Uranium is back in the spotlight and Thor has front row seats

Pic: John W Banagan / Stone via Getty Images

Special Report: Thor Mining’s entry into uranium could not be better timed given demand is widely expected to outstrip supply, a point that has sent prices soaring this year.

Back up a couple of years and Thor Mining’s (ASX:THR) main listing was in London as executive chairman Mick Billing was of the view that the ASX was dead in the water.However, that has now changed with the company raising close to $1m on the ASX and securing an option to acquire the US uranium projects.

And there are many reasons why this looks well timed.

Uranium prices have climbed substantially since January this year as the COVID-19 pandemic brought the already apparent disconnect between uranium demand and supply sharply into focus.

US President Donald Trump’s move to set aside $US150m in the 2021 budget to purchase uranium from US mines to create a national reserve just adds to the attraction, which has led several other Australian companies to acquire US uranium projects.

The US is a major consumer of uranium with nuclear power making up about 20 per cent of its total generation capacity but produces very little of its own fuel.

So just what are the assets that Thor is acquiring?

Under the option agreement, Thor has agreed to pay $100,100 in cash and shares to secure an exclusive option to acquire American Vanadium.

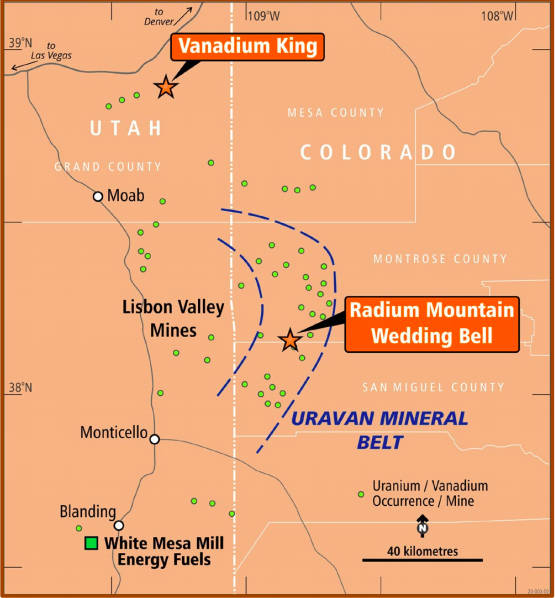

American Vanadium owns 199 contiguous claims (the Wedding Bell and Radium Mountain projects) in the famed Uravan Mineral Belt in southwestern Colorado and 100 claims (Vanadium King project) in southeastern Utah.

The Uravan Mineral Belt has been an important source of uranium and vanadium in the US for more than 100 years, producing more than 85 million pounds of uranium and over 660 million pounds of vanadium.

Average production grades from the 1940s to January 1979 are reported to be 0.25 per cent uranium and 1.29 per cent vanadium.

Should its due diligence work be satisfactory, Thor can acquire the company by issuing $144,000 worth of shares and future payments of performance rights for the issue of up to 102 million shares over three stages on the achievement of project milestones.

“The field component of the due diligence is complete. We had a Colorado-based team do the site reconnaissance work and take a whole bunch of samples from historical mining dumps, mine entrances and outcropping mineralisation,” Billing told Stockhead.

“There is the legal and tax associated with companies that we are acquiring that is not quite complete but so far nothing is causing us any grief or is a show-stopper.

“There are still a few things to do but so far it is all positive. I’ll be very confident that the due diligence process will be finished before the end of June and so far, nothing negative has come out of it.”

Fuelling the uranium sector

Billing noted that there was an enormous amount of historical data on the Wedding Bell and Radium Mountain projects, which were mined until about 1981 when the price of uranium fell through the floor.

“Obviously if we can get a hold of the data, it is extremely useful because we don’t have to do a whole bunch of drilling if it has already been drilled before,” he said.

“We also want to confirm there is no historical drilling on the outcropping mineralisation that we want to drill sooner rather than later.”

Another high-priority target is an area at the southeast end of its claims that has had no mining activity despite having exactly the same geology as everywhere else.

