The Explorers: Magmatic’s David Richardson on big porphyry potential and Alkane’s perfect timing

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

The Explorers is Stockhead’s in-depth look at the people behind some of Australia’s most innovative and courageous junior mining companies. This week, resources reporter Reuben Adams chats with managing director of Magmatic Resources, David Richardson.

In early September, ~$5m market cap Magmatic Resources (ASX:MAG) was finalising a WA gold project acquisition and, simultaneously, the demerger of its flagship East Lachlan copper-gold porphyry assets in NSW.

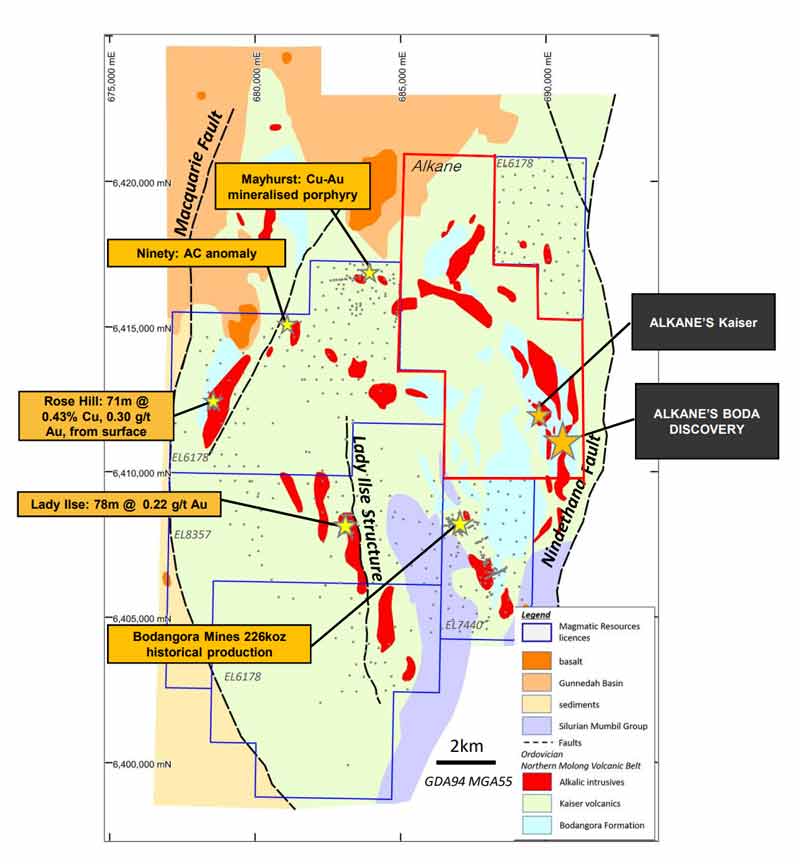

These East Lachlan projects – which the company floated on in 2017 — were always promising.

Magmatic just couldn’t get the market excited about their potential, and, without funding, these projects were destined to go nowhere.

