Resources Top 5: Lithium Australia builds its dreams as copper juniors rocket

Pic: Getty Images

- Lithium Australia signs battery recycling deal with EV maker BYD

- Augustus reveals a 1.1km-long copper zone at Ti Tree

- Marquee nabs option to acquire an antimony project in Italy

Here are the biggest small cap resources winners in morning trade, Wednesday, September 4. Prices accurate at time of writing.

Lithium Australia (ASX:LIT)

LIT has signed an exclusive agreement with Chinese EV car manufacturer BYD (Build Your Dreams) to provide battery recycling services for all its new energy vehicles’ end-of-life batteries in Australia for an initial three-year period with a two-year extension option.

BYD is a global EV powerhouse, delivering a record ~3 million New Energy vehicles globally in 2023 and holds ~14% of Australia’s EV market share after only entering the market two years ago.

The cars are fitted with the automaker’s ‘Blade Battery’, which uses lithium-iron-phosphate (LFP) cathode material that LIT can recycle at the end of their life cycles.

“This milestone achievement is expected to significantly increase our future collection volumes of large-format lithium-ion batteries (LIBs), further accelerating the company’s shift in battery collections mix to be primarily focused on the higher margin large-format LIBs,” said LIT CEO Simon Linge.

“The signing of this milestone agreement, alongside the various other exclusive recycling agreements announced in recent times, are evidence of our successful execution of the company’s recycling growth strategy.”

LIT rose 15% to the occasion to trade at 2.3c a share.

Marquee Resources (ASX:MQR)

MQR has stumbled upon a highly-prospective gold-silver-antimony project in Sardinia, Italy.

The explorer holds options to acquire 100% of the Sa Pedra Bianca project from a private company, and grades of up to 6.5% antimony have been identified through historical datasets.

A Research Permit (RP) application is in the final stages of being prepared and will be lodged in September 2024. It will overprint and replace the existing investigation permit.

The permit is expected to take 3-6 months to be granted to allow drilling activities to be undertaken, which MQR has pegged for early 2025.

“While Sa Pedra is already known for its substantial gold resources, this recent identification suggests that the project could also host critical metals, a prospect that is only beginning to be explored,” noted MQR exec chair Charles Thomas.

“We are eager to continue our exploration efforts, focusing on both the gold resources and the newly identified critical metals.

“I look forward to providing the market with updates on the status of the Research Permit and our future exploration plans as we continue to advance this promising project.”

With antimony on a price heater, so is MQR, adding further prospectivity for the mineral to its portfolio which already includes the Mt Clement project in WA.

Shares have doubled in the last month, inclusive of today’s 17.6% rise to trade at 2c.

Augustus Minerals (ASX:AUG)

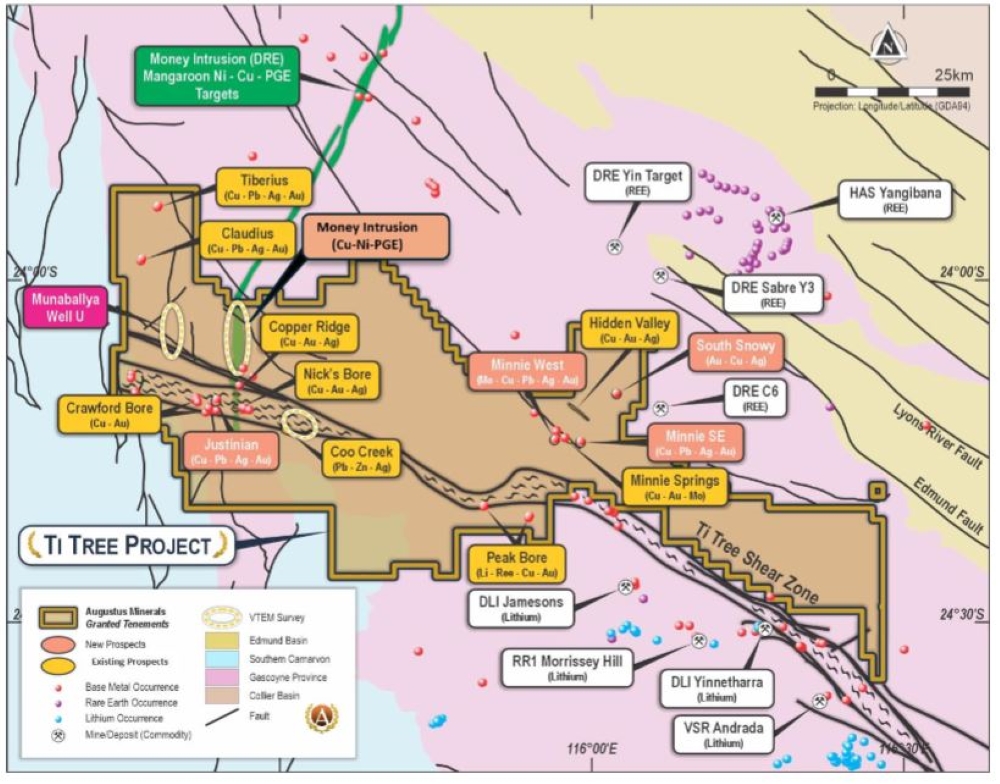

A 1.1km-long copper zone with grades of up to 3.1% Cu in rock chips has been discovered by AUG at its huge 3600km2 Ti-Tree project in WA’s Gascoyne mining district.

The rock chip samples also returned 11g/t silver within the newly identified “Nero” mineralised zone, comprised of multiple gossanous quartz veins.

Now, a total of three mineralised northeast trending structures (Claudius, Nero and Tiberius) have been identified to-date, and AUG says significant potential exists to identify additional structures in the area.

The Tiberius prospect (236g/t Ag, 35% Cu2 and 20.5% Pb1) is 8km north of the Nero prospect, where mapping and fieldwork is continuing.

As the news hit the market today AUG shares were up 26.5% to trade at 6.2c.

Eastern Metals (ASX:EMS) and Lachlan Star (ASX:LSA)

(Up on conference news, probably)

EMS CEO Ley Kingdom is presenting at the Resources Rising Stars Investor Conference on the Gold Coast today, so that’s possibly why shares are up.

Otherwise, the most recent news on its projects is that drilling commenced late August at some new high-priority targets within its Cobar copper-lead-zinc project in the prolific Lachlan Fold Belt of NSW.

The region has come under the spotlight recently as new tech has been able to delve into historical deposits that haven’t been given a makeover in years and find previously unknown deposits to mine.

The most recent discovery causing a ruckus is Australian Gold and Copper’s (ASX:AGC) high-grade Achilles gold, silver and base metals project right near EMS’ Browns Reef.

The initial focus is on the Kelpie Hill and Windmill Dam targets – north and south of the high-grade Evergreen Zone at Browns Reef, both of which returned highly anomalous grades from surface rock-chip sampling.

Shares in the $2.6m explorer are up almost 20% today, swapping at 2.5c.

The same pretty much goes for LSA, too. It’s presenting at Resources Rising Stars, and has identified high-grade copper drill targets at its Basin Creek prospect (part of its Junee project), nestled within the Lachlan Fold Belt as well.

Several zones of massive sulphides of up to 6.4% Cu were identified from half-century-old diamond drill cores and plans to spin the drill bit after securing permits for the the program to confirm the scale and geometry of the copper-rich system.

Shares in LSA shot up 14% on trade at time of writing to swap for 12c and have now risen >70% in the last month.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.