Odessa aims to be the diamond in the rough in bid to revive Australian industry

Pic: Schroptschop / E+ via Getty Images

Almost more precious and rare than a diamond itself is exposure to the sector on the ASX, where just two companies currently provide an entry to the world of Australian sourced luxurious gems.

Make that three, with the soon to be listed Odessa Minerals (proposed ASX code: ODE), which has launched a $6 million IPO at 2c a share, which is anticipated to close early due to strong demand.

It is not too difficult to see why demand for shares in Odessa could be as feverish as diamonds themselves at auction.

Armed with 2400sqkm of tenements and applications in the legendary Kimberley diamond district in WA, Odessa will join just Burgundy Diamonds and Lucapa Diamond Company in the Australian sector.While Burgundy and Lucapa trade at ~$80 million and $105 million, respectively, Odessa will have plenty of room for growth with an EV on listing of just $7.7 million, leveraging the company for exploration success on proven brownfields sites.

With the closure of Rio’s Argyle diamond mine in 2020, Australia went from one of the world’s largest producers of rough diamonds to none overnight.

Odessa’s board believes they have the projects and modern exploration nous to have a go at fixing that.

The Projects

Odessa lays claim to licenses over the Aries diamond project, where a mineralised kimberlite pipe—described by Odessa as one of the largest and most diamondiferous kimberlites in Western Australia—was discovered by Triad Minerals and Freeport in 1986.

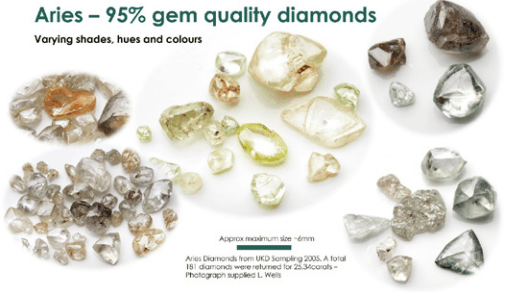

Bulk testing on pipes at the project by United Kimberley Diamonds in 2005 returned 181 diamonds for 25.34 carats in 2169t of material and the pipes have been known to host rare and highly sought after coloured diamonds.

Aries is located just 230km west of Rio Tinto’s recently mothballed Argyle mine, the source of 90% of the world’s fancy pink diamonds, and has only been sporadically explored since its discovery in 1986.

Rare coloured diamonds have seen a sharp rise in investor interest, especially after Argyle’s closure, with the investment value of pinks increasing by around 30% and Rio recording record prices at its final tender this year.

Odessa plans to use state of the art modern exploration techniques not available to the diamond explorers of the 1990s. It believes this will enable it to accelerate the exploration of the Aries project, with another four exploration leases around Aries waiting for agreement from traditional owners and grant by the WA Government.

Odessa has three additional projects in the Kimberley, including the Ellendale project surrounding the closed Ellendale diamond mine, famous for producing fancy yellow gems.

It also has license and applications at the Calwynyardah project, which has similar geology to Ellendale and includes two of the largest lamproite pipes in the Kimberley, and the applications at the Noonkanbah project which was explored for diamonds between 1969 and 1980 and hosts Walgidee Hills, the largest known lamproite in Australia.

The Market

Diamond markets have been resilient since the onset of the Covid-19 pandemic, with the rough diamond market now at its strongest since 2012.

They say timing is everything, and evidence suggests Odessa is entering the diamond market at the start of a long period of undersupply in the rough trade.

Less than 100 million carats are delivered to the market each year, but a little under 15% of that came from Rio’s Argyle.

That mine will likely never be reopened, with few large-scale operations in the global pipeline to replace it.

Odessa has also pledged to place its relationship with traditional owners front and centre of its work in its bid to produce ethically sourced diamonds, or “ESD”, to take advantage of the market’s desire for diamonds from an ethical supply chain.

Odessa is committed to adopting and implementing a comprehensive ESG plan next year that is reflective of their combined beliefs, ethics and commitment to working in partnership with the traditional owners and minimising the explorer’s footprint on the environment.

The People

Odessa will have an experienced board to direct its exploration plans at Aries and across its Kimberley diamond portfolio.

Former Arafura and Globe Metals and Mining boss Alistair Stephens, a geologist with 30 years of experience, will be at the helm as CEO.

The board will include non-executive chairman Zane Lewis, principal and joint founder of corporate advisory firm SmallCap Corporate, veteran geologist and Aurumin non-executive director Darren Holden, and Lisa Wells, a non-executive director of Territory Minerals who was a senior geo at UKD when the bulk sampling program at Aries South took place.

This article was developed in collaboration with Odessa Minerals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.