LEL wooed by major EV battery players, flags multiple development options at Solaroz

The scoping study has highlighted conventional solar pond evaporation and direction lithium extraction options. Pic: via Getty Images.

- Lithium Energy approached by multiple, major third parties active in the EV battery sector “seeking strategic partnership or investment opportunities”

- Scoping study work shows multiple development pathways at Solaroz lithium project

- Solaroz has MRE of 3.3Mt of LCE and sits in South America’s lithium triangle

- Neighbouring producers Alkem and Lithium Americans use pond evaporation

- Scoping study due for release in Q4 2023

“Major third parties” in the battery space are circling as Lithium Energy’s ongoing scoping study at Solaroz confirms the suitability of conventional solar pond evaporation or Direct Lithium Extraction (DLE) as a development pathway for the project.

Solaroz has a maiden Inferred Mineral Resource Estimate (MRE) weighing in at 3.3Mt of LCE and is located strategically within South America’s ‘Lithium Triangle’ in north-west Argentina.

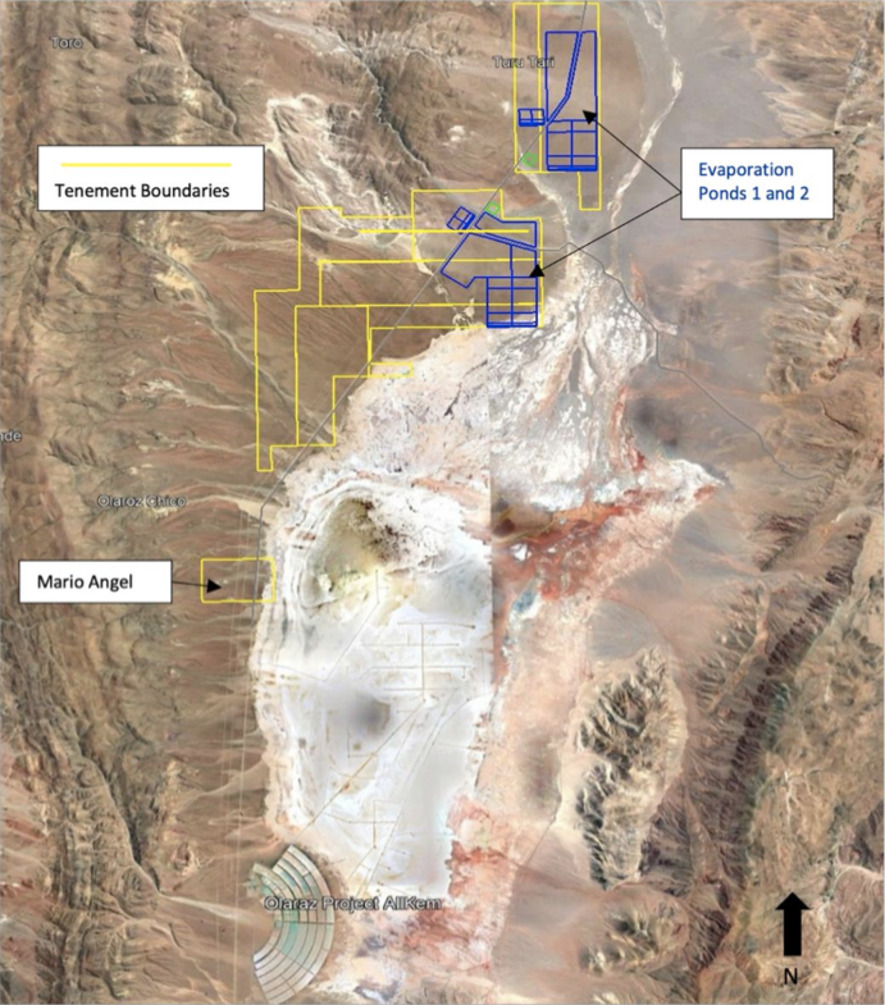

Lithium Energy (ASX:LEL) shares the lithium rights in the Olaroz Salar basin with neighbouring lithium carbonate producers Allkem Limited (ASX:AKE) (with its Olaroz JV with Toyota Tsusho Corporation), and Lithium Americas Olaroz-Cauchari JV (with Ganfeng Lithium).

Pond evaporation is a tried and tested production methodology on the Olaroz Salar and is currently used by both Allkem and Lithium Americas Corporation for battery grade lithium carbonate production.

However, work also indicates Solaroz is suitable for Direct Lithium Extraction (DLE), which means the company gains the benefit of having multiple potential development pathways.

Consideration will be given to both pond evaporation and DLE techniques as potentially complementary development methodologies with respect to different areas of the Salar.

Solaroz attracts multiple potential EV battery partners

LEL has garnered attention from several active parties in the EV battery sectoe, and while it’s still early days, there’s growing interest in strategic partnership or investment opportunities that will propel Solaroz’ development.

“This interest confirms the company’s view that the Solaroz lithium brine project is highly strategic, particularly given its size and location directly adjacent to two major producing lithium projects,” the company said.

“Given the positive results from the study to date and the multiple approaches by significant market participants, Lithium Energy is currently in discussions with parties to invite a strategic partner (or partners) to participate in the further development of Solaroz, as has been the case with its neighbours on the Olaroz Salar – Allkem and Lithium Americas.

“Negotiations with these parties are progressing and if such negotiations proceed to formal documentation or agreements, these will be disclosed to the market in due course.”

Scoping study release slated for Q4

The company plans to undertake further engineering and processing studies — along with laboratory scale pilot testwork to produce LCE samples from Solaroz brines — using both pond evaporation and DLE methodologies, as well as drilling multiple production test wells.

Notably, Lithium Energy already has an agreement in place with Xi’an Lanshen New Material Technology Co. to construct a demonstration plant capable of producing up to 3,000 tonnes per annum of battery grade lithium carbonate at Solaroz, which will use Lanshen’s proprietary sorbent-based DLE technology.

Resource expansion drilling is also underway in the Northern Block of concessions, where drillhole 7 recently confirmed a new occurrence of lithium rich brine in the Payo 1 concession.

The company is also advancing an infill drilling program to update a portion of the MRE to a JORC Indicated level.

This lines LEL up to release robust scoping study details, including proposed production details and associated financial information, sometime in Q4 2023.

This article was developed in collaboration with Lithium Energy, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.