Tesla Nearology Part 1: Which ASX lithium companies are right on Elon Musk’s doorstep?

Picture: Getty Images

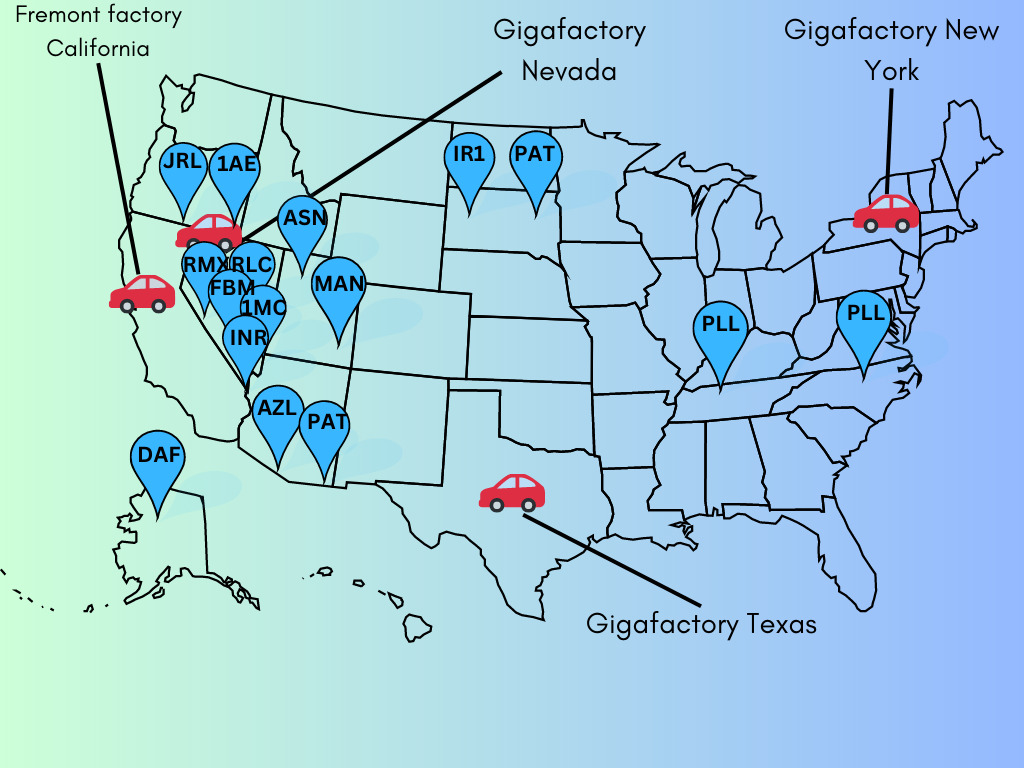

- Tesla has four factories in the United States

- There are 14 companies with lithium projects in the region

- Part 2 of the series will look at other critical minerals and locations

Nearology is a term used in the resource space when an explorer holds ground near a huge, company-making mineral discovery.

In exploration it might not always pan out, but here at Stockhead we wondered if the strategy could be valid when you compare companies with lithium projects in the USA near Tesla’s electric vehicle factories.

The carmaker has factories in California, Nevada, New York and Texas, and Elon Musk has made no secret of the fact the company is on the hunt for critical minerals to produce lithium-ion batteries – so it makes sense they would have a good look at projects right on their doorstep.

Some companies have already nabbed offtake deals – and you can read all about that here.

For the sake of simplicity, we are just looking at lithium (not nickel, cobalt, copper, manganese and graphite but we’ll get that in part 2) and we have not included Canadian and South American lithium projects (stay tuned) but we did include Alaska ‘cos technically that’s still North America right? Right.

There’s clearly a west coast pull here, and Nevada is looking kinda crowded.

