This ASX-listed iron ore developer is well placed to benefit from the shift to high grade ore

Pic: John W Banagan / Stone via Getty Images

All eyes have been on the price of iron ore in recent days as volatility in the iron ore price has had a big impact on markets.

But while that is where the focus is in the here and now, there remains a story bubbling under the surface about where iron ore is headed in the future.

Increasingly, iron ore experts believe grade will be an important factor for steel mills, as efforts to curb emissions and pollution from steelmaking take centre stage.

Take this comment for instance from Fastmarkets index manager Peter Hannah, who observes iron ore markets for one of the two major price-reporting agencies.

“To succeed in decarbonizing the global steelmaking industry there needs to be a greater recognition of how much the iron ore supply base needs to change,” he wrote recently.

“Vast volumes of existing production will need to be replaced by higher-grade supply, first to meaningfully reduce CO2 emissions from the prevailing BF/BOF (blast furnace) technology, and later to meet the demands of a DRI (direct reduced iron) sector at least an order of magnitude larger than it is today.”

As Magnetite Mines (ASX:MGT) showed in a presentation released on Friday, it is one of a handful of iron ore hopefuls able to capitalise on this growing thematic.

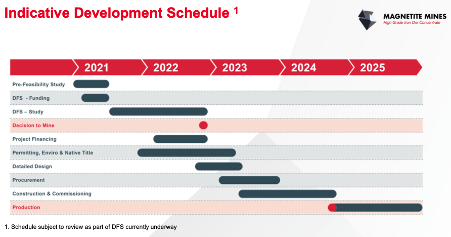

Its Razorback mine in South Australia is now in the Definitive Feasibility Study stage leading to decision to mine, planning to start operations around the end of 2024. It would produce a 68% iron magnetite concentrate.

That is well above any commonly quoted indices like the 65% Brazilian index, which already generates an substantial premium compared to the commonly quoted benchmark 62% fines price.

While the 62% iron ore index – used by most of the Pilbara iron ore miners such as BHP – was fetching US$108.67/t on Friday morning, 65% iron ore demanded US$134.60/t.

In the long run over the past decade the gap between discounted 58% iron ore, 62% product and premium product has trended wider and wider.

“Steelmakers need to adopt best practices that prioritise decarbonisation with existing assets. Some of these best practices include installation of energy efficient technology, optimisation of the blast furnace (BF) burden (e.g. with high- grade ore),” CRU Group says.

Razorback a logistical dream

While grade is one aspect of Razorback’s allure, it is not the only reason Magnetite Mines has been so keen to push ahead with a definitive feasibility study after releasing a successful PFS in July.

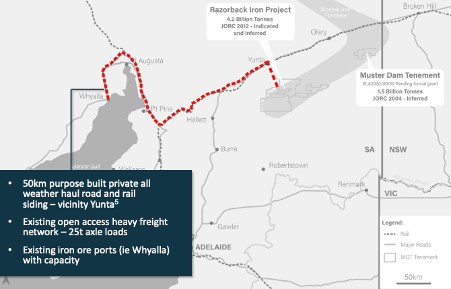

The mine, which has a resource of 4.2Bt of iron ore, stands to be a logistical dream. Located just 240km northeast of Adelaide, it has access to rail and high voltage powerlines that connect it to the Australian electricity grid.

That is significant from an ESG perspective as well because of South Australia’s high penetration of wind power and other renewables, which met around 60% of the State’s electricity needs last year.

Being in the vicinity of the town of Yunta, Razorback will have a 50km purpose built private all weather haul road and rail siding with access to an existing heavy freight network and iron ore port at Whyalla.

From a mining perspective it is also technically simple. Ore can be mined from surface, saving costs on pre-stripping with a low PFS strip ratio of 0.16:1 and the potential to improve grades with selective mining and or ore sorting.

Low cash costs underpin long-life operation

Once built, the project is highly competitive. As reported in Magnetite’s pre-feasibility study in July, the project is expected to generate cash when the 62% iron ore price is above US$54/t (including the appropriate quality adjustment). That would still be half the iron ore price on Friday, after the contraction seen in the benchmark 62% fines price in recent weeks.

At US$110/t, around the long-term average iron ore price over the past 10 years, Razorback would carry a post-tax NPV of $700 million and IRR of 20%, generating around $144 million a year in net cash flow after taxes and royalties.

At a production rate of 2.7Mtpa, the project would pay back its estimated $675m capex in 4.6 years, leaving two decades of reserves still to go.

If we were to see another bull run to US$150/t – and remember, at a 68% grade, Razorback’s concentrate would earn a premium on that – that would increase to an NPV of $1.67 billion, with an IRR of 33% and average net cashflow of $241m, something that would see Magnetite pay back its initial investment in just over 2 years.

DFS activities under way with appointment

Magnetite Mines this week appointed engineering and professional services company GHD to deliver its critical power supply and non-process infrastructure elements of the Razorback DFS, effectively kickstarting the process.

It will build on the power supply option selected from the DFS of installing a 132KV transmission line connecting to the national grid at Robertstown.

“GHD’s appointment is an important milestone for Magnetite Mines as it represents the commencement of the DFS and continues our commitment to delivering a well planned and high quality study for our shareholders,” Magnetite Mines executive chairman Peter Schubert said last week.

The DFS well underway and currently expected to be completed next year, with a decision to mine looking to be at the end of next year. Project financing and permitting will take place in parallel. The current schedule sees Razorback in production around the end of 2024, well placed to benefit from a stronger ESG focus in the mining and steel industries.

On the approval side of the ledger, work is well underway. South Australia is a predictable, stable and low risk mining jurisdiction and there is regular consultation between Magnetite and the State Government.

Baseline environmental studies are also well progressed, while the important consultation process with the people of the Ngadjuri Nation, the region’s traditional owners has started, reflecting the company’s acknowledgement of and respect for the traditional owners of the country.

Braemar district fertile for further development

While Magnetite has unlocked an impressive 5.7bt of resources across its Razorback (4.2Bt) and Muster Dam (1.5Bt) projects, that does not tell the full story of just how fertile the Braemar region is for iron ore discoveries and developments.

Of that bounty just 473Mt is included in the Razorback PFS reserve.

That factors in just 8% of Magnetite’s resource, 4% of the Braemar region’s kilometres long strike length and 0.3% of Magnetite’s tenured area.

That suggests Magnetite should have room to grow and expand beyond its initial 25-year project should the numbers stack up.

Its long life and plentiful resource and reserve base should be attractive to lenders, with Magnetite targeting early engagement to allow a collaborative approach to risk mitigation and achieve financial close by the fourth quarter of 2022.

Debt funding is likely to be complemented by a conventional equity raising or other options for equity funding.

Magnetite has $15.3m in the bank to progress its all important DFS, and a market cap of $69m as of September 21.

MGT stock is around 170% up over the past 12 months despite a dip after PFS release, but it has caught some tailwinds in recent days as investors responded well to news about its DFS preparations, rising by almost 29% from 2.1c a share to 2.7c a share over its past three trading days.

This article was developed in collaboration with Magnetite Mines, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.