Okapi Resources makes major gold discovery at Enmore in New South Wales

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

Okapi Resources has claimed a major discovery at the Enmore gold project in NSW’s emerging New England Fold Belt, striking more than 170m of continuous high tenor gold mineralisation in a single drill hole.

Okapi Resources (ASX:OKR) got out of trading halt this morning and the results from the maiden drill drive at the gold prospect 30km south of Armidale were well worth the wait for investors.

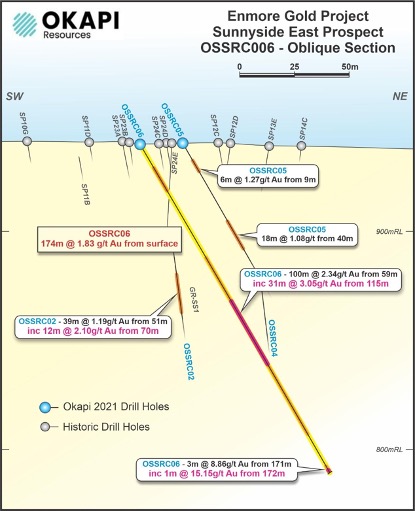

Hole OSSRC06 struck an incredible 174m at 1.83g/t of gold from surface at the Sunnyside East target, with grades appearing to increase significantly at depth.

For context, that is a stretch longer than the AFL Grand Final pitch at Optus Stadium from goal to goal, lit up with economic grade gold.

And mineralisation remains open both at depth and along strike, with Okapi openly discussing the prospect of holding a large and shallow open pittable resource at Enmore.

Intervals within hole OSSRC06 included 100m at 2.34g/t from 59m, which in turn included 31m at 3.05g/t.

The end of the discovery hole was its richest, with grades of 3m at 8.86g/t from 171m and 1m at 15.15g/t at 172m deep.

“These results show the potential for a very large, shallow, high-grade gold deposit at our Enmore Gold Project, with mineralisation from surface with some of the highest grades returned below 170m,” Okapi executive director David Nour said.

“The depth potential is very encouraging and we have multiple prospects that remain untested”.

There were top quality results in holes OSSRC01 and OSSRC02 at Sunnyside East also of 37m at 1.27g/t gold from 27m, including 3m at 3.12g/t from 53m and 39m at 1.19g/t of gold from 51m in hole OSSRC02, including an interval of 12m at 2.10g/t from 70m.

Enmore historically underexplored

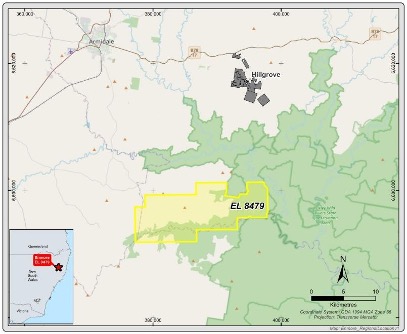

It is not surprising to find significant gold mineralisation at Enmore, given the project is located just 20km south of Red River Resources’ Hillgrove gold mine, which has historically produced around 730,000oz.

What was surprising was how little the ground had been tested before Okapi started its maiden campaign back in June.

Gold was discovered by the old timers back in 1876 at Enmore and operated on and off until 1940, but most exploration since has been shallow, with around 200 holes up to a depth of 50m and few deeper ones completed before Okapi sewed up the ground in a deal last December.

