These five ASX explorers got tickets for sudden price jumps – here’s their excuses

ASX high-rising resource companies have been asked to explain share price spikes: Getty Images

- ASX issues please explain notices to small cap explorers with spiking share prices

- Oakdale Resources’ share price soars after Chalice Gold’s Julimar update

- Riedel prepares statement after rising from 1c to 2.1c

Several ASX small cap miners have received so-called ‘speeding tickets’ from Exchange officials in the past few days, pulling them up for large rises in their share prices and asking them for an explanation.

Five of them answered their queries today – here’s what they had to say for themselves.

BBX Minerals (ASX:BBX) – up from 40c to 71c

The gold explorer with projects in Brazil’s Amazonas state said it was unaware of any non-public information that could have triggered trading in its shares.

The company’s shares rose from 40c at the close of trade Thursday, to a high of 71c Friday.

In response to an ASX notice, it pointed to media articles in early September reporting it was finalising an assay method with the Sao Paulo research institute for its projects’ complex mineralisation, and separately a drilling program.

Chalice Gold Mines (ASX:CHN) – up from $1.75 to $2.05

Chalice came out of a trading halt Tuesday with its shares rising nearly 20 per cent.

This was after the company issued an update on its Julimar project for copper-nickel-precious metals in WA’s Yilgarn Craton.

Chalice reported the discovery of a new 6.5km long electromagnetic anomaly beyond the northern limit of drilling at Julimar. In March, it traded as low as 16 cents.

Oakdale Resources (ASX:OAR) – up from 1.95c to 2.65c

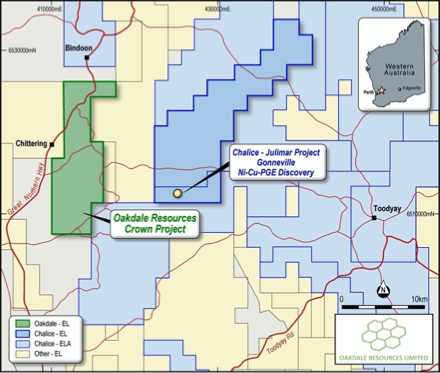

Oakdale’s Crown copper-nickel and precious metals project is located near Chalice Gold Mines’ Julimar project, received a price query from the ASX after its shares jumped from 1.95c to 2.65c last week.

This came with an accompanying increase in the volume of its shares being traded.

In its response to the ASX, the company said it was not aware of any material information that it had not already released that could explain the increase.

The company then announced Tuesday it had started drilling at its Lambarson Canyon gold project in the US state of Nevada, adding initial observations were its geology is consistent with gold mineralisation.

Oakdale Resources’s Crown gold project abuts Chalice Gold’s Julimar project in WA

Coppermoly (ASX:COY) – up from 0.9c to 2.5c

The PNG explorer saw its share price spike Friday and was placed in a trading halt.

The company said it was unable to explain the movement in its shares and did not have any information to disclose to the stock market.

In its June quarter report, Coppermoly said it had completed geophysical surveys at its Nakru copper-zinc-gold prospects on New Britain island in Papua New Guinea, on which exploration work has been suspended due to COVID-19 travel restrictions.

Piedmont Lithium (ASX:PLL) – up from 10c to 15c

Trading in share for this lithium explorer was suspended Tuesday pending a company announcement in response to an ASX query about a spike in its share price.

In early September, the Bank of New York Mellon told the ASX it had bought a 23.1 per cent stake in the company which is focused on the EV market in America and is developing a project in the Caroline tin-spodumene belt.

PENDING: Riedel Resources (ASX:RIE) – up from 1c to 2.1c

RIE halted trading Tuesday as it prepared to release a statement.

The company has a 18.9 per cent interest in the Marymia gold and copper project 900km north of Perth that is 40km east of the Plutonic gold mine in WA.

Australian Mines (ASX:AUZ) boosted to 80 per cent its stake in the Marymia project in May after spending $3m on exploration and then transferred its rights to Norwest Minerals (ASX:NWM) which has yet to undertake any exploration work because of COVID-19.

ASX price moves for BBX, Chalice, Coppermoly, Oakdale, Piedmont, Riedel, Resource Mining

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.