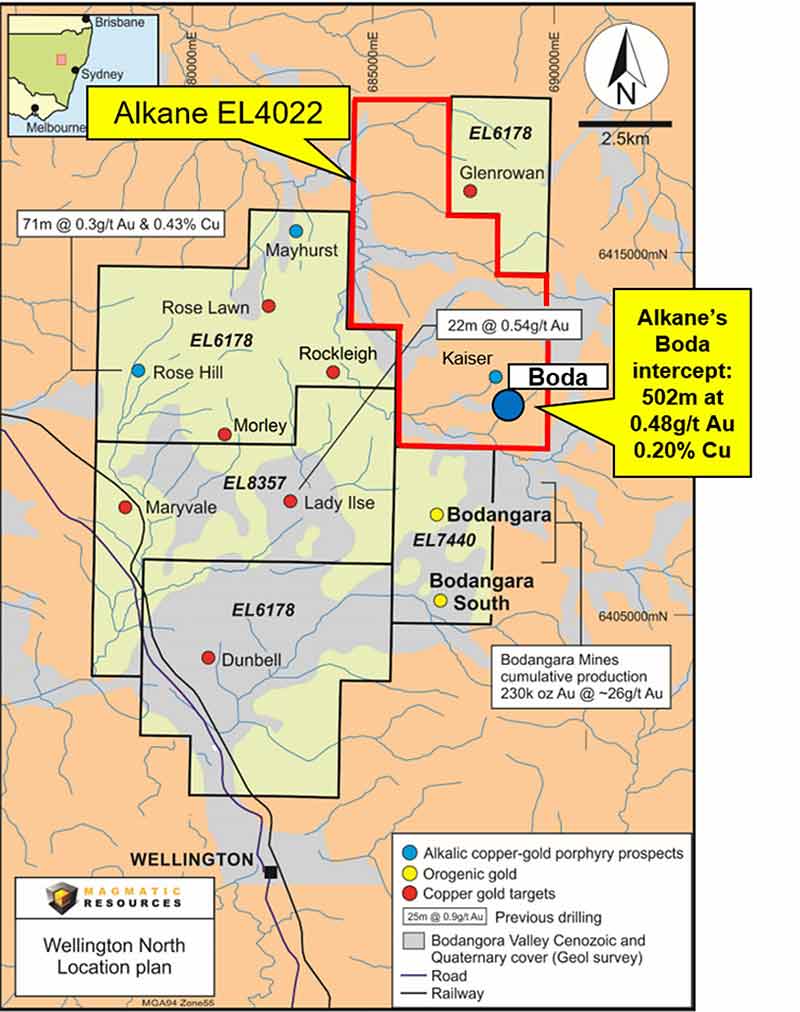

Then something happened. NSW neighbour Alkane Resources (ASX:ALK) hit the big one at Boda – a monstrous +500m intersection grading 0.48 grams per tonne (g/t) gold and 0.2 per cent copper.

Because of their easy-mining, very large volumes, porphyry orebodies can be economic from copper concentrations as low as 0.15 per cent.

And we also mean ‘neighbour’ quite literally:

Now — following a $2.2m cap raise and the appointment of experienced mining exec David Flanagan to the board — $24.5m market cap Magmatic has dumped the WA acquisition and officially refocused on copper-gold in the East Lachlan.

Managing director David Richardson says 2020 is going to be big. Porphyry big.

Let’s start with a short history of Magmatic.

“At the depths of the resources downturn in 2013, Gold Fields — like many of the major miners — exited their greenfields [unexplored, early stage] projects,” Richardson says.

“Gold Fields’ only greenfields projects were in the East Lachlan region of NSW, which it picked up years prior.

I contacted them and said, ‘you’ve had these projects for seven years, spent $14m, identified 60 targets – if you could keep your toe in the water, can we do a transaction?’

So, I set up a special purpose vehicle [private company] in 2014. As part of the deal Gold Fields held 20 per cent equity in the company until we listed.

I held it privately before listing the company in 2017.

We call them ‘advanced discovery’ projects. All three of our projects include similar grade intercepts to the original discovery hole at Newcrest’s Cadia operations [which produced an eye-watering 913,000oz gold and 91,000 tonnes of copper in FY19].

Gold Fields did major regional exploration, but they are a gold company. They were looking for a 5-10moz gold discovery and largely ignored the porphyry results.

They didn’t follow up on multiple intersections that the market recognises as discovery porphyry holes.”

You said previously that porphyries are a different beast – you really need to throw a lot of money at them during the discovery phase. Is this why you put a pin in these projects earlier this year?

“I have always believed in the massive opportunity the East Lachlan represents, but our share price earlier this year was not representative of that.

We didn’t have the money to advance them – we spent about $5m in two and a half years advancing them and the market still didn’t recognise the potential.

I refused to do a capital raising at a very low share price which would just dilute our shareholders.

So we decided to buy some WA gold projects and demerge our core East Lachlan projects and put them into an unlisted vehicle.

We were two weeks away from a shareholder vote when the Alkane hole at Boda was announced.”

READ: These explorers are right next door to Alkane’s massive copper-gold discovery

How’s that for timing.

“My reaction was’ holy s**t – this is fantastic! We had better stop the demerger, pull the prospectus’.

So certainly, the intersection was a surprise — a very happy surprise. But we knew that Alkane was going to make a discovery there eventually. It finally gave the exploration team money to drill a diamond hole and look what happened.

And sometimes it takes a number of events before the market gets excited. You had the Stavely (ASX:SVY) discovery which added $200m to its market cap.

Then six weeks or so later you had the Boda discovery which added +$200m to Alkane’s market cap.

Alkane has a producing gold mine and still their market cap was only $180m. The next day it’s worth $410m.

