Resources Top 5: I’ve got Sunshine on a cloudy day … and Sunshine has some thick high grade gold

There've been plenty of temptations for Sunshine punters today. Pic: Matt Winkelmeyer/Getty Images for The Recording Academy via Getty Images

- Sunshine Metals stuns the market with 17m gold hit at over 22g/t in Queensland

- Riversgold runs on tenement acquisition near Azure’s mammoth Andover lithium discovery in the Pilbara

- Up on no news: Techgen, PhosCo and Norfolk

Here are the biggest resources winners in early trade, Friday November 24.

SUNSHINE METALS (ASX:SHN)

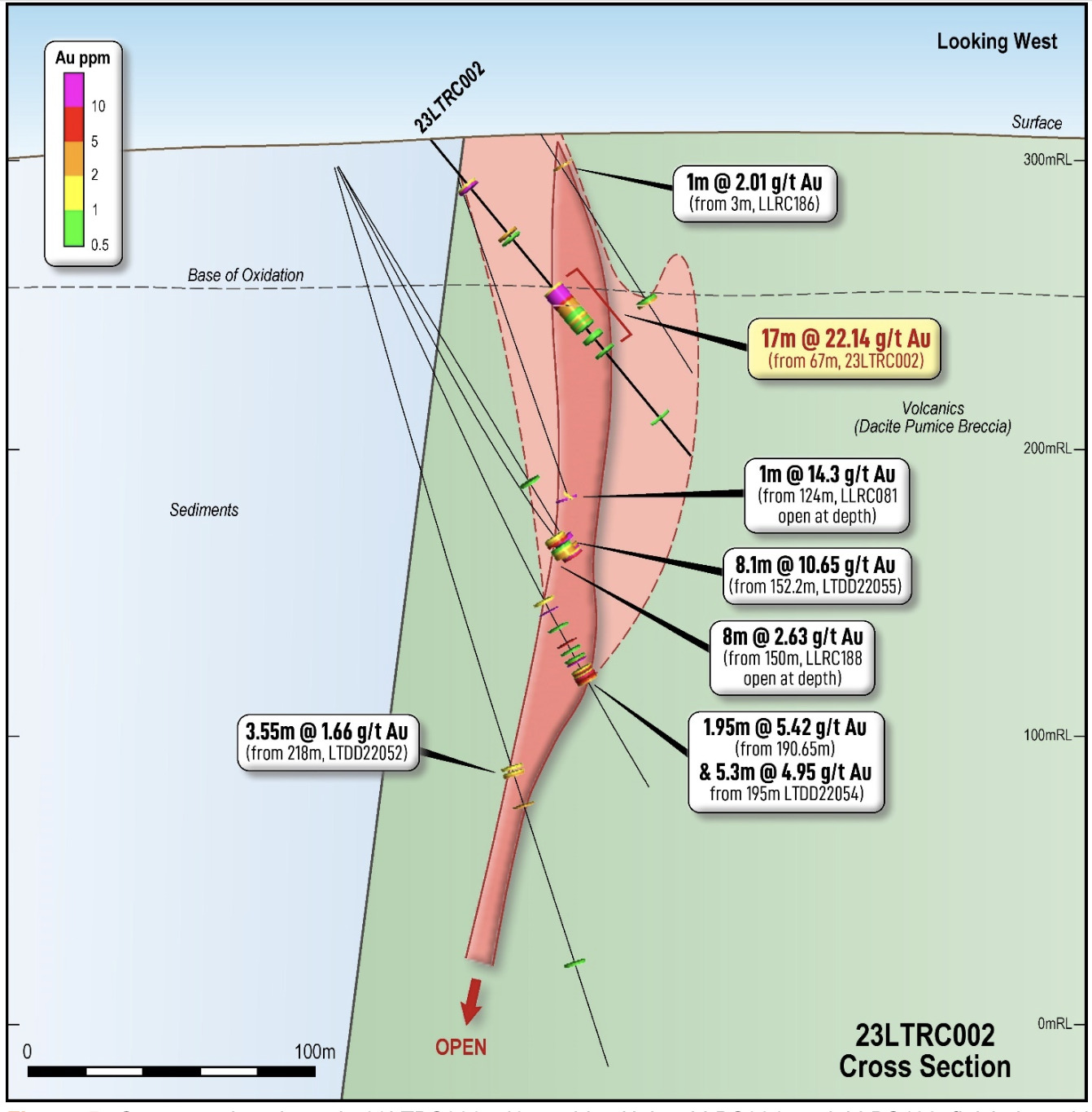

17m at 22.14g/t from 67m.

