Resources Top 5: This small cap is waiting on some potentially company-making copper results

Pic: Via Getty

- Thor Mining approved to drill uranium-vanadium projects in Colorado

- Tempest Minerals awaits assays from discovery holes at Orion target

- Star Minerals (gold), Titanium Sands (minerals sands), Pacific Bauxite (PGEs) up on no news)

Here are the biggest small cap resources winners in early trade, Wednesday June 22.

TEMPEST MINERALS (ASX:TEM)

(Up on no news)

In March TEM spiked hard on a potentially very large copper discovery.

The first 709m-long hole of a two-hole diamond drilling program at ‘Orion’, part of the flagship ‘Meleya’ project in WA, pulled up three mineralised copper sections.

The second, 1,021m-long hole hit more of the same.

Assays are pending.

Meleya is part of TEM’s 900sqkm ‘Yalgoo’ tenements, where the company has + 50km strike length of a previously unexplored segment of a mineral-rich greenstone belt.

The belt hosts several world class mines, including one of Australia’s most successful high-grade copper-zinc and precious metal operations, ‘Golden Grove’.

The $22m market cap stock has softened over the past few months but remains +145% year-to-date.

It had $8.1m in the bank following a recent raise.

READ: ASX Copper Stocks — 4 experts, 11 stock picks as global demand continues to surge

PACIFIC BAUXITE (ASX:PBX)

(Up on no news)

After two years in the wilderness this $5m capped battler recapitalised and recommenced trading on the ASX in May.

It has $4m in cash to explore its six platinum group elements (PGE) projects in WA and with no bauxite to be seen in the portfolio, a name change to something like ‘Pacific Palladium’ is surely coming.

