Hawkstone boosts lithium exploration target again at Big Sandy ahead of 2020 drilling blitz

Pic: Al Bello/ Getty Images Sport

Special Report: It’s an exciting time to be a US-based lithium play. With prices poised for a rebound more generally, the US push to build a domestic battery supply chain continues unabated.

But this is just one reason Arizona-based lithium explorer Hawkstone Mining (ASX:HWK) is in a great spot.

Another would be the sheer size of the company’s shallow high-grade Big Sandy project — a lithium-bearing sedimentary horizon 11km long, 2km wide and up to 60m deep essentially from surface.

Today, the explorer boosted the overall ‘exploration target’ at Big Sandy by 5 per cent to between 271.1 million tonnes to 483.15 million tonnes at 1000 – 2000 parts per million (ppm) lithium.

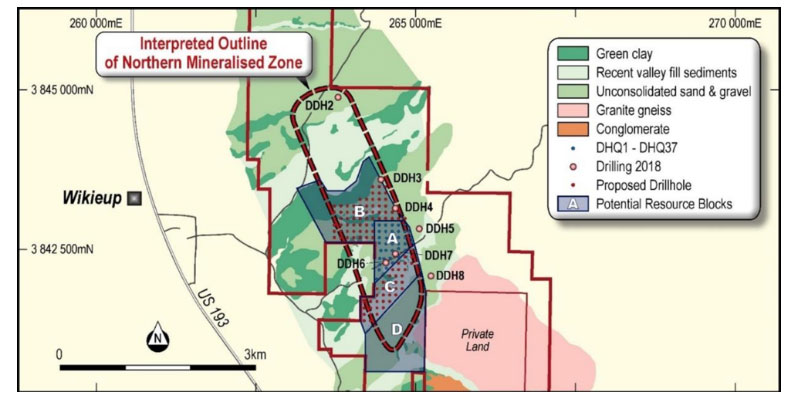

This is thanks to a 23 per cent increase in the size of the exploration target within Blocks C and D in the ‘Northern Mineralised Zone’ (NMZ):

Hawkstone recently converted the NMZ’s Block A exploration target into a maiden JORC resource — 32.5 million tonnes at 1850ppm for 320,800 tonnes lithium carbonate equivalent (LCE).

To put the overall size of Big Sandy into perspective – this maiden resource covers just 4 per cent of the project area.

A stage three drilling program is planned for 2020 with the objective of converting the current reported exploration targets, Hawkstone managing director Paul Lloyd says.

“This drilling will target Blocks B and C in the Northern Mineralised Zone as we continue to develop the Big Sandy lithium project.” Lloyd says.

“With mineralisation remaining open to the north, south and west, the project potential is huge.”

NOW READ: Four reasons why Hawkstone won’t fly under the radar for very long

This story was developed in collaboration with Hawkstone, a Stockhead advertiser at the time of publishing.

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.