Here’s the deets on ASX stocks with USA lithium plays

Anson Resources (ASX:ASN)

The junior is planning to extract lithium from production wells at the Paradox project in Utah, where it has re-entered historic oil and gas wells to extract lithium rich brines which flow to surface without pumping.

Anson upgraded its resource for the second time in three months in November last year to 1Mt lithium carbonate equivalent and 5.27Mt bromine.

A DFS (also last year) projected Anson would produce up to 13,074t of high purity lithium carbonate per annum at an estimated capex of US$495 million, using a proven Direct Lithium Extraction (DLE) technology developed with Sunresin New Materials, whose test work has demonstrated lithium recoveries upwards of 91%.

DLE is nothing new, in fact it’s been used in water treatment for decades, but it’s really coming into the spotlight as a cheaper and more environmentally friendly way to extract lithium from brines.

Also, with the Green River project in Utah in its portfolio, Anson is targeting lithium carbonate production in 2025.

Arizona Lithium (ASX:AZL)

Arizona Lithium is the owner of the Big Sandy lithium project in Arizona, where a DFS is expected to be complete by the fourth quarter of 2023.

The project contains over 320,000t of lithium carbonate equivalent, with just 4% of its landholding incorporated in the declared resource.

Last week the company picked up Prairie Lithium but that’s in Canada so you’ll have to stay tuned for Tesla nearology part 2 for more details there. The connection today is, Prairie’s board has some DLE processing technology expertise that AZL expects will expeditite the development of Big Sandy, so win win there.

Discovery Alaska (ASX:DAF)

This gold minnow enjoyed a solid rerate after converting to the Church of Lithium mid 2022, but it rapidly gave back those gains in the latter half of the year when early drilling results at the Coal Creek prospect, part of the Chulitna project in Alaska, didn’t meet expectations.

In its December quarter report DAF said it remained focused on proving up a maiden lithium resource at Coal Creek.

Ioneer (ASX:INR)

While it’s not exactly a Tesla nearology story, Ioneer recently nabbed a deal with Ford for the supply of 7,000tpa of lithium carbonate over a five-year term from its Rhyolite Ridge lithium-boron project in Nevada, starting in 2025.

In January, the company secured a loan up to US$700 million from the US Department of Energy (DOE) as part of the US drive to achieve long-term critical mineral supply chain security.

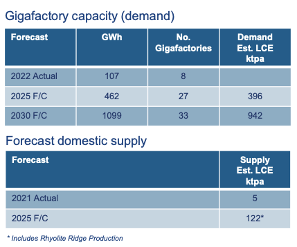

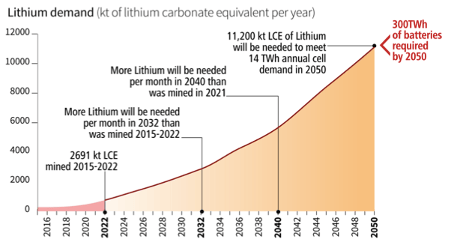

Here’s a look at what current demand forecast is for the US market:

Once INR meets the agreed upon conditions precedent, the very significant funding from both the DOE loan, and the expected 50% equity investment from expected Joint Venture partner Sibanye Stillwater are ‘anticipated to fund a substantial part of the preliminary capital expenditure estimate from the latest (revised) plan of operations’.

INR said the funds represent ‘a significant step towards completing the funding’ for the entire Rhyolite Ridge Project.

Future Battery Minerals (ASX:FBM)

Previously Auroch Minerals, FBM holds the Nevada lithium project (a state which is looking quite crowded on our map) and currently has phase 1 drilling underway – with 10 out of 15 holes to date testing the San Antonne East and Western Flats prospects having intersected claystone lithologies.

Where this gets interesting is the five prospective claim groups – Fraction, Heller, Lone Mountain, San Antone and Western Flats – that make up the project, surround existing lithium claystone deposits such as American Lithium Corp’s TLC deposit and American Battery Technology Corps’ Tonopah Flats deposits.

