You might be interested in

Mining

Gold is at ALL TIME HIGHS but bullion and equities have never been so disconnected. Experts think the gap will close

Mining

Undies for Xmas again? Stuff our experts' small cap picks in your stocking instead

Mining

Mining

Special Report: Saturn Metals has flagged a resource extension at its Apollo Hill gold project in Western Australia’s Goldfields on the back of a series of standout drilling results reported this morning.

Saturn Metals (ASX:STN) struck gold above the Apollo Hill resource cut-off grade in 29 of the 30 holes drilled in the latest round, with 23 of the holes reporting mineralisation above the average resource grade for the project.

These include intersections of 9m at 1.95 g/t gold from 166m within a broader intersection of 15m at 1.3 g/t gold from 160m; 8m at 1.13 g/t gold from 121m including 3m at 2.46 g/t from 121m; and 4m at 2.77 g/t gold from 51m.

These results sit outside the Apollo Hill project’s current mineral resource, which already comes in at 24.5 million tonnes grading 1 g/t gold for 781,000 ounces.

Drilling of the Apollo Hill main zone continued to extend and improve mineralisation there, with returned results including 3m at 8.25 g/t gold from 259m; 20m at 1.08 g/t gold from 235m including 6m at 2.54 g/t from 245m; and 5m at 1.94 g/t gold from 16m.

But it’s the potential for growth that’s particularly exciting at Apollo Hill. As previously reported by Stockhead, drilling results returned earlier in the year were similarly promising and managing director Ian Bamborough said with further assays to come there was potential for more on the horizon.

“Drilling continues to expand the Apollo Hill gold system and the mineralised picture is growing with every new batch of results,” he said.

“Assays remain pending for a further 55 holes in key growth areas of the deposit.

“We look forward to receiving and reporting on the next batch shortly. These assays will be incorporated into the next resource upgrade process planned for later this year.”

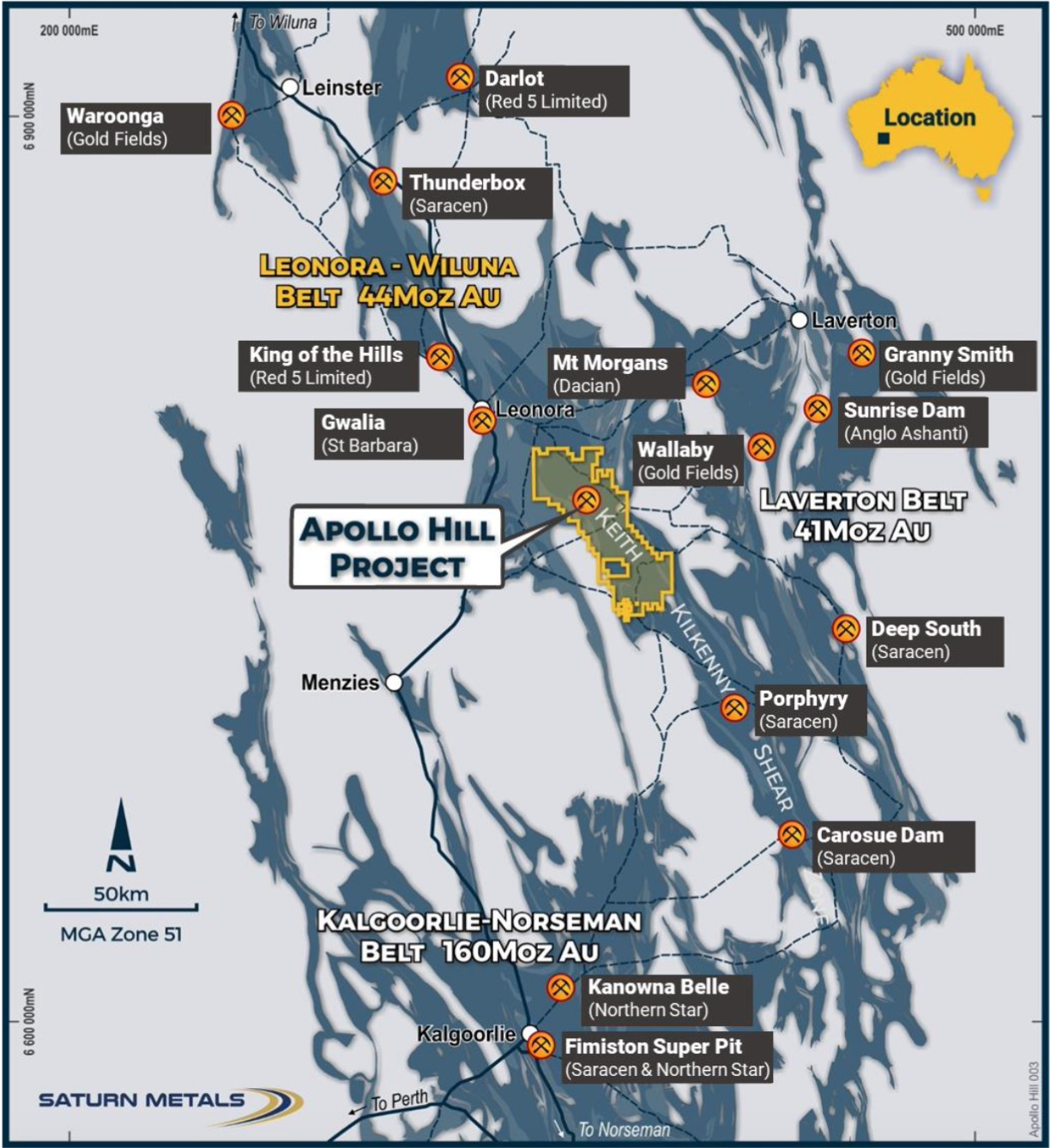

It’s not called the Goldfields for nothing. Located 60km southeast of Leonora in the heart of WA’s famed mining region, Saturn Metals’ 100%-owned Apollo Hill project is in good company.

Surrounded by great infrastructure and several deposits of significance, Apollo Hill has the potential to become a large tonnage, simple metallurgy, low-strip open pit mining operation.

The project spans 28 highly prospective gold exploration licenses covering some 1600sqkm.

Saturn Metals grew its exploration portfolio earlier this year, with entry into New South Wales’ well-endowed Lachlan Fold belt. The explorer has an option to earn an 85 per cent joint venture interest in the West Wyalong project – a high-grade veil opportunity on the highly prospective Gilmore suture within the famous gold region.

Historical production from West Wyalong, where mining was first undertaken between 1894 and 1915, totalled around 439,000 ounces of gold at 36 g/t gold.

Peak production was recorded in 1899, when 44,534 ounces of gold were produced at some 90 g/t – serious numbers indeed.

Saturn can earn an 85% stake in the project by spending $2.1 million over approximately four years.

This article was developed in collaboration with Saturn Metals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.