Resources Top 5: Alderan kicks hard into Brazil’s ‘Lithium Valley’, OzAurum raises $2.4m

Pic via Getty Images

- Aussie juniors Alderan and OzAurum make head-turning moves in pursuit of Brazilian lithium

- Besra moves on up on the back of an investor-satisfying gold sale

Here are the biggest small cap resources winners in early trade, Wednesday September 20.

Alderan Resources (ASX:AL8)

This gold and copper-hunting junior had made a 50% break for it up the ASX , although trading appears delayed at the time of writing.

Nevertheless, does it have hot news? White gold hot, yes.

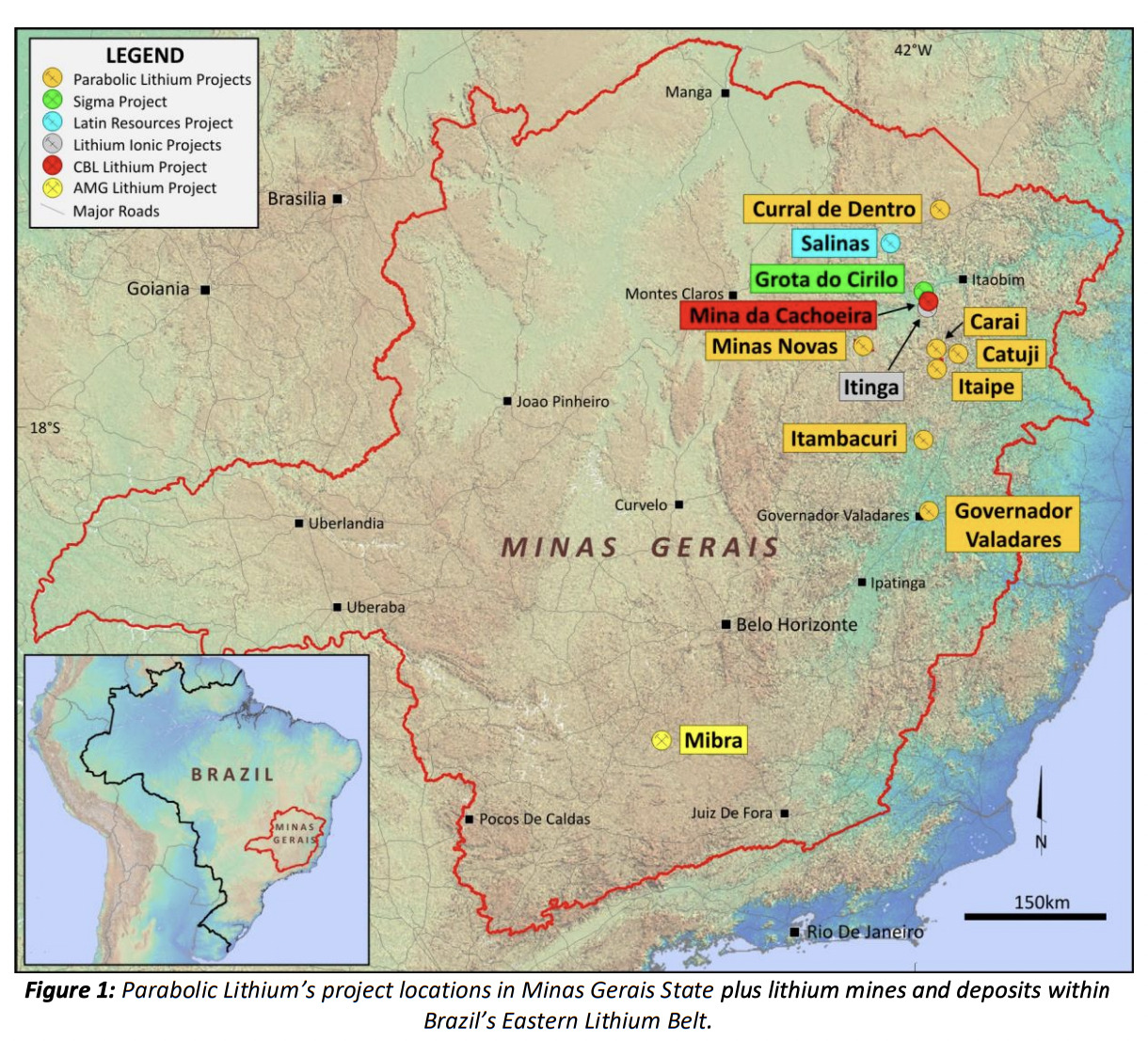

Alderan has acquired 100% ownership of seven lithium exploration projects from Parabolic Lithium Ltd, consisting of 24 granted exploration licences covering 472km2 in Brazil’s Eastern Lithium Belt.

