Resources Top 5: It’s gov love a-gogo today for Alliance Nickel, Perpetual and Rincon

Mining

Mining

Here are some of the biggest resources winners in early trade, Thursday May 9.

Whoa, another double bagger making headlines today.

Is nickel clawing its way back as an investible commodity/sector? The jury may be out on that one given negativity surrounding major nickel mining operations shutting down this year (eg Ravensthorpe, BHP’s Nickel West) and Indo-Chinese dominance of the asset’s production globally.

But… there have been more promising signs just lately, with the commodity staging something of a rebound in March and a potential floor forming since then.

Alliance Nickel is certainly showing some positivity as the clear frontrunner for intraday gains in the ASX ressie pack today at the time of writing with a +150% surge.

It has particularly affirming action from Albo and co, with news today that the NiWest nickel-cobalt project has been granted Major Project Status (MSP) by the Australian Government, which helps streamline approvals for mine development.

Hence this action…

MSP is awarded to Australian companies and projects identified to be strategically significant, “and that have the potential to contribute considerably to the nation’s economic growth and employment opportunities”.

The MPS is essentially a great big door opened for the company that will provide Alliance with access to the Major Projects Facilitation Agency, providing additional resources to assist streamlining a range of regulatory approvals for mine development.

NiWest is the first nickel project in Australia awarded MPS since nickel was added to Critical Minerals List in February this year.

NiWest is located near Leonora, WA, and contains one of Australia’s highest-grade undeveloped nickel laterite mineral resources and is targeting annual production of 90,000 tonnes nickel sulphate and 7,000 tonnes cobalt sulphate.

The company says the project is expected to create approximately 600 jobs during the construction phase and an additional 300 operational jobs.

Alliance notes it’s now in talks with WA State Government agencies to further assist streamlining approvals as it looks to finalise a Definitive Feasibility Study (DFS) in the second half of the year.

Lithium/critical minerals hunter Perpetual Resources’s main hunting ground is the booming, spodumene-tastic ‘Lithium Valley’ of Minas Gerais in Brazil, where it has secured some 12,000 hectares of highly prospective lithium exploration permits.

It also, however, operates the Beharra silica sand development project in WA about 300km north of Perth and that’s actually what brings PEC into focus on the ASX today.

It’s up near 20% on news today of a very healthy tax rebate from the Australian Government Department of Industry, Science and Resources, granting it an AusIndustry R&D tax incentive of $161,473.

The company says it’s in recognition of its “innovative processes undertaken to explore additional impurity reduction at the Beharra high grade silica sand project”.

Perpetual $PEC has today received a rebate from the Australian Government Department of Industry, Science and Resources for an AusIndustry R&D Tax Incentive grant.

The total amount is $161,473 with the funds to be received in the coming weeks. Read more: https://t.co/Z1cvn20PvH pic.twitter.com/GptVTuTI7w

— Perpetual Resources (@perpetualPEC) May 8, 2024

Where will the company’s new cash injection go? It says it will be added to current cash reserves with a view to advancing its various exploration projects “and other potential strategic initiatives”.

Rincon has been a particularly hot stock this year, cooling off somewhat this week after what appeared to be some profit taking. But it’s back up today with a decent double digit gain.

And that probably has something to do with yet more news today of action for ressies at a governmental level.

Specifically, the critical metals (REEs, niobium, copper, gold) junior has announced today that it’s been successful in its application under Round 29 of the Western Australian Government’s Exploration Incentive Scheme (EIS) for a co-funding grant of up to $180,000.

That grant is for the company’s RC drilling program in the West Arunta region, which will test new targets recently outlined from high-resolution ground gravity surveying.

We’ve secured an EIS co-funding grant of up to $180,000 for RC drilling at Avalon, Sheoak, K1, and K2 targets in West Arunta.💰🤝

Thank you to the WA Government for their support! 👏🏼

Full Ann 👉🏼https://t.co/nQMsS9PyRa$RCR #ASX #ASXNews #Investing #Exploration #Niobium #IOCG pic.twitter.com/ui0yy9EF1R

— Rincon Resources (@RinconResources) May 9, 2024

The company is particularly excited about its recently found ‘bullseye’ Nb-REE/IOCG target Avalon but also the similar Sheoak, K1 and K2 sites.

Rincon is currently in talks with the Tjamu Tjamu Aboriginal Corporation with the aim of completing an Aboriginal heritage survey and clearance in order to get the drills spinning at the targets “as soon as possible”.

This base and precious metals-hunting junior is also very close to nailing intraday double-bagging status as we type, with a +90% bourse burst.

It has acquisition news with a touch of nearology froth – usually a good price rocket launch pad – announcing it’s gaining a promising Niobium-REE project in the minerals-rich West Arunta region of WA.

