Round up: Where’s the best spots for ASX juniors to pop up in Latin America, and who’s already there?

Unlike explorers of the past, these ASX juniors are looking to help Latin America prove up mineral resources. Pic via Getty Images.

The experts agree — the world will need a lot more metal to support our global energy transition.

Benchmark Mineral Intelligence predicts over 300 new lithium, nickel, cobalt and nickel mines will be required to feed a 500% increase in battery demand by 2035.

Then there’s copper. On some demand outlooks, we’d need the equivalent of an extra Escondida — the world’s largest copper operation at ~1Mtpa — each year until 2030. Impossible.

Latin America contains a huge amount of untapped mineral wealth. According to Brookings’ The Future of Mining in Latin America report, Latin America is “particularly crucial to meeting demand for critical minerals” given both existing levels of production and its global share of reserves of copper, lithium, cobalt, and nickel.

“Chile, Peru, and Mexico hold an estimated 40% of global copper reserves, with additional reserves found in Argentina, Brazil, Colombia, and Ecuador,” it says.

“Roughly two-thirds of the word’s global lithium reserves are in Latin America. These are primarily in Bolivia, Argentina, and Chile, although Mexico, Peru, and Brazil are home to smaller shares and host some exploration projects.

“The region also has sizable nickel reserves—Brazil hosts 17% of global nickel reserves, with additional reserves in Colombia and Cuba—as well as small amounts of cobalt.

“We therefore believe that the trajectory of mining in Latin America will have an outsized impact on global commodities markets and the global energy transition.”

An outsized impact, they say. Meanwhile, several ASX explorers are hunting elephants — the kinds of discoveries that can rerate a stock — all over the region. Here’s a closer look at what’s happening, and where.

Brazil

While iron ore accounts for almost 75% of mining in Brazil, with its global miner Vale at the fore, Brazil is reinventing itself as an attractive lithium mining jurisdiction.

Sigma Lithium’s (TSX.V:SGML) success at its new 270,000tpa Grota do Cirilo hard rock mine has been a positive litmus test for operating in Brazil.

It’s sparked a torrent of interest in the country’s lithium, with Solis Minerals (ASX:SLM) boss Matty Boyes recently telling Stockhead that “there are people coming at [project] owners from all angles.”

“The prices are just going exponential as you are trying to close a deal,” he says.

“There is a lot of interest from North America. American juniors, Canadian juniors are throwing big money at assets in Brazil, so you must make sure you have a network in place, people that can get these assets to you ahead of the next guy.”

Latin Resources (ASX:LRS) is the most advanced of the ASX stocks, with a 45.2Mt @ 1.34% Li2O (~1.5Mt LCE) resource at Colina, part of the Salinas project in Minas Gerais state.

Ahead of its planned PEA, another 25,000m of drilling is currently underway to expand the overall footprint of Colina to the west and southwest where the resource remains open along strike.

LRS spinout Solis announced the acquisition of the Jaguar lithium project in late May.

At Jaguar – located in Bahia state — the company says there are rock chips grading up to 4.95% Li2O along a 1km long, 50m wide spodumene-rich pegmatite body.

Drilling is already underway. It also has a lithium project in northern Brazil called Borborema and several additional acquisitions in the pipeline.

Oceana Lithium (ASX:OCN) has started a 3,000m scout drilling program to test for near-surface lithium at the 124sqkm Solonópole project.

Gold Mountain (ASX:GMN) has a bunch of early-stage exploration ground near LRS and Sigma in northeastern Brazil, as does SI6 Metals (ASX:SI6) and Perpetual Resources (ASX:PEC).

The latest Aussie junior heading into Brazilian lithium is OzAurum Resources (ASX:OZM), which recently purchased some highly-prospective tenure in Minas Gerais for US$800,000.

Its Linopolis Jaime project hosts coarse spodumene crystals with grades up to 7.36% Li2O, which are known to occur at major WA lithium deposits such as Greenbushes and Mt Marion.

