These juniors are gearing up to reflect uranium’s bright future

Uranium's future is looking bright and these companies are positioned to benefit. Pic: Getty Images

- Uranium spot prices declined 3.09% in January 2025 to US$70/lb U3O9

- However, long-term fundamentals have improved due to geopolitics and structural supply deficits

- Sprott points to record nuclear generation expectations for 2025 as one key point favouring uranium

Recent softness in the uranium spot market, which has seen prices declining 3.09% in January 2025 to about US$70/lb, is masking the fact that its long-term fundamentals have improved.

In a recent report, Sprott highlighted potential US tariffs, bipartisan US support for nuclear, the impact of AI adoption, and market signals reinforcing a bullish long-term outlook for uranium.

It pointed out that the tariff on Canadian lithium exports to the US is significant as Canada is the largest foreign supplier of uranium to the US, accounting for 13.2Mlb of U3O8 purchased by US utilities in 2023 or 27% of total deliveries.

Along with the new 17.5% tariff on Chinese-enriched uranium (up from 7.5%), this has led to price dislocations with a premium emerging for uranium already held within the US compared to material stored in other countries.

While these trade policies introduce short-term uncertainty, they also reinforce the long-term importance of US uranium production and a fully Western-aligned nuclear fuel supply chain.

This also ties with the continued positive outlook for nuclear energy in the US with the appointment of Chris Wright, a former director of small modular reactors developer Oklo, to lead the US Department of Energy being a strong hint about US President Donald Trump’s views towards the power source.

Looking more broadly, Sprott believes that structural supply deficits, an increasing term price and record nuclear generation expectations for 2025 reinforce a bullish long-term outlook for uranium.

It noted the market remains well-supported by rising global nuclear commitments and persistent supply constraints.

Sprott also noted that while the emergence of Chinese AI model DeepSeek, which requires less energy than Western AI models, had initially raised concerns that it would reduce AI’s impact on energy demand, many have since suggested that the greater efficiency might actually accelerate energy consumption over time.

Long-term vs spot prices

Koba Resources’ managing director Ben Vallerine told Stockhead at the sidelines of RIU’s Explorer’s Conference in Fremantle in mid-February that the share price of uranium-focused junior companies could track the spot price quite closely as sentiment affected retail investors.

He pointed out that long-term prices, which account for 80% of the world’s uranium supply, remain locked in quite high close to the US$80/lb mark.

However, while this is considered to be a fairly good price, Alligator Energy managing director Gregory Hall said it could be better.

“While there are some plays such as our in-situ recovery project that can operate at that price, there are others that need a better price than that,” he told Stockhead.

Hall said the market remained solid as there was still a supply shortage while new reactors continued to come online.

“New mines are needed, the preferred jurisdictions for Western utilities, meaning North America, Japanese, European utilities, in the US, Canada, Australia and Namibia,” he noted.

”They all have shown over 40-50 years that they follow the rule of law, have good jurisdictions and stable political systems.”

Riding the uranium wave

So, who are some of the uranium juniors that are positioned to benefit from the long-term prospects of the energy metal?

Alligator Energy (ASX:AGE)

