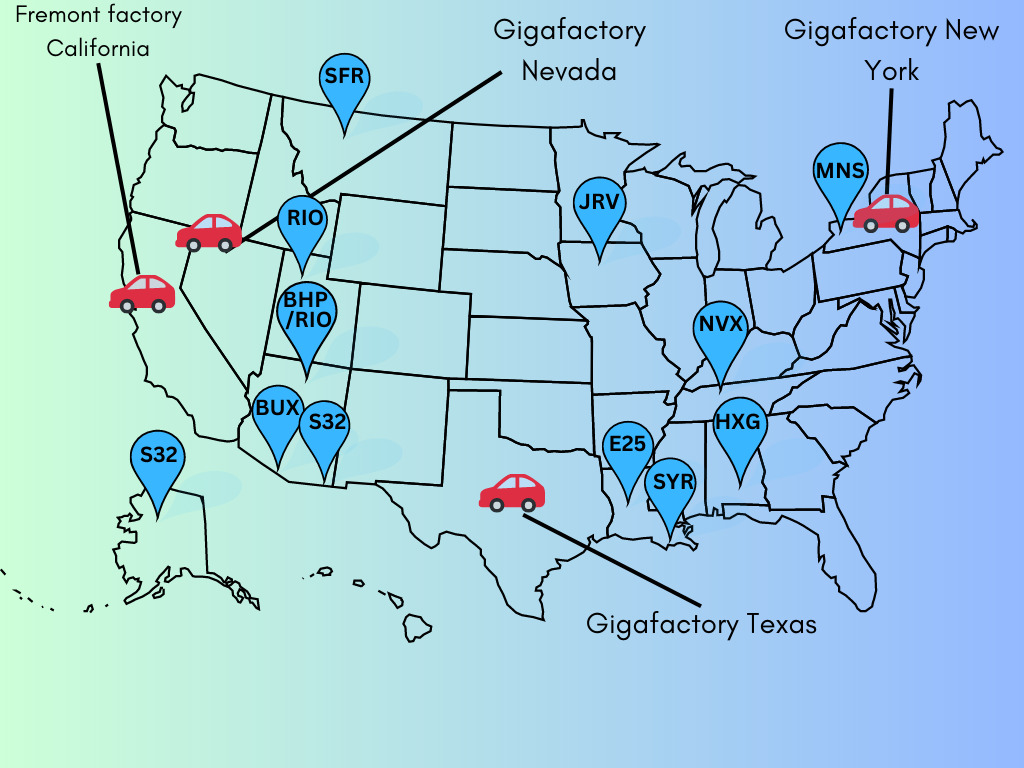

Tesla Nearology Part 2: Which ASX copper, cobalt, graphite and manganese companies are in the neighbourhood?

Via Getty Images.

- Tesla has four factories in the United States

- There are 11 companies with non-lithium-EV-metal projects in the region

- Part 3 of the series will look at other critical minerals and locations

Nearology is a term used in the resource space when an explorer holds ground near a huge, company-making mineral discovery.

Electric vehicle car maker Tesla has factories in California, Nevada, New York and Texas, and since we’ve already looked at lithium, (you can read that here if you missed it) it’s time to check out nearby ASX plays in other EV metals like copper, cobalt, graphite, and manganese.

ASX companies with nickel in North America are sadly lacking, and we can take REE off the list (‘cos Tesla not likely) so, let’s start with copper.

BHP Group (ASX:BHP) / Rio Tinto (ASX:RIO)

Everyone’s eyes have been on BHP’s takeover of OZ Minerals (ASX:OZL) lately, which makes sense because copper is one of the company’s largest strategic priorities – with copper demand expected by many analysts to double by the middle of the decade as electric vehicle and renewable manufacturing rises to replace fossil fuel emitting transport and electricity.

And BHP and RIO’s 50/50 Resolution copper project in Arizona is tipped to potentially supply up to 25% of US copper demand – if they can get it up and running.

Ore production from the operations will be approximately 132,000 tons (120,000 tonnes) per day after extensive construction and ramp-up periods. The mine is estimated to produce as much as 40 billion pounds of copper over 40 years.

The companies have been working for years to get support from First Nations groups since beginning the permitting process in 2013 for the mine.

Late last year, BHP chief technical officer Mark Davies said the US is going to be extremely short on copper in the coming years, at a time when it is aiming to move away from external critical mineral supply chains.

“The society, the US needs it desperately,” he said.

“In the US, you’ve got 1 million tonnes of production, but the consumption is 2 million tonnes.

“With the current plans, at the end of this decade, the US will consume 4 million tonnes, but still producing one, unless they start unlocking new copper deposits.”