Argentina

Among the world’s top 15 mining exploration destinations, investment into Argentina hit its highest level in a decade last year.

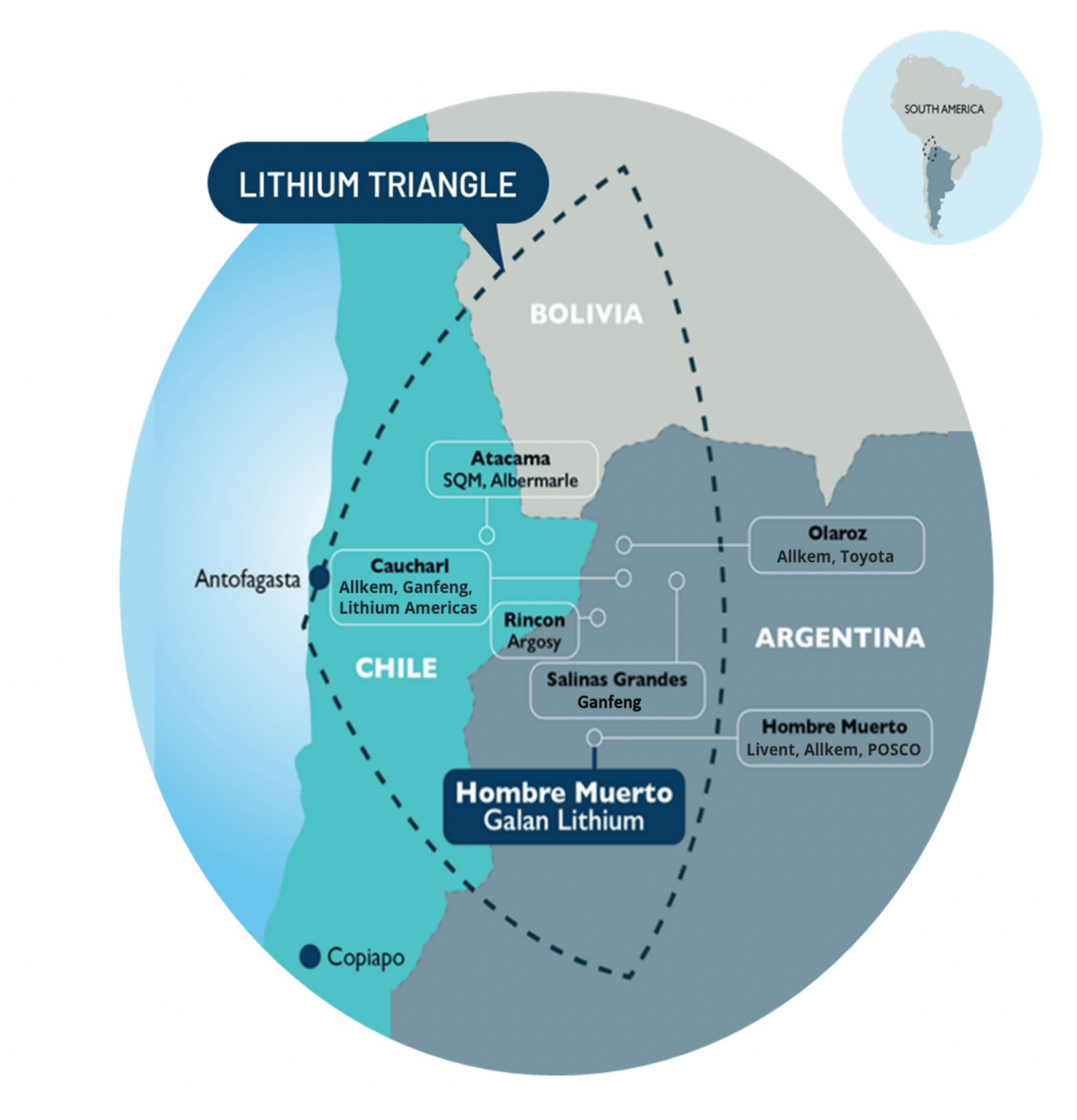

While known for its gold and copper production, there’s also a hotbed of activity around Argentina’s portion of the lithium triangle, which it shares with neighbours Chile and Bolivia:

