Resources Top 5: ‘It was all yellow.’ Uranium hunter GUE also digs New England gold

Pic via Getty Images

- Global Uranium and Enrichment Ltd commits to Enmore gold project for six years

- Australian Vanadium up on downstream facility completion in Perth

Here are some of the biggest resources winners in early trade, Friday December 15.

Global Uranium and Enrichment (ASX:GUE)

Formerly known as Okapi Resources (ASX:OKR), GUE is up and to the right today on a yellow metal narrative first, followed by its namesake yellowcake.

It’s just revealed its exploration licence for the Enmore gold project – in the New England Fold Belt in NSW about 30km south of Armidale in NSW – has been renewed for another six years.

The company compares the project with the nearby Hillgrove Gold Mine, which belongs to Larvotto Resources (ASX:LRV) and has produced more than 730,000oz of gold.

By comparison, Enmore is largely underexplored, hence the company’s interest.

A maiden drill program completed in 2021 delivered strong results at Enmore, including 174m at 1.83g/t goldfrom surface, ending in mineralisation, with the deepest interval returning 3m at 8.86g/t gold from 171m.

A follow-up drill program in 2022 confirmed the high-grade gold mineralisation over significant widths.

Says GUE MD Andrew Ferrier:

“This renewal is a critical milestone as we progress discussions with potential project partners for Enmore. Our renewal decision is of particular significance given the favourable conditions and strong outlook for the gold market, with prices reaching all-time highs above A$3,000/oz.”

Meanwhile, the company also has uranium news out of Colorado, posting this tweet…

$GUE is pleased to a announce the delivery of a high-grade Exploration Target of 4.3– 3.3Mlbs U3O8 at a grade range of 587–1,137ppm U3O8

at the Maybell #Uranium Project after the completion of an extensive data review of over 3,000 mineralized drill holeshttps://t.co/I57ACpbh9d— Global Uranium and Enrichment (@Global_Uranium) December 14, 2023

GUE share price

Australian Vanadium (ASX:AVL)

Vanadium – the oft neglected critical mineral and battery metal – is in the spotlight on the bourse this morning, thanks to an announcement from AVL, a significant producer and manufacturer focused on vanadium electrolyte.

The Perth company has now completed construction of its vanadium electrolyte manufacturing facility “without injury”, it says. Which is always a plus.

AVL notes the facility, in the northern suburbs of Perth, has potential to produce up to 33MWh of high purity electrolyte per year. It adds that its vanadium electrolyte product comes at the right time – “into a growing demand market and allows for qualification of AVL material with battery manufacturers”.

The construction of the facility has been supported by a $3.69 million Australian Government Modern Manufacturing Initiative grant, which backs up a strategic shift to invest in local downstream processing capabilities in Australia’s resources sector.

See High Voltage for more on this, specifically regarding the WA government’s focus.

AVL share price

Kalamazoo Resources (ASX:KZR)

(Up on no news)

This gold and lithium exploration company has assets in Tier 1 mining jurisdictions – the Victorian Goldfields, the Pilbara region in WA and the Lachlan Fold Belt in NSW.

That’s all very well, but does it have any news that’s pushing its share price up 18% at the time of writing? We’ll field that one: no, it doesn’t seem to.

Looking back recently in time, then, we can tell you this:

• Kali Metals, a spinoff of gold stocks Kalamazoo Resources’ and Karora Resources’ lithium rights, recently finished a $15m IPO raise oversubscribed.

And that’s about the size of KZR-related activities, with shareholders of KZR “on the record date of 22 December 2023”, ready to receive an “in-specie distribution of Kali Metals shares”.

#Lithium exploration company, @KaliMetals (proposed ASX code: KM1), a spin-out of @KalamazooRes & @KaroraRes has now closed its IPO raising the maximum subscription amount of $15m due to strong level of interest.

Read: https://t.co/7vC8ewm5hT$KZR $KM1 pic.twitter.com/CUiHbXfhzu

— Kalamazoo Resources (ASX:KZR) (@KalamazooRes) November 21, 2023

KZR share price

Green Technology Metals (ASX:GT1)

(Up on… news from the other day)

This downstream lithium aspirant recently revealed it’s raised $14.6m to progress exploration at its Root Bay and Junior lithium projects in Ontario, Canada.

Via a staged strategy, the company is looking to become Ontario’s first battery-grade lithium producer from a current resource of 24.9Mt at 1.13% Li2O across its Seymour and Root Bay projects.

It recently conducted a Preliminary Economic Assessment (PEA) with two options for development, which you can read about > here.

