Resources Top 4: White Cliff signs literal John Hancock as mining royalty brings in the critical minerals gains

Pic: Getty Images.

- Rich-lister and mining royalty John Hancock joins White Cliff as strategic advisor

- Astute rises hard on lithium hits at Red Mountain

- AuKing jumps with turn to niobium

Here are some of the biggest small cap resources winners in morning trade, July 22, 2024.

White Cliff Minerals (ASX:WCN)

After announcing more IOCG, copper and epithermal mineralisation from its Great Bear Lake copper-gold-silver project in northern Canada, the ASX junior has signed on none other than John Hancock.

Not a euphemism for a signature, mine you (pun, sadly, intended), but a true to life member of WA’s mining royal family whose success in the global resources game extends beyond his famous name.

The grandson of WA’s superstar of Pilbara mining, Lang Hancock, John has >40 years’ experience from representing the prolific Hope Downs iron ore project to making early stage investments as a money man backing lithium and uranium companies such as Vulcan Energy (ASX:VUL) and Aura Energy (ASX:AEE).

Hancock will advise on WCN’s three-project portfolio in Canada as well as significantly expand exploration work at both the Great Bear Lake and Rae copper (Nunavut-Coppermine) projects.

“Attracting someone of John’s experience and calibre is a great development for White Cliff,” MD Troy Whittaker says.

“John has an extensive international network and is a successful resources veteran with deep roots within the mining industry.

“I look forward to working with John as we execute this next corporate step and continue to unlock the untapped potential of all of the company’s projects.”

Shares in WCN rocketed on the news to trade at 1.5c – a 15.4% rise.

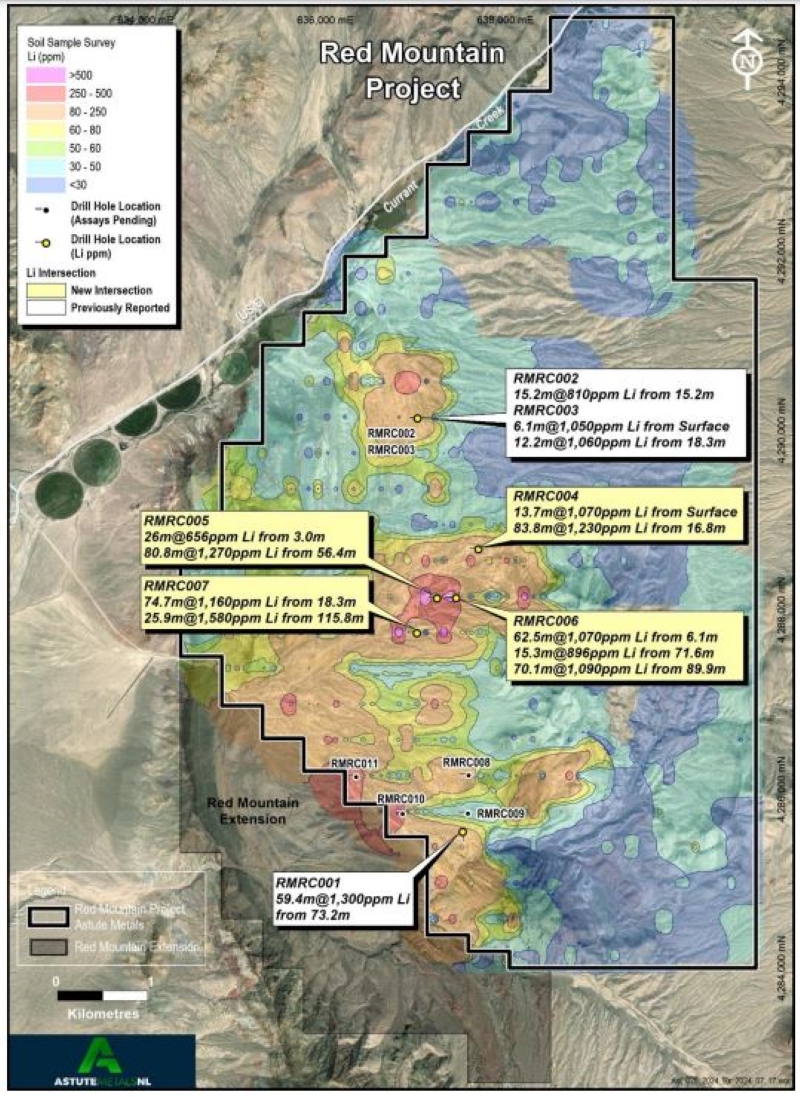

Astute Metals (ASX:ASE)

ASE was an early Monday morning riser after reporting assay results from a further four drill holes at its Red Mountain lithium project in Nevada, USA.

Drilling has found thick intersections of Li above 1000ppm, with the standout result of 13.7m at 1070ppm Li /0.57% lithium carbonate equivalent from surface, including 83.8m at 1230ppm Li / 0.65% LCE from 16.8m.

Staked in 2023, the project is surrounded by some substantial Li deposits such as Lithium Americas’ 16.1Mt Thacker Pass, American Battery Technology Corp’s 15.8Mt Tonopah Flats and American Lithium’s 9.7Mt projects.

There was pretty big trading volume in the morning and shares spiked to 8c from a 4.4c open.

While there was a retrace, the lithium hunter is still up 13.5% at time of writing.

Waratah Minerals (ASX:WTM)

(Up on no news)

On July 3 gold-copper explorer WTM struck into shallow, high grade mineralisation at its Spur project in NSW’s prolific Lachland Ford Belt, where major deposits such as the Newmont-owned >50Moz gold and 9.5Mt copper Cadia is hosted.

The intersections are pretty thick, with highlights of:

- 89m at 1.73g/t gold, 0.08% copper from 115m, including 57m at 2.5g/t gold and 0.11% copper from 115m; and

- 16m @ 5.59g/t gold, 0.32% copper from 156m.

The news is almost three weeks old, yet investors seem to have picked up on something.

WTM is targeting the margins of the Cargo Intrusive Complex at Spur for epithermal-porphyry mineralisation, and the initial success bodes well for ongoing exploration.

Shares are up 27.27% so far today, trading at 35c.

Auking Mining (ASX:AKN)

AKN has hopped on the niobium train and is optioning to acquire the Myoff Creek project in British Columbia, Canada.

Niobium’s a vital element used to create nanocrystalline materials, spearheading next gen advanced soft magnetic alloys that are used to control and convert electricity.

By adding niobium to the alloys, the materials can have a crystal size of <10 nanometers. Translation? High permeability and a high heat tolerance – perfect for making miniature and lightweight materials that advanced technology is increasingly seeking.

The identified carbonatite mineralisation at Myoff Creek is near-surface and primed to potentially host a significant deposit, with previous drilling already cropping up high-grade intercepts that include 0.93% Nb and 2.06 total rare earth oxides (TREO).

It’s also raising $150,000 of capital in a share placement to fund acquisition and early doors exploration.

AKN has had a wild ride this morning. On just 33 trades it surged from 2c to 2.4c just after midday Sydney time before a precipitous fall to 1.7c and rebound to 1.8c by the time of publishing.

The bizarre trading day for Auking could take another twist in an agility test for the day trader in us.

At Stockhead we tell it like it is. While White Cliff Minerals is a Stockhead advertiser, it did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.