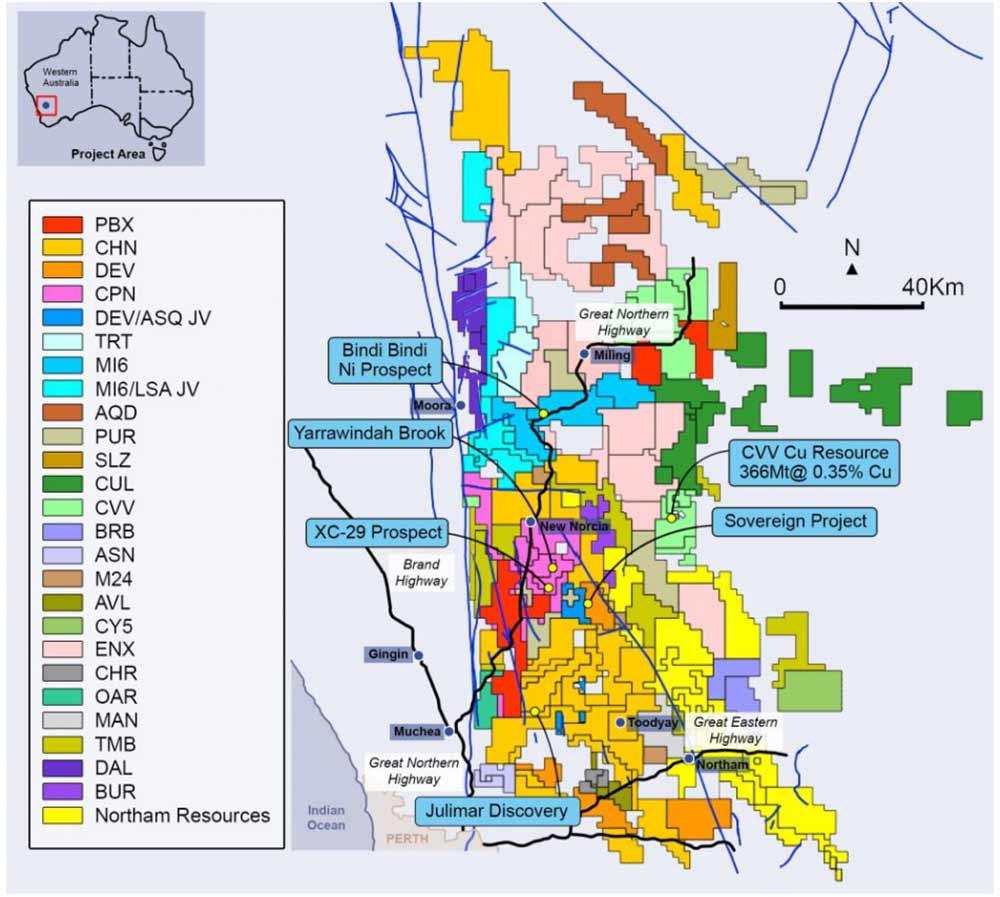

PBX’s ‘Darling Range’ project is few klicks from Chalice Mining’s (ASX:CHN) Julimar discovery, where it sits shoulder-to-shoulder with countless other juniors searching for the next Gonneville.

Just check out this jam-packed tenement map:

“Upon granting of the Darling Range PGE Project, the company plans to undertake an extensive reconnaissance mapping, geophysical surveying and re-interpretation work to delineate targets for drill testing,” the company said May 4.

“Given the recent discovery of significant tonnages of nickel-copper-PGE mineralisation at the Julimar Discovery located within the adjacent tenure held by Chalice Mining Limited, the Company has prioritised data compilation and analysis over the Darling Range PGE Project to delineate targets capable of representing known extensions or repetitions of this mineralisation style.”

The company is down 35% on its relisting prospectus price of 20c per share.

TITANIUM SANDS (ASX:TSL)

(Up on no news)

TSL has a flagship mineral sands project called ‘Mannar’ in economic basket case Sri Lanka.

Last week it started the last part of an ‘infill’ drilling program that is required to increase the 93Mt at 5.24%THM high grade zone resource from ‘Inferred’ to the higher confidence ‘Indicated’ category.

This is required by the ASX so TSL can release a revised Scoping Study, the first proper look at the economics of building a mine.

The $18m market cap stock is down 35% year to date. It had about $2.4m in the bank at the end of March.

In May, an insto placement for an initial $500,000 was done at 4.5c – a ~300% PREMIUM to the closing price of the company’s shares on 10 May.

THOR MINING (ASX:THR)

Busy times for THR, which has approvals to begin drilling its ‘Wedding Bell’ and ‘Radium Mountain’ projects, located in a historic uranium-vanadium mining district in Colorado, USA.

The drilling program at priority prospects will commence once a suitable drill rig has been sourced, the company says.

“Based on my recent site visit I am very encouraged by the extent of mineralisation observed and the project’s overall prospectivity,” managing director Nicole Galloway says.

“Drillholes are now pegged and final drilling preparation underway.

“We look forward to getting on the ground and testing these shallow high-grade targets, especially Section 23, where Thor will be the first company to access and drill test this highly prospective area.”

Yesterday, THR began a 3,000m drilling program at the ‘Ragged Range’ gold project in the Pilbara region of WA.

The $7.5m market cap stock is flat year-to-date. It had $2.7m in the bank at the end of March.

STAR MINERALS (ASX:SMS)

(Up on no news)

The recently listed Bryah Resources (ASX:BYH) spin-out set itself the ambitious goal of starting gold mining at the ‘Tumblegum South’ project within 12 months of completing its IPO.

That’s late October 2022.

Following resource drilling completed last week SMS is now updating the 42,500oz resource at Tumblegum South for a scoping study.

Star Minerals acquired Tumblegum South from BYH for $500,000 cash, 9 million shares (valued at $1.8m) and 7m performance rights.

Current resources are for a planned open pit development, though there is also scope for underground development in the future subject to further drilling.

The company also acquired the ‘West Bryah’ project from BYH for 2 million shares along with a 0.75% royalty on any future production.

West Bryah covers 349sqkm in the Peak Hill area and was historically worked during the early gold rush days in the late 1890s.

The $4m market cap tiddler is down 33% year-to-date. It had $3.5m in the bank at the end of March.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.