In its latest quarterly, RIO said the US Forest Service is working to progress the Final Environmental Impact Statement and complete actions necessary for the land exchange.

“We continued to advance partnership discussions with several federally recognised Native American Tribes who are part of the formal consultation process,” they said.

Rio has a copper project in Utah too

Speaking of RIO, they also get a standalone mention here for the Kennecott copper project in Utah, which has a Mineral Resource of 7.5Mt at 1.9% copper, 0.84g/t gold, 11.26g/t silver, and 0.015% molybdenum identified based on drilling and a Probable Ore Reserve of 1.7Mt at 1.9% copper, 0.71g/t gold, 10.07g/t silver, and 0.044% molybdenum.

The company expects to deliver close to one million tonnes of refined copper between 2026 and 2032 and is also progressing feasibility studies to extend open pit mining at Kennecott beyond 2032 to produce an additional 1.5 million tons of copper and extend the life of mine to about 2040.

In late 2022, the company made an $108 million investment in underground characterisation studies are ongoing, with $55 million in development capital approved to commence underground mining – which is expected to kick off this year with full production by the end of 2023.

The plan is to deliver a total of around 30kt of additional high quality mined copper through the period to 2027 alongside open cut operations.

The ore will be processed through the existing facilities at Kennecott, one of only two operating copper smelters in the United States.

Buxton Resources (ASX:BUX)

The company kicked off a maiden drilling program earlier this month at its Copper Wolf project in Arizona with all exploration fully funded by miner and major shareholder (19.9%) IGO (ASX:IGO) as part of pre-earn-in Option.

It’s the first exploration in the project area since 1993, with drillhole CW0001DD targeting areas proximal to and beneath historical hole RC-UC-17 which ended in porphyry style copper-molybdenum mineralisation.

The drillhole will test the hanging wall of the Bobcast Cluster Fault which is thought to have strongly influenced the emplacement of the Copper Wold Laramide porphyry mineral system.

Drilling is planned to continue at least 320m deeper than RC-UC-17 to an initial target depth of 1,100m – and Buxton will have the capacity to extend the hole if favourable geology and mineralisation is intersected.

The program is expected to take a minimum of four weeks to complete.

Sandfire Resources (ASX:SFR)

Sandfire holds an 87% interest, via Canadian listed company Sandfire Resources America Inc. (TSX-V:SFR) in the Black Butte copper project in Montana.

But it’s run into some regulatory hurdles after nabbing the necessary permits to appropriate water for the project from the State of Montana Department of Natural Resources and Conservation (DNRC) in November last year.

In its December quarterly, the company said while it had received objections to the water use permits and the mitigation changes, it was able to resolve all but one of the objections through negotiated settlements, “which may not be challenged as agreed upon by the parties.”

“The one remaining objection to the groundwater permit, which is pending before the Meagher County district court, relates to the DNRC’s interpretation of whether mine dewatering constitutes ‘waste’ under the Montana Water Use Act,” BUX said.

South32 (ASX:S32)

The mining giant has a foothold in Alaska – which is still technically part of the USA – with its Ambler Metals polymetallic and copper JV project where it spent its share of capitalised exploration of US$8m in the December 2022 half year.

Exploration efforts have been focused on two deposits in the Ambler mining district – the Arctic VMS deposit and the Bornite carbonate replacement deposit.

A 2020 feasibility study detailed an operation based on 43 million metric tons of reserves averaging 2.32% copper, 3.24% zinc, 0.57% lead, 0.49g/t gold, and 36g/t silver – with the plan at Arctic to produce 1.9 billion pounds of copper, 2.3 billion lb of zinc, 388 million lb of lead, 386,000 oz of gold, and 40.6 million oz of silver over an initial 12-year mine life.

The JV is currently working on the pre-feasibility study for the deposit, with the plan in CY23 to focus on consolidating geological knowledge and advancing engineering studies, “while we monitor progress on approvals for the Ambler Access Project,” the company says.

S32 also has a manganese asset – more details on that one shortly.

BHP, RIO, BUX, SFR and S32 share prices today:

Who has cobalt project on the cards?

Cobalt is produced as a by-product of copper and nickel production and is dominated by Chinese companies operating in the Democratic Republic of the Congo — but it’s been under pressure lately.

Prices for cobalt metal on the LME have fallen from over US$80,000/t early last year to US$34,930/t yesterday.

And these prices drove Jervois Global (ASX:JRV) to hit pause on the commissioning of its Idaho cobalt mine in the USA last year.

But things could be looking up.

As Stockhead’s Josh Chiat points out, the short-term headwinds mask the long-term tailwinds from a) the growth of the electric vehicle industry and b) the US Government’s desire to take it right up to China in a battle where it is sorely outmatched.

