Uranium has started a new bull run… but who will bake the first yellowcake?

- Uranium spot price cracked US$80/lb this week, its highest level since the Fukushima incident in 2011

- Industry leaders confident a new uranium bull cycle has commenced, and there is plenty of upside still to come

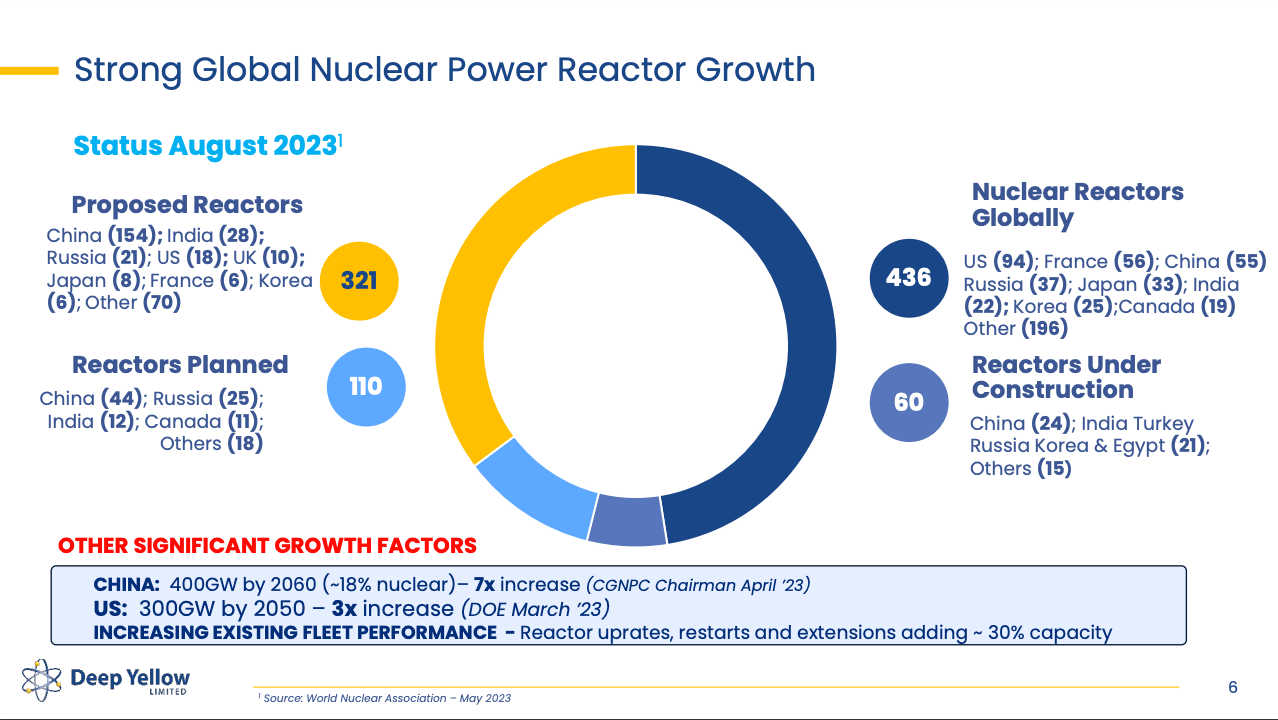

- Some 160Mlb of yellowcake has been contracted this year alone despite no new uranium mines coming online in the past decade

- Australia tipped to embrace nuclear power in the near term, but there’s less optimism WA will overturn its ban on uranium mining