Some of the world’s biggest lithium names are active in the region, including Allkem (ASX:AKE) at its Olaroz brine operation, which recently achieved record production of 16,703tpa of LCE, marking a 30% year-on-year increase.

Next up is Galan Lithium (ASX:GLN) , developing its Hombre Muerto West (HMW) and Candelas lithium brine projects in three stages to lower initial capex and help fund development.

The two projects have a combined resource of 7.3Mt at 852mg/l Li – with HMW providing the bulk of this at 6.6Mt LCE at 880m/l Li – giving the company one of the highest grade, large scale resources in the brine-rich Catamarca region.

Construction is underway, with an aim to start production of Phase 1 in H1 2025 which will output 5,400tpa of LCE. Phase 2 is aimed at 20,000tpa and a final output Phase 3 will deliver 60,000tpa.

Generating a lot of interest of late is Argosy Minerals’ (ASX:AGY) flagship Rincon lithium-brine project, where a 2,000tpa lithium plant is being commissioned this year, with plans to expand to 10,000tpa.

Rincon currently has a resource of 245,120t contained lithium carbonate and exploration upside could see that double in the near future.

Power Minerals (ASX:PNN) and Summit Nanotech are proceeding with the formation of a joint venture into the potential use of the latter’s DLE tech at the Salta project, which has a 490,000t and growing LCE resource.

Lake Resources (ASX:LKE) is developing its 8.1Mt LCE Kachi brine project while Lithium Energy (ASX:LEL) has tenements in the Olaroz basin which it shares with neighbour Allkem, focusing on its 3.3Mt Solaroz project with a scoping study due for release in Q4 this year.

But Argentina is more than just lithium. Belararox (ASX:BRX) is hunting for epithermal gold and porphyry copper systems at its Toro-Malambo-Tambo project in Argentina.

The project is in the underexplored gap between the El Indo and Maricunga metallogenic belts, which host some monster deposits such as Barrick Gold and Shandong Gold’s Veladero JV which has a 6.1Moz resource, as well as the 22Moz Pascua Lama deposit.

Belararox is now preparing to immediately commence work in line with the start of the field season in September, sending scout crews on quad bikes to assess access to the Sur high-sulphidation and/or porphyry targets.

Then there’s Challenger Gold’s (ASX:CEL) advanced 2.8Moz Hualilan gold project, which is also near the ~400,000ozpa Veladero mine.

Chile

Could Chile’s new plan to nationalise lithium resources send investment running for Australia and Argentina?

Not necessarily. Chile’s state-owned Codelco has maintained a leading position in its copper sector for decades while other private players including majors like BHP (ASX:BHP), Rio Tinto (ASX:RIO) and South32 (ASX:S32) have prospered in the country.

Chile is home to one of the largest brine lithium sources in the world and has long been the number one supplier of lithium from extraction ponds. It is also the largest copper producer in the world.

One of the most advanced copper plays on the ASX is Hot Chili (ASX:HCH). which is currently upscaling its already significant 2.8Mt copper, 2.6Moz gold flagship Costa Fuego flagship project in Chile with a move to acquire the nearby Cometa asset.

Hot Chili says Costa Fuego is already “one of the world’s lowest capital intensity major copper developments” and one of only a handful of projects outside of the control of major miners capable of delivering meaningful new copper supply this decade.

The company is now focused on upscaling Costa Fuego’s resource base to support an increase in the copper production profile to 150,000tpa ahead of its Pre-Feasibility Study, which is expected to be delivered in the first half of 2024.

