Will Simandou’s high-grade iron ore end Australia’s market dominance? Experts are sceptical

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

What a difference a week makes in iron ore.

Seven days ago successful attempts from the Chinese government to put the kybosh on the iron ore price – from records of $US230/t to only near records of ~$US190/t – led to some apocalyptic takes from commentators.

Since then China showed producers in the steel city of Tangshan a draft plan to relax emissions reducing production restrictions, apparently in the hope increasing steel supply would bring down prices.

Iron ore futures went boing, iron ore was back above $US200/t and the draft was pulled. Not, presumedly, what the CCP had planned.

As prices have remained stubbornly high Australia has benefitted in the form of record export earnings from China, despite ongoing trade tensions that have seen Aussie coal and crayfish turned away at the border.

Enter Capital Economics economist Julian Evans-Pritchard, who suggests a mix of scrap steel, sliding demand and Chinese sponsored overseas developments like the massive Simandou mine in Guinea could help the Middle Kingdom wean off Australian iron ore over the next decade.

“On their own, none of these factors would be enough to wean China off Australian iron ore,” he wrote in a note last week.

“But taken together, they could lower China’s dependence to levels where it would be feasible for the country to cut off shipments from Australia and still source enough from elsewhere to meet its needs.”

What is Simandou?

Located in Guinea, Simandou is one of the largest, highest grade iron ore deposits in the world, but is currently broken into a couple of discrete parts.

Australia’s Rio Tinto owns one half of the deposit (blocks 3 and 4) with Chinese aluminium giant Chinalco and the Guinean government.

It has held onto the project since it made the discovery in the mid-1990s, but only revealed plans to revisit it last year as iron ore prices sky-rocketed after finding it uneconomic to develop back in 2015.

The other half (blocks 1 and 2) had been held by companies associated with Israeli diamond and mining magnate Beny Steinmetz, who engineered a multi-billion dollar deal with Brazilian major Vale, before they were stripped amid allegations of corruption against Steinmetz.

Those blocks were then awarded by the Guinean Government in a tender to a consortium of Chinese, Singaporean, French interests and Guinea’s government owned Alumina company.

They have stated their ambitious aim to bring the roughly US$14 billion development, including a nation-building 620km railway through the Guinean countryside, online by 2025.

Simandou’s grade, scale and quality of resource is not in question. But what it is in question is whether it can be developed and what impact it will have on the global iron ore market?

The most pessimistic narratives involve it either displacing Australian production tonne for tonne, or bring so much additional supply into the market it would hammer prices, but there are a number of analysts who are sceptical about these outcomes.

Is it the Pilbara Killer, or another drop in the ocean as steel demand rises?

Developing Simandou a tall order

Iron ore market expert and Magnetite Mines (ASX: MGT) director Mark Eames said bringing Simandou into production would be more complicated than many analysts believed.

He noted the cost of Simandou in 2015 – when Rio shelved the project as the iron ore price fell away – was rumoured to be US$22 billion, complicated by the Guinean government’s insistence its product be transported through Guinea as opposed to a shorter, cheaper route through neighbouring Liberia.

Eames was involved on project development in Africa with Xstrata and Glencore and warned the history of African iron ore developments showed it would be no easy task to bring it online in the timeframe being put forward.

“Even if you could get through all of this mess of corruption, government relations, history and even if it proved to be economic, and the last design Rio did proved not to be economic, you’ve still got 8-10 years even if it’s physically possible for all of that ore to reach market,” he told Stockhead.

“And even after all of that you’ve got in the order of 60-70 million tonnes, which is not going to move the dial.

“In my opinion, the people who talk about Simandou have absolutely no idea of the practical challenges or the real issues involved in developing that resource.”

Fortescue Metals Group (ASX: FMG) chief executive Eizabeth Gaines, whose Pilbara mid-major reportedly missed out to the SMB Winning consortium in the tender process for blocks one and two, believes Simandou will be developed.

But presenting to delegates at the Australian Shareholders Association conference, she said supply from Simandou would be incremental and replace production from mines coming to the end of their life by the time it was ready to produce.

Australian iron ore still sailing high

For now, Australian iron ore appears to be in the driver’s seat, with the Pilbara miners’ main competitor, Brazil’s Vale, yet to recover to export levels seen before the Brumadinho dam collapse in 2019.

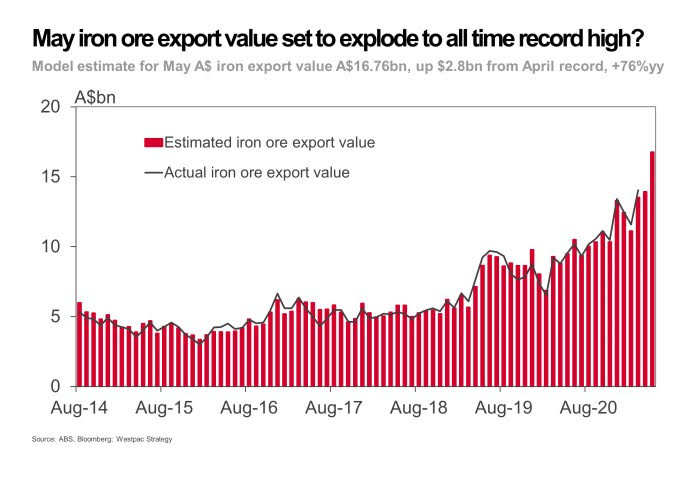

Based on shipping data and average May prices, Westpac estimates Australian iron ore exports were worth a colossal $16.7 billion last month.

It is the big boys dining out the most at the moment, but current prices also give a hell of a lot of support to junior miners with small projects that would be unfavourable in lower price environments.

Yesterday iron ore minnow GWR Group (ASX: GWR) announced a fourth shipment through Geraldton Port from its Wiluna West iron ore project.

Having made its first shipment this year from its stage 1 C4 iron ore deposit, it expects to hit the 1Mt mark by December.

A stage 2 expansion is under review to assess how best to exploit the remainder of its resource, which included 21.6Mt at an iron grade of 60.7%.

$80 million capped GWR has fallen from 45c to 27c since the start of 2021, but remains more than 400 per cent up on its share price this time last year.

GWR Group share price today:

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.