Strike shows early promise for replicating Orocobre’s lithium success in Argentina

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

Special Report: Besides having some potentially lucrative iron ore projects, Strike Resources also has a lithium project that could rival Orocobre’s Salar de Olaroz mine in Argentina.

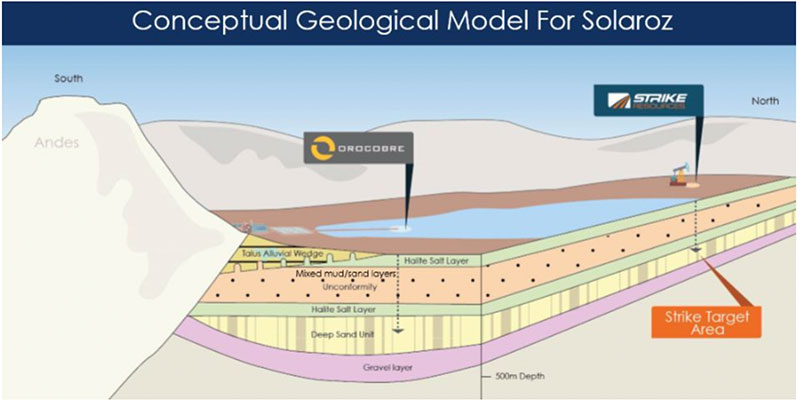

Strike’s (ASX:SRK) project is located in the heart of South America’s “Lithium Triangle”, on the same Salar (salt lake) as Orocobre’s (ASX:ORE) operation.

The region is host to the world’s largest reserves of lithium, and Argentina is the world’s third largest producer of lithium after Australia and Chile.

>> Learn more about Strike Resources

Strike managing director William Johnson says the company’s Solaroz project has the potential to host a similar resource to Orocobre’s mine.

Orocobre’s Salar de Olaroz has a measured and indicated resource of 6.4 million tonnes of lithium carbonate equivalent (LCE), which is capable of sustaining current continuous production for 40-plus years, with only about 15 per cent of the defined resource extracted.

Strike has 12,000 hectares of concessions adjacent to Orocobre and TSX-listed Lithium Americas.

“Solaroz offers significant upside potential, given its location next to Orocobre’s producing project,” Johnson said.

Brine advantage

Solaroz is a brine project, which has significant advantages when compared to hard rock lithium deposits.

Lithium is mined from two main sources — hard rock (hosted in spodumene ore) and brine (lithium-enriched saltwater).

Most of the world’s lithium supply currently comes from brine projects, and those in Argentina are among the lowest on the LCE cost curve.

This is because the operating costs of brine projects are lower, and the production process is much simpler and more environmentally friendly.

Strike believes that its Solaroz project overlays the same lithium brine-rich aquifer targeted by Orocobre.

The company plans to ramp up exploration activity in Argentina towards the end of the year as environmental approvals are secured.

Another string in Strike’s bow

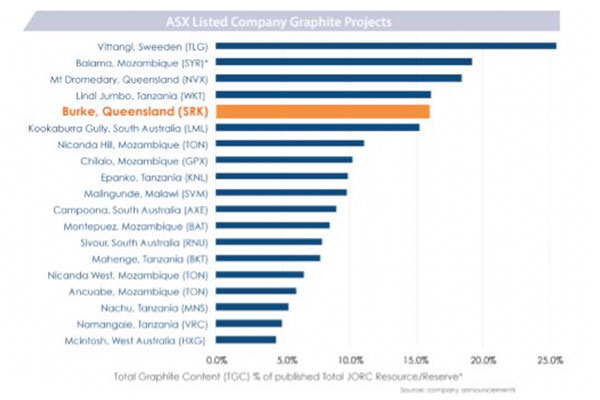

Strike also has one of the highest-grade deposits of graphite in the world owned by an ASX-listed company.

It has a 70 per cent stake in the Burke graphite deposit in Queensland, which so far hosts a resource of 6.3 million tonnes at 16 per cent total graphitic carbon (TGC) for 1 million tonnes of contained graphite.

That includes 2.3 million tonnes at 20.6 per cent TGC for 464,000 tonnes of contained graphite.

In terms of grade, the project ranks just behind Walkabout Resources’ (ASX:WKT) Lindi Jumbo project in Tanzania – placing it fifth on the list.

Australian government-backed CSIRO has already confirmed that Strike’s graphite is suitable for use in lithium-ion batteries.

The Burke project also has the added advantage of being located in a low sovereign risk jurisdiction when compared to most other graphite projects, particularly those in Africa.

Capitalising on rapid EV growth

Strike is well placed to take advantage of the rapidly rising demand for lithium and graphite thanks to the booming electric vehicle industry.

While prices for lithium and cobalt products have continued to fall, “long term demand projections haven’t budged and are still very much intact”, according to lithium expert Chris Berry.

The consensus is that demand for LCE will still rise to 1 million tonnes per annum, it will just take a little longer than the originally expected 2025 timeframe.

A typical 60 kilowatt-hour EV battery requires about 50kg of LCE and 50kg of graphite.

In 2018 there were just 2 million EVs on the roads, but by 2030 that is projected to reach 30 million.

>> Lithium stocks guide: Here’s everything you need to know

This story was developed in collaboration with Strike Resources, a Stockhead advertiser at the time of publishing.

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.