Resources Top 5: Hillgrove kicks on back of China antimony ban as juniors of hard rocks rise

ASX juniors are dancing on China's antimony ban. Pic: Getty Images.

- Chinese antimony ban spurs ASX juniors into gains as trade tensions tighten between global superpowers

- M2R kicks off drilling at Bangemall, which has Norilsk-style mineralisation potential

- Adriatic stares death in the face, rises on ramp-up of Vares silver production

Here are the biggest small cap resources winners in morning trade, Friday, August 16. Prices accurate at time of writing.

In the latest chapter of China banning exports of minerals critical to Western supply chains, the Middle Kingdom has now tightened its grip on antimony, a lightly traded metal with defence applications, adding to previous restrictions on gallium, germanium and graphite.

The ban came in overnight, in a move seen as to stifle US military equipment production, battery tech, semiconductors and other green tech applications.

READ MORE: Shoot across here if you want to know more about China’s bans.

Larvotto Resources (ASX:LRV)

(Up on China’s news)

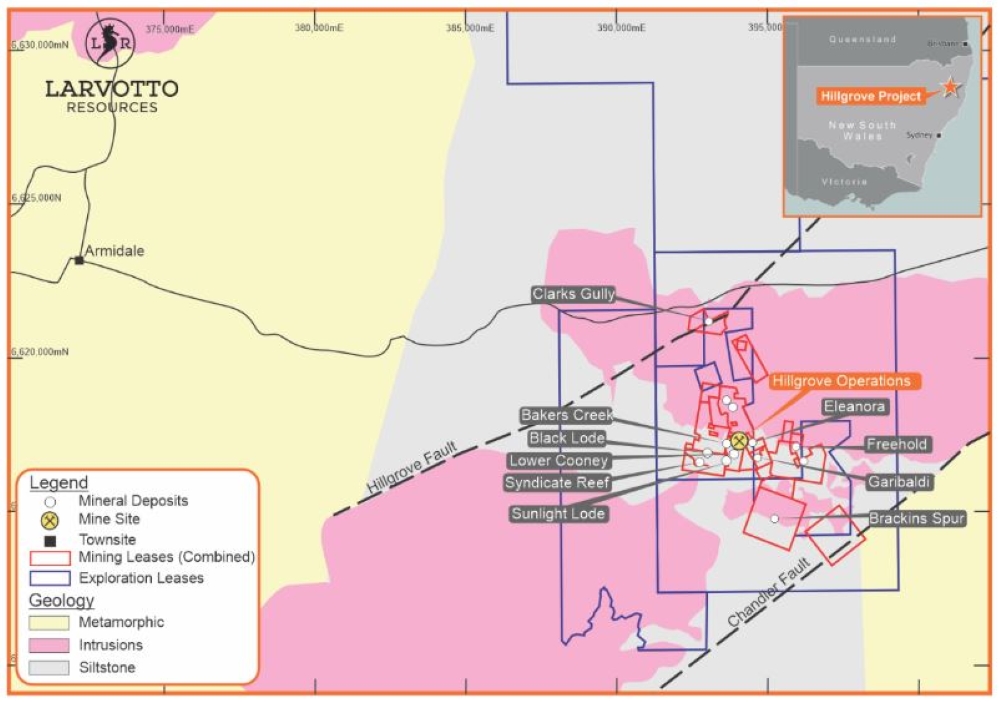

Targeting first ore in 2026, LRV’s Hillgrove gold-antimony project in NSW has a maiden 606,000oz AuEq reserve, yet it’s the antimony that could really be the economic kicker, with 39,000t of the material.

Priced conservatively at US$15,000/t and including the gold endowment, the project is expected to have a capex of $73m and an NPV8 of $157m, according to a PFS.

At spot prices though, the NPV8 sits at $383m and an eye-whopping IRR of 114%.

Those numbers are huge, and China’s export restriction announcement could see antimony prices spike considerably.

LRV’s Hillgrove is one of the world’s top 10 antimony deposits and if into production, would provide an extra supply chain avenue against China’s dominant position as its number 1 exporter.

A definitive feasibility study is underway as exploration looks to increase existing resources, which include metallurgical testwork also being conducted to de-risk and further increase economic processing margins.