ASN, AZL, DAF, FBM and INR share prices today:

IRIS Metals (ASX:IR1)

Just last week this explorer acquired the historical Longview and Beecher mines in South Dakota that are located within existing granted mining licences.

This complements its previous acquisitions of the Black Diamond Mine and Beecher Extended prospect, effectively giving it control of the historical Beecher lithium mining trend.

Additionally, the company will also acquire the historical Edison lithium mine and an additional 313 BLM claims in the Keystone and Tinton districts of South Dakota.

Together, these acquisitions make Iris the largest holder of lithium mining claims in South Dakota. Now they just have to explore them… oh, and relist on the ASX.

“Theoretically the company could be mining and shipping DSO spodumene very quickly though strategically we wish to better define the potential with drilling in the first instance,” chairman Simond Lill said.

“The opportunities within the United States for critical minerals suppliers are numerous and we also look forward to better exploring those once we are reinstated to trading.”

Jindalee Resources (ASX:JRL)

The company holds the McDermitt project in Oregon, along with the Clayton North prospect in Nevada, basically combining at Tesla’s Nevada Gigafactory in a classic pincer manoeuvre.

In Feb, JRL bumped up the mineral resource estimate for a combined Indicated and Inferred Mineral Resource Inventory of 3 billion tonnes at 1,340ppm Li for total of 21.5 million tonnes Lithium Carbonate Equivalent (LCE) at 1,000 ppm cut-off grade.

That makes for the largest lithium deposit in the US by contained lithium in Mineral Resource, the company says.

They also signed an MOU with POSCO – a Korean lithium producer and supplier of cathode active materials to US auto-maker General Motors – to fund around $2m of testwork into lithium extraction.

To date, they have flagged acid leaching with beneficiation as the most economic pathway for the project, with testwork highlighting recoveries of over 95%.

Further metallurgical testwork is now underway to refine the preferred flowsheet.

Morella Corp (ASX:1MC)

Another Nevada play, the company has the Fish Lake Valley and North Big Smoky projects [60% earning in with Lithium Corporation (OTCBB:LTUM)], where exploration work is currently being planned.

At Fish Valley a reflective seismic survey will be carried out on the southern project area, and the company has submitted a notice for drilling in the north project area – with a determination from the Bureau of Land Management (BLM) expected shortly.

At North Big Smokey, auger drilling last year showed elevated lithium assays up to 499 ppm with over 40% of the assays with grades of 200ppm lithium or more. Nearly 90% of the deposit shows lithium grades greater than 100ppm.

The next steps are for soil samples to be analysed for the Carvers and Austin areas, passive seismic and MT surveys to be processed and drilling programs to be developed.

A shallow drilling program based on the results of the current soil sampling and the just completed soil sampling at Carvers will be developed and permits applied for from the BLM.

Mandrake Resources (ASX:MAN)

Earlier this month Mandrake increased its acreage at the large-scale Utah lithium project after securing an extra 254km of prime ground in the prolific ‘lithium four corners’ Paradox Basin – about 60km from Anson’s project.

Plus, developer Galan Lithium (ASX:GLN) has a 5% stake in the company, and their MD JP Vargas de la Vega says the project’s location “in an extremely attractive jurisdiction boasting power and water infrastructure in the lithium-hungry United States presented a compelling opportunity for Galan to gain early-stage exposure.”

Mandrake says it is going to “extraordinary lengths” to encourage and support domestic production of strategic and critical materials such as lithium in the heart of the United States.

A JORC exploration target is expected in Q2, 2023 and in parallel, preparations are continuing for field activities to begin in the short term.

Patriot Lithium (ASX:PAT)

This fresh explorer listed on 5 December with an IPO $10m at $0.20 and a focus on the Blacks Hills hard rock lithium project in South Dakota and the Wickenburg lithium project in Arizona.