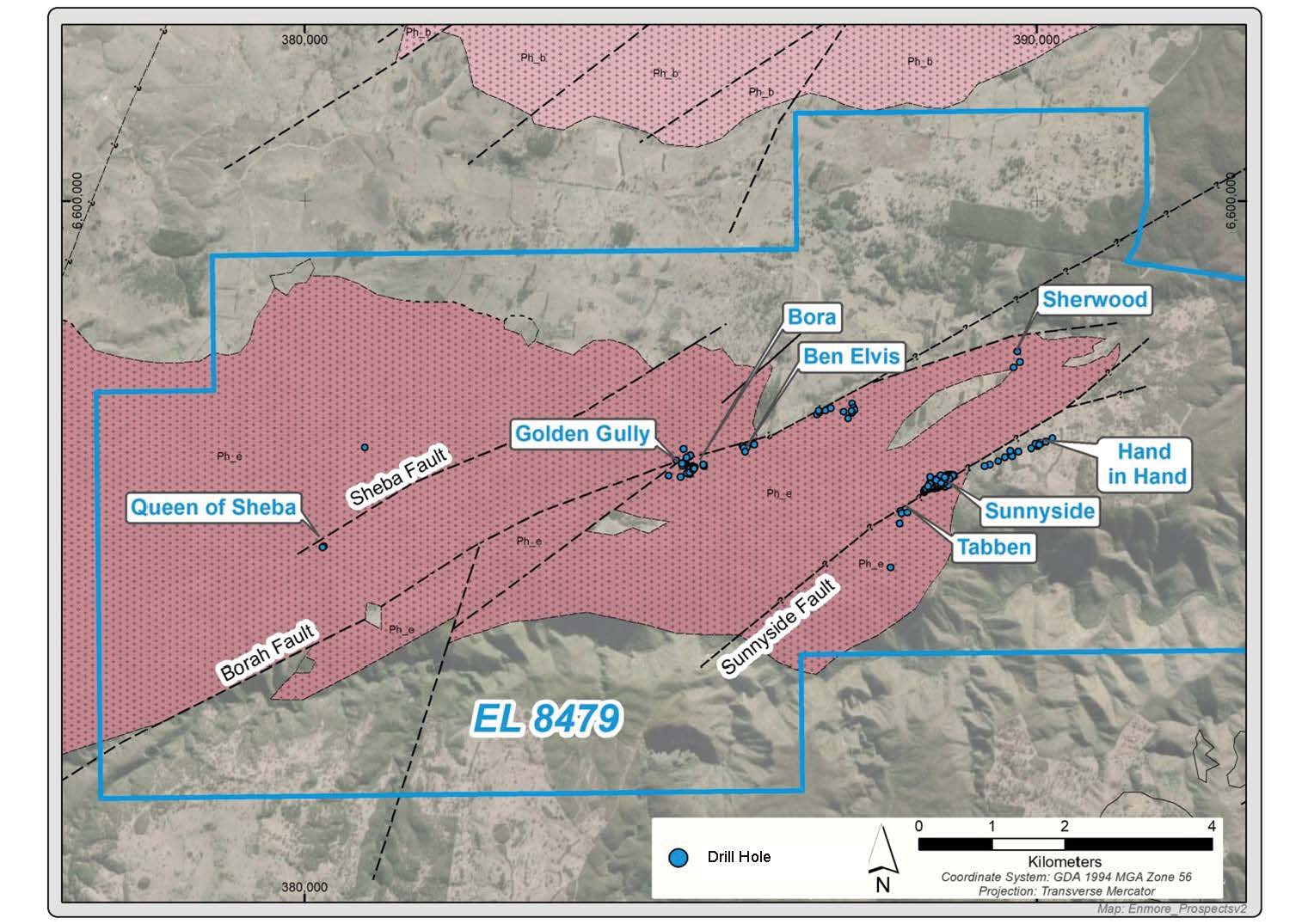

There is a catalogue of 39 identified prospects there, the majority of which are untested with deep drilling, and limited to no modern geophysics or other targeting methods have been applied across the project.

The gold mineralisation at Enmore is believed to be controlled by the same northwest cutting structures as the gold found at Hillgrove.

The current program included just 10 drill holes for 1,257m across three prospects, at Sunnyside East, Sunnyside West and Bora, with all holes encountering significant results.

Sunnyside West returns economic gold hits as well

Results from Sunnyside West and Bora were not as startling as the mammoth hit at Sunnyside East, but still returned interesting results to follow up in further exploration.

Significant mineralisation has now been uncovered in the 400m corridor between Sunnyside East and West, with a best result at Sunnyside West of 7m at 1.25g/t of gold from 30m, including 1m at 5.61g/t of gold from 36m in OSSRC07.

Hole OSSRC08 hit 17m at 0.69g/t from 20m, including 7m at 1.10g/t at the start of the mineralised interval. Further exploration will focus on the potential to identify high grade shoots associated with cross-cutting structures.

Two holes were also drilled at Bora, 4km west of Sunnyside, targeting a small historic gold mine.

Drilling intersected several siliceous veins in the host rock, with best results of 3m at 0.51g/t gold from 53m and 2m at 0.52g/t gold from 69m in OBARC01 and 2m at 0.58g/t gold from 67m in hole OBARC02.

The major discovery adds another string to Okapi’s bow.

The company owns the 26Mlb Tallahassee uranium project in the United States, and has enjoyed a 206% rise in its share price over the past six months, largely made since July amidst a renaissance for uranium stocks globally.

While Okapi says its primary focus is on its uranium assets in the States, the explorer is planning a follow up exploration program to generate a maiden JORC resource at Enmore.

This article was developed in collaboration with Okapi Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.