Southern Hemisphere Mining’s (ASX:SUH) flagship Llahuin copper project in Chile currently boasts an open-pittable resource of 169Mt at 0.4% copper equivalent.

SUH also has the 30.26Mt Los Pumas manganese project and the recently pegged 27km2 Lago lithium brine project, located near operations run by SQM and Albermarle in the lithium-rich Atacama region in northern Chile.

Lithium Power International (ASX:LPI) is looking to develop its Maricunga lithium brine operation, where it has produced lithium carbonate from test ponds with a 99.92% purity.

That’s well above the 99.5% grade typically required for battery applications. A stage 1 DFS put a US$626m capex bill on the development, which would produce 15,200t of LCE annually over a 20-year period with an IRR of 39.6%.

Meanwhile, Pan Asia Metals (ASX:PAM) announced in August that exploration was already underway at its lithium clay project in Chile, through the collection of 30 surface and trenching samples.

And Variscan Mines (ASX:VAR) has skin in the game with its Rosario copper project – a stone’s throw from CODELCO’s El Salvador Mine — one of the country’s largest copper operations.

Cuba

Foreign investment in Cuba is structured as a partnership with state-run miner GeoMinera.

A first mover is Aussie copper-gold hunter Antilles Gold (ASX:AAU), which has four concessions in a JV with GeoMinera.

“We are a first mover investing in the emerging mining sector in Cuba because it is mineral rich, extensively explored, but under-developed, and our partnership with GeoMinera has led to numerous opportunities for copper and gold projects,” executive chairman Brian Johnson said.

The plan is to fund a copper porphyry hunt at El Pilar in central Cuba via the near term development of the Nueva Sabana and La Demajagua gold mines.

La Demajagua will produce ~80,000 oz Au Eq annually as gold, antimony, and silver concentrates for 9 years, with possible underground operation to follow.

Nueva Sabana will initially produce +50g/t Au gold concentrate followed by ~25% Cu copper concentrate.

Peru

Mining investment continues to flow into the world’s second-largest producer of both copper and silver, and remains one of the critical drivers of the country’s economic growth over the past 20 years.

Last month, Firetail Resources (ASX:FTL) acquired 80% of Valor Resources (ASX:VAL) Picha copper-silver project and its Charaque copper project in southern Peru.

Firetail will inherit the company’s recent earn-in agreement with leading global gold and copper producer Barrick Gold Corporation for a five-year option to acquire a 70% interest in the Charaque project for cash payments totalling US$800,000 and US$3m of exploration expenditure.

The transaction is now scheduled for completion shortly, with final drill permitting secured for Picha and a maiden 5,000m diamond drilling program scheduled to commence in October 2023.

Ecuador

Ecuador is relatively untapped in terms of exploration, with only 10% of the country explored. But it has incredible potential because of its proximity to the northern end of the mineral-rich Andes Mountain range.

The government’s mining policy has also become more robust in recent years and is considered the second-most attractive mining destination in Latin America, according to the Fraser Institute.

Leading the Aussie pack gold explorer is Titan Minerals (ASX:TTM), which is currently increasing its gold inventory at its flagship Dynasty project.

Dynasty currently has a resource of 3.1Moz gold and 21.98Moz silver across four major prospects hosted within a 9km long x 2km wide corridor of epithermal gold and silver vein-hosted mineralisation.

Drilling is set to commence across a largely underexplored 9km epithermal vein system at the project.

Its other forays in the country include the Linderos, Copperfield and Copper Duke projects.

Meanwhile, Australian miner SolGold (TSX:SOLG) is developing its >330,000tpa copper equivalent Cascabel copper-gold project and was recently granted a 25-year mining license extension.

Challenger Gold (ASX:CEL) is another Aussie explorer in Ecuador exploring its early stage El Guayabo copper-gold project which contains a high-grade core of 1.5Moz @ 1g/t AuEq.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.