Lucapa will soon step into the shoes of Australia’s beloved Argyle as the country’s only diamond producer

P{icture: Getty Images

- The diamond market was hit hard during COVID but new ASX players are coming to the fore

- Lucapa’s Merlin project will be Australia’s next commercial diamond mine when it comes online in the next two to three years

Rio Tinto’s closure of the Argyle diamond mine in 2020 marked the end of a 37-year history for Australia as a top producer of gem-quality sparklers.

Throughout its mine life, Argyle produced more than 865 million carats of diamonds and kept the nation at the top of the global diamond mining game right until the end.

According to Western Australian Department of Mines, Industry Regulation and Safety (DMIRS), Western Australia’s diamond sales increased to 17.4 million carats (worth around $225 million) in 2019 – 2020 – the state’s highest level in more than a decade after an upsurge in Argyle’s final output.

Over the last three years, domestic diamond production has been non-existent.

Like most sectors, volatility and uncertainty rocked the diamond market as the pandemic hit and consumer confidence waned around the world.

According to S&P Global, diamond exploration spend plunged to US$1.5 million in 2021, the second lowest on record since the reporting agency started coverage of the data in 1997.

Diamond explorers on the ASX

But experts say an uptick in diamond exploration is warranted given the number of new companies coming to the fore.

Almost more precious and rarer than a diamond itself is exposure to the sector on the ASX, where just a few companies provide an entry to the world of Australian sourced luxurious gems.

One of the newcomers, Odessa Minerals (ASX:ODE), listed on the bourse in 2022 with a $6 million IPO at 2c a share, armed with a 2400sqkm of tenements and applications in the Kimberley diamond district of WA where its Aries diamond project is located.

While exploration has curtailed due to the early onset of the wet season, bulk testing on pipes by previous explorers in 2005 returned 181 diamonds for 25.34 carats in 2160t of material, with the pipes known to host rare and highly sought after diamonds.

Other diamond explorers include Burgundy Diamond Mines (ASX:BDM) which is looking to build an integrated luxury diamond brand with the recent addition of a top-10 global Canadian diamond mine to its portfolio.

The US$136 million (A$209m) deal would see BDM raise $231 million in fresh equity via Aitken Mount Capital Partners and Bell Potter Securities to secure the Ekati mine, which sold 4.2Mcts at US$117/ct in 2022 and delivered revenue and EBITDA respectively of US$494m and US$200m last year.

Lucapa’s near term development opportunity

But perhaps the most exciting, near-term development opportunity in Australia right now is Lucapa Diamond Company’s (ASX:LOM) Merlin project in the Northern Territory, home to a JORC compliant Indicated and Inferred resource of 4.4m carat.

Once owned by Rio Tinto (ASX:RIO) and Ashton Mining, Merlin holds the distinction of producing Australia’s largest ever rough diamond (104.73 carats) valued around A$1 million in 2003, now worth upwards of A$3 million.

The mine operated for roughly three years from 2000 to mid-2003, during which it produced about 500,000 carats of high quality diamonds.

It is known for its significant recovery of gem quality stones (~65%) and relatively high proportion of white gems (~35%), as compared to the worldwide average of just 20% gem-quality diamond production, and a mere 5% gem quality production at Argyle.

In an interview with Stockehead LOM managing director and CEO Stephen Wetherall said the company bought the project for A$8.5 million, which at a cost per carat basis, equals to a mere $2 per carat.

“As a global miner we look around the world for good projects and when a project comes up in Australia, which is a tier-1 mining jurisdiction with a very good reputation globally, it is a very enticing opportunity for us,” Wetherall explained.

“We have the potential to bring this project into production in the mid-term, and when I say mid-term, I mean the next two to three years.

“An open pit, vertical mine development at Merlin will significantly grow the company’s production earnings and cash flows by multiples – not small percentages, by multiples, and will transform Lucapa from a small producer of 65,000 carats into a significant mid-tier diamond company producing well over 200,000 carats.”

Feasibility study just around the corner

In addition to advancing work on a feasibility study for the Merlin project, which is set for release in Q2, Lucapa kicked off a kimberlite exploration program in April 2022 to identify further primary source targets across the two Merlin tenements.

Hyperspectral data which had been left unused for more than 25 years was acquired from global diamond producing giant, De Beers.

Together with the company’s historical database, the information allows for a level of target generation not previously seen in this highly prospective kimberlite province, where all 13 of the previously identified kimberlite bodies are diamondiferous.

Seven new kimberlite targets were identified, around ~3km to the east of the known Merlin kimberlites, providing confidence that there could be more diamondiferous kimberlites at the project beyond the 13 previously identified.

Perfect timing

From Wetherall’s point of view, the diamond market is entering a sustained period of lower diamond supply and expects the market to be less versatile in 2023.