That’s the headline from drilling at Sunshine Metals’ Ravenswood Consolidated Project in North Queensland, where the heavily diluted $24 million micro cap may have struck paydirt in a gold and copper rich feeder zone to its 2.3Mt zinc, gold, copper, lead and silver VMS resource at the Liontown deposit.

This is the first of 12 RC holes in a program using a new geological model to target a feeder zone at Ravenswood, located in the famous Charters Towers gold district.

Other hits from hole 23LTRC002 included 2m at 8.99g/t from 20m, 1m at 4.54g/t from 42m and 6m at 58.74g/t — almost two ounces — from 68m in the broader 17m drill hit.

It’s not quite all the riches one man could ever need, but it does have Sunshine’s shares doubling today. Talk about a rerating.

“The stunning intercepts at Liontown are a great reward for the solid geological work completed by the team,” MD Damien Keys said.

“The decision was made to target the gold-copper rich footwall and feeder zones to the Liontown Resource with a high impact, shallow RC program. The feeder zones have not been recognised by past explorers and are often difficult to target.”

Another 11 holes have already been drilled to target these feeder zones and footwall lodes, with assays due in December this year. A second — diamond — hole which was drilled 30m west of 23LTRC002, known as 23LTRD001, is already bearing some strong hallmarks of mineralisation, with abundant barite veining and disseminated pyrite, chalcopyrite and sphalerite — sulphide minerals associated with gold, copper and zinc.

And you bet a zone from 60m to 129.2m deep is being rushed for assays.

“The diamond hole will yield critical structural orientation data, which will be used to target the feeder to the north of the current Liontown Resource,” Dr Keys said.

“The identification of the likely feeder zone has given us confidence in our novel approach. It also suggests that there are possibly two further feeder zones that are poorly drill tested.

“One coincides with the historic Carrington gold workings and the second is potentially located in the under drilled Gap Zone between Liontown and Liontown East.

“The find presents a new opportunity to rapidly grow the gold and copper inventories at the Liontown Resource and validates a means of hunting these feeder zones at other VMS prospects nearby including Waterloo and Orient.”

The find is intriguing given the project is located in the Charters Towers area, once one of Australia’s great gold fields and host to more than 20Moz of gold and 14Mt of VMS base metals ore in its past.

Mining in the area held by Sunshine ran intermittently for gold, copper, zinc and lead from 1905-1911 and then 1936-1961.

Sunshine Metals (ASX:SHN) share price today

RIVERSGOLD (ASX:RGL)

More like Rivers-white-Gold.

David Lenigas’ WA explorer is running hot today, up over 50% early doors, and the magic word is Andover.

