Resources Top 5: Nearology, a lithium pivot, and ‘game on!’ at an emerging high grade gold discovery

Pic: Via getty.

- BMG Resources hits super thick, high-grade gold at emerging ‘Capital’ deposit

- Diamond explorer Odessa Minerals branches out into lithium and rare earths

- Vanadium Resources dual lists on the Frankfurt Stock Exchange (DAX)

Here are the biggest small cap resources winners in early trade, Tuesday April 26.

BMG RESOURCES (ASX:BMG)

“It’s now well and truly game on at Abercromby,” BMG managing director Bruce McCracken says.

The WA explorer just hit thick, high-grade gold at ‘Capital’ — part of the ‘Abercromby’ project — including a highlight 31m at 6.18g/t gold.

This was part of a broader 77m intersection grading ~3g/t from 116m.

Other notable hits included:

- 10m @ 11.71 g/t Au from 295m, and

- 8m @ 6.56 g/t Au from 446m

That 10m, ~11.7g/t hit was 250m south of known mineralisation.

So far, drilling has more than doubled the mineralised envelope to 550m long, 520m deep. It remains open in multiple directions.

Results from early stage ‘aircore’ drilling, testing new areas to the south of Capital, are expected shortly. Follow-up drilling to find the edges of the Capital deposit could kick off next month.

“In one single program, we have more than doubled the likely size of the deposit, intersected extremely high-grade gold in fresh rock, and proven the system is fertile at depth via the deepest drilling undertaken at the Project to date,” McCracken says.

“Our geological and grade models have again successfully targeted mineralisation at or very close to predicted locations, with extrapolation holding true at distances in excess of 250m.

“The nature and style of mineralisation is becoming well recognised, and the company is in a great position to leverage further success with the drill bit from here.”

Abercromby is on the Wiluna Greenstone Belt, one of WA’s most significant gold producing regions.

The project area neighbours notable discoveries like Northern Star’s (ASX:NST) 10Moz ‘Jundee’ and Bellevue Gold’s (ASX:BGL) namesake high grade project (2.2Moz at 11.3g/t).

$15m market cap BMG is down 15% year-to-date. It had $3.1m in the bank at the end of December.

ODESSA MINERALS (ASX:ODE)

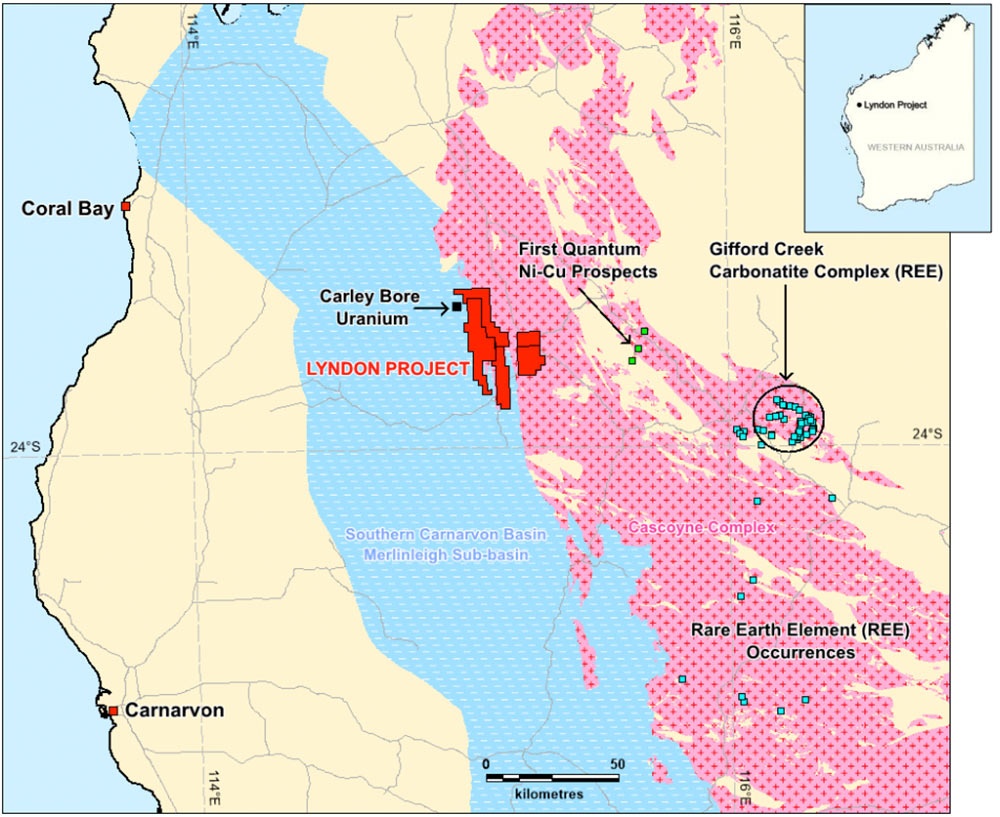

The diamond explorer is branching out into lithium and rare earths, acquiring the 606sqkm ‘Lyndon’ project near Carnarvon in WA.

