Resources Top 5: A couple of big gold discoveries and ‘some of the highest-grade intercepts I have drilled’

Pic: Schroptschop / E+ via Getty Images

- African Gold announces incredible ‘screen fire’ assay results like 10m at 123g/t gold

- Nexus uncovers giant gold system at ‘Wallbrook’ project

- Uranium focused Okapi makes major discovery at Enmore project, NSW

Here are the biggest small cap resources winners in early trade, Wednesday September 8.

AFRICAN GOLD (ASX:A1G)

In January, high profile investor Tolga said A1G was worth a closer look.

Today, the stock punched through all-time highs after announcing incredible ‘screen fire’ assay results like 10m at 123g/t gold from 66m (including 2m at 613g/t gold) at the ‘Didievi’ project in Côte d’Ivoire.

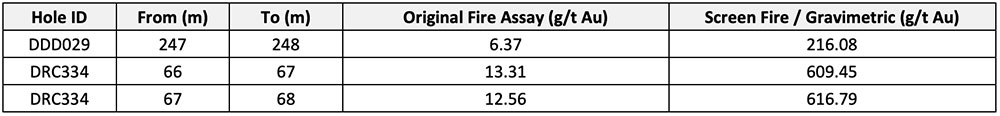

Intercepts reporting +5g/t gold by standard fire assay technique – first announced 11 August — were sent for screen fire assay to check for potential coarse gold.

Incorporating these results has in most cases significantly improved the interval and points to coarse gold in several samples.

Check this out:

Outstanding.

Historically, it hasn’t been recognised that a high-grade gold component existed at Didievi, however artisanal miners have been collecting free gold on the margins of the deposit, says A1G CEO Glen Edwards.

“The historical drilling was assayed by fire assay (the most common assay method) which picked up some very high grades,” he says.

“As part of the QA/QC of our current drill program we ran screen fire assays over the higher-grade intervals.

“These screen fires returned some spectacular intercepts including some of the highest-grade intercepts I have drilled in my career.

“We are extremely excited about the prospectivity of this gold system and look forward to kicking off the next phase of drilling when I arrive back to the project later this month.”

$35m market cap A1G is up 42% year-to-date and 90% on its February 2019 IPO price of 20c per share.

NEXUS MINERALS (ASX:NXM)

More high-grade gold from the emerging ‘Wallbrook’ gold project in WA, which follows some punter-pleasing results from the ‘Crusader’ target last month.

This time it’s the nearby, previously undrilled ‘Templar’ discovery delivering numerous hits like 10m @ 5.64g/t gold (within 23m @ 2.85g/t Au from 132m).

Crusader and Templar could be part of one giant system, Nexus managing director Andy Tudor says.

“These broad high-grade results received from Templar occur in the same altered and mineralised rocks we see at the Crusader prospect, 1.2km to the south,” he says.

“This has effectively linked the two prospects together into one large mineralised system.”

A 700m deep diamond drill hole at Templar is now underway.

$53m market cap Nexus is up 175% over the past month to hit five-year highs.

OKAPI (ASX:OKR)

What’s going on in gold today?

Okapi has made a “major discovery” at the Enmore project, NSW, with maiden drilling pulling incredible intercepts like:

▪ 174m @ 1.83g/t gold from surface including,

▪ 100m @ 2.34g/t gold from 59m, and including

▪ 31m @ 3.05g/t gold from 115m, with the hole terminating in

▪ 3m @ 8.86g/t gold from 171m.

That’s one drill hole.

Mineralisation remains ‘open’ at depth and along strike with indications that grade may be increasing with depth, Okapi says.

“These results show the potential for a very large, shallow, high-grade gold deposit at our Enmore Gold Project, with mineralisation from surface with some of the highest grades returned below 170m,” exec director David Nour says.

“The depth potential is very encouraging, and we have multiple prospects that remain untested.”

The explorer’s chief focus remains on its recently acquired portfolio of advanced, high grade US uranium assets, it says.

METALSTECH (ASX:MTC)

The MetalsTech lithium spin out, Winsome Resources (expected code: WR1), will have a bunch of advanced exploration stage lithium assets in the James Bay region of Quebec, Canada.

Managing director (and lithium veteran) Chris Evans reckons Winsome is in the right time and place to ride the next lithium wave with the company’s three main projects – Cancet, Adina and Sirmac-Clappier.

MTC shareholder will receive $9m worth of shares in Winsome by way of an ‘in specie’ distribution in proportion of their MTC holding — about 1 free 20c WR1 share for every 3.5 MTC shares.

The in-specie distribution date has been set for 7 October.

Winsome expects to list early November.

Gold focussed, $47m market cap MetalsTech is up 28% over the past month and 40% year-to-date.

AUSTRALASIAN GOLD (ASX:A8G)

(Up on no news)

Late last month, the recently listed explorer surged after lodging a tenement application in the Mt Peake lithium pegmatite district in Northern Territory.

Earlier this week, it finalised the acquisition of the ‘Capella’ gold project in Queensland.

Historical drilling at the Capella gold project includes 2m at 32.8g/t Au inside a larger 32m section grading 3.8g/t, 33m from surface.

“We know the Clermont region is well endowed in gold. The acquisition of the Capella project is highly complementary to our existing Mt Clermont polymetallic project with wide zones of high-grade gold intercepts,” managing director Dr Qingtao Zeng says.

“Field work will commence immediately to better understand structures and find continuity of the known gold mineralisation.”

The $9m market cap stock is up 93% over the past month and 35% on its IPO price of 20c per share.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.