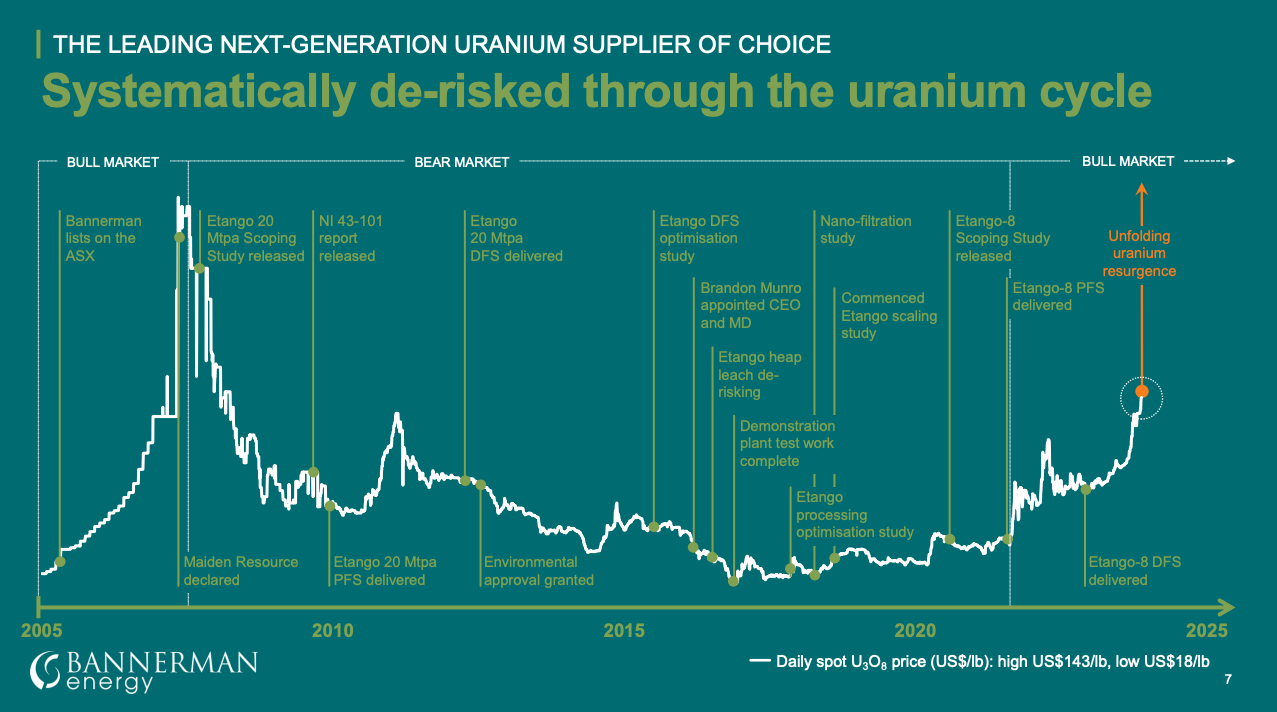

After more than 12 years of depressed prices and sentiment, uranium has at long last clawed its way back into favour with investors. It appears this renewed confidence in the yellowcake sector is here to stay, but the question remains – what more will it take to incentivise new supply into an industry which has developed just one greenfields project in the past decade?

With the spot price sailing through US$80/lb this week – its highest levels since early 2011 when the Fukushima incident delivered an almighty dent in global ambitions for nuclear to become a more widespread energy solution – there is growing talk we are at the start of a new uranium bull cycle.

Given the spot price has soared more than US$30/lb over the past six months alone, it is hard to argue otherwise.

It might not have been reflected in too many individual company share prices, but there was certainly a strong appetite for yellowcake among the throng of investors at this week’s RIU Resurgence conference in Perth.

Due to a lack of interest from pretty much anyone not looking for lithium or gold, conference organisers – and long-time uranium bulls – Stewart McDonald and Jaxon Crabb leaned heavily on their mates in the sector and scheduled two dedicated “uranium power” sessions on the opening day.

It only seemed fair that “Mr Uranium” himself, Deep Yellow (ASX: DYL) boss John Borshoff, would be entrusted to kick off proceedings with the usual disclaimer that he oversaw the original Paladin Energy (ASX: PDN) team which established a “formidable pipeline” of projects, including Langer-Heinrich in Namibia and Kayelekera in Malawi, developed during the last uranium bull cycle at the turn of this century.

“It all feels a bit deja vu to me about positioning a company to where it should be at the right time,” Borshoff told conference delegates. “The big difference today is we’re even better prepared.”

