Resources Top 5: China swoops on Peak’s Tanzanian rare earths for $96m

Pic: Getty Images.

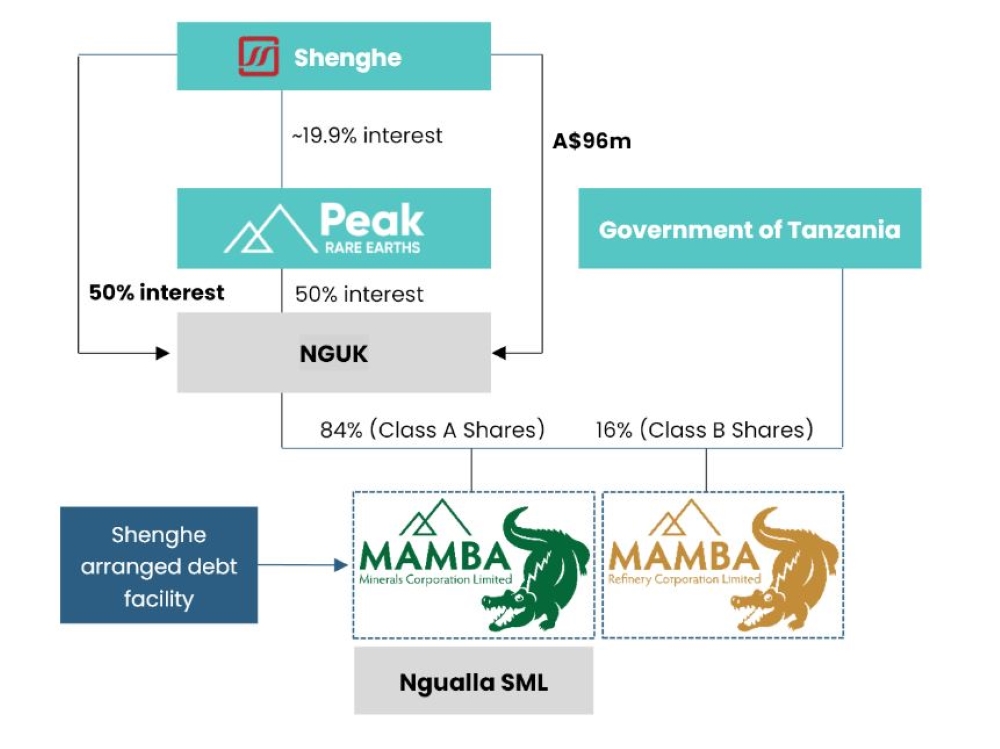

- Peak to offload 50% of Ngualla to major investor Shenghe for $96m

- Peregrine up on no news, though drill results expected from Tin Can gold prospect

- Koba’s Yarramba uranium acquisition spurs stock price boost

Peak Rare Earths (ASX:PEK)

Coming out of a trading halt, PEK has been further backed by US$2bn market-capped Chinese REE major Shenghe for a cool $96m, signing a non-binding term sheet for a 50% interest in the company’s stake in the Ngualla project in Tanzania.

Peak previously held an 84% stake, with the rest held under the African nation’s mining laws by a free-carried Tanzanian Government.

Shenghe has a 19.9% interest in PEK, which it bought back in 2022, and has a binding offtake agreement already in place.

It’s all a bit skew-whiff, but luckily we have a cool diagram of the ownership structure around Ngualla for your benefit.

Ngualla has a confirmed 3.7km Breccia zone which contains high percentages of valuable magnetic REEs such as neodymium and praseodymium.

Recent exploration also encountered widespread shallow mineralisation of niobium and phosphate at the Northern Zone of Ngualla, with up to 1.88% Nb intersected.

Shenghe will take over the tender process for development of the project and the term sheet transaction is set to be finalised in September this year, with an FID due by December 31st.

As well as being a major producer of rare earths, Shenghe has supply deals with major western producers including MP Materials, the US-listed and based owner of the long-running Mountains Pass mine, the largest REE operation outside south-east Asia aside from Lynas’ (ASX:LYC)Mt Weld mine in WA.

Shares in the explorer shot up 28.6% to trade at 22.5c this morning.

Peregrine Gold (ASX:PGD)

(Up on no news)

Nothing’s been happening with PGD since it started rattling the Tin Can prospect at its Newman gold project in WA – 70km from Capricorn Metals’ (ASX:CMM) Karlawinda gold mining operation.

Significant drill hits of up to 11.35g/t gold were intersected back in June from a 31-hole program and the drill bit is currently spinning on follow-up targets at the greenfield discovery.

PGD discovered the bedrock-hosted Tin Can gold deposit during a 2023 drill program, which pulled up stand out assays including 8.08m at 5.63g/t gold from surface and 9.85m at 5.43g/t gold.

There’s one significant gold shoot identified at the prospect already and PGD reckons it potentially has another one – I guess we’ll find out.

Shares in the junior are up 31% to 4.5c today, so keep an eye out for more news.

Fin Resources (ASX:FIN)

(Up on no news)

The company’s been pretty quiet since it successfully intersected near-surface spodumene during maiden drilling of its White Bear prospect within its Cancet West project in Quebec, Canada.

Yet shares in the penny stock are up a handy 50% today with a few decent buys on the register to sit at 0.9c.

FIN discovered the White Bear pegmatite outcrops back in 2023, where rock chip samples in the area returned up to 6.85% Li2O.

It drilled eight diamond holes, although the market is yet to see the results.

Last we heard, potential further surveying and drilling programs are on the cards too.

Firetail Resources (ASX:FTL)

(Up on recent news)

FGL has been pretty quiet too, barring a few board changes, with the significant appointment of Glen Poole to the role of CEO earlier this month.

Poole is an experienced exploration and mining geo with previous roles at Northern Star (ASX:NST), Greenstone Resources (ASX:GSR) and Firefly Resources (now Spartan Resources (ASX:SPR)).

He’s tasked with driving maiden exploration at FTL’s early doors York Harbour copper-zinc-silver project in Newfoundland, Canada, which will include surveys, mapping and planning of an initial drill program.

“I look forward to expediting the exploration efforts across the York Harbour project,” Poole said.

“(The project) has both existing substantial drill intercepts requiring follow up and large scale prospectivity which has never been evaluated.”

FTL was up 28.33% early today to trade at 7.7c per share.

Southern Cross Gold (ASX:SXG)

(Up on yesterday’s news)

SXG extended its gold run with ongoing exploration at the Golden Dyke and Rising Sun prospects, part of its Sunday Creek gold-antimony project in Victoria, after results from four diamond holes showed up some seriously high-grade gold intercepts.

Drillbits were sent deep down across the prospect and a new vein was discovered with intercepts of up to a whopping 291.3g/t gold.

A fifth drill rig is being carted to the project as Sunday Creek keeps on delivering the gold hits underground.

“Now we have five rigs drilling at site, we look forward to more than doubling the metres drilled at Sunday Creek via the 60 km of drilling planned over the next year,” SXG MD Michael Hudson said yesterday.

At Stockhead we tell it like it is. Fin Resources, Peregrine Gold and Firetail Resources are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.