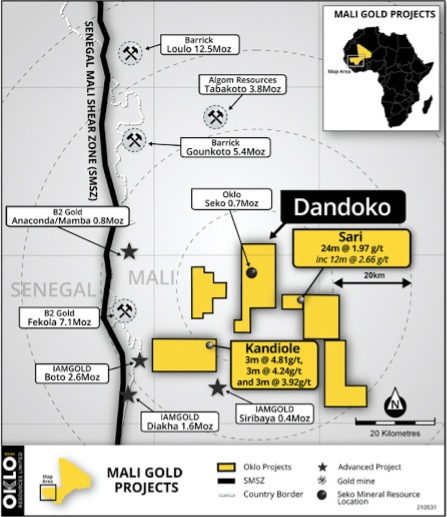

He pointed to two companies in particular – Marvel Gold (ASX:MVL) and Oklo Resources (ASX:OKU).

“Marvel is a really interesting company,” he said.

“They morphed themselves from a graphite producer in Tanzania into a gold explorer, and have come up with the best part of 1 million ounces at the Tabakerole project.

“Exploration is ongoing and they’re consolidating all of the tenements around the project. We would hope that in due course they could put together enough reserve ounces for a mine.

“They bought the project cheaply, and they’ve reinvented themselves nicely.”

The wildcard in the Marvel story is graphite – with the commodity back in favour the company is looking to spin out its graphite assets into a new company called Evolution Energy Materials.

“It’s a real left-field opportunity – both gold and graphite,” Dr Baker said.

Oklo recently defined a maiden resource at its Seko tenements, within the broader Dandoko gold project, of 668,500 ounces – 79% of which is in the measured and indicated resource categories.

Since then, the company has embarked on an aggressive exploration campaign to grow its Mali figures, with early drilling successes at both the Sari and Kandiole prospects in proximity of Seko.

Dr Baker said market expectations that the company would replicate the success of Papillon Resources’ 7Moz Fekola gold discovery nearby hadn’t been realised yet, and that created potential value for shareholders.

“They haven’t found the multi-million-ounce deposit yet, but they are in the right part of the world to find elephants,” he said.

“Whether there’s one to be found, it’s hard to know. But they are hitting gold and they’re doing all the right things by drilling it.”

A matter of circumstance

Tom Fairchild – capital markets at Conrad Capital

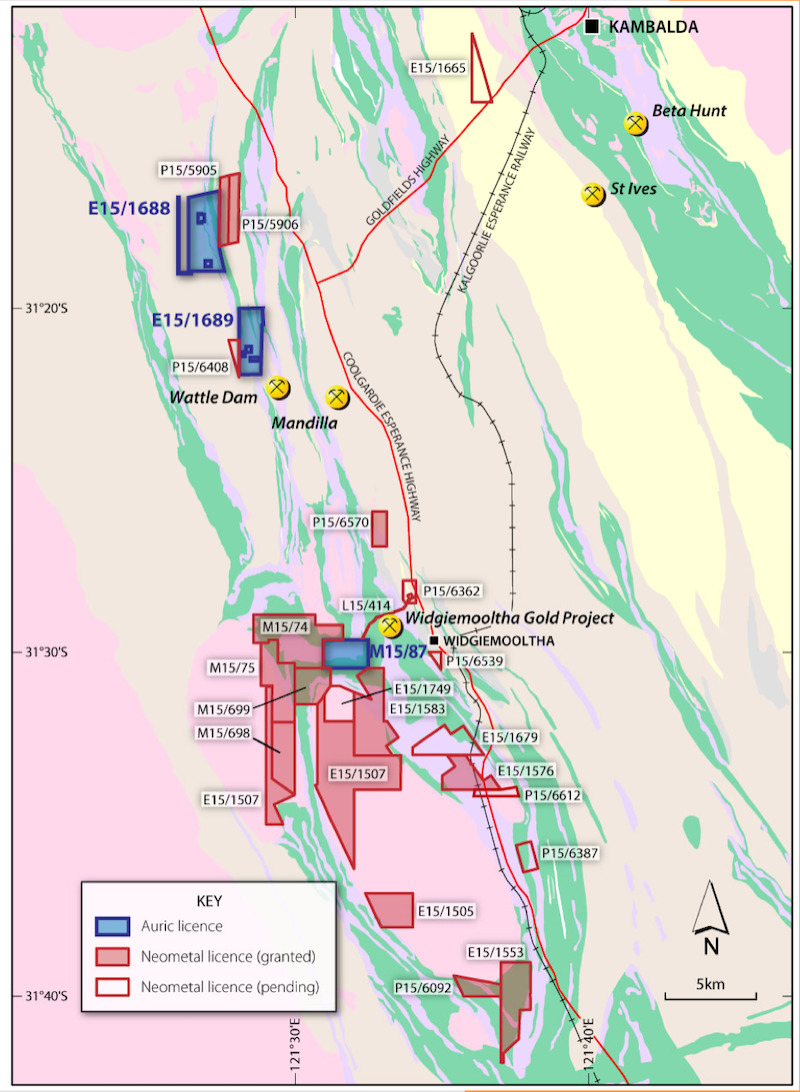

Listed this year, Fairchild picked Widgiemooltha-focused Auric Mining (ASX:AWJ) as his new entrant gold play to watch.

For the uninitiated, Widgiemooltha sits in the southern part of WA’s Goldfields and was once a hotspot for gold.

However, a net smelter royalty payable to Morgan Stanley’s Hong Kong office from 2002 onwards – which changed in terms over the years but was at times worth as much as 10% of the difference between the average spot price and $600 – was a significant deterrent, and companies in the region largely turned their exploration focus to nickel.

When that office closed, all leaseholders were given a pre-emptive right to buy back the royalty – a golden opportunity for gold explorers like Auric.

“This is a really prolific area for gold historically, but this royalty hurt it,” Fairchild said.

Since listing earlier this year, the company has drilled 27 holes, with 24 hitting gold mineralisation and another pass of drilling in the pipeline.

It yesterday struck a deal over gold rights to 21 tenements held by Neometals – one which technical director and master geologist John Utley has identified as a transformational opportunity on the geographic formation known as the Widgiemooltha dome.

Also working in Auric’s favour, according to Fairchild, is the company’s experienced board – including Melbourne Football Club VP and former De Grey Mining board member Steve Morris, Utley and MD Mark English, who took Bullion Minerals to their float.

Among Bullion’s four spinoff companies is Chalice Mining – a recent market darling.

In all, Fairchild said Auric was a prospect well worth a look.

“This company has so much in its favour – it’s got a great address, it’s got mining licences, there’s no royalty which has given management the opportunity to go in and pick up the ground,” he said.

“For a long time the area was essentially a bit unloved.”

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewees and do not represent the views of Stockhead. Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.