TNT Mines launches into budding US uranium sector with historic high-grade project acquisition

Getty Images

Special Report: TNT Mines (ASX:TIN) will acquire a historic, high-grade uranium-vanadium project in Utah called East Canyon. The purchase is both strategic and timely, as the US government moves to support domestic uranium production ahead of a broader positive trend for uranium pricing over the next 15 years.

The spot uranium price is up +35 per cent year-to-date, driven by ongoing COVID-19 supply disruptions.

These mine shutdowns by major producers including Cameco (Canada) and Kazatomprom (Kazakhstan) have temporarily slashed global uranium output by more than half.

But more important for the junior exploration and development sector are the overwhelmingly optimistic medium to long-term trends.

To meet an increased requirement for stable, baseload power supply, 53 new nuclear reactors are under construction worldwide, more than 100 have been ordered, and more than 300 others are proposed.

As a result, uranium demand is forecast to increase considerably over the next 15 years.

But a depressed uranium market over the past decade means few projects have entered the development pipeline, leading analysts to predict a major supply shortage in coming years.

The outlook for the US uranium sector looks particularly positive. Over the past 12 months, the Trump Administration has demonstrated a strong desire to reinvigorate the domestic uranium industry in the interests of reducing the nation’s reliance on imported uranium.

East Canyon: a proven uranium-vanadium producer in a tier 1 jurisdiction

This is great news for explorers like TNT Mines.

TNT Mines has inked a binding agreement to acquire the historic high-grade East Canyon uranium and vanadium project in Dry Valley/East Canyon mining district, Utah.

The district lies within the wider Uravan Mineral Belt, an important source of uranium and vanadium ore in the US for more than 100 years.

Historic production from Uravan comprises +85 million pounds of uranium at an average grade of more than 0.13 per cent and 660 million pounds of vanadium at an average grade of 1.3 per cent.

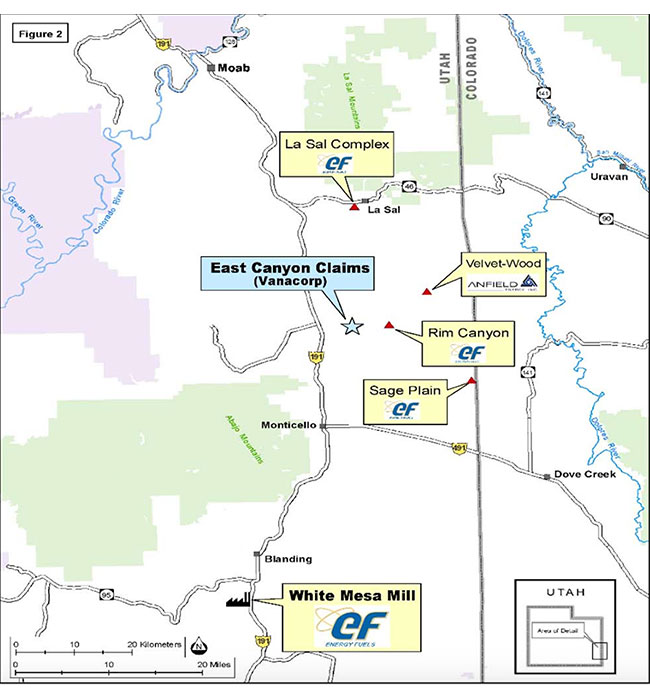

Currently, the region hosts several significant uranium-vanadium operations including TSX-listed Energy Fuels’ Rim/Columbus and La Sal Complex mines.

Energy Fuels is also in the permitting process for the Sage Plains uranium-vanadium project, 13 miles south-east of East Canyon.

And within trucking distance (50km) is Energy Fuels’ White Mesa mill, the only fully licensed and fully operating conventional uranium/vanadium mill in the US.

TNT Mines says Energy Fuels has historically accepted toll milling agreements as well as purchase programs for processing ores from third party mines.

This could represent a low-cost opportunity for developers in the region to use existing infrastructure, removing the substantial capital requirement of developing a mill.

