The small caps with prime real estate in the Eastern Goldfields, ‘one of the world’s best gold districts’

Pic: John W Banagan / Stone via Getty Images

Western Australia is very well known globally for its extremely fertile gold ground.

Just take a look at that spectacular high-grade discovery made at the Beta Hunt mine in Kambalda, 60km south of Kalgoorlie, back in September 2018 by Toronto-listed RNC Minerals (TSX:RNX).

In less than a week, RNC unearthed more than 9000 ounces of gold worth about $C15m ($16.7m) at 2018 gold prices (~$1,650/oz).

Check it out:

The news made headlines all around the globe. And at today’s even higher gold price, that +9000 ounces would be worth over C$20m.

WA is littered with gold — even in the Pilbara, which is more traditionally known for its vast iron ore operations, people are tripping over gold nuggets. Prospector Johnathon Campbell and his crew is credited with kickstarting the modern-day Pilbara goldrush after finding “thousands and thousands” of gold nuggets on land that is now owned by Artemis Resources (ASX:ARV) and its Canadian partner Novo Resources.

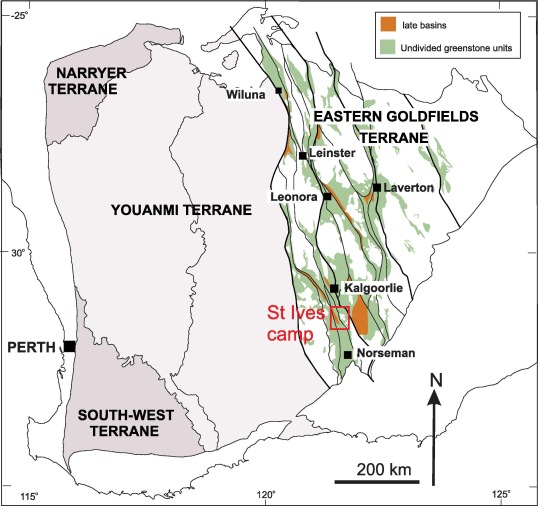

Another region that has been mined for centuries and is now home to a still increasing number of juniors is the Eastern Goldfields. Just check out the multiple greenstone belts in the region.

The Eastern Goldfields is a multi-million-ounce gold region, with majors in the area like Gold Fields, Regis Resources (ASX:RRL), Northern Star Resources (ASX:NST), Saracen Mineral Holdings (ASX:SAR) and St Barbara (ASX:SBM).

Just seven of the region’s biggest mines produce a collective 2 million ounces each year.

Mining goes back about 150 years or so, according to Mark Williams — managing director of Red 5 (ASX:RED), a junior that is currently producing in the Eastern Goldfields, near the town of Leonora.

“The human story about people putting all their worldly goods into a wheelbarrow and leaving the comfort and security of the towns to head out into the bush is really quite phenomenal,” he told Stockhead on a recent site visit to the company’s King of The Hills (KoTH) mine.

“It’s hot and dry and there’s not much water, and to imagine doing that 150 years ago is just mind boggling.”

Red 5 chief corporate development officer Patrick Duffy told Stockhead that international industry representatives raved about the region.

“We had some visitors from Canada a couple of weeks ago and their words were ‘this is the best gold district in the whole of the world’,” he said. “You can’t help but fall over the stuff.”

Near the town of Leonora is one of the original mines in the area, Gwalia, which now extends 2km deep and has been mined as an open pit and underground under multiple owners.

Gwalia was originally discovered by Welsh miners in the late 19th century, and Herbert Hoover, who would eventually become the 31st President of the United States, was the mine manager from May to November 1898.

The mine was previously owned by Sons of Gwalia, which went into liquidation in 2004 largely because of its big hedge position. That presented the perfect opportunity for St Barbara to swoop in and pick it up.

And there’s still plenty of gold left in the mine – Gwalia is still producing about 200,000oz-300,000oz each year.

Big opportunities for the little guys

But it’s not just the majors that have had a win in the area – the Eastern Goldfields has also handed several opportunities to the juniors.

Bellevue Gold (ASX:BGL) became a market darling thanks to the prime patch of real estate it is sitting on.

The $270m market cap explorer is advancing the Bellevue mine — one of Australia’s highest-grade gold mines having produced 800,000oz at 15g/t from 1986 to 1997.

Since January 2017, the share price of the advanced gold explorer has rocketed over 2300 per cent — from 2.5c to +60c per share – driven by success at its namesake historic project.

Bellevue recently boosted the resource to 2.2 million ounces.

Simon Popple, of UK-based Brookville Capital, told Stockhead late last year that while Bellevue doesn’t yet have project financing, if it keeps finding high-grade gold at its current rate, production may not be that far away.

Meanwhile, Red 5’s pivot away from the Philippines and into the Eastern Goldfields has also been quite successful.

Back in 2017, the company placed its Siana gold project in the Philippines on care and maintenance. Later that year it locked in two separate deals, on the same day, that saw it become the new owner of the KoTH and Darlot mines previously owned by Saracen and Gold Fields, respectively.

