Is Africa ready to pounce on the world’s demand for critical minerals?

Look inside yourself, Africa. You are more than what you have become. You must take your place in the circle of life. Via Getty Images.

In part 2/2 of our ‘Africa’s energy evolution’ series, we go to ground and explore the high-demand minerals required for our clean energy transition and how Africa can leverage its endowment to enrich itself, and the world.

Africa is blessed with vast reserves of untapped critical mineral resources and is home to some of the largest producers of key minerals such as aluminium, bauxite, graphite, cobalt, chromium, platinum, manganese and copper.

ICYMI: Missing the resources down in Africa? ‘Hurry boy they’re waiting there for you!’

Current wealth

According to the International Energy Agency (IEA), the continent is home to about a third of the world’s bauxite reserves, with Guinea itself exporting >50% of global aluminium ore in 2020.

Chromium – used in geothermal and hydropower technology, is concentrated in South Africa, producing almost 50%, with demand expected to almost triple by 2030.

Madagascar, Mozambique and Tanzania together are the second-largest reserves of graphite, and the world’s leading cobalt producer, the Democratic Republic of Congo (DRC), produces over 70% of the raw material, yet 60% of that is processed in China.

Africa also has huge deposits of lithium, manganese, copper and platinum group elements (PGE) and rare earths – all classed as critical minerals.

Yet most of these are exported as raw materials, due to Africa’s nascent domestic downstream processing and manufacturing industries, leaving countries unable to generate extra wealth for their populations.

And so these critical minerals leave the continent at a discount and come back at a premium, in the form of smartphones, solar panels, electric vehicles, batteries and a whole range of other manufactured items.

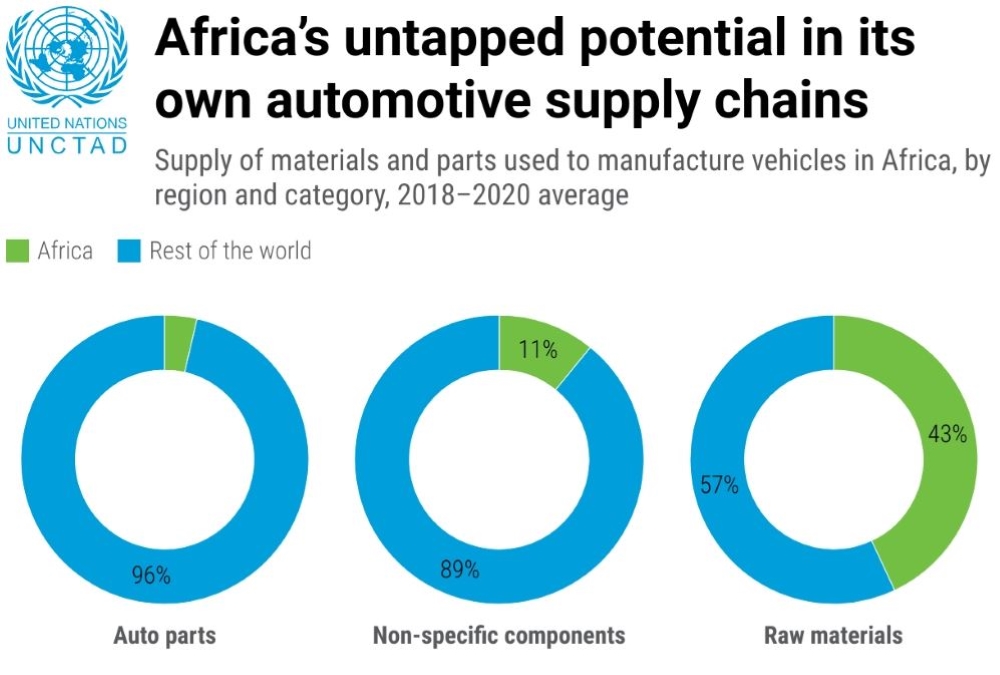

These statistics show just how lop-sided the African supply chain is when it comes to raw material production, manufacturing and other key components:

Opportunity knocks

The IEA says developing more robust governance, transparency of contracts and strong labour rights “will be key to maximising the opportunity for the continent, as will targeted industrial policies that focus on processing minerals in-country for consumption in domestic or regional markets.”

With this in mind, and with such high demand for critical minerals, African countries cannot sit back and let this opportunity to create domestic processing and refining capabilities pass them by, as they’ve been far too marginalised for far too long.

The United Nations Conference on Trade and Development (UNCTAD) agrees, saying African economies can become major participants in global supply chains by harnessing their vast resources of materials needed by high-technology sectors and their own growing consumer markets, according to its Economic Development in Africa Report 2023.