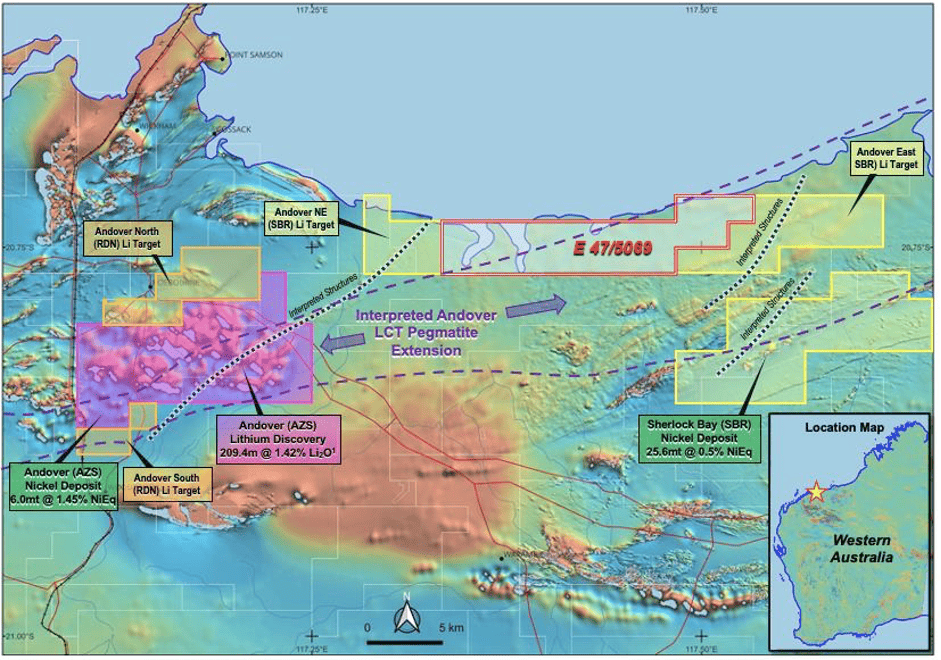

Riversgold has bounced on 74km2 of turf some 8km to the northeast of Azure Minerals and Creasy Group’s stellar Andover lithium discovery.

Andover has struck hits like 209.4m at 1.42% Li2O and without even a resource to speak of is now worth over $3 billion, with 60% owner Azure up 1700%+ YTD on the back of a corporate tug of war for its heart and soul from some of the mining game’s biggest names for its stake.

Chilean giant SQM bid $3.52 for the company, but has found mammoth competition from interlopers Mineral Resources (ASX:MIN), Gina Rinehart’s Hancock Prospecting and rumoured interest from other market giants like Chinese battery maker CATL and Pilbara Minerals (ASX:PLS), which has its shares above $4 today.

Like Cameron Diaz at the turn of the century, that’s made Andover nearology the sweetest thing in 2023. Neighbour Raiden Resources (ASX:RDN) is up more than 400% over the past 12 months for instance.

Riversgold is obviously at a very different side of the timeline as Azure, but these things can move quick if you make a discovery. AZS was barely over 20c at the start of the year.

RGL says its new tenement E47/5069 lies in the same structural corridor as Andover, with consultants to begin exploration within a week and geophysics and drilling programs planned to test new pegmatite targets.

“This is a tremendously exciting acquisition for RGL. To pick up such a sizeable tenement in the heart of what is turning out to be a new lithium province, following Azure’s lithium discover at Andover, is brilliant for us,” RGL chairman Lenigas said.

“With the tenement’s location being so close to Karratha, exploration here can be almost year-round, something not always possible in the Pilbara region.

“The geology of this tenement appears to be somewhat similar to Andover, with the difference being a lot of the ground is under shallow cover. Following grant of this new tenement, the next steps will include geophysics programs designed to identify buried pegmatites which will then be tested with shallow bedrock drilling.

“The drilling will test for buried pegmatites within this highly prospective tenement within what is now recognised as a world class lithium pegmatite region.”

The purchase price is pretty mild. $50,000 to vendor Redstone Metals Pty Ltd, along with a deferred payment of $150,000 in Riversgold shares pegged to the 10-day VWAP immediately prior to the issue date.

Riversgold is no stranger to ground near mega pegmatite projects. In the Pilbara it also boasts the Tambourah project, Upper Five Mile Creek and Wodgina East, the latter within 2km of Albemarle and MinRes’ 260Mt Wodgina mine.

Over in the Yilgarn it boasts 292km2 of ground at Marvel Loch and Southern Cross, just shy of SQM and Wesfarmers’ (ASX:WES) 189Mt at 1.5% Li2O Earl Grey pegmatite.

Riversgold (ASX:RGL) share price today

TECHGEN METALS (ASX:TG1)

(Up on no news)

Techgen Metals is up a tidy 233% over the past month and another 20% plus today on not much of anything at all.

Coincidentally its ticker code is mighty close to one of the real market darlings of the moment — TG6 or TG Metals, the leader of the Lake Johnston lithium rush (which has even seen Rio Tinto (ASX:RIO) partake in the form of a farm-in with Charger Metals (ASX:CHR)).

But let’s not be too pessimistic here, because Techgen has had plenty of lithium hunting of its own going on.

It’s got pegmatite mapping going on at its Ida Valley lithium project, 50km north along strike from Delta Lithium’s (ASX:DLI) popular Mt Ida project (14.6Mt at 1.2% Li2O).

Sampling there has returned peak soil grade of 144.5ppm lithium and 49.8ppm caesium, with pegmatites identified in all three of the target areas among 41 rock chop samples, 29 of them in the northwest where a large pegmatite field on a 800m by 400m area remains open in all directions.

Another 500 soil samples located between its central and southern targets which were only previously assayed for gold have also been resubmitted for lithium and associated element assays.

