Besra drilling tells tale of ‘multi-storey’ gold endowment at Bekajang

The Bekajang project sits within the 3Moz Bau goldfield in Malaysia. Pic: via Getty Images.

- Follow up drilling confirms at least two levels of gold mineralisation at Bekajang

- The project sits within the 3Moz Bau goldfield in Malaysia

- More drilling being considered to determine source of mineralisation

- Environmental Impact Assessment underway for Jugan project at Bau goldfield

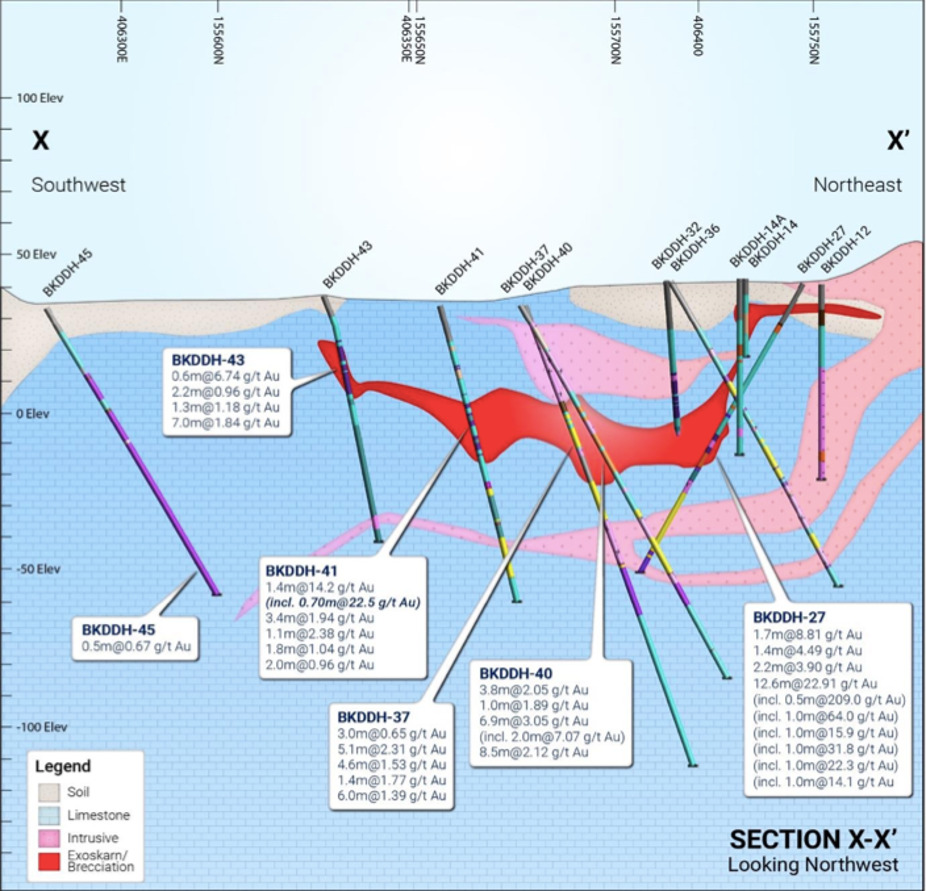

A 1,450m follow up drilling program at Besra’s Bekajang project – within the Bau goldfield corridor in Malaysia – has confirmed the project’s ‘multi-storey’ endowment with at least two levels of gold mineralisation now identified.

The company is focused on the exploration and development of the 3Moz Bau goldfield, where the Bau Project hosts 3.4Mt at 1.5g/t for 166,900oz at the top confidence Measured category, 16.4Mt at 1.6g/t for 824,000oz at the high confidence Indicated level and a further 47.9Mt at 1.3g/t for 1,989,400oz of Inferred Resources.

The Bekajang project is also in the Bau goldfield and includes two historical mine sites including the Bukit Young Gold pit (BYG) which produced some 440,926 tonnes at a grade of 4.51g/t gold and Tai Parit which produced some 700,000oz of gold.

Historical drilling provides the basis for a substantial resource inventory at Bekajang, comprising a Measured and Indicated resource totalling 120,400oz at 2g/t gold, an Inferred resource of 524,000oz at 1.5g/t gold, and an additional exploration target of 0.5Moz to 0.80Moz at 2-3 g/t gold.

Besra Gold’s (ASX:BEZ) latest drilling program was designed to follow up previous high grade gold hits below Bekajang’s overlying limestone-shale contact (LSC) in hole BKDDH-27 – which included 10m at 7.09g/t gold from a down-hole depth of 8m including 2.6m at 20.81g/t from 15.1m.

Potential understory of mineral endowment

The follow up drilling has confirmed a discrete high-grade zone, between ~30m-60m depth that is shallow dipping with a surface footprint currently extending about 150m to the south-southwest and which remains open along strike to the west-northwest.

Notable assay results include:

- 8.9m at 2.43g/t gold from 50.6m (BKDDH-32);

- 1.0m at 10.7g/t gold from 40.7m and 1m at 5.6g/t gold from 45.3m (BKDDH-36); and

- 1.1m at 6.25g/t gold from 6.9m (BKDDH-37).

“During 2022, we discovered exceptional and bonanza grade gold below the traditional LSC target at Bekajang,” Besra interim chairman John Seton said.

“Following this up has been the focus of our exploration in 2023 and we are very pleased to report the confirmation of our earlier success, and then some.

“Assays from this 14-hole program indicate the presence of a potentially very significant understorey of mineral endowment, separate and distinct from that at the overlying LSC level and it remains open along strike.

“With unparalleled funding capacity for a junior, we intend to exploit these results with further drilling to identify the source of these exceptional gold grades.”

The discovery of a new zone of mineralisation that remains open along strike has the potential to add significantly to the existing, already substantial, resources at the project.

EIA underway for Jugan pilot plant

The company added that the coincidence of at least two levels of gold mineralisation at Bekajang gives “impetus to a further drilling program to identify the source and geometry of the associated hydrothermal conduit system(s) which facilitated this local ‘multi-storey’ endowment.”

In the meantime, Chemsain Konsultants Sdn Bhd has been engaged to undertake an Environmental Impact Assessment (EIA) of Bekajang to facilitate representative bulk sampling for processing studies at Besra’s Jugan pilot plant, once commissioned.

The EIA is expected to take around 3 months to complete.

This article was developed in collaboration with Besra Gold, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.