Shares in the explorer have spiked on the news, up 32% to trade at 16c.

Other antimony boasting juniors were also higher including the earlier stage Southern Cross Gold (ASX:SXG) and Nagambie Resources (ASX:NAG).

In the US Perpetua Resources, which is planning to develop an onshore antimony operation in the States with the support of the US Department of Defense, was up 19% to three year highs overnight, while TSX-listed Victorian gold and antimony miner Mandalay Resources, owner of the Costerfield mine, was also ~4% higher.

Miramar Resources (ASX:M2R)

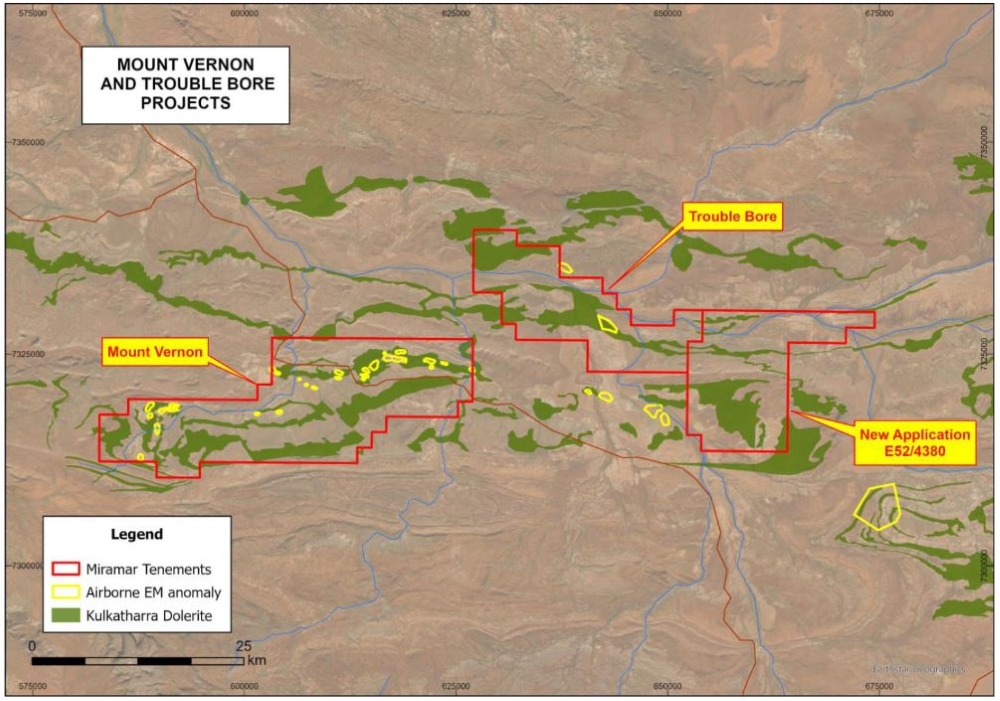

Backed with co-funding from WA’s Exploration Incentive Scheme (EIS) and a $1.7m cap raise in April, M2R’s maiden drilling at Bangemall is testing several airborne +/- ground EM anomalies at the Mount Vernon and Trouble Bore deposits.

The campaign is targeting Kulkatharra dolerites in WA’s Capricorn Oregon – which contains geology akin to hosting high grades of nickel, copper, cobalt and platinum group elements (PGE).

M2R exec chair Allan Kelly says mafic intrusion-hosted magmatic Ni-Cu-Co-PGE deposits are some of the largest and most valuable metal deposits in the world and remain profitable at low nickel prices.

“The Edmund and Collier Basins are recognised by the GSWA, Geoscience Australia and the CSIRO as displaying all the key ingredients for Norilsk-style mineralisation: major deep crustal-scale structures, Warakurna-age dolerite sills and extensive sulphide and/or sulphate-rich sedimentary units,” Kelly says.

What Kelly means by “Norilsk-style” is a term specific type to PGE ores found in the Norilsk-Talnakh region of Siberia, which exhibit high PGE-sulphide ratios.

Bulk sulphides in low-sulphide ores, on a wet-tonne average, can contain around 1400-2500g/t PGEs, while disseminated ores have lower PGE values around 35–120g/t PGEs.