Deep Yellow delivered a DFS for its flagship Tumas project in Namibia earlier this year and remains confident of developing the shovel-ready Mulga Rock project in Western Australia despite the incumbent Labor State Government’s ban on uranium mining.

Borshoff said any decision to develop greenfields projects such as Tumas and Mulga Rock lies in the hands of the utilities which set contract prices for uranium.

“Nobody is going to build a uranium mine now at US$75/lb, so the incentivisation for greenfield projects is not there yet,” he said.

“Is it going to be US$90/lb or US$100/lb? Let’s see what happens when the utilities get off their arses and say, ‘look, I know what it was like in the good old days’, throwaway the rear vision mirrors and look forward to how they’re going to get greenfields projects on this planet because that’s the only way we’re going to meet this incredible growth in the nuclear fleet.

“Everyone has to come to grips with the hard decisions that have to be made to get new projects on the ground.”

‘Next year is going to be uranium’s year’

Joining Borshoff on the main stage at RIU Resurgence were other advanced developers Bannerman Energy (ASX: BMN), Aura Energy (ASX: AEE) and Toro Energy (ASX: TOE) alongside a host of emerging explorers, including GTI Energy (ASX: GTR), Basin Energy (ASX: BSN) and Haranga Resources (ASX: HAR).

The only major name missing from the uranium-rich conference program was Peninsula Energy (ASX: PEN) which was originally listed to attend but withdrew at the last moment due to apparent legal constraints regarding the proposed $60 million capital raising announced this week to fund the restart of its Lance operations in the US.

One explorer which continues to pique the interest of investors is 92 Energy (ASX: 92E) which was the first new uranium company to list on the ASX in more than a decade when it joined the bourse almost three years ago.

As managing director Siobhan Lancaster noted, 92E’s debut and subsequent exploration success in Canada’s Athabasca Basin was the catalyst for many other uranium companies to either IPO or peg ground in one of the world’s highest-grade uranium districts.

Lancaster, who was part of the Extract Resources team which sold the then-undeveloped Husab uranium mine to China General Nuclear Power Group for $2.2 billion, highlighted the extreme underinvestment in the uranium sector since 2012.

“Husab is the last uranium mine to be built and that was a mine that we sold during the last uranium cycle,” she said.

“It’s now the second largest producer of uranium in the world, but really nothing has come into this market for a very long period of time. And the result is a massive supply shortfall looming in the market, we are currently producing less than the demand. This, of course, is cumulative in the market as the years go on.”

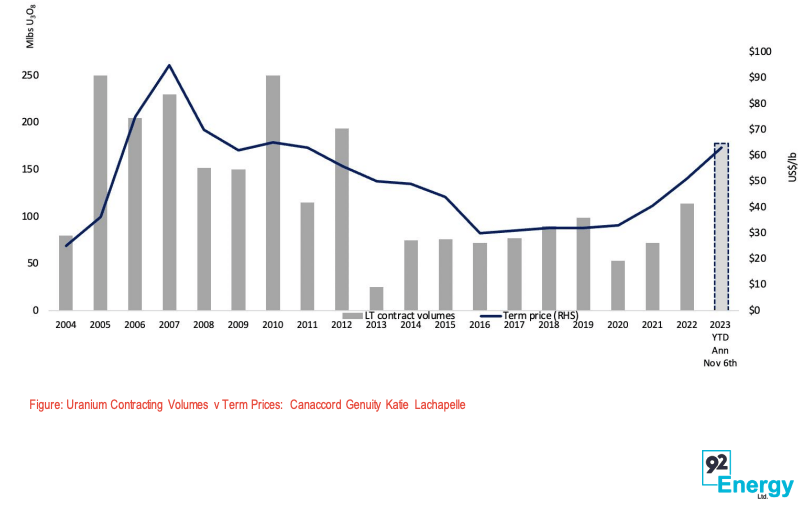

Lancaster turned heads when she produced a graph which showed some 160Mlb of uranium has been contracted this year alone.

“It’s the highest amount of uranium contracting in the market since Fukushima and you can see that the contracting really begets the increase in the long-term price for uranium,” she said.