That means it’s throwing money left, right and centre at miners to deliver raw materials and onshore manufacturing which presents an opportunity for Jervois to get cozy with the Biden Administration – with the plan to pivot a planned 6000tpa refinery expansion in Finland to the US in a bid for Whitehouse backing.

JRV is currently working through the final documentary steps to formalise a US$15 million grant under the Defense Production Act Title III program the DoD intends to award which is expected to fully fund a Bankable Feasibility Study (BFS) on a US cobalt refinery and proposed drilling program at the Idaho operations.

Inflation Reduction Act a juicy carrot

A key piece of legislation, the Inflation Reduction Act, is at the centre of the US’ bid to become a major hub for EV production and critical mineral supply.

“The IRA is designed to stimulate U.S. domestic cobalt refining and recycling activities,” JRV said in a recent statement to the ASX.

“Jervois’ future U.S. cobalt refinery is expected to benefit from, inter alia, a 10 percent operating cost credit for the duration of its operating life.

“Despite initial steps by Europe through its recent 2023 European Union Critical Raw Materials Act and Net Zero Industry Act, this represents a material competitive advantage over facilities not located in the U.S.

“In addition, Jervois is encouraged by discussions with the U.S. Department of Energy (DOE) regarding various loan and grant programmes that are expected to be available to support refinery construction.”

The company said it expects refinery expansions in either the U.S. or Europe will be funded by third parties, via a combination of government and or customer support.

JRV share price today:

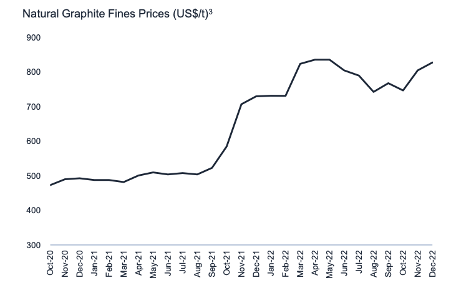

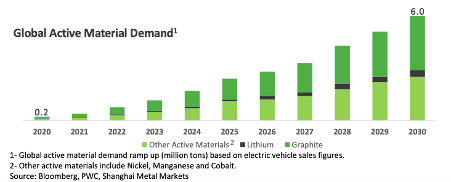

Graphite stocks securing supply deals with Tesla

Another key commodity in the EV revolution is graphite, which is the core component of a lithium-ion battery.

Global synthetic graphite demand for electric vehicles and energy storage systems is growing with forecasts of a ~15x increase in demand from 2021 to 2030, and companies with graphite assets in the US are sitting pretty, with some players already taking advantage of demand from car makers like Tesla who looking to shore up raw materials supply in an increasingly tight market.

Companies like Magnis Energy Technologies (ASX:MNS) who signed a deal in February with the EV giant to supply a minimum 17,500tpa of active anode material (AAM) beginning in February 2025 for a minimum term of three years with fixed pricing from its yet-to-be-built-plant.

“The agreement is conditional on Magnis securing a final location for its commercial AAM facility by 30 June 2023, producing AAM from a pilot plant by 31 March 2024, commencing production from the commercial AAM facility by 1 February 2025, and customer qualification,” the company says.

MNS is in the process of selecting a location in the US for its AAM facility. Large scale pilot plant development for both AAM and Nachu graphite concentrate will then commence “immediately”.

Syrah Resources (ASX:SYR)

Syrah is also set to supply Tesla with 8,000tpa of AMM from its 11,250tpa Vidalia facility in Louisiana for a period of four years, starting with first commercial production at the site.

Tesla recently exercised its option to offtake an additional 17,000tpa AMM from Vidalia at a fixed price, subject to the expansion of Vidalia’s production capacity to 45,000tpa AAM.

Syrah says Tesla’s offtake obligation is a key customer commitment for a final investment decision (FID) on the Vidalia expansion, accounting for a combined 56% of the planned production capacity.

It’s not Tesla nearology (worth a mention though we think) but the company also has a non-binding MoU with Ford and SK On to evaluate a strategic arrangement, including AAM supply from Vidalia to the BlueOval SK joint venture, with an offtake commencement date of no later than 2028.

Novonix (ASX:NVX)

In 2022, Novonix signed an agreement to be the exclusive supplier of graphite anode material out of its plant in Chattanooga, Tennessee to KORE Power as part of its thrust into North America.

In December, NVX announced it would expand production at is Tennessee plant to a target of 10,000tpa output at full operation to support KORE’s requirements, which will begin at a rate of approximately 3,000tpa in 2024 and ramp to approximately 12,000tpa in 2028, to match KORE’s required volume.