All seven projects are within, and to the south, of the famed ‘Lithium Valley’ in the resource-rich Minas Gerais state, which hosts 40 of Brazil’s top 100 mines. And those include Companhia Brasileire De Litio’s (CBL) and Sigma Lithium Corporation (NASDAQ: SGML; TSX: SGML), along with the deposits of Latin Resources Limited (ASX:LRS) and Lithium Ionic (TSX.V: LTH).

As Stockhead’s Cameron Drummond noted in a broader piece on the increasingly fervent Latin American lithium hunt, Latin Resources (ASX:LRS) is the most advanced of the ASX stocks pursuing this geographical narrative, with a 45.2Mt @ 1.34% Li2O (~1.5Mt LCE) resource at Colina, part of the Salinas project in Minas Gerais state.

Managing Director of Alderan, Scott Caithness, said:

“The acquisition of Parabolic’s large and highly prospective granted tenement package in an established lithium district in Brazil is a very exciting development for Alderan and represents the successful culmination of project generation focused on securing high potential critical metals exploration opportunities.

“Brazil’s Eastern Lithium Belt is one of the world’s premier lithium provinces with operating lithium mines and recent major discoveries made by Sigma Lithium Corporation and Latin Resources Ltd.”

Alderan notes that the projects are in the “right geological setting”, located on the margins of known and interpreted fertile G4 granites.

Pegmatites and lithium indicators, including spodumene, beryl and niobium are all found within and close to the seven project areas.

Alderan’s on-ground exploration activities are planned to commence before the end of this year.

AL8 share price

OzAurum Resources (ASX:OZM)

This junior goldie ($13m market cap) went gangbusters late last week and has maintained those solid gains for now.

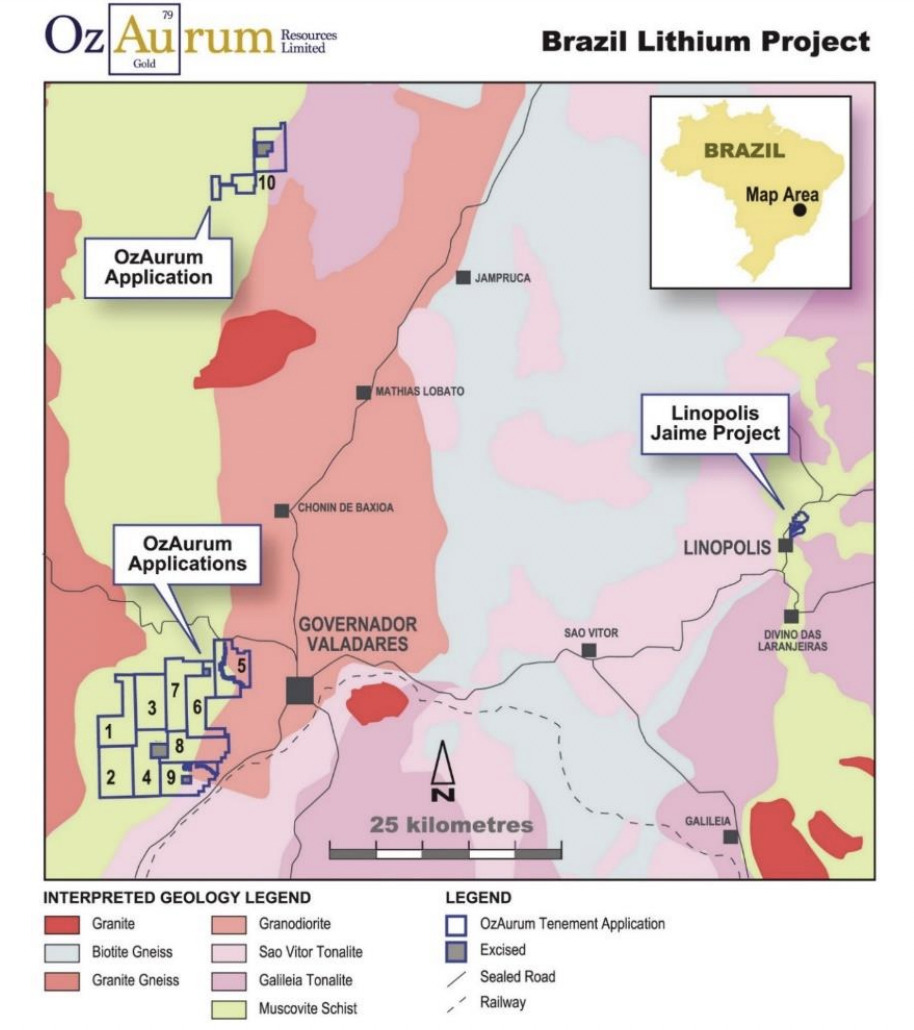

Last Friday OzAurum broke news of its diversification into lithium with the acquisition of the Linopolis Jaime project – also in the State of Minas Gerais, Brazil – where it appears to be onto some particularly juicy-looking spodumene.