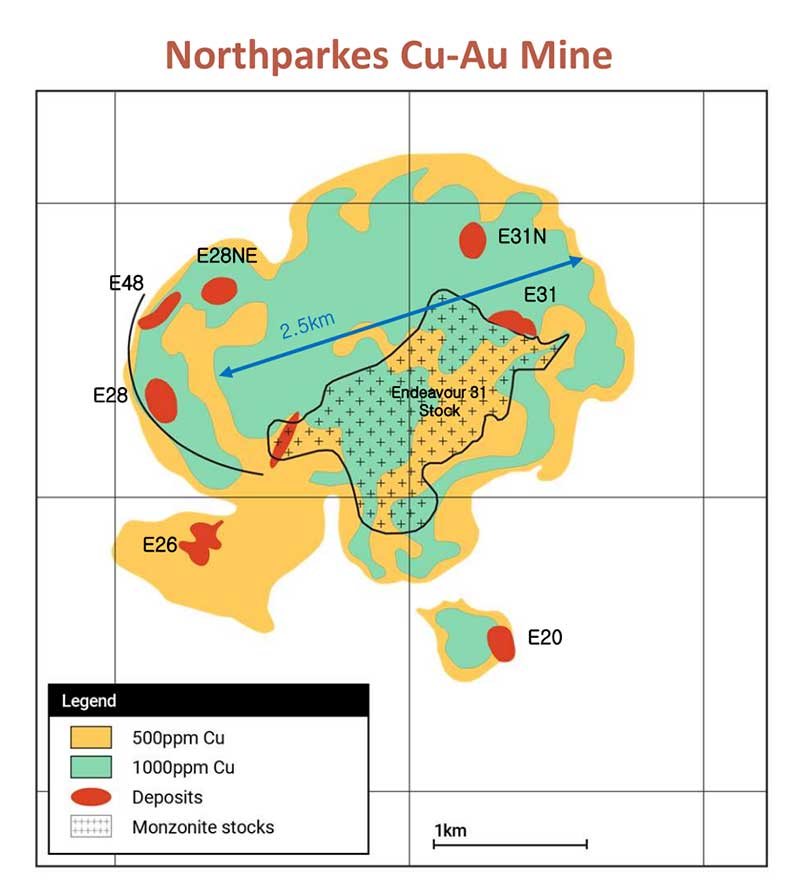

And the deposits at both Northparkes and Cadia Valley occur in clusters.”

“Northparkes has mined five deposits – they’re a cluster. Cadia Valley has six mineralised areas.

So, that’s the reason we’re excited — and why Alkane is excited about Boda. More than likely there are multiple deposits.

People are realising that porphyries are monsters and there’s a wonderful opportunity for a major, major discovery here.

Now we’ve been able to leverage our recent share price success by bringing recognised market leaders who have fallen in love with our story.

David Flanagan, who took Atlas Iron from a $9m market cap [iron ore explorer] to a Top100 company, has joined our board. He built five mines in four years at Atlas.

Our company secretary now is Tony Walsh, formerly of Atlas Iron and [major miner] Independence Group (ASX:IGO).

And the people now buying our stock are influential family offices and brokers.”

Lady Ilse looks really interesting. Is that your initial target?

“We think Lady Ilse is a Boda lookalike – just bigger.

The Boda discovery is outcropping. They have a 100m wide surface expression – which is like a ‘cap’ on top of the porphyry system.

The ‘cap’ at Lady Ilse is 120m wide and open east and west. It’s actually a larger structure. It ticks every box.

We are most excited about Lady Ilse but our other two porphyry projects are also fantastic. We’ve actually got four targets and growing.

I think we are going to be very busy, but our initial focus is Lady Ilsa.”

There’s a number of majors, like FMG and Freeport, in the region chasing big porphyries. Is there an opportunity to form a JV to take some of the financial pressure off you guys?

“We certainly wouldn’t consider that on our Wellington North project. It’s a once in a lifetime opportunity.

There have been no tier one copper discoveries over the last couple of decades. There will be a long-term shortfall in copper supply.

The real estate on these two East Lachlan volcanic belts have been owned by the majors for 20 years, and they haven’t been exploring. When you have a massive 40-year producing mine like Newcrest does you’re not focused on greenfields exploration.

At some stage there will be be ‘corporate activity’ – and I think we are better placed for exploration success on our projects than anyone else.”

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.