Gold and silver prices tumble on stronger US dollar

Gold and silver markets were caught up in heavy selling pressure: Getty Images

- Silver and gold prices tumble on rising US dollar

- ‘Lack of safe-haven buying’ for gold: RJO Futures

- Everything you need to know about ASX gold stocks

Gold and silver prices suffered a heavy sell-off Tuesday triggered by an upturn in the US dollar index and a tumble in US equity markets.

The price of gold hit a one-month low Tuesday of $US1,918 per ounce ($2,652/oz), while silver was trading at $US25.12 per ounce ($34.68/oz) after losing 8 per cent at one point in Monday’s session.

“There is just a lack of safe-haven buying and it’s following the sell-off in equities … dollar strength is an additional weakness,” Bob Haberkorn, senior market strategist at RJO Futures told Reuters.

The US dollar index, which measures its strength against a basket of other currencies, ticked up to 93.50 from 92.9 Friday.

“Gold was a victim of a stronger dollar,” Sucden Futures managing director, Janet Mirasola told Bloomberg.

The Dow Jones index fell 1.8 per cent Monday to 27,147 points and the Nasdaq index of tech stocks dipped 14 points to 10,778.

Swiss bank Credit Suisse is still bullish on gold, with a forecast price of $US2,300/oz.

“We look for an eventual move above $US2,075 with resistance seen next at $US2,175, then $US2,300,” said Credit Suisse in a report.

Silver prices have taken a sharp dive

Sandstone gold project receives funding boost

Alto Metals (ASX:AME) has raised $5.5m of capital to develop its Sandstone gold project in WA’s Murchison gold district including funding 5,000m of exploration drilling over its Lords’ Corridor prospect.

Institutional and overseas investors backed the capital raising, and Alto plans to drill for potential repeat lodes along 3km of the Lords’ Corridor in its Sandstone project.

Sandstone has an estimated mineral resource of 6.2 million tonnes at 1.7 grams per tonne gold for 331,000 oz, said a company presentation.

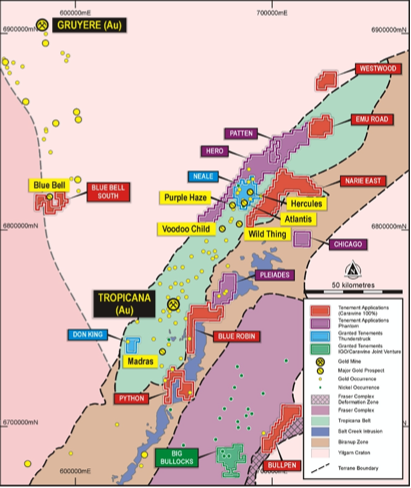

Carawine secures two Tropicana gold tenements

Fresh from adding its Eider tenement to its Coolbro joint venture with Fortescue Metals Group (ASX:FMG) in the Pilbara, Carawine Resources (ASX:CWX) has acquired two new gold tenements also in WA.

Carawine has secured a 90 per cent interest in two exploration licences from Thunderstruck Investments adjacent to its Tropicana North gold project in WA’s north-eastern goldfields of Tropicana and Yamarna.

The company’s North Tropicana tenements now cover 80km strike of the Tropicana gold belt, within 10km of AngloGold Ashanti (ASX:AGG) and IGO’s (ASX:IGO) Tropicana gold mine.

“Our new Tropicana North project gives Carawine significant exploration exposure to the active and highly prospective Tropicana gold province,” managing director David Boyd said.

Carawine Resources has added tenements to its Tropicana gold project

Mont Royal in deal for Quebec copper-gold project

Mont Royal Resources (ASX:MRZ) has struck a joint venture agreement with Toronto-listed Azimut Exploration to earn up to a 70 per cent interest in the Wapatik gold-copper project in Quebec, Canada.

“With proprietary technology and extensive exploration experience in the region, Azimut contributes significant value to the project,” managing director, Peter Ruse, said.

Oakdale Resources (ASX:OAR) said its drilling program at its Lambarson Canyon gold project in the US state of Nevada has started.

Initial core samples indicate a geology consistent with a structural zone that hosts gold mineralisation at the surface, and previous rock sampling has returned results including, 3m at 6.9 g/t gold.

ASX share prices for Alto Metals, Carawine Resources, Mont Royal and Oakdale Resources

At Stockhead we tell it like it is. While Alto Metals is a Stockhead advertiser, it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.