The Black Hills region of South Dakota is a globally prolific high-grade, hard rock lithium district and hosts some of the largest and highest grade spodumene crystals globally – up to 14m in length – and boasts some of the highest-grade concentrates in the world at ~6% Li2O.

And already at Wickenburg, first pass field work has tripled the strike length of a major pegmatite, with soil and rock chip samples underway and results expected shortly.

IR1, JRL, 1MC, MAN and PAT share prices today:

Piedmont Lithium (ASX:PLL)

PLL has already scored an offtake deal with Tesla – from the North America Lithium JV project (NAL) with Sayona Mining (ASX:SYA) in Canada – but still.

On the US side of the border, the company has the Carolina and Tennessee projects (in, wait for it, North Carolina and Tennessee) along with the support of the US Government via a conditional US$141 million grant for a proposed 30,000tpa lithium hydroxide plant in Tennessee.

First production is projected in 2025, though a study on the Tennessee plant’s financial metrics are yet to be released to the ASX or NASDAQ, where PLL is also listed.

If it can’t produce its own primary supply, Piedmont plans to use a network of supply agreements to service its downstream needs.

A previous study on the Carolina Lithium project in late 2021 suggested it would produce 30,000tpa of lithium hydroxide at average all in sustaining costs of US$4,377/t over its first decade.

Reedy Lagoon (ASX:RLC)

The company has a couple of Nevada lithium assets in the States, where it has spent the past year staking additional claims to secure extensions over targets beyond the boundaries of its Alkali Lake North project, proximal to the Silver Peak Lithium Operation and Tesla’s Reno gigafactory.

“The elevated demand for lithium is not likely to be short term. The battery factories that have been and are still being constructed for the battery electric vehicle factories all need lithium,” managing director Geof Fethers said.

“The transition to BEVs has only just begun. Long-term demand for lithium provides an exciting opportunity for Reedy Lagoon’s shareholders given the location of our lithium brine projects in North America. Large battery plants (such as Tesla) require a stable local supply of feedstocks.

“Lithium is listed by the USA as a ‘critical metal’ for good reason. Large parts of the world are moving to exclude the use of cars that burn fossil fuels. Lithium is a critical part of that transition.”

Red Mountain Mining (ASX:RMX)

Earlier this year, RMX increased the size of its newly acquired Mustang lithium project in Nevada which is prospective for clay hosted deposits.

The explorer says the 1,070ha project area sits in the same rocks and “lithium enrichment settings” as American Lithium’s 10.7Mt TLC project and Cypress Development Corp’s 7.2Mt Clayton Valley project.

Early-stage exploration has now kicked off, ahead of a planned 10-hole drilling program – with assays pending due to some unusual blizzards and extreme weather in the area.

Aurora Energy Metals (ASX:1AE)

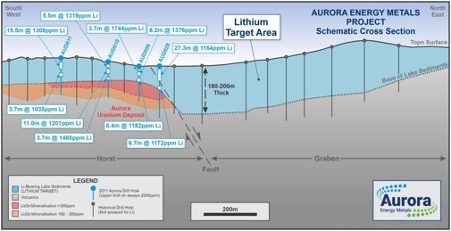

And finally, we have 1AE who we’ve thrown in here as a bit of a curveball because yes, their namesake project in the US has one of the country’s largest uranium deposits — 104.3Mt @ 214ppm U3O8 for 50.6Mlb U3O8 – but it also contains lithium in the sediments overlying and surrounding the uranium resource.

There is potential here to define and develop the two separate resources “providing commodity diversification and economies of scale”, 1AE says.

More drilling, assay results and met test work will culminate in a scoping/pre-feasibility study on the uranium deposit sometime this year.

A maiden lithium resource is targeted for release in the first half of 2023.

PLL, RLC, RMX and 1AE share prices today:

At Stockhead we tell it like it is. While Anson Resources, Arizona Lithium, Future Battery Metals, Ioneer, Patriot Lithium and Red Mountain Mining are Stockhead advertisers, they did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.