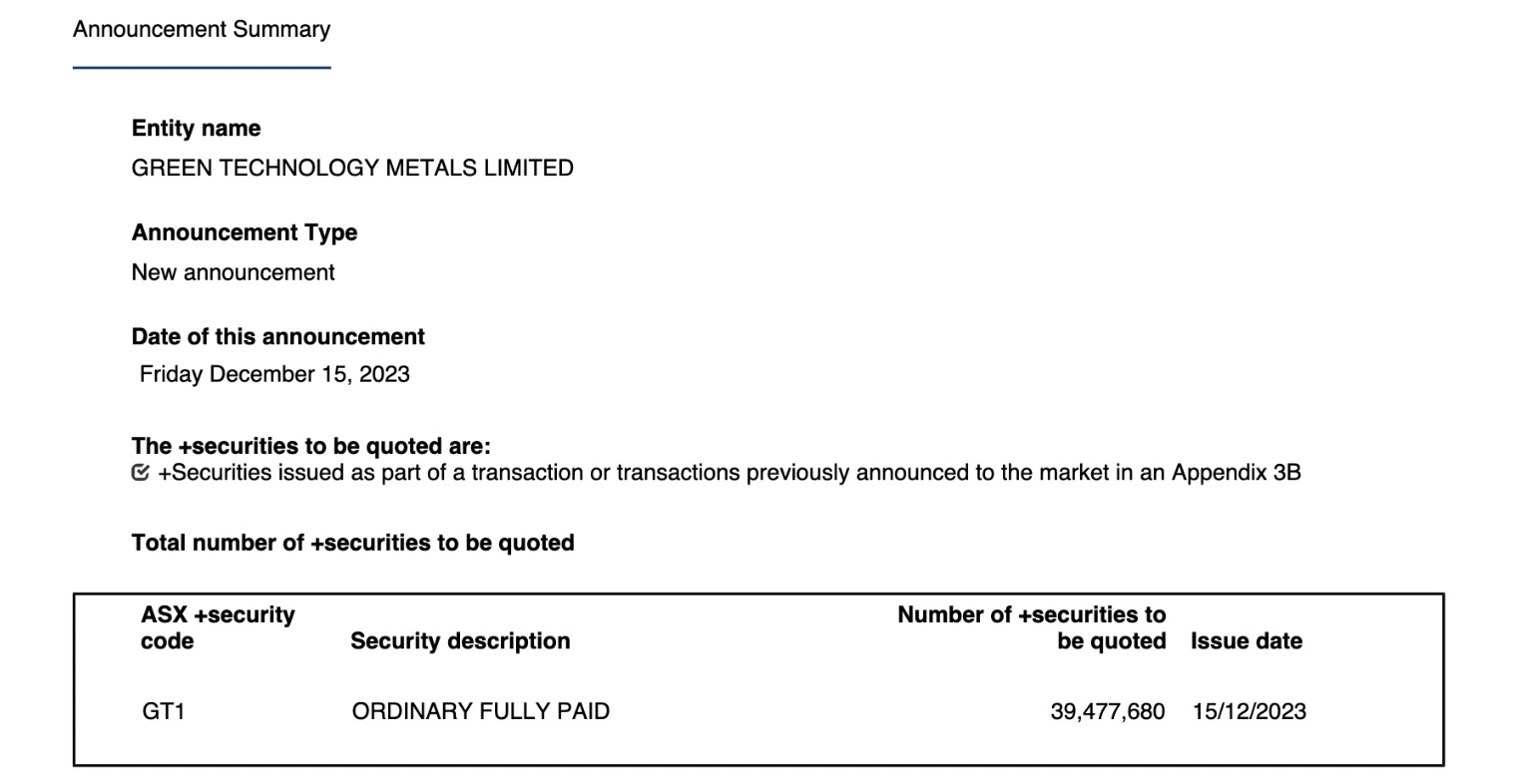

This morning, meanwhile, GT1 made an application for quotation of securities – 39,477,680 of them:

GT1 share price

Newfield Resources (ASX:NWF)

(Up on no news)

It’s not been the greatest of years for this Sierra Leone diamond miner. A -67% emphatically speaks to that.

That said, it’s now up 41% over the past month, grabbing a 24-hour 20% gain at the time of writing.

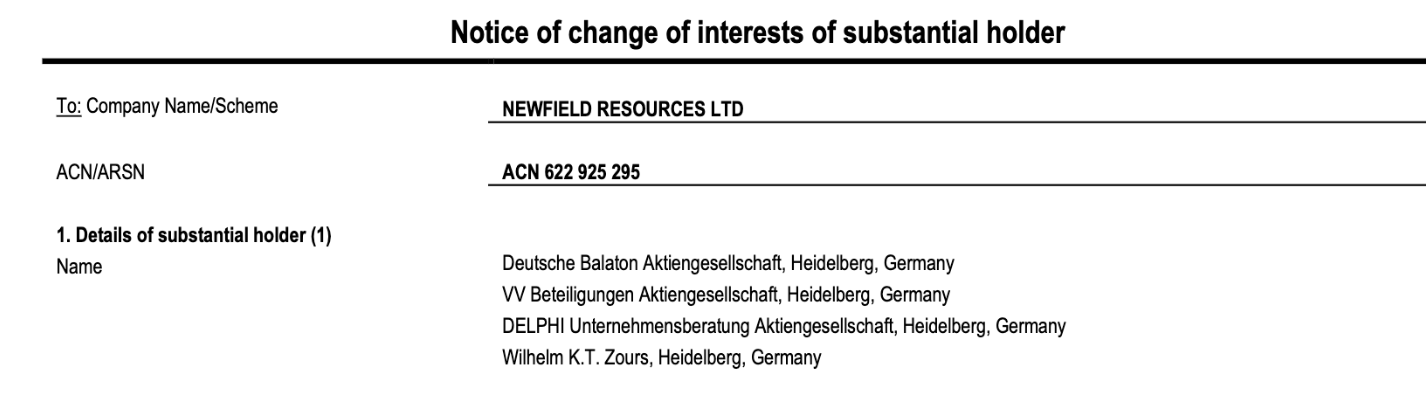

News? Nope, well not much. There’s this – some substantial holder movement, regarding some dilution of issuance of new shares by some German entities:

Other than this, though, not too long ago NWF managed to halt its yearly slide after releasing a fairly positive AGM presso.

The company reported in November that it’s ramping up the flagship Tongo mine, which has an 8.3 million carat resource at a grade weighted average of 2.4 carats per tonne.

As Stockhead’s Reuben Adams noted late last month:

That’s high grade – one of the highest in the diamond world, the company says — equivalent to 9g/t gold.

NWF is targeting production of 250,000cts per annum by 2027 and 400,000cts per annum by 2029.

Meanwhile the diamond trade is looking rosier in the medium term, as global rough diamond supply decreases alongside increasing demand.

NWF share price

At Stockhead we tell it like it is. While GT1 is a Stockhead advertiser at the time of writing, it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.