“In addition to providing financial assistance, the EIS funding is further endorsement of the merits of Miramar’s geological model and targeting to date,” Kelly added.

The explorer says 2500m worth of RC drilling should take 2-3 weeks to complete.

M2R shares soared on open 16.6% to trade at 0.7c.

Adriatic Metals (ASX:ADT)

(Up on no news)

Adriatic Metals announced a fatality at its Rupice deposit, part of its 65,000tpa Ag and 90,000tpa Zn Vares silver-zinc mine in Bosnia and Herzegovina, when an employee of a local Bosnian sub-contractor’s vehicle overturned.

The incident didn’t occur near any mining operations but ADT secured the mine for 24 hours just in case.

It follows a tumultuous time for Adriatic, which saw its CEO and MD Paul Cronin resign, stepping down and returning to Australia ‘for family reasons’. He was replaced by interim CEO Laura Tyler who yesterday said ADT was ‘deeply saddened’ by the ‘tragic incident’.

“The local authorities are conducting an immediate review of the incident, and we will be reinforcing our commitment to a safe working environment through improvements in risk management and all the safety procedures of our contractors,” she added, with ADT committing to ‘enhance all safety protocols’ and conduct an investigation into to rollover, which occurred at a rescue station.

ADT is ramping up Vares into steady-state production – expecting to hit nameplate in Q4 this year. What impact the contractor’s death will have there remains to be seen.

Saleable grades of over 2,500g/t Ag and close to 50% Zn produced 257 dry metric tonnes (dmt) of silver-lead concentrate and 128dmt of zinc concentrate in Q2 2024 and sold to offtakers Trafigura and Transamine.

Plant upgrades and exploration to expand the resource is ongoing, as of an EOFY year update on June 30.

Shares are were up 13.4% to $2.92 per share, giving ADT a ~$630 million market cap.

Patriot Battery Metals (ASX:PMT)

(Up on recent news)

Hard rock lithium explorer PMT is trundling along with exploration of the 80.1 Mt at 1.44% Li2O indicated resource at its Shaakichiuwaanaan (formerly Corvette) project in Canada.

It’s just hired Alex Eastwood as a senior mining executive to help drive commercialisation efforts downstream. Eastwood is a Pilbara Minerals (ASX:PLS) alumni, rejoining his former-coworker and PMT MD Ken Brinsden.

“There is no one more experienced commercially in lithium raw materials than Alex and I am pleased that we have been able to secure him to join the Patriot team,” Brinsden says.

“It is another important endorsement of what the Shaakichiuwaanaan project represents to the lithium world.

“With Patriot’s ongoing engagement with the industry downstream, it’s great to have someone of Alex’s calibre and experience in helping us position the Company for success.”

Shares in the $322m market-capped explorer are up almost 10.5% at time of writing and up >20% this week, swapping at 53c.

PMT has been regularly regarded also as a potential takeover target, with the market now on watch after Brinsden’s former company Pilbara Minerals lobbed an approved $560m scrip offer for Latin Resources (ASX:LRS) yesterday.

READ: Monsters of Rock: How soon is counter-cyclical lithium M&A? In the words of Morrissey: Now

Wildcat Resources (ASX:WC8)

(Up on no news)

WC8 is up almost 20% this week as it continues to prove up its Tabba Tabba lithium project in the Pilbara, which is surrounded by the world-class 414Mt Pilgangoora and 259Mt Wodgina hard rock lithium mines.

It’s Leia deposit continues to bring in the hits, with 67m at 1.9% Li2O, including 46m at 2.5% registered to the market on August 5.

In 2023, the explorer drilled ~105,020m, comprising 236 RC holes for 59,648m and 128 diamond drill holes for 45,372m.

That drilling has defined a 3.2km-long LCT pegmatite field hosting at least six significant pegmatite bodies – Leia, Luke, Chewy, Tabba Tabba, Han and The Hutt.

It’s aggressively looking for new discoveries and from a personal note, this Stockhead can’t wait to see a Darth Vader deposit eventually proved up.

Shares in WC8 are up 12.5% at time of writing, trading at 29.3c.

At Stockhead we tell it like it is. While Miramar Resources and Latin Resources are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.