Techgen has also submitted tenement applications in a ‘prospective lithium district’ in the Pilbara, as well as boasting copper and gold prospects in WA and NSW.

It’s well stocked for its early stage exploration push at Ida Valley as well after announcing a raising this week of $2.79 million at 5.6c per share … already well in the money with the company’s stock trading at 10c this morn.

Punters backing the raising also got a 1 for 4 free attaching listed option at 12c

“The return of our dedicated shareholders and the addition of new prominent industry supporters profoundly signifies the confidence in the Company’s management to propel and realize the potential of our significant assets, thereby enhancing shareholder value,” MD Ashley Hood said on Tuesday.

“Your consistent support is immensely appreciated, and we look forward to delivering further discoveries for the benefit of all our stakeholders.”

Techgen Metals (ASX:TG1) share price today

PhosCo (ASX:PHO)

(Up on no news)

PhosCo’s stock tanked back in January after the Tunisian Government torpedoed its application for a mining concession for the Chaketma phosphate project in the North African country.

It’s applied for a new exploration permit there, mirroring the original permit boundary.

Still it’s a hard blow to take. When it comes to the phosphate game, the company has continued with efforts to seize the remaining 48.99% in Chaketma it doesn’t own from its JV partner TMS for non-payment of damages and costs, and is waiting on the grant of permits for Chaketma and the lookalike Sekarna project 10km to the north-east, as well as the Amoud project, which neighbours the multi-billion tonne Sra Ouertane deposit.

It’s all being done on a light budget. PhosCo had $700,000 in cash at the end of the September 2023 quarter, with the ability to draw down on a loan facility of up to $500,000 from major shareholders, including major shareholder Lion Selection Group (ASX:LSX) and exec director Taz Aldaoud.

What has PhosCo running 20% higher and then some today then? No news to speak of.

It did have a win of sorts with the Tunisian Government ealier this month with the grant of an exploration permit over the Simitu copper and gold project.

That covers a mineralised corridor over 30km with numerous targets and old workings, including Kef El Agueb. That’s where historic exploration has defined a 7.5km soil anomaly with gold, copper and arsenic, including rock chip results of 1.7g/t gold and 2.4% copper.

“We are delighted to announce the granting of the Simitu tenement with multiple exploration indicators highlighting its prospectivity. Our in-country team have done an incredible job in identifying additional exciting opportunities to bolster the company’s portfolio of assets,” PhosCo chairman Robin Widdup said earlier this month.

“Importantly, these 100% owned projects offer PhosCo tremendous optionality whilst maintaining momentum in assembling a district scale Northern Tunisia Phosphate hub.

“The PhosCo board has approved an immediate start on Simitu technical work to expand our geological understanding of this very underexplored region.”

PhosCo (ASX:PHO) share price today

NORFOLK METALS (ASX:NFL)

(Up on no news.)

$9m capped Norfolk Metals probably couldn’t have picked a better time to get the thumbs up to drill for uranium.

Two days ago it announced a $1m placement cornerstoned by existing major shareholders, $840,000 of that to be put to exploration at the Orroroo project in South Australia.

The same day it announced that South Australia’s Department of Energy and Mining had approved its exploration program for environment protection and rehabilitation (huh), enabling its maiden drill program to take place, pursuant to it securing a bond ahead of drilling as per the State’s mining act.

Located within the Walloway Basin, 274km northwest of Adelaide, it’s one of two major projects being progressed by Norfolk, which also boasts two exploration licences to search for gold and copper 410km northwest of Hobart in Tasmania.

South Australia is, of course, the only state in Australia with any active uranium mining. It all comes with uranium prices looking better than at any point since Fukushima in 2011.

Numerco has spot U3O8 fetching US$80.75/lb right now. Only a few years ago that was a pitiful US$18/lb.

“Shareholders, management team and key personnel could not ask for a more favourable position considering Norfolk is a well-structured South Australian uranium explorer on the cusp of their maiden drill program,” Norfolk exec chair Ben Phillips said this week.

“Now fully permitted and funded to drill the known uranium occurrences and potential palaeochannel extensions of the Orroroo Project with a highly efficient drill rig and operator; we look forward to presenting our results in December”.

Norfolk Metals (ASX:NFL) share price today

At Stockhead we tell it like it is. While Riversgold and Sunshine Metals were Stockhead advertisers at the time of writing they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.