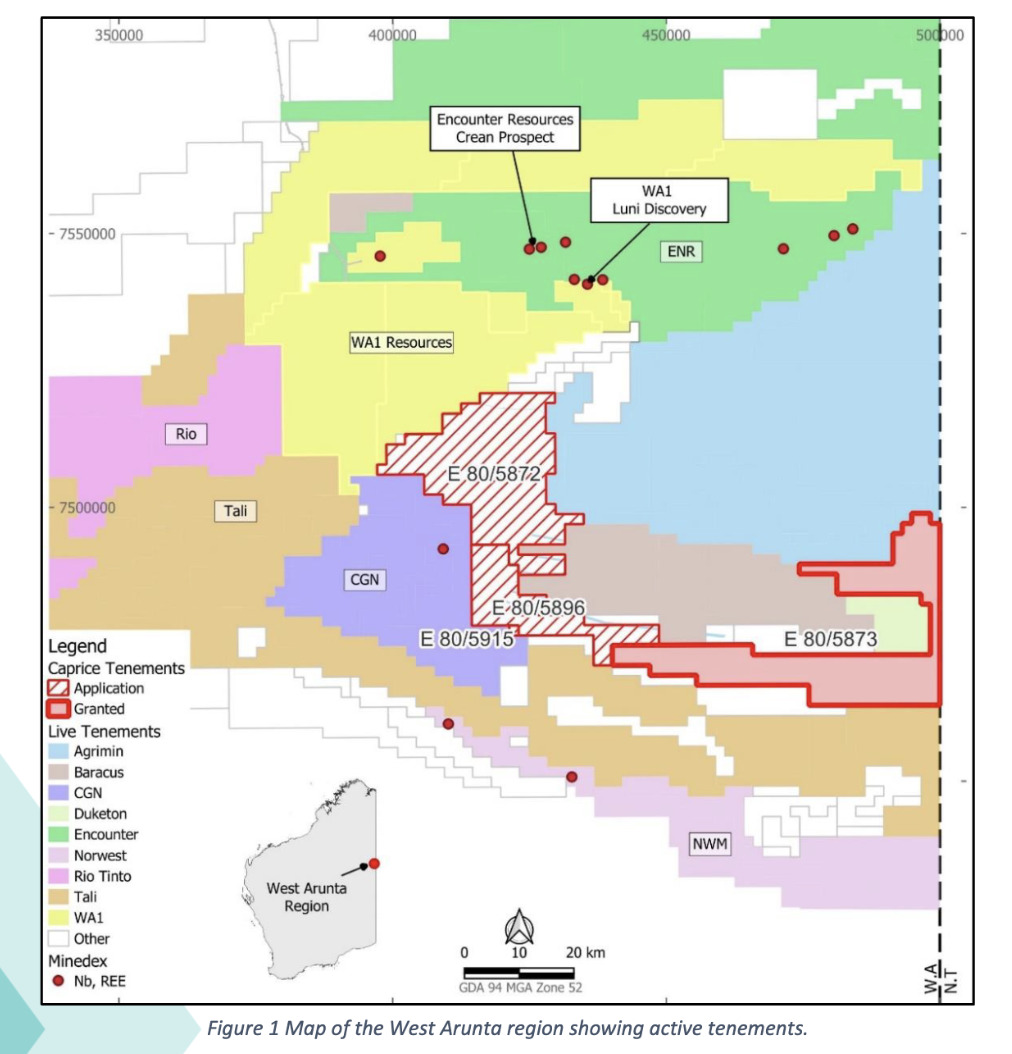

Specifically, it’s signed a binding option agreement to acquire 90% of the Bantam project, which consists of four tenements (one granted, three applications) considered highly prospective for niobium, rare earths and IOCG mineral deposits.

What’s got investors most excited about that, probably, is the fact the newly acquired ground is a stone’s throw – actually quite literally as it shares a 30km-long border – to WA1 Resources’ West Arunta project. That’s an impressive operation host to the world-class Luni Niobium-REE discovery.

Caprice notes that multiple targets show structural and magnetic features similar to WA1’s project, including mirroring mineralised carbonatites on WA1’s ground and at the nearby Aileron Project of Encounter Resources (ASX:ENR), too.

What next?

A Heritage Agreement is currently under review with a commitment to progress granting of tenements at application and pushing ahead with geophysics activities. The company also has “heavily oversubscribed placement and commitments” received to raise $1.584m.

Caprice chairman, Glenn Whiddon, added further context:

“Since the significant Luni discovery by WA1 Resources, the region is actively being explored by numerous companies such as Encounter Resources, CGN Resources, Rio Tinto and Tali Resources.

“The prospective ground covers 1,470km2 over the four contiguous tenements which shares borders with WA1, CGN and Tali Resources. A land package of this size with very little exploration work to date is an exciting prospect for Caprice which aims to replicate the success of its peers through targeted, strategic exploration.”

This critical minerals exploration minnow is double digits to the good today after announcing some beaut REE drilling results.

Marquee has turned up an encouraging assay result from the company’s Redlings project, which is roughly 40km west of Leonora, WA and 77km north of Menzies. Big gun Lynas’ (ASX:LYC) Mt Weld project lies approximately 150km east of the project.

The highlight interval drilled was 14m at 980ppm TREO from surface, which follows on from its 2021 drilling at the site that returned results including 5m at 9,100ppm TREO from surface, with 2m at 18,600ppm TREO from 2m.

Marquee says that both the recent results and its historical work “indicate the potential for multiple zones of shallow mineralisation”.

The company has a further 405km2 of tenure that it plans to explore in the area and it aims to nail down a mineral resource for the Redlings REE project in the not-too-distant future.

Marquee’s executive chairman Charles Thomas said:

“Although we experienced significant difficulties throughout the drilling program, we are extremely buoyed by the potential of the project and the opportunity it presents to us given the great result from [hole] MQRC170.

“We believe there is the potential to delineate a significant economic mineral resource at Redlings and after recent conversations with experts in the industry, we have significantly expanded our footprint in the region.”