Today’s news is that the company has raised $2.4 million in a share placement to pro and sophisticated investors through the issue of 31,750,000 shares in OZM at a price of $0.075 per share. (Options will have an exercise price of $0.11 each and an expiry date three years after issue.)

What will these funds be used for? Yep, we foreshadowed it above. At the forefront of the company’s plans is the commencement of its Brazilian lithium operations, including a geological mapping and geochemistry activities, diamond drilling and assessment of further potential lithium project acquisitions in Brazil.

That’s not to say OzAurum is forgetting its gold foundations – funding will also be funnelled into the company’s scoping study at the Mulgabbie North gold project in WA.

OZM share price

Besra Gold (ASX:BEZ)

This $62m goldie is up on news the company has agreed to sell to Quantum Metal Recovery (Besra’s major CDI holder) a quantity of refined gold from the Bau gold project, up to 3,000,000oz or a value of US$300,000,000, whichever comes first.

The Bau project is on the island of Borneo in Malaysia, within the rich, 3Moz Bau goldfield corridor.

Besra recently announced some eye-popping success in the region with a 1,450m follow up drilling program at its Bekajang project, confirmed the project’s ‘multi-storey’ endowment with at least two levels of gold mineralisation now identified.

The company notes that, per the agreement with Qauntum, it’s entitled to deploy the proceeds for a variety of uses, including exploration, feasibility studies, mine development purposes and working capital.

“Updating the 2012 Bau Feasibility Study is one of Besra’s primary objectives,” it notes.

BEZ share price

Osmond Resources (ASX:OSM)

(Up on no news)

Another Aussie gold (and base metals)-hunting minnow, Osmond has, like so many others, taken the plunge into the battery metals race this year.

In May, the explorer made an agreement to assume 5E Advanced Materials’ (ASX:5EA) rights to earn-in and acquire the Salt Wells lithium-borate project in Nevada.

Under the agreement, the company was able to claim the right to an initial 80% interest in the project, which covers about 36km2 of ground, with a limited right to move to 100%.

Salt Wells is located in Churchill County, Nevada, within close proximity to major highways and the town of Fallon, and has seen historical borate production from surface salts in the 1800s from the northern part of the project area.

Surface salt samples from this area have returned up to 810 parts per million lithium and 1% boron.

More recently, however, Osmond confirmed its gold, nickel, copper and REE exploration of its South Australian projects – Fowler and Yumbarra – have been accelerated by up to two years following the release of positive historical exploration company data related to the projects’ areas.

🔔 $OSM.ax $OSM Exploration On South Australian Projects Accelerated By Up To Two Years 🔗 https://t.co/DPMHdzBFZ0

⛏️“The recent historical #exploration company data released by the South Australian Dept. Energy and Mining, have been a major upgrade to our South Australian… pic.twitter.com/p0meponoJG

— Osmond Resources Ltd (ASX:OSM) (@OsmondResources) August 28, 2023

OSM share price

Megado Minerals (ASX:MEG)

(Up on no news)

Rare earths and critical minerals explorer is up no fresh news today, but a couple of days ago, it announced something significant – the acquisition of the K Lithium project in the James Bay lithium hotspot of Quebec, Canada.

🔔 $MEG.ax $MEG Acquisition of the K Lithium Project, James Bay, Quebec, Canada 🔗 https://t.co/uVs5tE3K8R

🔋⛏️ “Acquisition of the K Project further enhances our North American footprint and is consistent with our strategy of securing prospective #exploration projects that… pic.twitter.com/VxFBCH9MOF

— Megado Minerals (ASX:MEG) (@megadominerals) September 17, 2023

The project covers approximately 16km2 (1,598 ha) and includes 35 claims within the La Grande Sub province.

Megado CEO and MD Ben Pearson, said:

“Acquisition of the K Project further enhances our North American footprint and is consistent with our strategy of securing prospective exploration projects that provide exposure to the green energy transition.

“The deal metrics for the K Project were compelling, especially considering that competition for assets in the James Bay region is fierce.”

Also within the James Bay area, the company boasts the Cyclone project, encompassing 130km² (13,166 ha) and includes 304 claims.

MEG share price

At Stockhead we tell it like it is. While Besra Gold is a Stockhead advertiser at the time of writing, it did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.