Drilling underway as Oklo aims for rapid Dandoko resource growth

Pic: Tyler Stableford / Stone via Getty Images

Drilling to grow the already significant mineral resource at Oklo Resources’ Dandoko gold project is underway while the company explores its development options.

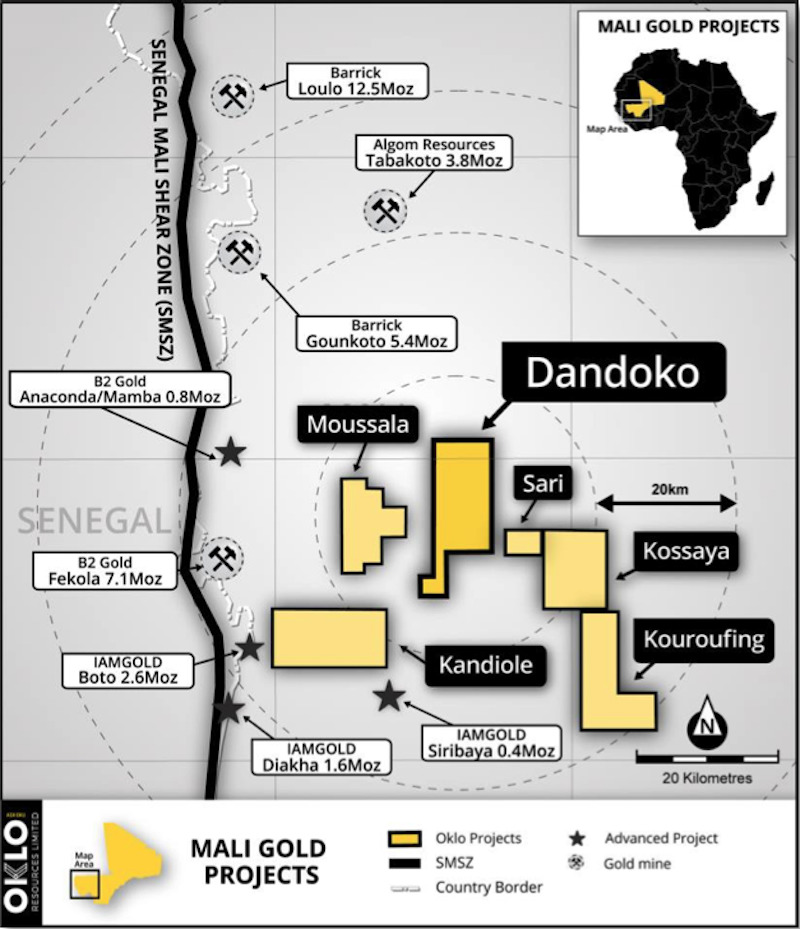

Dandoko, located along the gold-rich Senegal-Mali Shear Zone in Mali, was given an initial maiden mineral resource just last month, coming in at 11.34 million tonnes grading 1.83 grams per tonne gold for 668,500 ounces of gold – a great start which Oklo (ASX:OKU) is looking to rapidly build on. Mineralisation is open at depth and along strike.

