The US wants to revitalise its domestic uranium industry. What does this mean for explorers?

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

While, there aren’t many surprises in the newly released, long-delayed report from the US Nuclear Fuel Working Group (NFWG), the recommendations add momentum to an already bullish outlook for uranium.

In July last year the world’s biggest uranium consumer, the United States, concluded that restricting uranium imports and providing extra support for its struggling local sector “was not warranted as a matter of national security”.

The US Administration, however, subsequently established a Nuclear Fuel Working Group (NFWG) to examine the entire nuclear fuel supply chain and provide recommendations.

While countries like China are building new nuclear power plants at a faster rate, the US still has the largest number of operable reactors in the world – 96 of 441 globally in April 2020.

These domestic reactors will require about 19,746 tonnes of uranium in 2020, according to the World Nuclear Association.

US companies provide just 10 per cent of domestic needs; over 60 per cent of the remainder comes from allies such as Canada, Australia and Kazakhstan.

The US Administration’s 2021 budget request, unveiled February 10, had already included an extra $US150m ($234.7m) per annum to purchase uranium from US mines and for US conversion services.

Alex Molyneux, advisor to the Eightstone-Oclaner OAM Uranium Opportunity Fund, says the headline ‘$US150m per year of uranium spending from the US government’ was expected but there are some very interesting details in the new report.

“This includes confirmation that buying will only be for US mined uranium; previously people thought maybe Canada or others might also be included,” he told Stockhead.

“Also, the concept that the material will be stored as low enriched uranium (LEU), means the US government will have to also buy conversion and enrichment services.”

The interesting thing is the language around using the purchasing to promote the objective of supporting the vibrancy of the industry, Molyneux says.

“I think this makes it clear that they will likely spread the purchasing around to support multiple mines, which probably means mines in the US currently on care and maintenance and undeveloped mines will benefit most,” he says.

“From an ASX perspective, I think the NFWG outcome will really be of direct benefit to [US-based] Peninsula Energy (ASX:PEN). Being able to avail themselves of that support now sets them apart from other ASX-listed uranium producers.

“On the TSX, I think the biggest beneficiaries are Azarga Uranium, UR-Energy and Energy Fuels.”

But Duncan Craib, managing director of Australia-based Boss Resources (ASX:BOE), says any support for local US players won’t reduce US import demand in the mid-term.

Boss, which released a feasibility study for its Honeymoon project back in January, hopes to be one of the first new Aussie operations to take advantage of a sustained market rally.

He told Stockhead engagement with US utilities had been picking up in recent weeks.

Adding support to an emerging uranium rally

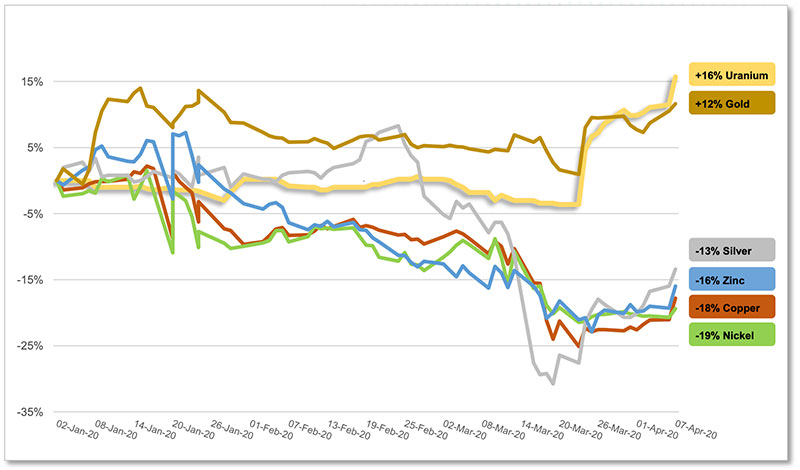

Uranium is already looking very good so far in 2020. For global explorers and miners, this report ostensibly ends the Section 232 saga and removes ambiguity that has hung over the sector since January 2018.

Spain-based project developer Berkeley Energia (ASX:BKY) said that the report was expected to contribute to improved market conditions moving forward, as US nuclear utilities, in particular, re-enter the market and term contracting in order to address future uncovered uranium requirements.

“Nuclear fuel buyers for utilities typically look to secure contracts a minimum of two years ahead of use,” the company says.

“With a number of contracts dropping off from 2021, buyers may step into the market, providing another possible prop to uranium prices.”

More generally, NFWG also recommends getting rid of the US Department of Energy ‘uranium barter’, which would remove as much as 5 million pounds of secondary uranium supply from the market.

“This is great news, as these US government sales previously added to excess secondary supply and market overhang,” says Mike Young, managing director of advanced Australian hopeful Vimy Resources (ASX:VMY).

Young says the working group also calls for a level playing field for all forms of energy in the power markets, “which would especially give merchant nuclear plants a boost”.

“The one most relevant to Australian uranium producers,” he says.

“For too long nuclear has been hurt by the asymmetrical advantage given to intermittent renewables.”

NOW READ: Barry FitzGerald — Confidence is brewing, is the uranium renaissance upon us?

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.