How ‘deteriorating’ China-Australia relations could affect booming iron ore markets

(Pic: Getty)

China-Australia relations are at a low ebb, but that hasn’t dampened Chinese enthusiasm for our largest commodity export.

The trade spat has hit a key route for Australian agriculture exports (grain, barley, wine) and other bulk commodities (coal).

Meanwhile, iron ore prices are holding at decade highs above $US200/tonne.

And along with these long-term structural supply-side factors, demand out of China has been the key driver. Mainly so it can do this:

[RTRS] – CHINA DAILY CRUDE STEEL OUTPUT AT RECORD HIGH IN APRIL – RTRS CALCULATIONS

— David Scutt (@Scutty) May 17, 2021

It’s made for a unique geo-political backdrop where despite rising tensions, China has drawn the line at iron ore when it comes to putting the clamp on Aussie trade exports.

In research last week, UBS analysts asked the question; could “deteriorating China-Australia relations impact iron ore?”

The answer is — not any time soon.

“Near-term, we do not expect the bilateral tension to have a major impact on the iron ore trade as there is no immediate source of iron ore units to replace Australia,” UBS said.

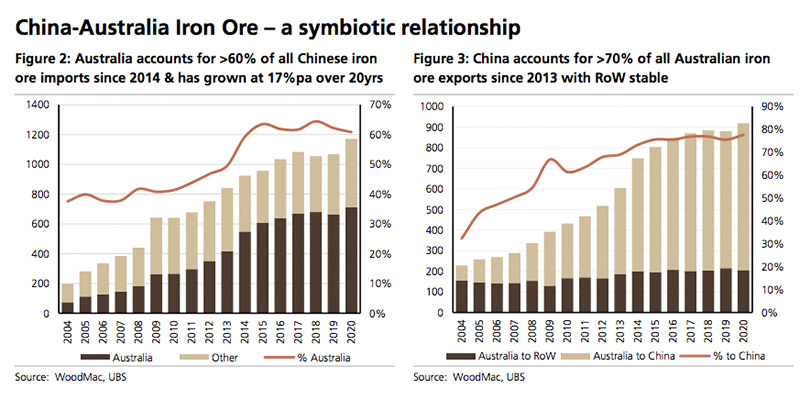

As things stand, China imports around 60 per cent of its iron ore from Australia.

Concurrently, iron ore sales to China make up around 70 per cent of Australian exports.

That means the pieces are in place for this “symbiotic” (mutually beneficial) relationship to continue for now, UBS said.

Medium-term though, the analysts expect China to execute on a number of strategies that reduce its dependence on Australian iron ore, starting with direct ownership of overseas assets.

The most obvious example of that is the Simandou project in the West African nation of Guinea, UBS said.

With an estimated reserve of 2.4 billion tonnes, Simandou is one of the world’s largest known deposits of high-grade iron ore and long-term development plans are underway through a joint stakeholder initiative between China, Singapore and France.

A second option will be to accelerate the transition to scrap-based steel production.

Speaking with Stockhead recently, Magnetite Mines (ASX:MGT) director Mark Eames discussed the outlook for increased scrap production on Chinese shores.

“A lot of people are making projections about China and how much scrap it’s going to use,” Eames said.

“The key point is the amount of scrap China has today is related to what they were making out of steel 30 years ago.

“So if you go back to China’s steel production 30 years ago, that’s how much you’d expect to be coming out now as obsolete.”

Ultimately, Eames said it’s “part of the steel story but not all of it, and in my view a lot smaller and further away than people think.”

“But it does over time have an impact — for example in the US, over half of all steel is made from scrap,” Eames said.

On balance, UBS said returns “should be attractive” in 2021 for Australian iron ore miners.

However, “we are cautious on the iron ore prices medium-term as supply is lifting annd demand is set to moderate”.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.