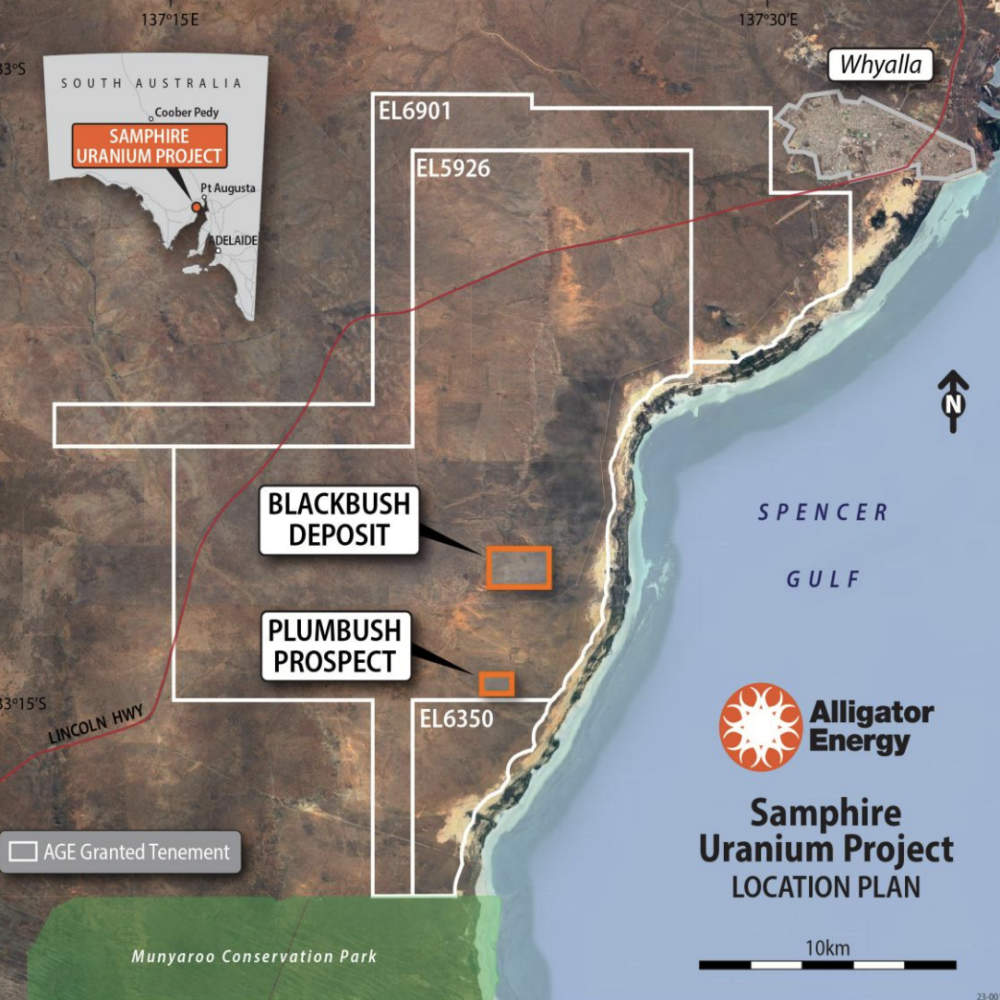

Alligator Energy has been progressing its ~18Mlb U3O8 Samphire ISR project in South Australia – a tier 1 uranium mining and production jurisdiction.

Potential exists to increase this further through drilling of the 75Mlb U3O8 exploration target.

The company recently secured a retention lease from the state’s Department of Energy and Mining, paving the way for the company to carry out a field recovery trial.

Hall said the company had three rigs and was getting the operating plan for the FRT, which will factor in conditions attached to the retention lease, approved in the coming months.

It also expects to start construction from mid-May with operations starting in Q3 2025 to capture all parameters needed for a feasibility study.

“This will give us the mining rates for uranium, the volume flow rate, all of those things,” Hall added.

“We have an updated resource underway and at the same time, we will go to engineering firms for feasibility studies from H2 2025.”

Alligator Energy will also carry out preliminary discussions with government departments for scoping of the future mining program.

“We start that process very early, scope what the approvals will look like, and start the documentation for it,” Hall added.

Fabrication of the FRT pilot process plant was completed in July 2024 and it is currently stored in Whyalla.

Separately, the company has started follow-up drilling at its Big Lake ISR uranium project in SA’s Lake Eyre Basin after assays of inaugural drilling confirmed that significant thicknesses of anomalous uranium mineralisation were intersected within interbedded palaeochannel sand units of the Namba Formation.

Big Lake targets northern extensions of the same Eyre and Namba edimentary formations which host the Beverley, Four Mile and Honeymoon ISR mining operations in the state.

Koba Resources (ASX:KOB)