THE project includes numerous clusters of pegmatites prospective for lithium, and several features similar to those associated with Dreadnought’s (ASX:DRE) nearby rare earth discoveries.

There is also nickel and copper potential, ODE says, and a uranium project next door.

“This Lyndon project acquisition is an excellent opportunity for Odessa to enter the battery metals sector, in a part of the Gascoyne Complex that is host to a number of newly discovered occurrences of lithium, rare earth and nickel-copper,” ODE CEO Alistair Stephens says.

“We remain resolutely focussed on progressing our cornerstone diamond projects in the Kimberley region, and as work becomes limited during the northern wet season, this acquisition will provide an excellent year-round exploration project for Odessa.”

Veteran small cap leader David Lenigas is also joining the board.

ODE, one of only three diamond companies on the ASX, relisted in January after raising $6 million IPO at 2c a share.

Odessa has a bunch of WA projects located between the historic Argyle and Ellendale diamond mines including ‘Aries’, which it calls “the largest and most diamondiferous kimberlite in WA”.

The $6.8m market cap minnow is up 30% year-to-date. It had $5.5m in the bank at the end of March.

MARMOTA (ASX:MEU)

Gold-uranium focussed MEU is hoping nearology (being ‘near’ another explorer’s mineral discovery) will help boost its share price.

Today, it highlighted the fact that its tenement boundary in the Gawler Craton adjoins Petratherm’s (ASX:PTR) rare earths discovery, announced Wednesday last week.

“The largest and most exceptional of the high-value magnet REE results (1015 ppm: Hole 590) attained so far is located on the Marmota tenement boundary,” MEU says.

“Marmota [will] commence new exploration program for Rare Earth Mineralisation with immediate targets starting at the discovery on Marmota’s tenement boundary.”

Last week, PTR rerated after shallow drilling testing the top three metres of the prospective clay horizon encountered “impressive concentrations of high-value REEs”.

All 44 holes returned strong results, with 23 holes hitting TREO (Total contained Rare Earth Oxides) at 1,000ppm.

PTR described these intersections as similar in characteristics and grades to ion-absorption rare earth deposits of China – a major world supplier.

$50m market cap MEU is up 35% year-to-date. It had ~$3.3m in the bank at the end of December.

ALCHEMY RESOURCES (ASX:ALY)

(Up on no news)

ALY is up 55% since finding multiple lithium anomalies at its Karonie gold project in WA last week.

The company says the signatures of these soil anomalies are consistent with possible hard rock lithium mineralisation.

They are also 8km along strike and within contiguous tenure to Global Lithium Resources’ (ASX:GL1) ‘Manna’ lithium deposit (9.9Mt at 1.14% Li201).

“The geochemical review reaffirms the prospectivity of our large tenement package at Karonie in what has historically only ever seen gold and base metals exploration,” CEO James Wilson said.

Detailed mapping and sampling are ongoing.

$26m market cap ALY is up 210% year-to-date. It had $3m in the bank at the end of December.

VANADIUM RESOURCES (ASX:VR8)

VR8 joins a growing list of ASX-listed vanadium companies that have been dual listed on the Frankfurt Stock Exchange (DAX), such as Neometals (ASX:NMT), Australian Vanadium (ASX:AVL) and TNG (ASX:TNG).

The listing will broaden VR8’s exposure to European investor cash as it develops the Steelpoortdrift vanadium project in Limpopo, South Africa.

“With increasing awareness of vanadium’s demand, both as a strategic metal and its use in the storage of renewable energy, we are pleased to have listed on the Frankfurt Stock Exchange, to provide the Company exposure to the European Investment community,” VR8 exec director Jurie Wessels says.

“Europe is a driving force behind the push for green metals and renewable energy, so investors are well informed on how Vanadium will play its part in this new green era.”

Steelpoortdrift is one of the world’s largest deposits, located within the famous, vanadium-rich Bushveld Complex. A DFS is now underway.

A recent pre-feasibility study indicates the Steelpoortdrift project “is well positioned to become a significant high volume and low-cost producer”.

It is also one of the few vanadium resources globally with a mining right granted, which includes environmental approval.

The $80m market cap stock is up 150% year-to-date. It had $4.8m in the bank at the end of December.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.