Thor’s initial sampling at US uranium project delivers positive vanadium results

Thor Gods. Pic: Getty Images

Special Report: Market watchers with an interest in uranium and vanadium stocks are keeping tabs on Thor Mining as it unveils positive test results for its US uranium-vanadium project.

Thor Mining (ASX:THR) has been diligently carrying out field sampling on its uranium-vanadium project in the US state of Colorado and has now received the results which it says are ‘promising’.

Highlights for the test results show an average content for vanadium of 1 per cent and 0.04 per cent for uranium in eight initial tests.

Two outcrop samples from the Rim Rock mine, however showed much higher grades of 1.8 per cent and 2.0 per cent vanadium.

Executive chairman Mike Billing said he was pleased with the calibre of the vanadium samples collected at the company’s Colorado claims.

Vanadium is used in heavy-use steel products such as armour plating for military vehicles, locomotive and truck axles and engine pistons.

More detailed assay tests are pending for Thor’s uranium prospects, and Billings said he was pleased with initial results for the uranium content of test samples.

“Assays of the higher-level radioactive samples are eagerly awaited. These assay results are expected later in July,” he said.

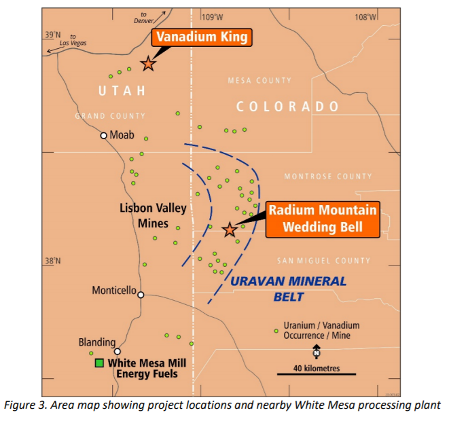

Thor has interests in a number of vanadium and uranium prospects in Colorado and Utah, held by American Vanadium, which Thor is in the process of acquiring.

In June, Thor said it had picked up an exclusive option to acquire 100 per cent of the shares of American Vanadium, a private Australian company.

Prices on the rise

Positive sentiment has buoyed uranium prices to levels last seen five years ago, while vanadium prices are coming off market lows as global steel production stays resilient.

Uranium prices took off to US$33/lb in June from US$23/lb in March, coinciding with COVID-19 related disruption to global supply chains, as countries looked to secure sources of energy such as nuclear power.

Thor said previously market fundamentals for uranium were looking healthy as global demand was expected to exceed supply in 2020.

President Trump has underlined the health of the uranium market with his pledge to stockpile $US150m of uranium fuel for US power generation.

A nearby toll treatment plant located close to Blanding has traditionally taken ore for processing, and could provide a low-cost entry into production for Thor.

Thor is making progress in developing its vanadium and uranium projects and with these markets moving in the right direction looks poised to benefit long term.

>> Now watch: Stockhead V-Con: Why uranium is set to go nuclear

This story was developed in collaboration with Thor Mining, a Stockhead advertiser at the time of publishing.

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.