Another company also taking advantage of the US push for onshore supply is Novonix, which nabbed a US$150 million of Department of Energy (DOE) grant funding to expand domestic production of high- performance, synthetic graphite anode materials.

Specifically, the grant funds will be dedicated to the company’s construction of a 30,000tpa US manufacturing facility, including site selection, plant layout, and engineering design with capability for additional expansion.

The idea is to be ready for production by 2025, with potential to expand up to 75,000 tonnes capacity.

Hexagon Energy Materials (ASX:HXG)

The company is focused on hydrogen, but in the US, it has an 80 per cent controlling interest of the Ceylon Graphite project located in Alabama, over which South Star Battery Materials Corp (TSXV:STS) on 7 December 2021 signed an Option to develop and Earn-In up to 75% interest in December 2021 for C$750,000 in expenditure on the project.

So far, South Star has completed a 10-15 holes program, installed a piezo to monitor groundwater levels on site – and initiated the 43-101 Maiden Resource Report which is due Q1 2023.

Metallurgical work was also carried out during the December 2022 quarter, with three tonnes of ore being turned into RoM concentrate at North Carolina State University, 15kg of which will be tested for a variety of value-add/battery applications.

HEX expects that Q2 2023 will see mobilisation to complete an additional 1500-2000m of drilling with a preliminary economic assessment completed in Q4 2023.

MNS, SYR, NVX and HXG share prices today:

Last but not least… manganese

Around 90% of the global market for manganese comes from the steel industry, where it is used both in the refinement of iron ore and as an alloy which helps to harden and fortify the final steel product.

But it is finding an emerging market as a critical component of lithium ion batteries.

Even with current battery chemistries, Stockhead’s Reuben Adams estimates Tesla’s manganese requirements equate to around 14% of annual global manganese sulphate production, or 65% of the projected output of Element 25’s (ASX:E25) Butcherbird project in the Pilbara. More on that company later.

Right now, we’re circling back to South32, whose MD Graham Kerr reckons manganese for batteries could rise from a tiny proportion of the end user demand to as much as 30% by 2030.

A final investment decision on the development of the Taylor deposit at the company’s Hermosa project in Arizona is due by mid-2023 after a PFS last year suggested the mine would produce 111,000t of zinc, 138,000t of lead and 7.3Moz of silver annually over a 22-year mine life.

But the Clark deposit, also part of the Hermosa land package, is a different beast, containing a mixture of zinc, manganese and silver.

And in the miner’s half year results released in February, it said it had established the ability to produce high purity manganese sulphate suitable for batteries from Clark, where 9.08% of the 55Mt resource is manganese metal.

Should Clark be developed, it would make South32 the only miner producing manganese on US shores.

“The Inflation Reduction Act that came out last year was all about trying to push EVs in the US but also have secure and, where possible, domestic US supply chains,” Kerr said in a conference call at the time.

“And I think that’s where Clark is uniquely positioned. And it’s not only about security of supply and domestic security needs, it’s also about the cost of logistics when you’re right in their own backyard.”

E25 has a foot in the door in Louisiana

It’s not a Tesla deal but in January the miner announced an offtake and funding agreement with another auto giant in Stellantis, owner of the Chrysler, Jeep, Peugeot and Fiat brands, which would see Stellantis part-fund the development of E25’s high purity manganese sulphate (HPMSM) facility in the States with a US$30m investment in two tranches.

HPMSM is required for the production of pre-cathode active materials (pCAM) used in EV batteries.

E25 plans to supply up to 10,000tpa of HPMSM to Stellantis over five years, with the ability to increase volumes and the opportunity to extend the arrangement for its USA based facility beyond the initial five-year term.

The company will feed the plant with manganese concentrate from its Butcherbird Project in WA, and as an added bonus, the HPMSM plant will also produce re-usable material in the form of a fertiliser feedstock, a ferro-silicon (FeSi) smelter feedstock suitable for use in steel production processes and a gypsum by-product for industrial use.

And earlier this month E25 released the feasibility study, which flagged the capital costs for train 1, which will produce 65,000tpa, estimated at US$289m, with an additional US$187m for train 2 to bump up production to 130,000tpa by year five.

The plant would have a pre-tax NPV of US$1,662m and pre-tax IRR of 29% at full production.

Plus, along with Federal support from incentives like the Inflation Reduction Act, E25 has support from the State of Louisiana around recruiting, training and sustaining a skilled workforce for the project – which was included in the financial model.

Negotiations are progressing with other leading EV OEMs, and a DFS is expected to be delivered this quarter.

Stay tuned for Part 3 of the series where we check out all the ASX players with EV metals in Canada and South America.

E25 share price today:

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.