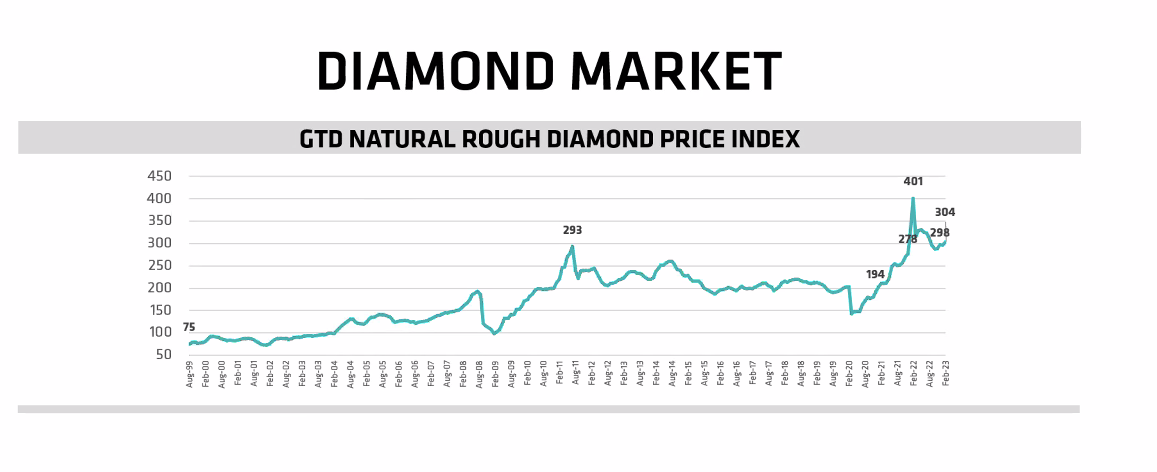

“Diamond prices have already materially increased over 50% on average from pre-COVID levels and diamond production is maxed out at 120 to 125 million carats per annum for the foreseeable future, but it will drop come the end of 2030,” he told investors during a webinar on Thursday.

“There are a number of large mines that are ending their life of mine and will be exiting the production stage in 2030.

“So down from the highs of 170 million in 2003, down from the recent highs of 150 million in 2017 with retail luxury demand on the increase and natural rough diamond supply on the decrease, you’re going to see positive impacts on diamond prices.”

With prices four times higher than they were when Merlin was last in operation, Wetherall said therein lies the opportunity to reignite the historic mine.

“We will always have cyclical highs and we will always have cyclical lows during the year as we deal with the demands from the various centres but on the whole, we believe that they will trend positively.”

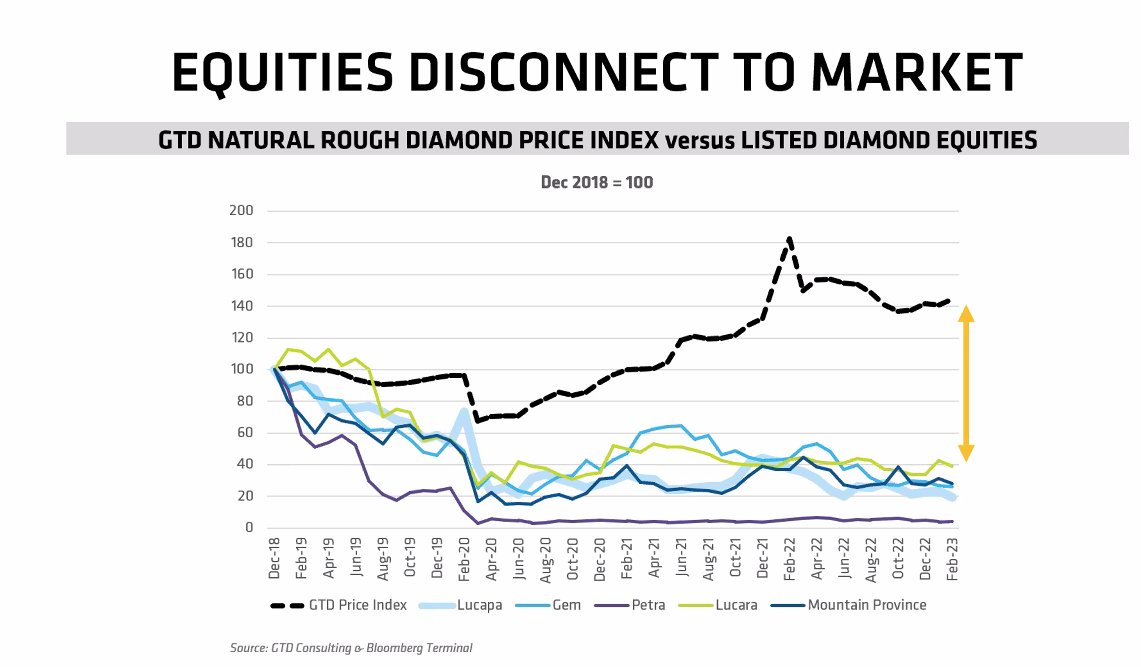

He acknowledged the disconnect between the upward trend of diamond prices versus the decline in diamond equities.

“This isn’t going to last for very long,” he says.

“There will be a correction, this is the opportunity to get into the diamond sector at the ground floor and we believe we will be a major deliverer of value going forward as this gap is narrowed.”

Lucapa share price today:

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.