This is why broker PAC Partners is backing lithium play Hawkstone

Pic: John W Banagan / Stone via Getty Images

Special Report: Equities provider PAC Partners shares the reasons why it stands behind Hawkstone Mining.

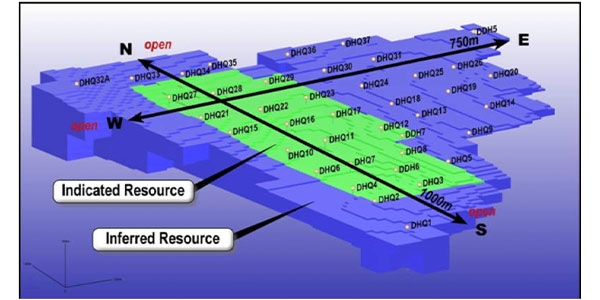

Hawkstone Mining (ASX:HWK) recently passed a key milestone with the announcement of an initial resource at its Big Sandy lithium project in Arizona.

While the resource of 320,800 tonnes of lithium carbonate equivalent with an in-ground value is certainly a step in the right direction, it represents just four per cent of the project area — a lithium-bearing sedimentary horizon which is 11km long, 2km wide, and up to 60m deep essentially from surface.

The average realised price of lithium carbonate was about US$10,000 per tonne in October.

But the potential size of the project is just one of the things that motivated equities provider PAC Partners to support Hawkstone’s share placement that raised $2.4m in May this year.

>> Learn more about Hawkstone Mining

One of the other reasons is the type of mineralisation at Big Sandy.

“I certainly had some pre-conceived ideas about the geology. I thought that it was just a lithium brine that has evaporated and left the lithium behind in the clays,” Pac Partners senior resource analyst Andrew Shearer told Stockhead.

“But it is a bit more geologically unique, in that it is more the interaction of volcanic fluids with volcanics and sediments. What this means is there is a uniqueness here that represents an opportunity.”

Preliminary metallurgical test work carried out by the company proves that lithium can be readily extracted from Big Sandy material using sulphuric acid, a well-known and well-tested process that is widely used by copper producers in Arizona.

Another of Big Sandy’s advantages was the easy access to infrastructure, Shearer said.

“It was quite easily accessible, there is power running to the site, there is not a lot of competing land use; it is dry, arid desert, the only impediment is the odd cactus plant,” he said.

PAC Partners managing director Craig Stranger added that the project was close to major cities such as Las Vegas and Los Angeles — a competitive advantage over Australian projects.

Its all about the team

However, Shearer emphasised that one of main reasons PAC Partners supported Hawkstone was the quality of its management team.

Besides non-executive chairman Barnaby Egerton-Warburton, who had previously served as a non-executive director of ioneer (ASX:INR), the company also boasts ex-Tesla technical expert Dr David Deak as a consultant.

“Deak’s background includes working on Lithium America’s large Thacker Pass lithium clay project. He brings the technical role at Lithium America’s and his lithium market understanding from Tesla,” Shearer said.

“This includes his knowledge in how to extract the lithium out (of Big Sandy) right through to his ability to understand the lithium market.”

Lithium Market

The view that the lithium market is being flooded with supply right now does not take into consideration that ‘not all lithium material is created equal’, Shearer said.

“Lithium is essentially an industrial metal; it is not like gold or copper where you produce it to a spec and sell it on the open market. It takes time for the various lithium components to be accepted by the end users,” he said.

“People don’t realise that there is a three-year qualifying period for lithium supplies to be acceptable by the end user. This is the case for any energy minerals — quality is paramount.

“That’s where I think that David’s [Deak] ability to understand the nuances of what is essentially, an industrial mineral market will be very valuable to a microcap like Hawkstone going forward.

“At a higher level, the supply side ramped up faster than the demand side with the expectation that the demand side would ramp up. But it is coming. I’m still bullish further down the track.”

Supply Security and End Users

Hawkstone’s location in the US also presents some added benefits. With the ongoing trade war between the US and China, the former has moved to secure its critical supply chains.

This includes the recent designation of lithium as a mineral critical to the country’s national security and economy.

“You have to bear in mind that a lot of the current (lithium) production is used by China and if these trade wars continue to escalate, it will have to some merit in being a US based company as well for security issues,” Shearer added.

“As for potential end users in the USA, you have the likes of Tesla and the larger battery manufacturers with manufacturing facilities.

“Tesla is a great technology company that builds electric cars. VW are ramping up their electric vehicle side of things. Premium brands are starting to get into the space. Once you begin to see that wholesale adoption, it will snowball quickly.”

The Road Ahead

“It is a micro cap story, a lot of opportunity to add value to the project. They have started to do that, they are on the ground running, got the resource, geologically speaking getting a resource on this project is not that hard,” Shearer said.

“The next big challenge is going to be proving to the market that the metallurgy can be solved, and bench scale and pilot scale economic extraction can be achieved.

“But the real big one for us, the gamechanger that will take Hawkstone from a micro to moving up into the ioneers’, Lithium Americas’ in terms of market cap is probably how they fund it.

“Again, we are going to need someone to come in and help, to be the cornerstone, in my view. Equity markets can’t provide all the financing needed and certainly third party verification will be very beneficial for them.

“Again, David’s relationships with those end users will certainly help there.”

Read more: Hawkstone unveils game-changing maiden lithium resource at Big Sandy

Four reasons why Hawkstone won’t fly under the radar for very long

>> Now watch: 90 Seconds With… Paul Lloyd, Hawkstone Mining

This story was developed in collaboration with Hawkstone Mining, a Stockhead advertiser at the time of publishing.

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.