“The mineralisation there is likely to be relatively shallow and we want to be drilling those things as soon as we sensibly can this year,” Billing explained.

Over in Utah, the Vanadium King project was the subject of historical drilling in the early 1980s by Hunt Oil which resulted in the definition of a shallow, low-grade non-JORC resource in the Brushy Basin formation.

However, it is the historical mining immediately to the south of the company’s claims that are of especial interest to Thor as these operations extracted high grade ore from the deeper Salt Wash formation between 30m to 50m below the Brushy Basin formation.

This raises the possibility that Hunt Oil’s drilling might have only tested the shallower formation.

“If this is confirmed, then there is likely to be higher grade Salt Wash formation mineralisation just a little bit deeper than the 1980’s drilling had intersected,” Billing said

However, it is the proximity of all three projects to Energy Fuels’ White Mesa mill, which traditionally toll treats ore from the region and is publicly known to be operating well below capacity that has Billing excited.

“That represents to us good potential to get these deposits established into development and production quickly as we may not have to finance processing plants or get environmental approvals for a processing plant and tailings disposal facility,” he said.

It’s not all about nuclear energy

There is more to Thor than a couple of uranium projects — no matter how prospective or interesting. The company also has a number of non-uranium projects in Australia.

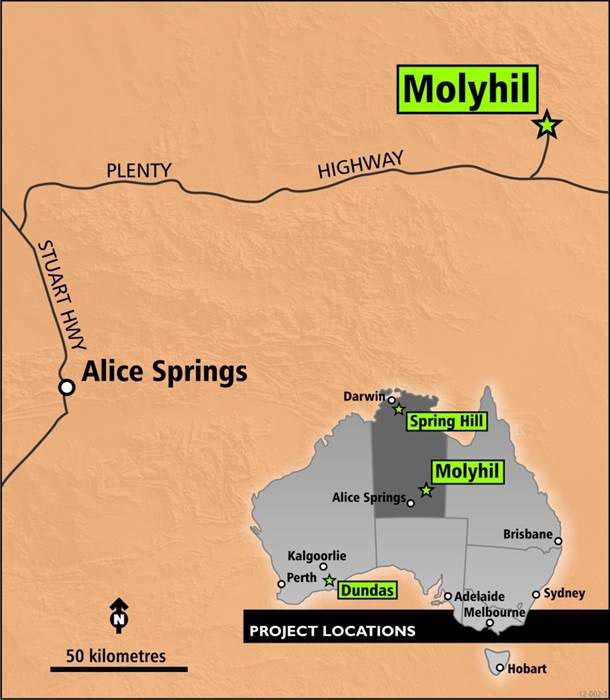

At the top of the list is the development ready Molyhil tungsten-molybdenum project in the Northern Territory.

“The work on Molyhil is all done and dusted. We are now at the stage where we are trying to secure project finance,” Billing explained.

Thor has already defined a resource, completed the metallurgy, environmental work and feasibility for the project and now just needs to raise $US40m to get it into development.

“Once we get project financing, we will take the project on with vigour,” he added.

Molyhil has an ore reserve of 3.5 million tonnes grading 0.29 per cent tungsten and 0.12 per cent molybdenum.

Thor is also maintaining its copper investment in the in situ recovery projects held by EnviroCopper.

While the company has a budget to increase its equity in EnviroCopper by investing a further $300,000, the bulk of the work to be carried out in the next few months is substantially covered by a research grant from the Australian government.

Billings added that the gold potential of these copper projects was especially of interest as while there was a reasonable amount of gold in historical drilling, a lot of the historical work did not assay for the precious metal.

“So we are going back to try and fix that because if there is gold there, the in situ leaching process that we are proposing and testing at Kapunda, we get the gold out of there for nothing along with the copper,” he said.

Thor also holds a gold exploration project in the Pilbara, though Billing says this is still at a very early stage.

This story was developed in collaboration with Thor Mining, a Stockhead advertiser at the time of publishing.

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.