This is why Hawkstone’s Big Sandy project has all the makings of a successful lithium play

Pic: John W Banagan / Stone via Getty Images

Special Report: A large potential resource, simple mining and excellent infrastructure are all the ticks that Hawkstone’s man on the ground has made on his checklist.

Hawkstone Mining’s (ASX:HWK) US general manager Doug Pitts is looking to leverage his experience working on new ventures and start-ups to help drive the company’s promising Big Sandy lithium project in Arizona.

Pitts started his career with Hazen Research, which does contract research and development and pilot plants.

He then worked for global engineering, procurement, construction and project management company Bechtel for 18 years and spent a considerable amount of time in Australia on several mining/metals and oil/gas projects that were undergoing construction.

He also worked for a number of start-ups including Molten Metal Technology, which focused on a technology to destroy and recycle hazardous and low-level radioactive waste, six years with US defence, intelligence, security and infrastructure engineering firm Parsons Corporation and a stint with French multinational AAREVA Renewables.

“I had the opportunity at Bechtel and Parsons and now at Hawkstone to work on new ventures and go through the process of defining the projects and doing all the work that is necessary to develop plants that are financeable,” Pitts told Stockhead.

He said the Big Sandy project’s two largest advantages were its large resource size and ease of mining and processing.

“We are planning to produce up to 30,000 tonnes per year of lithium carbonate for a period of over 45 years.”

He noted that mining Big Sandy would be like mining a quarry.

“There’s not a lot of overburden, so the mining costs are quite low and we have very good infrastructure here to transport consumables into the plant and transport product out,” Pitts said.

He also pointed to the US designating lithium as a critical mineral as being a big deal thanks to its use in electric vehicles and battery storage for renewable energy.

“That’s a very big priority for the US government and the region that we are in, Arizona, Nevada and even down into Mexico will become what we call the lithium corridor,” Pitts said.

“The designation of lithium as a critical mineral in the US is going to expedite the permitting, that’s the biggest hold up there.”

“And the final thing is that Arizona is a very mining-friendly state. There are a lot of big mining companies here and the regulatory and incentive environment of the state has been very good.”

“We talked to the Arizona Commerce Authority and they are very interested in providing some incentives for us to make the project even more attractive.”

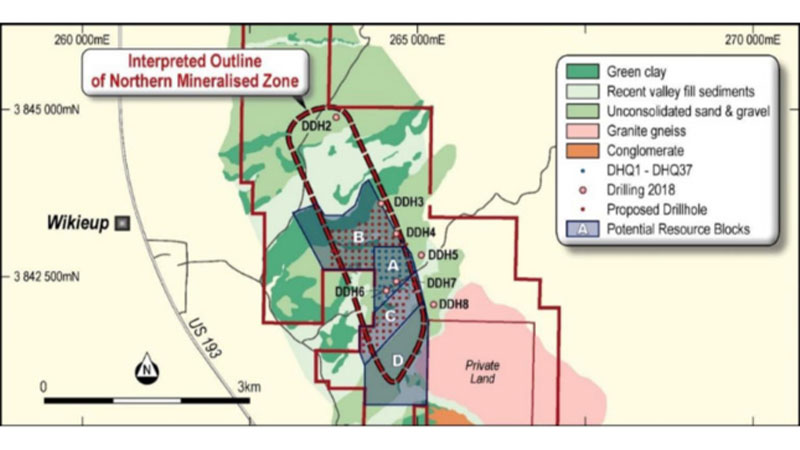

Hawkstone recently boosted the overall ‘exploration target’ at Big Sandy by 5 per cent to between 271.1 million tonnes and 483.15 million tonnes at 1,000 – 2,000 parts per million (ppm) lithium.

While exploration targets are conceptual in nature, the first phase of drilling conducted by the company has only covered about 4 per cent of the total leases but has already allowed Hawkstone to define a maiden resource of 32.5 million tonnes at 1,850 ppm lithium.

The end product

Hawkstone is looking to produce battery-grade lithium carbonate and, while Pitts noted that the company was about two to three years behind Lithium America, he added that the flow sheet had already been tested with Thacker Pass already running major pilot plant tests.

“Realistically, the development of sedimentary clays is new,” Pitts said.

“Spodumene has been around a long time, Australia is a major producer in that. The brines have been around for a long time too but no one has brought a sedimentary clay deposit into commercial operation yet.”

However, he added that the process that Hawkstone was planning to use was very simple and had proven chemistry.

“We are basically going to leach the lithium from the ore using sulphuric acid and do some purification steps, then hit the leach liquor with soda ash and precipitate lithium carbonate,” Pitts explained.

Having Lithium America’s Thacker Pass or even Ioneer’s (ASX:INR) Rhyolite Ridge lithium-boron project enter production first would also be a benefit, with Pitts saying that it would assure investors of the financial viability of sedimentary clay deposits and allow the company to move up the learning curve a lot faster.

“I am excited to be able to draw on my experience to construct a bankable pilot plant for the Big Sandy project that will prove that the lithium can be efficiently and commercially extracted from the sedimentary material. This will be my short term focus and absolute priority in 2020.”

He also flagged the potential for the company to build its own sulphuric acid plant and sell any excess to the market in Arizona.

“The biggest operating cost we have is sulphuric acid. We are looking at a variety of options — we may buy the acid in the early years then build an acid plant. Arizona has a shortage of sulphuric acid now because of all the mining opportunities there,” he said.

“So if we build a large acid plant, we can provide all the acid for ourselves and sell excess acid to the Arizona market and it produces a substantial amount of carbon-free power.”

Read more:

This is why broker PAC Partners is backing lithium play Hawkstone

>> Now watch: 90 Seconds With… Paul Lloyd, Hawkstone Mining

This story was developed in collaboration with Hawkstone Mining, a Stockhead advertiser at the time of publishing.

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.