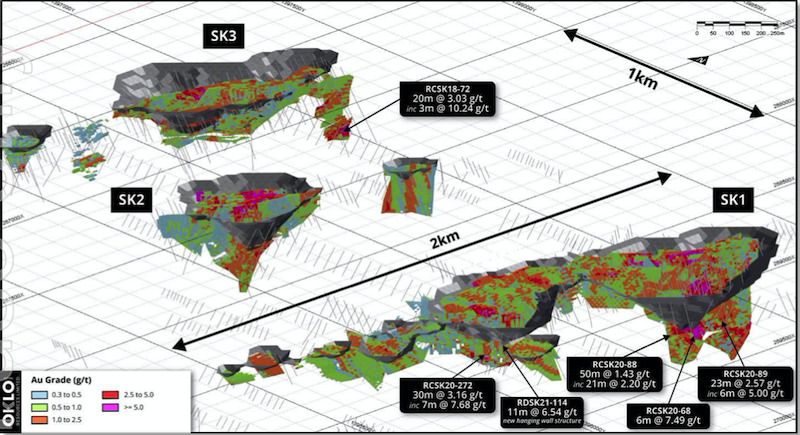

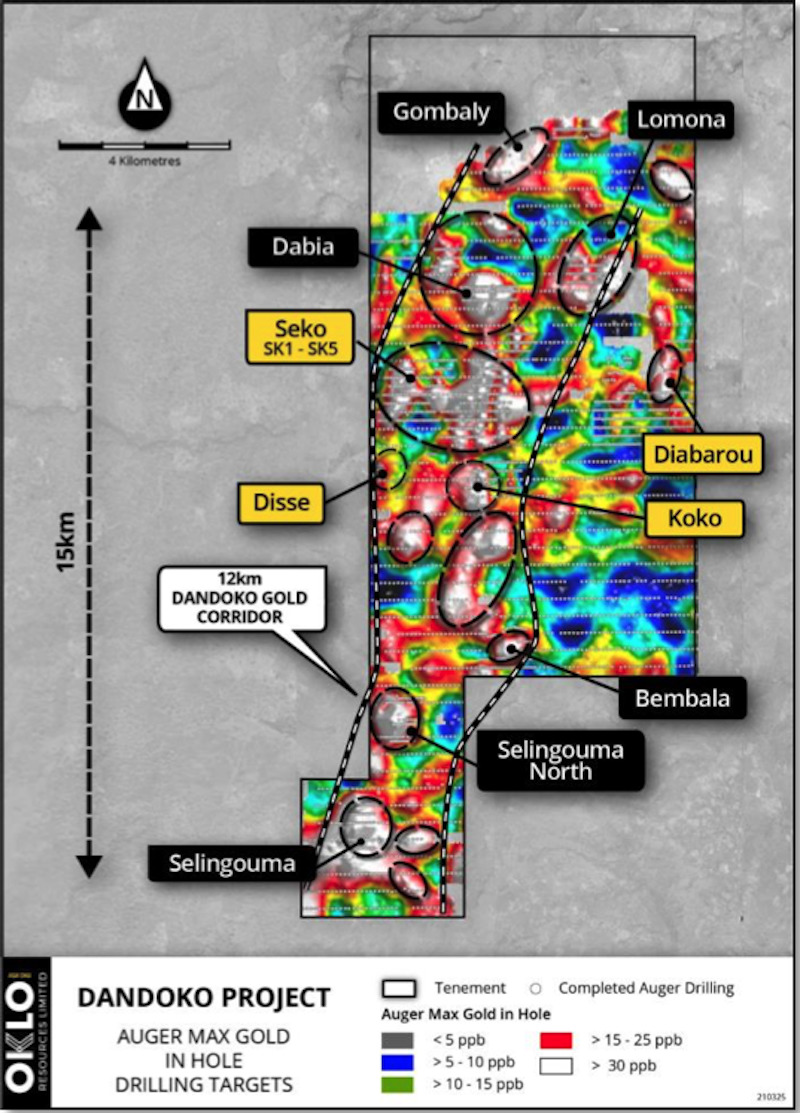

The company is undertaking a 14,000m drill program at Dandoko alone, targeting resource extensions along strike and at depth at the impressive Seko deposit, while also drilling targets generated using auger and IP geophysical methods along the 15km Dandoko gold corridor.

In addition to the 14,000m program at Dandoko, a further 8,146m of aircore drilling has been carried out at the nearby Kandiole and Sari regional projects with assays pending.

At Seko, the major prospect within the Dandoko project, resource growth drilling will target areas immediately outside the resource pit shells and starter pit opportunities – as outlined in the graphics below.

Oklo managing director Simon Taylor said the company had wasted no time in looking to build on Dandoko’s maiden resource.

“Following the recent announcement of the initial MRE at Seko, we are pleased to report that our resource growth drilling programs are advancing over a range of targets immediately adjacent to Seko and at various regional targets at our Kandiole, Kouroufing and Sari Projects within Oklo’s strategically located landholding in west Mali,” he said.

“Importantly, all targets being tested are located within reasonable trucking distance of the 0.67-million-ounce Seko gold resource.”

All programs are fully funded from the company’s current cash reserves of around $14 million.

Technical studies underway

In addition to growing the resource, Oklo has accelerated studies looking at the potential for a high grade oxide mining operation based on the initial resource numbers, with over 60% of the contained ounces above a 2.0g/t gold grade cut-off.

Taylor said the studies would likely be expanded should the resource grow.

“With over 65% of the Seko resource hosted within the oxide zone, the potential of a large-scale open pit mining development with a simple gold processing flowsheet is being assessed as part of initial technical studies,” he said.

“With 79% of the mineral resource estimate already in a combined measured and indicated category, and considerable potential to rapidly grow the resource through successful drilling, results from initial studies may be expanded to encompass new opportunities as they arise.”

Oklo is also progressing its permitting at Dandoko, where it currently holds an exploration permit.

In the December quarter, Digby Wells Environmental was appointed to undertake a series of baseline studies which will form the basis of the ongoing Environmental and Social Impact Assessment and environmental licensing requirements related to a mining licence.

The company said flora and fauna, aquatic ecology, soils, wetlands and water monitoring, socioeconomic and health, demographic and land use studies were all progressing well.

This article was developed in collaboration with Oklo Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.