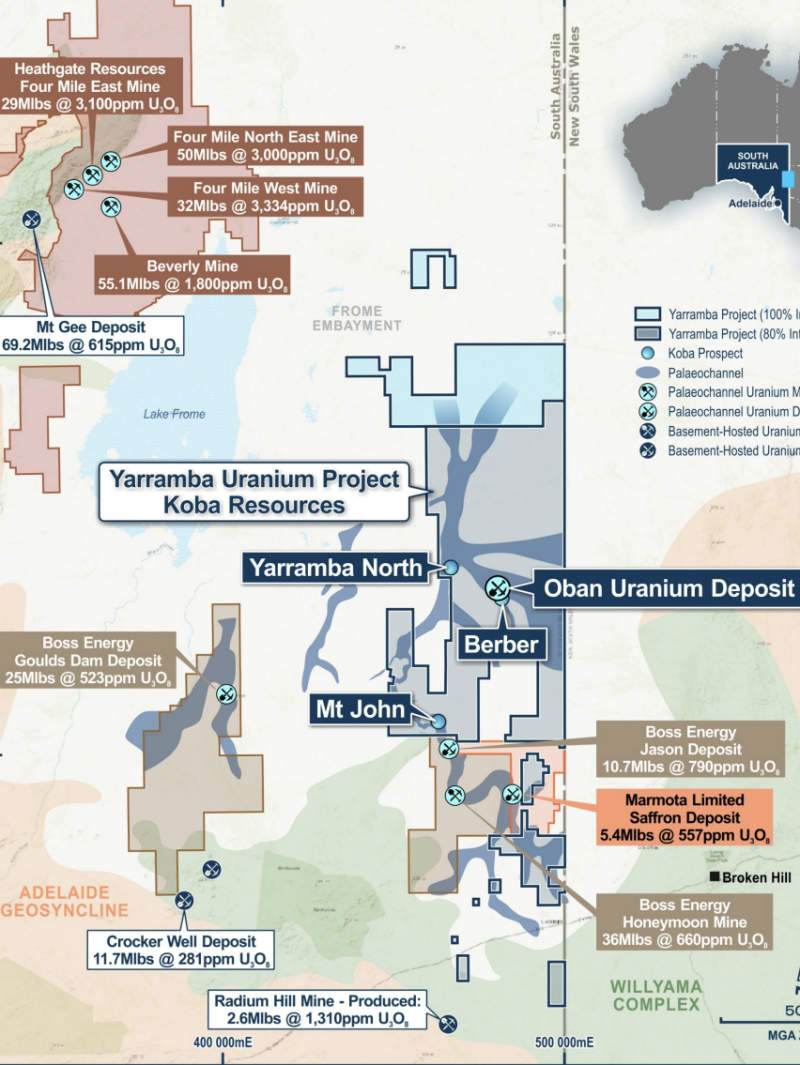

Koba Resources is focused on developing its Yarramba project just 17km north of Boss Energy’s (ASX:BOE) producing 71.6Mlbs Honeymoon operation.

It already hosts a significant resource at the Oban deposit, though this was defined under the older JORC 2004 standards while maiden drilling in 2024 confirmed the presence of shallow, high-grade mineralisation at Oban and intersected high-grade uranium at the Berber and Chivas prospects.

More recently, first pass drilling at the Mt John prospect also intersected significant mineralisation.

And there’s more news coming with Vallerine saying the company that results from a recently completed drill program will be out in the coming weeks.

“We finished up a passive seismic survey as well and we are looking to announce that in the next couple of weeks as well,” he added.

“We are currently refreshing permits and approvals to work. And then we will be ready to drill again in the next couple of months and continue to progress our uranium portfolio.

“Hopefully, that coincides with some change in the spot price and market sentiment.”

Core Energy Minerals (ASX:CR3) and Uvre (ASX:UVA)

Core Energy Minerals is preparing to carry out on ground exploration at its recently acquired Cummins project in SA after raising $3.7m through a two-tranche placement.

On-ground exploration including, mapping, confirmatory drilling and geophysical surveys at the Cummins project is planned to commence in the first quarter of 2025, with drilling proposed to commence immediately following receipt of statutory approvals.

The company is led by Latin Resources (ASX:LRS) alumni executive director Anthony Greenaway and chairman Chris Gale who were key figures in the growth of Latin Resources, a Brazilian lithium upstart that captured a major win for investors with its $560m sale in January to Pilbara Minerals (ASX:PLS).

Uvre is currently preparing to carry out the first drilling program at its Frome Downs uranium project in SA.

This follows a Phase 2 geophysical program that refined multiple paleochannel targets which are prospective for sediment-hosted uranium.

A review of historical electromagnetic data has also identified a second target area about 10km north of the Phase 1 area.

Elevate Uranium (ASX:EL8), Aura Energy (ASX:AEE), Moab Minerals (ASX:MOM) and Star Minerals (ASX:SMS)

Elevate Uranium owns the Koppies and Marenica project in Namibia and is currently working to design and construct a demonstration plant in the first half of this year with operations to start before the end of 2025.

Its proprietary process reduces ore mass by 95% prior to leach, providing a potential 50% capex and opex reduction compared to conventional processes.

Koppies has a resource of 56Mlb U3O8 with a further 10Mlb at the Hirabeb tenement.

The company also recently announced that gross resources at its 20.8%-owned Bigrlyi joint venture in the Northern Territory had increased by 12% to 23.9Mlb U3O8.

Also operating in Namibia is Star Minerals, which had secured shareholder approval for earn-in and exploration rights at the Cobra uranium project, which boasts a foreign resource estimate of 15.6Mt at 260ppm U3O8 for 9Mlb U3O8.

Over in northwestern Africa, Aura Energy had in mid-December 2024 upgraded ore reserves at its flagship Tiris project in Mauritania by 49% to 33.6Mlb U3O8.

This covers 64% of the production target and underpins its development plans, which targets project throughput of 4.1Mtpa to produce 2Mlb U3O8 per year with a production target of 43.5Mlb U3O8.

A final investment decision could come in the current quarter.

Moab Minerals’ consolidation of all Manyoni uranium deposits in Tanzania appears to be the right move after the first batch of assays from its drill program returned uranium intersections in every one of the 51 holes with 49 returning assays of >1m at 100ppm U3O8.

The results show that Mayoni is a consistently mineralised, flat-lying system with just 1m of overburden, making it suitable for low-cost, open-cut mining.

At Stockhead, we tell it like it is. While Aura Energy, Core Energy Minerals, Elevate Uranium, Koba Resources, Moab Minerals, Star Minerals and UVRE are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.