“The long-term market for uranium between producers and utilities has resumed in earnest. It’s a very exciting time to be in the market.

“I think next year is going to be in uranium’s year and everyone’s going to get behind the equities.”

Name your uranium price

A jovial but insightful panel discussion chaired by Bannerman managing director Brandon Munro rounded off 14 company presentations and a keynote address from Edith Cowan University’s Dr Martin Ralph on radiation exposure in WA mines and the challenges for the industry to consider.

Munro adopted a persona usually reserved for the likes of Australian quiz show stalwarts Tony Barber, Baby John Burgess and Larry Emdur as he prodded Argonaut co-head of funds management David Franklyn, Aurora Energy Metals (ASX: 1AE) managing director Greg Cochran and NexGen Energy (ASX: NXG) investor relations director Stacey Golokin on the outlook for uranium both near term and long term.

The first task was to set a theoretical uranium spot price. The only guidance around this “guesstimate” was consider a one-in-20 chance the world could find itself at this theoretical limit.

Golokin declared a whopping US$300/lb and Cochran an equally optimistic US$200/lb, while Franklyn opted for a more conservative US$150/lb by comparison.

Asked to explain her price limit, Golokin said: “I’m a pretty bullish investor when it comes to uranium and I also work for NexGen Energy, which has one of the best resources (the basement-hosted Arrow deposit in the Athabasca Basin) at the moment.

“I just feel the way that the market is going – the supply challenges, the complexity in permitting a uranium mine – at NexGen, we’ve reached the provincial step of permitting and we’ve done it faster than anyone else in history, I believe, and it’s still taken 9-10 years to get here.

“Even if more resources were to come online, there will be at least 10-15 years (to allow for permitting) so I feel like the price has a lot of room to move in that time period.”

The panel were then asked to declare a practical uranium spot price for investors to consider with everyone, including Munro, nominating US$120/lb as an attainable target for this bull cycle.

Munro likened the circumstances which are giving rising to the current opportunity for uranium investment to the great oil shock of the 1970s.

“In those days, it was called the oil crisis, today it’s called the security crisis,” he said.

“Both involve wars, both involve a fundamental rethinking about how we do energy. In those days, it was to get away from Middle Eastern oil. Today, it’s to get away from carbon dioxide.

“Inflation adjusted, the sector spent 7-8 years during the ’70s at a price in today’s dollars of over US$200/lb. I don’t see any reason why the sector can’t support that today. I’m not saying it’s a forecast, but I’m just saying on fundamentals we should think about that.”

Spot price vs contract price: Don’t ask a journalist!

Each panellist also agreed a contract price in the $US80-100/lb range was likely to incentivise development of new uranium mines.

Munro did his best to throw this author under the bus following a pre-panel pep talk about the “horseradish” US$60/lb incentive price which many companies spruiked during the 2010s.

“It was not a US$60/lb incentive price back in those days, the economics were exactly the same with a bit of inflation today,” Munro said.

“I’m not saying that he was talking horseradish, I’m just saying that the concept that a US$60/lb incentive price, I did not believe that. There was no grounds for believing that. Of course, we’ve sailed through US$60/lb and we haven’t seen a single greenfields production pound come in yet.”

All panellists agreed jurisdiction was more important than orebody quality and the spot price holds greater importance to investors than the price which ultimately determines whether a uranium project can be financed and developed.

“We all know that in some respects, the spot price is a lottery, because it doesn’t really mean anything to the financing of the project, the way that financiers look at it,” Munro said.

“However, it’s a pretty opaque sector and, as investors, you’ve got to run on something. And the one thing that does have good visibility is the spot price.”

The panellists were also unanimous in their view Australia would embrace nuclear power by the end of 2028, but Golokin and Franklyn both believe the WA Labor Government won’t lift its ban on uranium mining anytime soon.

Cochran, who permitted the original Honeymoon mine in South Australia for Uranium One, was only slightly more optimistic.

At Stockhead we tell it like it is. While GTI Energy, Aura Energy, Basin Energy and Haranga Resources are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.