This ASX vertically integrated battery stock says graphite will remain at centre of world’s EV plans

Pic: Getty Images

- Graphite is the largest component by volume in lithium-ion batteries (LIBs), making up around 20-25% by weight

- Graphite supply as a LIB active anode material (AAM) will be in deficit within the next two years

- Magnis is developing a vertically integrated battery business in Tanzania and the US

- Irrespective of a battery’s cathode chemistry over the coming decade, graphite will remain the predominant AAM

While lithium is the poster child of the energy transition, graphite might well be the great sleeper battery mineral that is starting to awaken.

After all, most people don’t realise that graphite is the largest component by volume in any given lithium-ion battery, making up around 20-25% by weight of LIBs or about 15 times the amount of lithium.

That means a supercharged appetite for a battery-quality graphite.

This demand is now likely to surpass the capacities of existing graphite mines with Macquarie’s Graphite Market Outlook estimating graphite supply will be in deficit within the next two years.

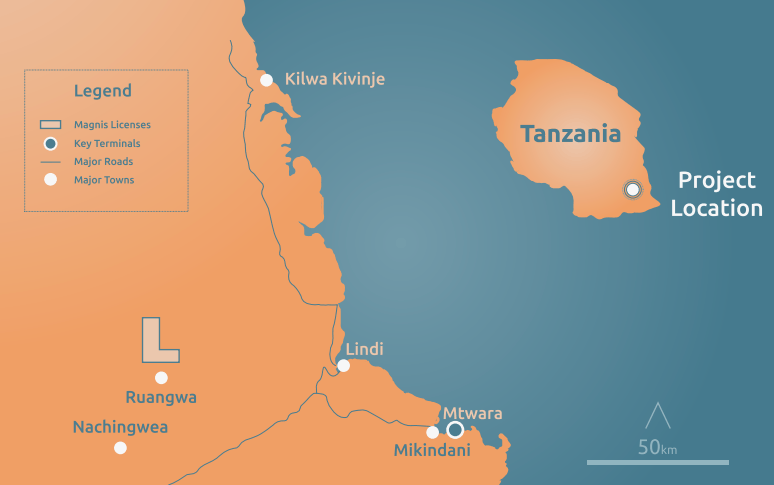

Companies with established resources and a clear plan for vertically integrated production are in the best position to capitalise in the highly demanding LIB market. That’s companies like Magnis Energy Technologies Ltd (ASX:MNS) with its proposed Nachu graphite project in Tanzania, and graphite AAM plant and currently operating iM3NY lithium-ion battery plant in the US.

Graphite: the predominant active anode material

Magnis has been active on major fronts of the LIB value chain. It is looking to produce 236,000Mt of graphite concentrate per year from its 29.77km2 Nachu project, home to a 174Mt resource at 5.4% Total Graphitic Carbon (TGC) for 9.3Mt contained graphite.

The plan is to utilise the intrinsic high-quality, high-purity Nachu graphite concentrate as a feedstock to make battery-active anode material (AAM).

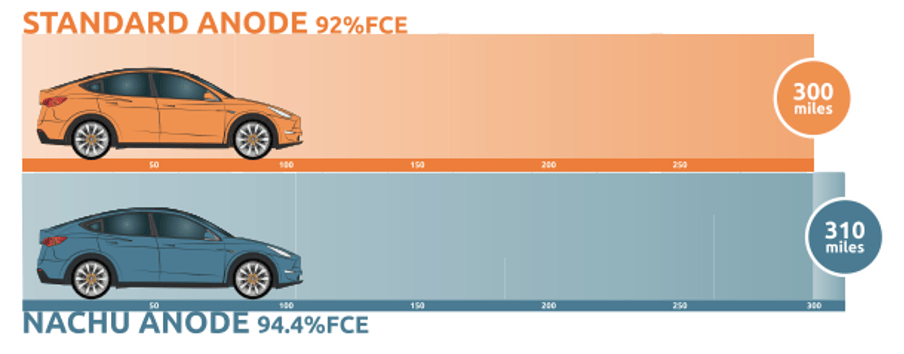

Standard natural graphite anode products in the marketplace have a first cycle efficiency (FCE) of 92%.

Nachu AAM provides benefits to EV and ESS manufacturers with a enhanced energy density cell, resulting in a longer average range and lifespan.

In February, Magnis signed an agreement with EV giant Tesla to supply a minimum 17,500tpa of AAM beginning in February 2025 for a minimum term of three years with fixed pricing from its yet-to-be-built-plant.

Meanwhile, the company’s 73% owned subsidiary Imperium3 New York, Inc (iM3NY) operates a gigawatt-scale lithium-ion battery manufacturing plant in Endicott, New York.

During the July quarter iM3NY entered into a joint venture agreement with Indian electric vehicle manufacturer Omega Seiki Mobility for the manufacture and sale of lithium-ion battery packs.

The JV company act as a stand-alone profit centre and will manufacture and sell lithium-ion battery packs produced in India to be used in OSM’s two, three- and four-wheeler electric vehicles with a geographical target covering India, UAE, Bahrain, Kuwait, Qatar and Saudi Arabia.

Batteries may evolve, but graphite to remain in high demand

Electrification of the transportation sector expected to account for 80% of global battery demand by 2030.

EV manufacturers are now competing to provide consumers with optimum-range vehicles powered by high-capacity, high-energy density, safe, sustainable, and cost-effective lithium-ion batteries.

“They are doing this by forming strategic partnerships with innovative Li-ion battery manufacturers, who in turn, are employing advanced battery chemistries, battery pack designs, and processing technologies in their batteries,” MNS director of battery technologies, Dr Jawahar Nerkar, says.

Battery makers like Magnis.

Dr Nerkar observes that competition-driven innovation is pushing battery manufacturers to utilise next-gen materials such as Ni-rich cathode materials and higher loading of silicon in graphite composite anode in batteries to enhance energy density, while next-gen technologies offering fast-charging capability are also sought.

“The commercial viability of alternative high-energy density technologies such as high-voltage cathodes, lithium-sulphur, solid-state electrolytes, and lithium metal anode are being explored,” Dr Nerkar says.

“At the same time, solvent-free dry electrode manufacturing and cell-to-pack battery assembly are being pursued as efficient, sustainable and cost-competitive processing and cell engineering battery technologies respectively.”

Dr Nerkar says irrespective of a battery’s cathode chemistry over the coming decade, graphite will remain the prevalent active anode material (AAM) in lithium-ion batteries.

“Securing graphite supply to meet demand and mitigate production delays is crucial,” he says.

“This is what we are starting to see now.”

At Stockhead we tell it like it is. While Magnis Energy Technologies is a Stockhead advertiser, it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.