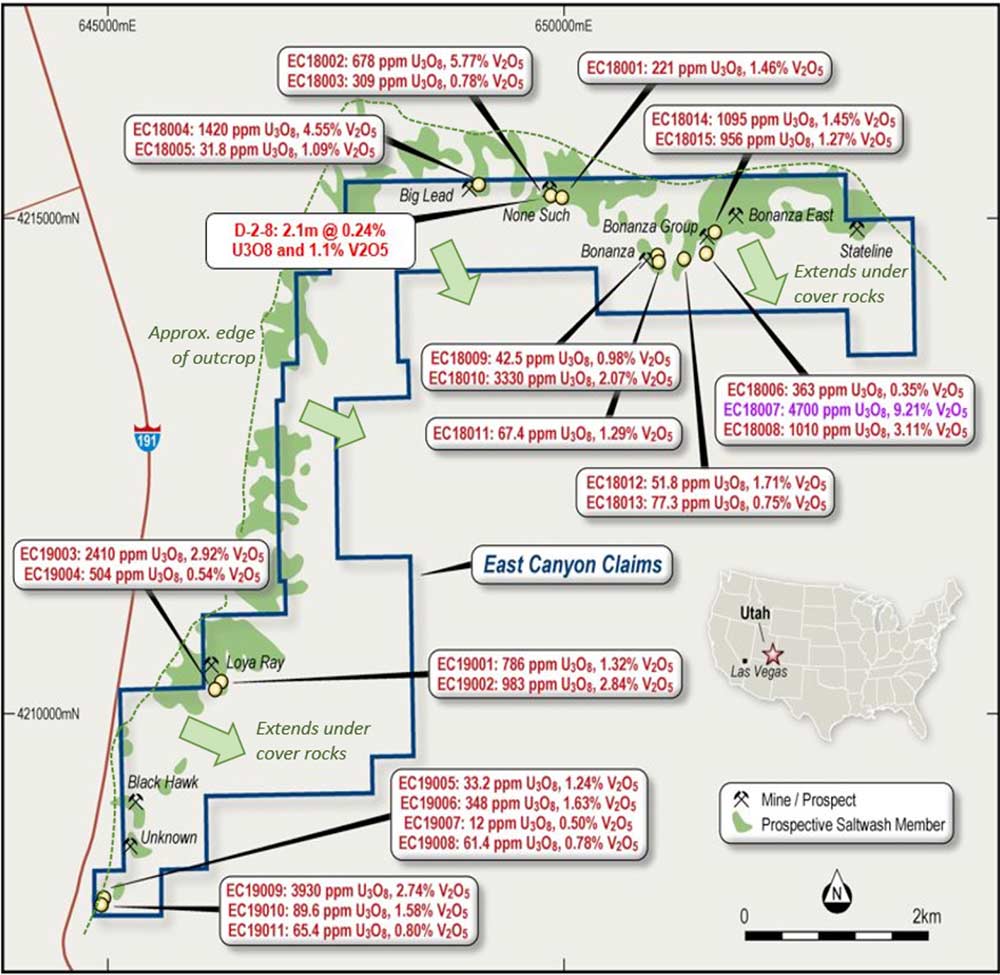

East Canyon itself features numerous historic workings including the None Such Mine, previously owned and operated by Vanadium Corporation of America (VCA).

Drilling by VCA recorded mineralised intercepts up to 2.13m grading 1.07 per cent V2O5 and 0.237 per cent U3O8, while field work carried out in 2018/2019 also “yielded highly encouraging results” TNT says.

Many of the mines and workings in the project area are still open and appear in good condition.

TNT executive director Brett Mitchell says the company is pleased to have identified an asset with the quality of East Canyon from its strategy of securing a strategic mineral project in North America.

“The current outlook for the US uranium sector is extremely positive, driven by forecast trends in power generation and strong support from the federal government,” he says.

“Being a part of that will be exciting for the company.”

Hitting the ground running

After the acquisition is completed TNT plans to conduct preliminary sampling and mapping work to identify targets for maiden drilling.

The company says it intends to move quickly to drill within the main target area, which would be relatively shallow as there is a limited amount of ‘cover’ above the mineralised zones.

The process of securing permits for drilling is expected to take three months.

This story was developed in collaboration with TNT Mines, a Stockhead advertiser at the time of publishing.

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.