Red 5 picked up these two “unloved” assets for $34.5m in cash and shares. Gold Fields and Saracen also agreed to underwrite 70 per cent of Red 5’s one-for-three rights issue at a 43 per cent premium to the company’s share price at the time.

Today, Red 5 is now a +$260m company, having witnessed an 800 per cent increase in its share price since announcing the acquisition, hitting a peak of 36c in February this year, and is producing 110,000oz to 120,000oz of gold each year.

The company plans to expand production substantially within the next couple of years, at a time when the gold price keeps hitting new Aussie dollar records.

“What we’re looking to do is be able to build a standalone mill at King of The Hills, which is in the order of about a 4-million-tonne mill, and have two standalone operating mines producing somewhere between 250,000-300,000oz of gold on an annual basis,” Williams explained.

“We saw the opportunity to be able to fill the mill at Darlot by restarting King of The Hills and being able to truck high-grade ore from here to Darlot.”

Williams says Darlot is one of WA’s iconic gold mines. It has been mined continuously for 30 years by majors including Canada’s Barrick Gold, Gold Fields and US-based Homestake Mining. So far it has produced about 3 million ounces of gold.

KoTH, meanwhile, has produced around 2 million ounces and Red 5 has defined a further 3.1-million-ounce open pit and underground resource, which is due to be updated in a matter of weeks.

Walking around the underground at KoTH, it is clear to see the rock is just penetrated with visible veins, with several quite high-grade veins also present.

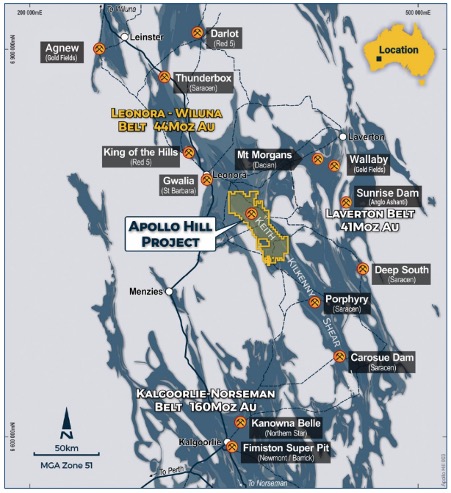

Then there’s Magnetic Resources’ (ASX:MAU), which is exploring in the Leonora-Laverton district, where over 34 million ounces has been mined and defined in resources.

The company’s Hawks Nest 9 (HN9) — a very shallow high-grade gold zone 3km long, 200m-wide and growing — is the reason Magnetic quietly slipped into Stockhead’s top 10 biggest resources movers for 2019 with a 12-month, +278 per cent gain.

Previously an iron ore play, Magnetic began picking up greenfields (untouched) exploration ground around the Laverton and Leonora districts in 2016.

Most of the gold targets Magnetic has identified are within 10-15km of operating gold mines.

Managing director George Sakalidis is confident HN9 has the potential to be a multi-million-ounce mine, and that a resource is not too far away.

“The past 12 months have seen the company define additional mineralisation both at depth and along strike at the Hawks Nest 9 project, with the company of the belief that additional drilling will result in a JORC resource being declared,” he said recently.

Horizon Minerals (ASX:HRZ), meanwhile, is on the cusp of production from its large land package that currently hosts 1.1 million ounces of gold.

The company, which has a market cap of just $31m, is in the process of securing financing to fund the staged development of its Boorara project, which it is aiming to bring online this year.

The Boorara project sits 10km east of the Super Pit and hosts over 1.5km of gold mineralisation.

Horizon’s plan is to toll mill up to three starter pits to generate at least $5.8m in early cash flow over a six-month period to help fund the expansion of the project.

The company said yesterday statutory approvals and talks with contractors and third-party milling operators were “well advanced” with first production on track to begin in the September quarter.

Also one of the Eastern Goldfields crew is Saturn Metals (ASX:STN), which continues to find high-grade gold at its Apollo Hill project 60km from Leonora.

The company revealed yesterday that it had discovered a potential major satellite gold discovery at Apollo Hill.

Drilling at the Calypso prospect returned a high-grade interval of 9m at 8.67 grams per tonne (g/t) gold from 116m including 3m at 24.6g/t gold from 119m.

As a rule of thumb results above 5g/t gold are generally considered high grade, but given the strong gold price, grades of as low as 1-2g/t can be profitable for a company.

In February, Saturn reported drilling had identified the potential to repeat the high-grade gold mineralisation within the hanging walls of the Apollo Hill project.

The company is drilling to grow its 781,000oz resource.

Tell us what you think

The content of this poll is not selected, modified or otherwise controlled by Stockhead. Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this poll.

Other small caps making headway in the region include Kingwest Resources (ASX:KWR) — which recently acquired the Menzies and Goongarrie projects for $8m in cash and shares from Horizon Minerals, Genesis Minerals (ASX:GMD), Ardea Resources (ASX:ARL), and Yandal Resources (ASX:YRL).

At Stockhead, we tell it like it is. While Magnetic Resources, Saturn Metals and Kingwest Resources are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.