“This is Africa’s moment to bolster its position in global supply chains as diversification efforts continue. It’s also an opportunity for the continent to strengthen its emerging industries, foster economic growth and create jobs for millions of its people,” UNCTAD Secretary-General Rebeca Grynspan said.

“Africa’s abundance of critical minerals and metals, including aluminium, cobalt, copper, lithium and manganese, vital components in technology-intensive industries, positions the continent as an attractive destination for manufacturing.

“Africa also offers advantages such as shorter and simpler access to primary inputs, a younger, technology-aware, and adaptable labour force and a burgeoning middle class, known for its growing demand for more sophisticated goods and services.”

Which ASX juniors are currently on safari?

Malawi is becoming a hotbed for ASX-listed critical mineral projects lately, as the country’s government views mining as one of the main pillars of its economic revival and wants to push mining’s long-term GDP contribution from 1pc this year up to 10pc by 2063.

Popping up in the critical minerals space is DY6 Metals (ASX:DY6) with its significant Machinga REE deposit – enriched with dysprosium and terbium, as well as significant potential for niobium and tantalum.

Results from ongoing exploration drilling returned an average of 26% high-value heavy rare earths (HREE) and 3.2% dysprosium and terbium at a cutoff grade of >2500ppm TREO.

“We’re expecting another couple of batches of results over the coming weeks and expect that market demand for HREEs and magnet rare earths from outside China puts us in a great position to keep proving up Machinga,” DY6 CEO Lloyd Kaiser says.

In terms of investment and downstream capabilities in Africa, Kaiser says “there’s a lot of scope for rare earths and it’s only a matter of time before explorers in Africa will be able to access more types of funding options as governments such as Malawi look to domestic refining options to add value to the product”.

It’s just 40km east-southeast of Lindian Resources’ (ASX:LIN) huge 261Mt @ 2.19% TREO Kangankunde project which is thought to be one of the biggest and best rare earths projects outside China.

Receiving strong support from Malawi’s government is Sovereign Metals (ASX:SVM) for the development of its 244,000tpa graphite and 222,000tpa rutile Kasiya project.

With a resource of 1.8bn tonnes @ 1% rutile and 1.4% graphite, Kasiya is the largest natural rutile and second-largest flake graphite deposit in the world.

A newly created ministerial project development committee has declared its support and lauded Rio Tinto’s (ASX:RIO) decision to back SVM as a strategic investor.

SVM’s objective is to also develop a sustainable power solution for the mine – accessing hydro and solar solutions.

Mali is known to have one of the largest reserves of lithium in Africa, and First Lithium (ASX:FL1) is off to start drilling at its Blakala prospect within its Gouna permit.

Blakala has the potential geology to mirror Leo Lithium’s (ASX:LLL) enormous 211Mt Goulamina hard rock lithium deposit grading @ 1.37% Li2O and pegged to produce 220,00tpa of spodumene concentrate over an initial 8.5yr mine life.

Across to Tanzania, vertically-integrated graphite business Magnis Energy Technologies (ASX:MNS) is looking to produce 236,000tpa graphite concentrate from its 174Mt Nachu project.

It plans to turn Nachu’s high-purity graphite feedstock into battery-active anode material (AAM) for EV manufacturers such as Tesla – with which it signed an offtake agreement for product from the yet-to-be-built plant.

Downstream, it also operates its 73%-owned subsidiary Imperium3 New York, operating a gigawatt-scale lithium-ion battery manufacturing plant – of which battery-grade graphite is integral.

HREE explorer Ionic Rare Earths (ASX:IXR) 60% owns the advanced Makuutu project where a stage 1 DFS has defined a whopping 35-year initial project life to produce a 71% rich magnet and HREE carbonate (MREC) product basket.

It has significant potential to scale that up too, and is currently undertaking further exploration while it focuses on the commercialisation of high purity magnet rare earths from its newly commissioned demonstration plant.

Over to Namibia, Arcadia Minerals (ASX:AM7) has just bought a brine lithium tenement package for $164,000 to add to its suite of projects targeting lithium, nickel, copper, tantalum and gold in the country.

The Bitterwasser lithium-in-clay project covers 327,285t of LCE, and the explorer is planning infill drilling over the Eden pan to possibly upgrade the resource into the indicated category, as well as progress a scoping study to define the lithium clay potential.

At Stockhead we tell it like it is. While Magnis Energy Technologies, Sovereign Metals, DY6 Metals, Arcadia Minerals and First Lithium are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.