This is why Strike is bullish about its Argentinean lithium play

Pic: Tyler Stableford / Stone via Getty Images

Special Report: Strike Resources managing director William Johnson on why he’s excited about the Solaroz lithium play, which neighbours Orocobre’s producing Salar de Olaroz project in Argentina.

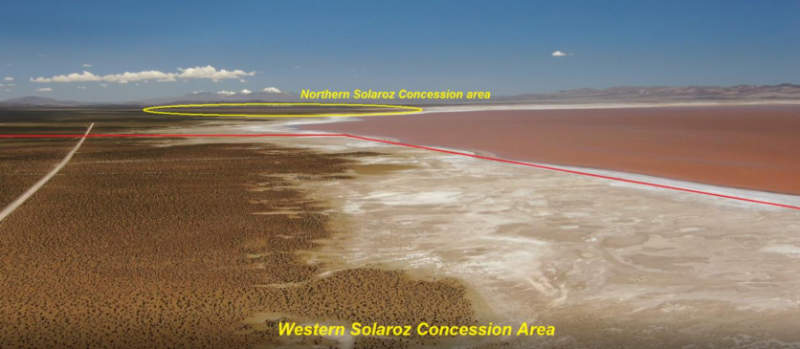

In March this year, Strike Resources (ASX:SRK) acquired a 90 per cent interest in a 12,000 hectare land package that makes up the Solaroz lithium brine project.

What makes the project so intriguing is its location in the heart of South America’s “Lithium Triangle”, on the same salar (salt lake) as Orocobre’s (ASX:ORE) operation.

The region is host to the world’s largest reserves of lithium. Argentina is the world’s third largest producer of lithium after Australia and Chile.

Lithium brines are currently responsible for most of the world’s supply, and those producers in Argentina are amongst the lowest on the lithium carbonate cost curve thanks to their world- leading operating costs and a production process that is both simpler and more environmentally friendly.

The location is what drew Strike to this project, managing director William Johnson told Stockhead.

“What particularly attracted us to it is location right in the heart of South America’s “Lithium Triangle” and directly adjacent to Orocobre’s Salar de Olaroz project, which is one of two lithium producers in Argentina,” Johnson said.

“At 12,000 hectares, it was the largest remaining landholding on that particular salt lake.

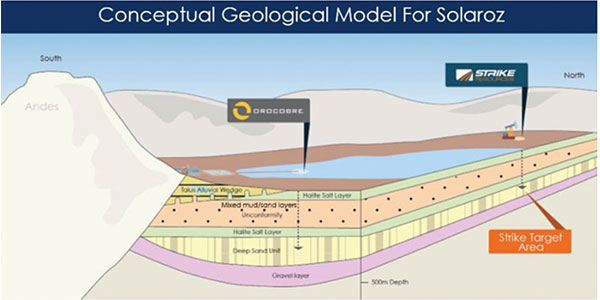

“Given its location and its size, we believe there is a very good chance that directly below the concession areas we have, we can tap into the same underground aquifers that Orocobre are using.”

“On the assumption that the lithium-rich brine flows relatively freely through the aquifers, there is no reason, given this location and the size of the concessions we have, why we couldn’t potentially find a resource of similar size and quality to that which they have.”

Game-changing potential

Johnson said that project could have a major impact on the company.

“We are a small company with a market capitalisation of less than $15 million, Orocobre has a market cap close to a billion dollars,” he said.

“We potentially have the ability to create something similar to what they have, so in that respect, it is very important to us.”

Strike filed its Environmental Impact Assessment (EIA) with the local authorities in July and Johnson told Stockhead that he expects the company to start work early in the new year.

“Once they are done reviewing the EIA, we will be able to start a fairly aggressive exploration strategy that will include geophysics and drilling which will allow us to define the potential size and quality of the resource.

“Once we have done that work, we will be able to review the results and work out what is best direction that this company should take.

“This could include setting up a fully integrated operation, which obviously will involve a very high amount of capital expenditure, or the fast and lower cost option of producing a lithium brine product that we can either export in bulk to customers or feed into an existing plant nearby.”

To provide some context into the potential that Strike could be looking at, Orocobre’s Salar de Olaroz project has a measured and indicated resource of 6.4 million tonnes of lithium carbonate, which is capable of sustaining current continuous production for 40-plus years, with only 15 per cent of this resource extracted to date.

Lithium Market

Johnson also touched on the overall lithium market, noting that most reports are forecasting a 20 per cent compound annual growth rate per year in demand for lithium, mostly driven by the growth in electric vehicles.

“I am personally very bullish on the medium to long term prospects for the market,” he told Stockhead.

“Electric vehicles probably account for about 40 per cent of lithium demand and when you look at forecasts for electric vehicle penetration, they currenty account for about 2 per cent of global vehicle sales.

That is forecast to double within five years to about 4 per cent — an enormous increase in electric vehicles and battery capacity which will drive demand for lithium.”

Other Projects

“Outside of that (Solaroz) in the battery minerals space, we have an interesting graphite project in Queensland. The Burke project is relatively small, but it has extremely high-grade graphite which makes it attractive,” Johnson said.

Australian government-backed CSIRO has already confirmed that graphite from the Burke project is potentially suitable for use in lithium-ion batteries.

“Apart from that, our company has been traditionally focused on the iron ore space,” Johnson said.

“Our flagship Apurimac project is a very large, high-grade magnetite iron ore project in Peru that we have been developing for 15 years.

“With iron ore prices where there are at the moment, we are obviously having a close look at that to see what opportunities we have to can capture some value in the near term.

Closer to home, Strike has a very attractive iron ore project in the Pilbara, called Paulsens East, which it is attempting to bring into production during 2020 to capitalise on high iron ore prices.

“Hopefully, we can move Paulsens East towards production within the next six to nine months,” Johnson said.

“If we can generate some early cash flow from Paulsens beginning next year, it can feed into our bigger projects particularly the lithium project and iron ore project in Peru.”

>> Learn more about Strike Resources

>> Lithium stocks guide: Here’s everything you need to know

Read more: Strike shows early promise for replicating Orocobre’s lithium success in Argentina

>> Now watch: 90 Seconds With… William Johnson, Strike Resources

This story was developed in collaboration with Strike Resources, a Stockhead advertiser at the time of publishing.

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.